-

Elliott Wave View: Further Downside in GBPNZD

Read MoreGBPNZD broke below 3.19.2020 low creating bearish sequence from 3.9.2020 high. This article & video look at the Elliott Wave path.

-

Elliott Wave View: Amazon (AMZN) Impulsive Move In Progress

Read MoreAmazon (AMZN) rally from March 16, 2020 low is impulsive and favors further upside. This article and video look at the Elliott Wave path.

-

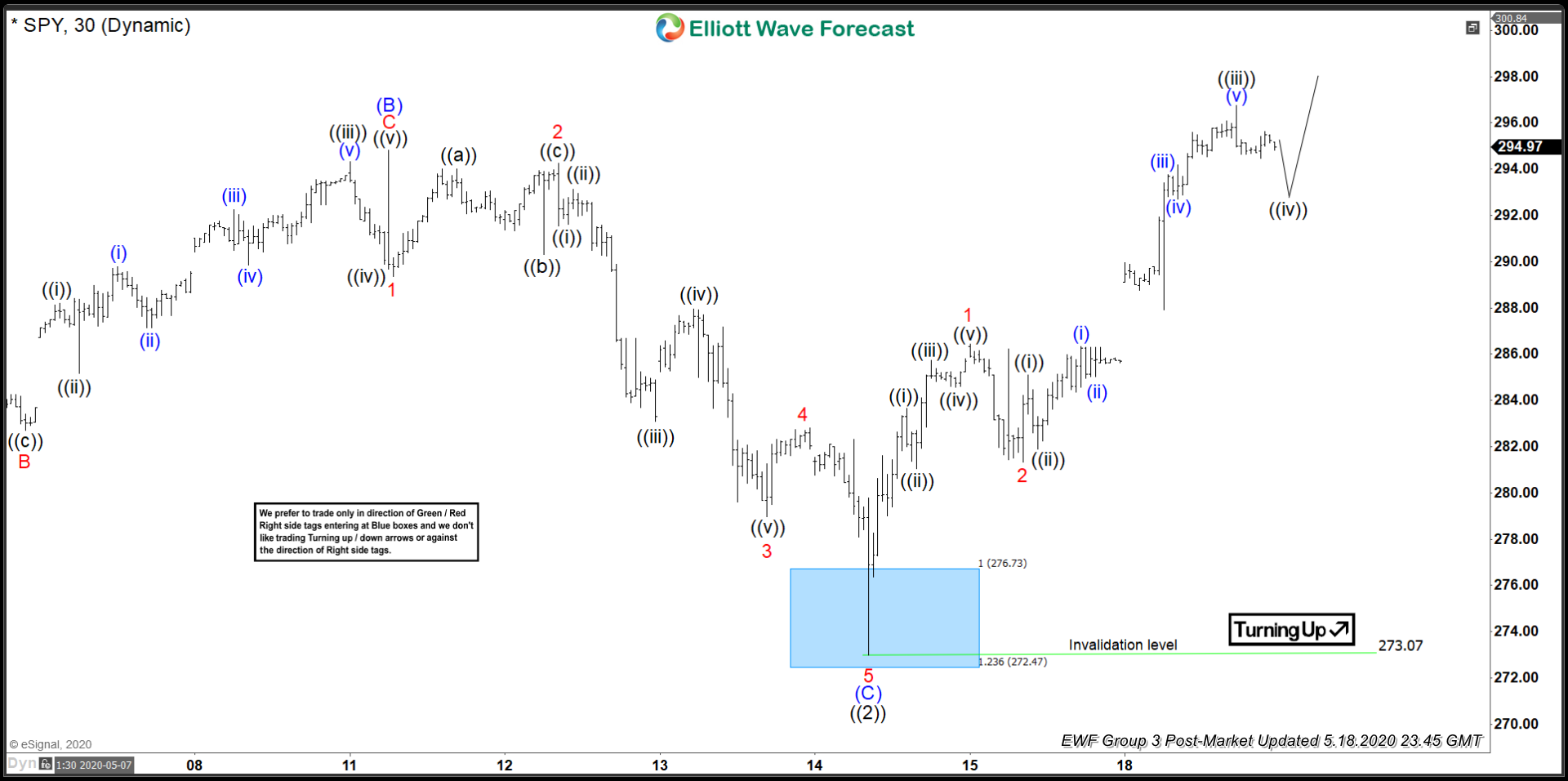

Elliott Wave View: SPY Has Resumed Wave 3 Higher

Read MoreSPY Has ended Correction to Cycle from 3.23.2020 low and resumes higher in wave 3. This article and video look at the Elliott Wave path.

-

Elliott Wave View: Pound Sterling in a New Impulsive Lower

Read MoreDecline in Pound Sterling from April 15 high is proposed to be in impulsive structure favoring further downside.This article looks at the Elliott Wave path.

-

Elliott Wave View: Russell 2000 (RTY) Reaching Short Term Support

Read MoreRussell 2000 is approaching support area soon in which buyers can appear for 3 waves bounce at least. This article & video look at the Elliott Wave path.

-

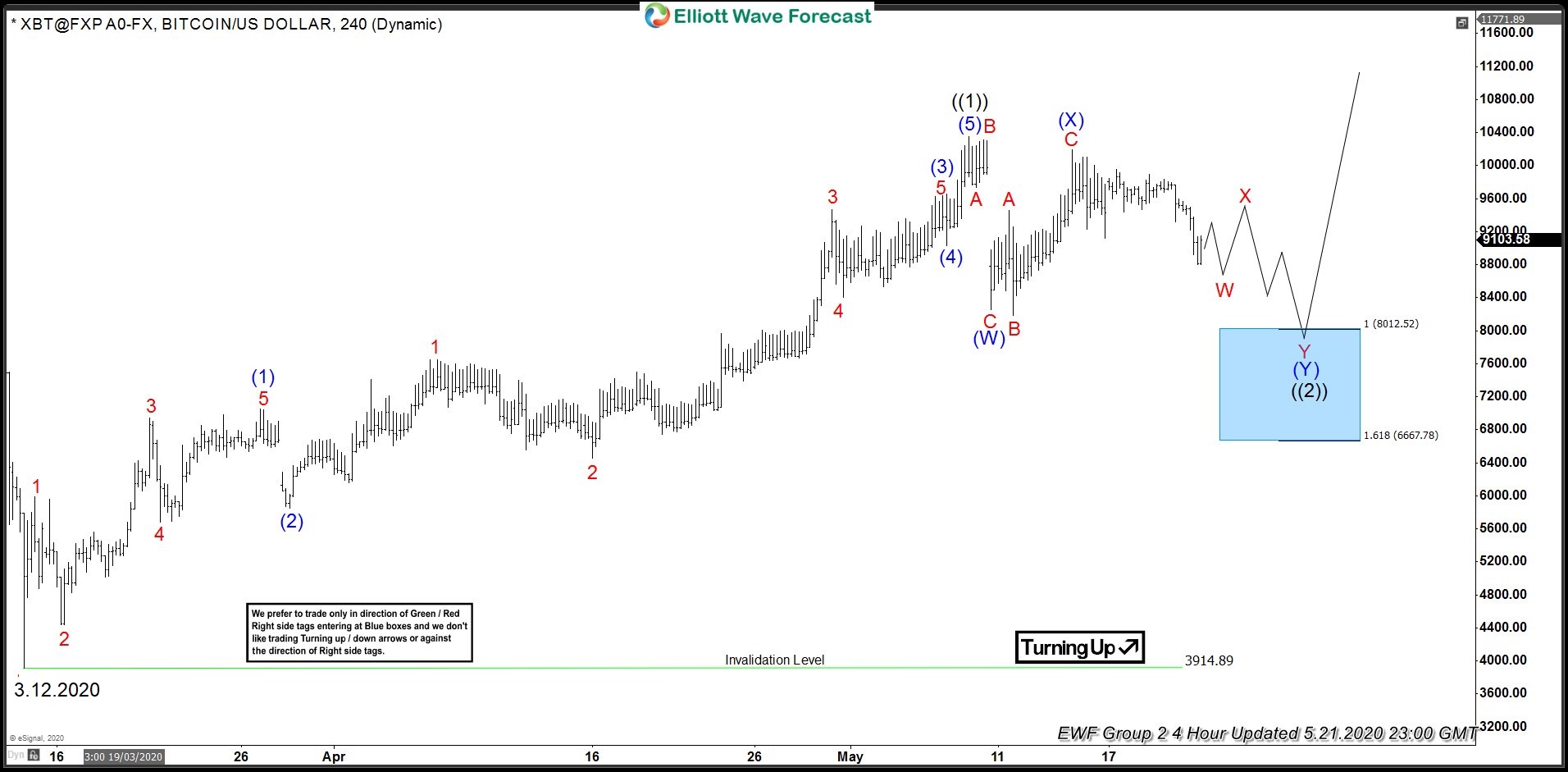

Outlook in Bitcoin after Halving

Read MoreRetail investors may return to Bitcoin again after the digital currency completed the one-in-four year adjustment called halving. Halving provides less rewards to miners who run high-powered computers to solve complex mathematical puzzles in order to generate new bitcoins. After this Monday, the current reward for unlocking a “block” has halved from 12.5 new coins […]