-

Elliott Wave View: S&P 500 Futures Eyeing New All-Time High

Read MoreS&P 500 is close to breaking about 2018 high. This article and video explains the short term Elliott Wave path of the Index.

-

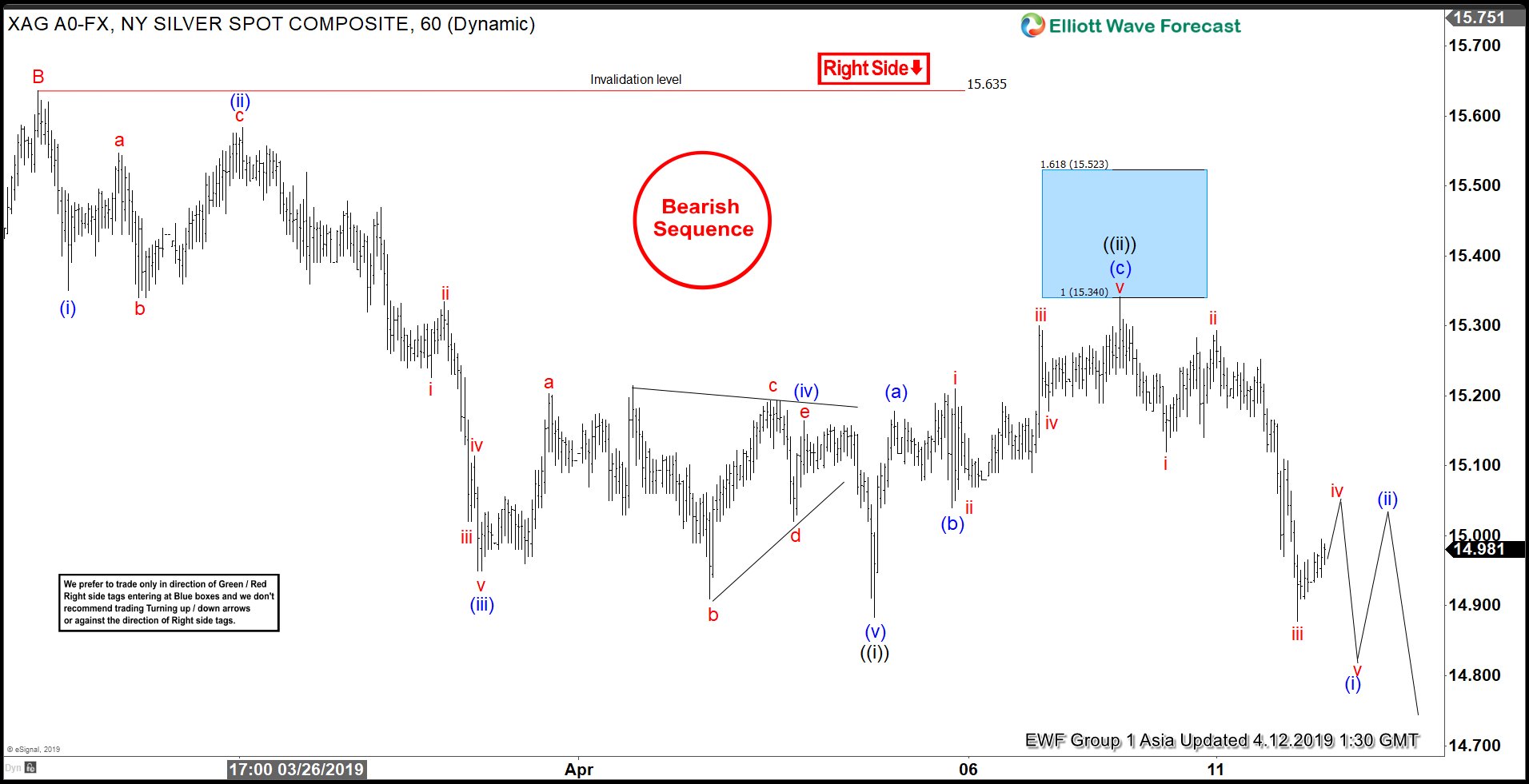

Elliott Wave View: Silver Extending Lower

Read MoreSilver continues to show incomplete sequence from Feb 21. This article and video explains the short term Elliott Wave path for the metal.

-

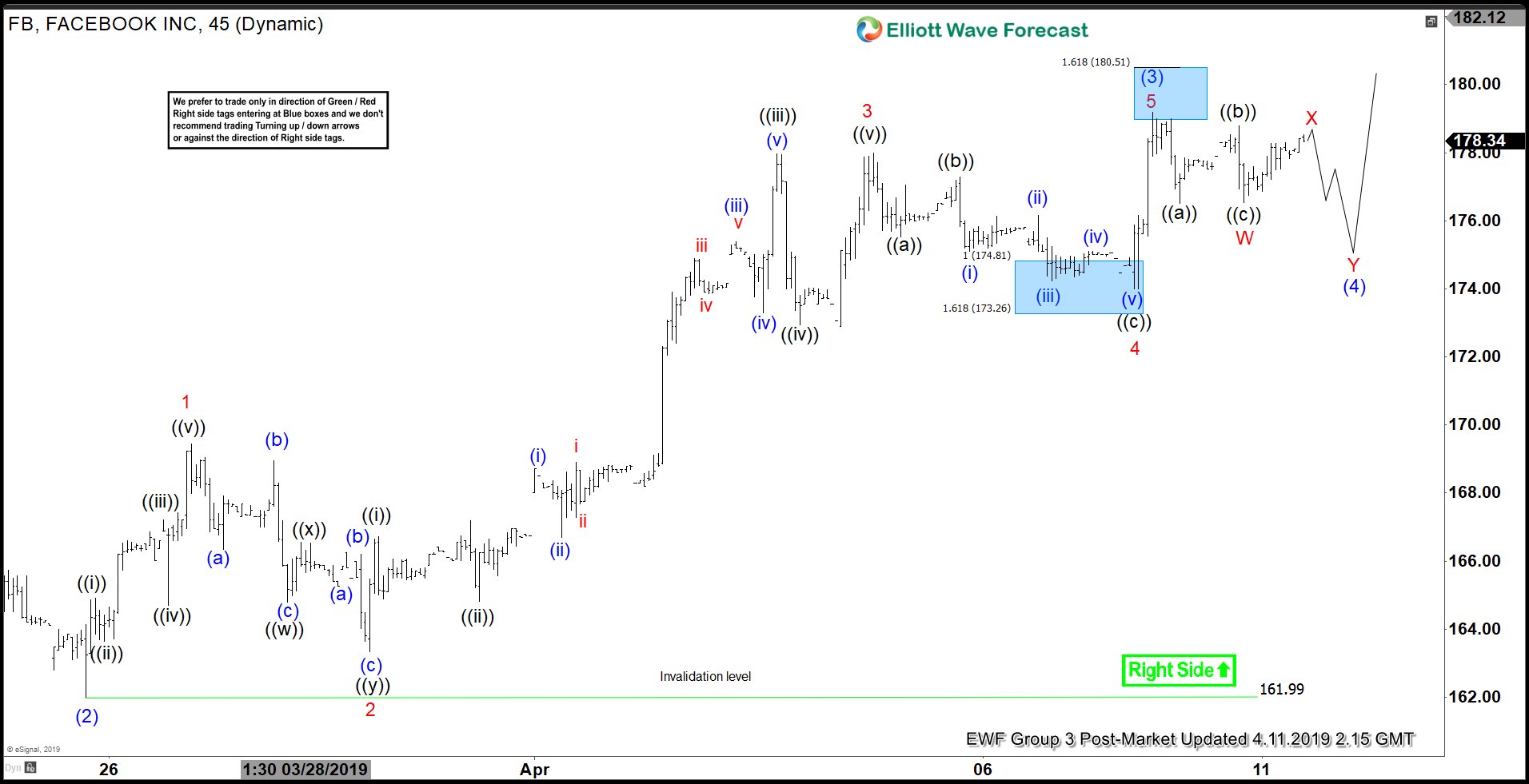

Elliott Wave View Favors More Upside in Facebook

Read MoreFacebook shows incomplete sequence from December 2018 low. This article and video explains the short term Elliott Wave path.

-

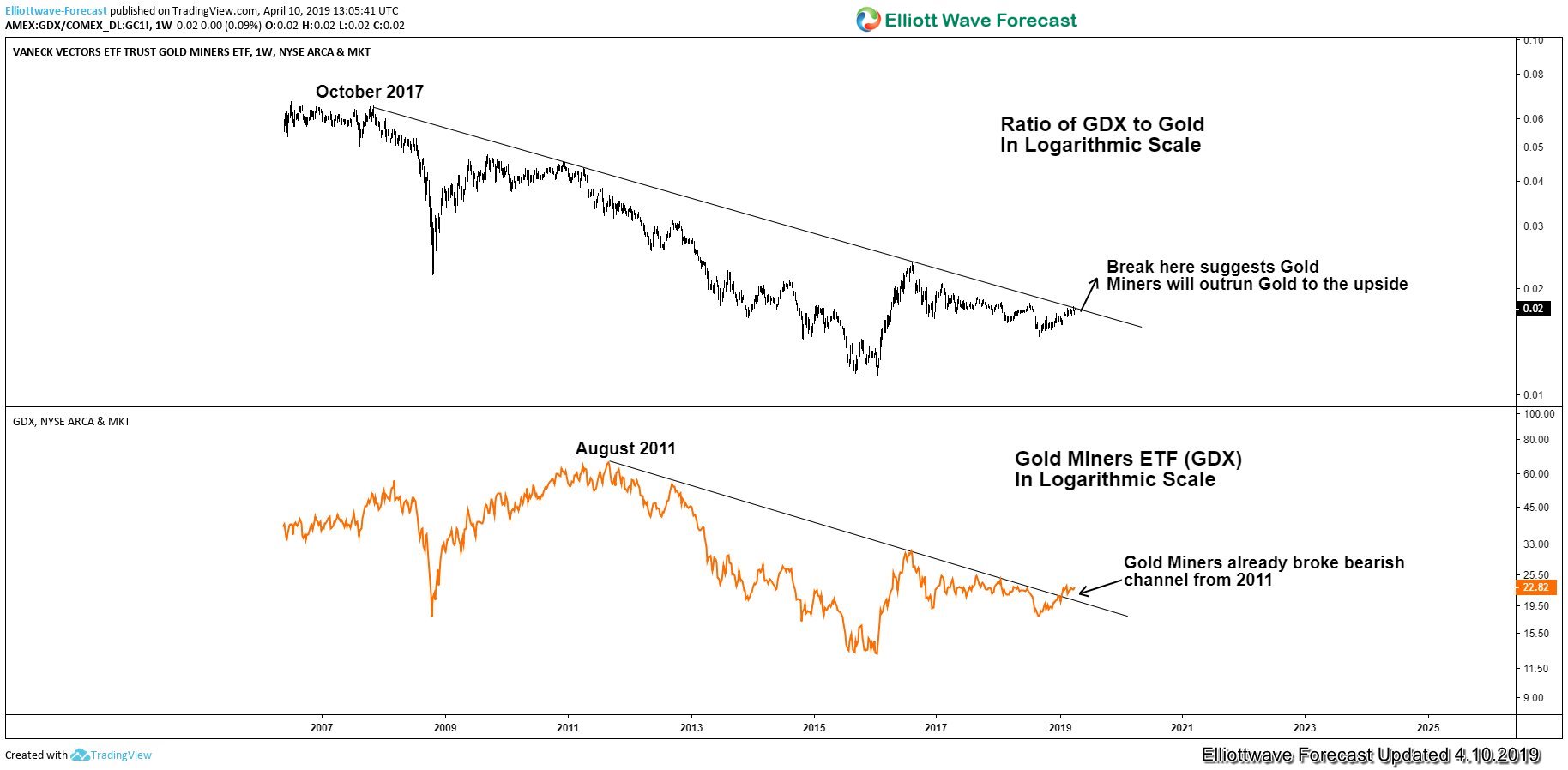

Gold Miners (GDX) Ready for Breakout

Read MoreGold miners as a group is unpopular since it topped in 2011 together with Gold. One well-known Index which represents major Gold Miners is the GDX. The Index topped in 2011 at $67 and declined a massive 81% before forming a low in 2016 at $12.40. None of the ample liquidity from central bank’s money […]

-

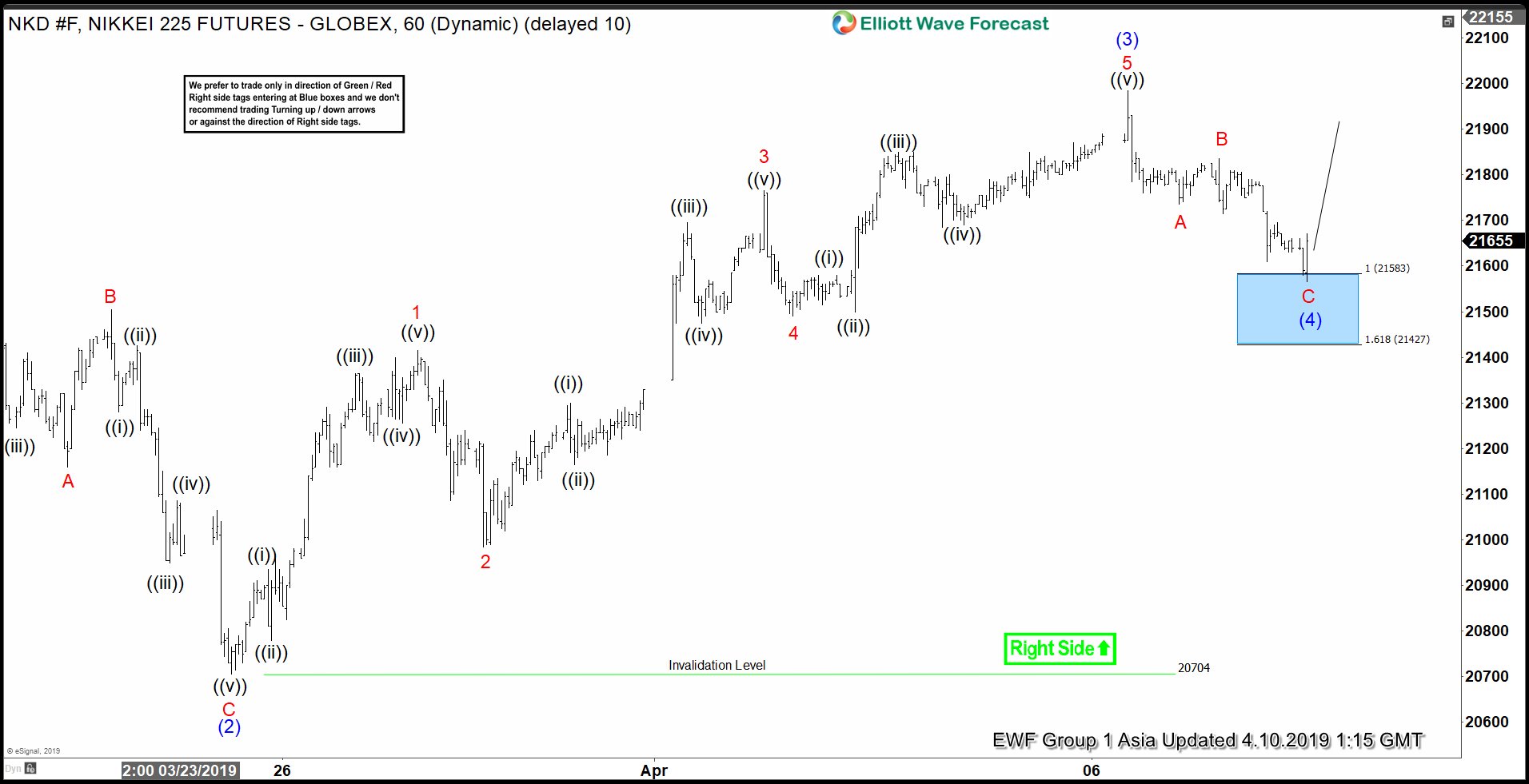

Elliott Wave View: Nikkei Still Missing Wave 5

Read MoreNikkei rally from March 8 low is in 5 waves & the Index is still missing 1 more leg higher. This article & video explains the short term Elliott Wave path.

-

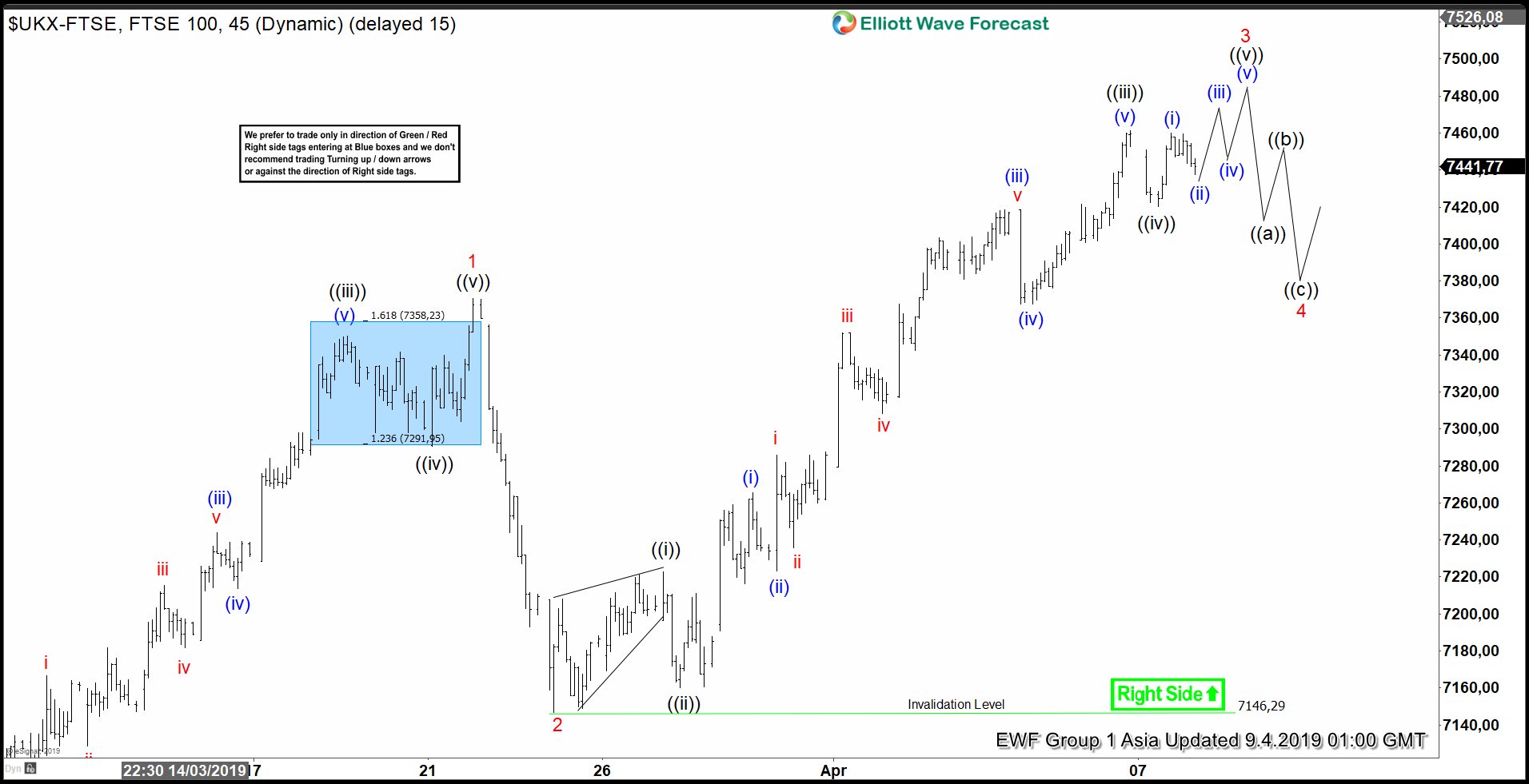

Elliott Wave View: Further Strength in FTSE

Read MoreFTSE cycle from February 28, 2019 low remains in progress as 5 waves. This article and video explains the short term Elliottwave path.