-

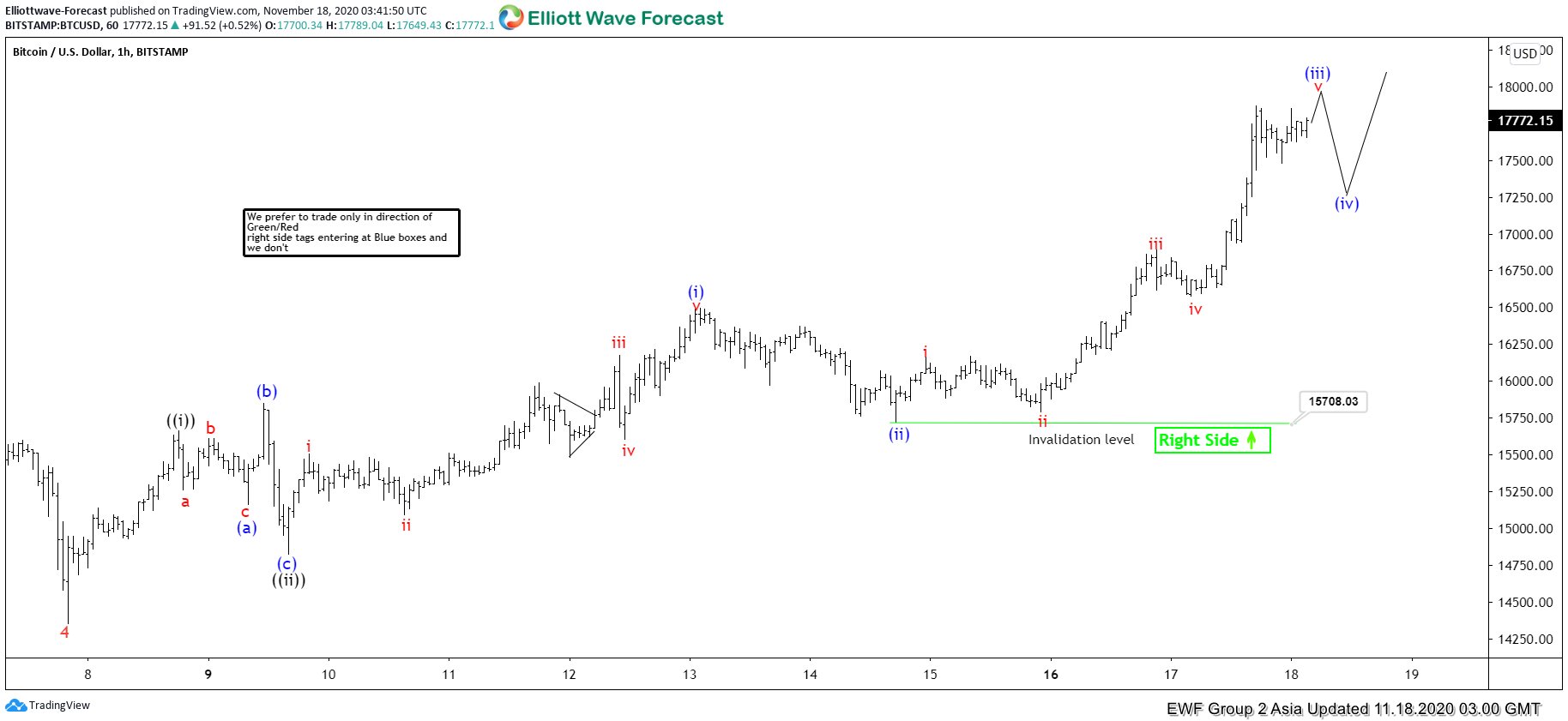

Elliott Wave View: Bitcoin Closing in to All-Time High

Read MoreBitcoin shows an impulsive rally and dips should continue to find support for more upside. This article and video look at the Elliott Wave path.

-

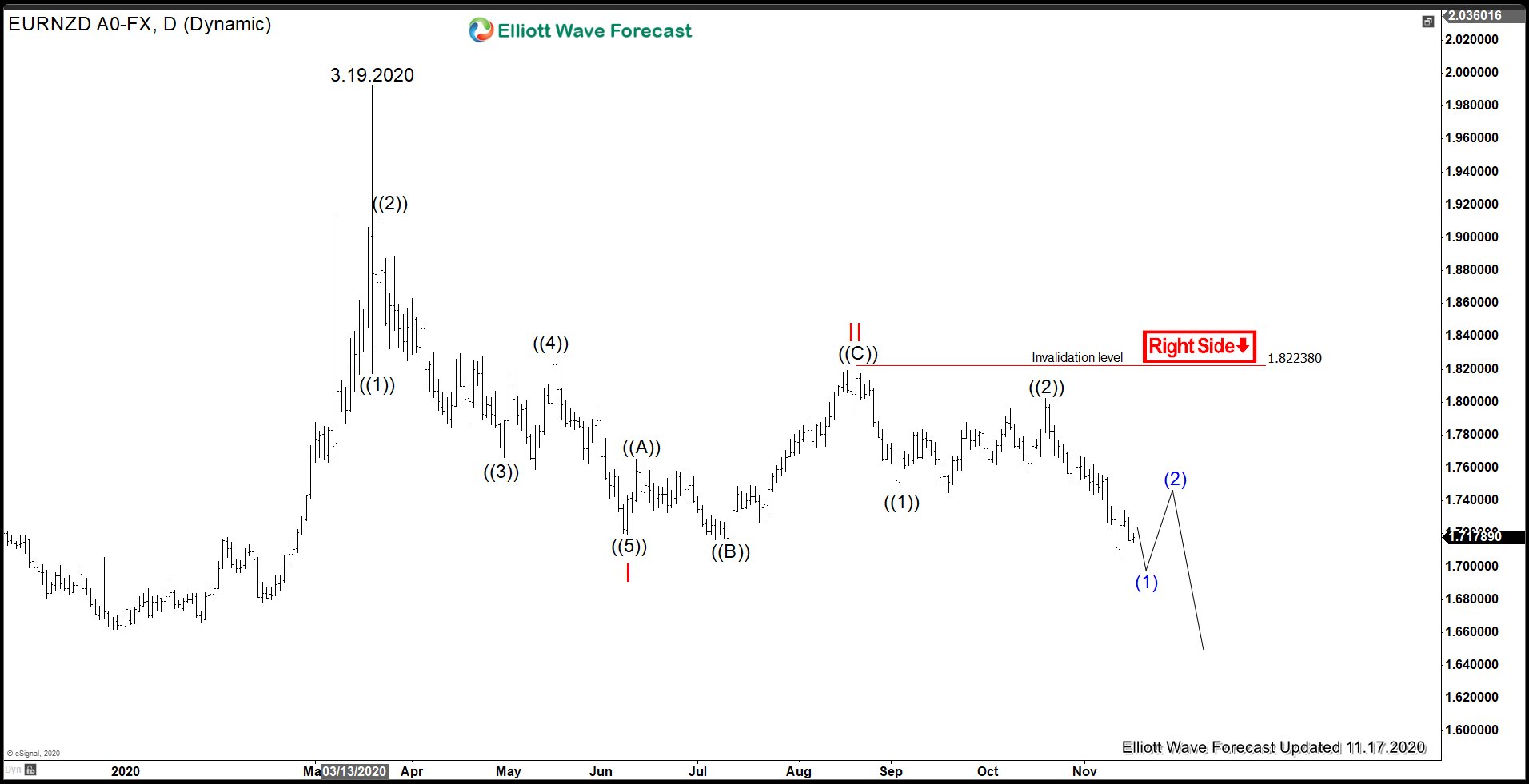

Virus Vaccine Hopes Support New Zealand Dollar

Read MoreTwo weeks’ back-to-back good news on virus vaccine from Pfizer and Moderna have buoyed risk sentiment. Overnight news reports Moderna’s COVID-19 vaccine has even a better 94.5% efficacy rate and longer shelf life compared to the Pfizer’s. New Zealand dollar, usually a proxy for risk sentiment, rose to 0.6910 after the news. Prior to all […]

-

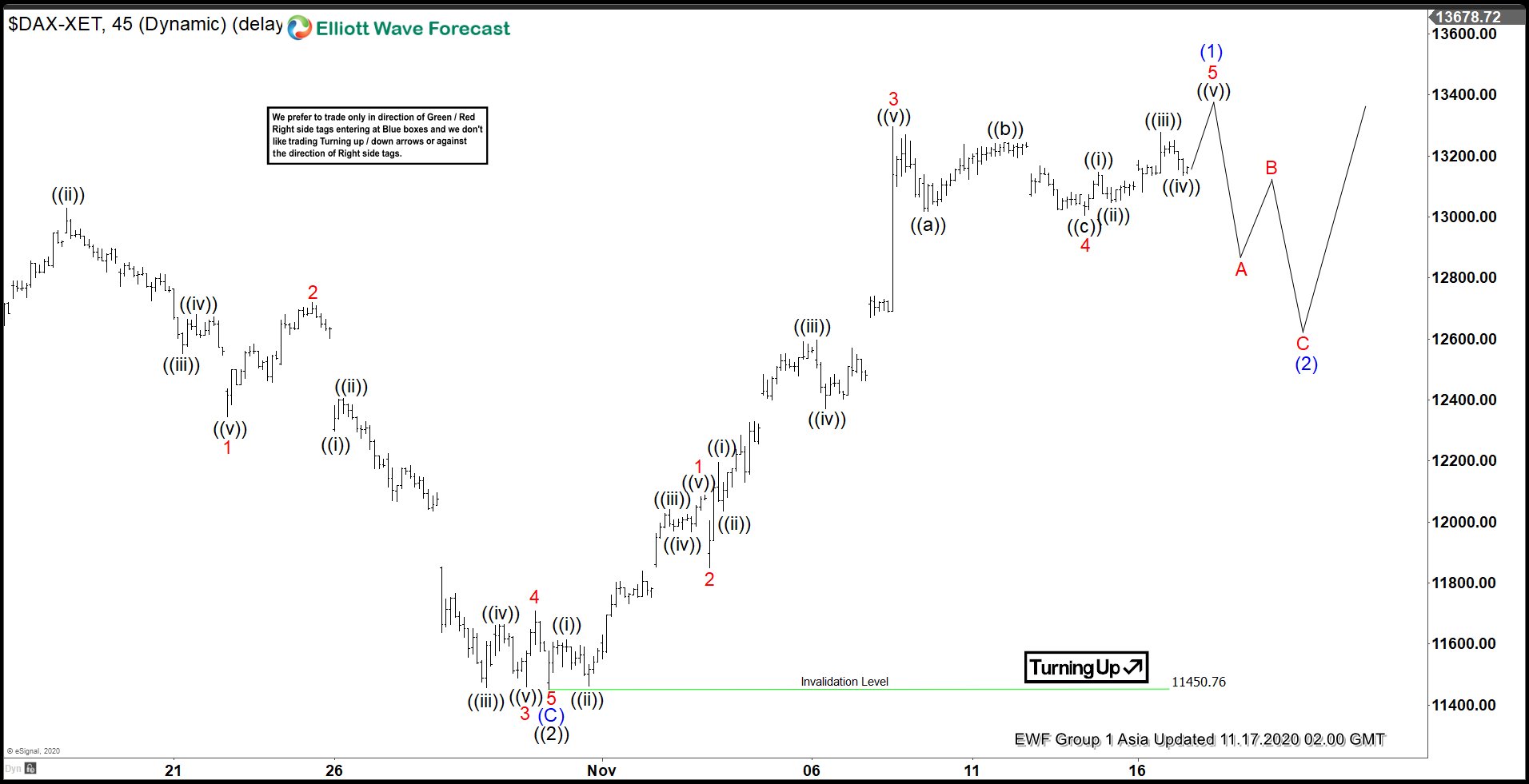

Elliott Wave View: DAX Impulsive Rally Suggests Buyers in Control

Read MoreDAX rallies in an impulsive structure from Oct 30 low suggesting further upside is likely. This article and video look at the Elliott Wave path.

-

Elliott Wave View: Pullback in Dow Futures (YM) Should See Buyers

Read MoreDow Futures (YM) has broken to all-time high and should continue to find support in 3, 7, 11 swing. This article and video look at the Elliott Wave path.

-

Elliott Wave View: USDJPY Rallies Higher Together with Indices

Read MoreUSDJPY shows an impulsive rally from Nov 9 low suggesting further upside is likely. This article and video look at the Elliott Wave path.

-

Bullish Sequence in Eurostoxx (SX5E) Favoring More Upside

Read MoreEarlier this week, news came out that a vaccine from Pfizer and BionTech has a 90% effectiveness. It triggered a big rally in the market on Monday. The U.S. and Europe are now still struggling with a new wave of Covid-19 infection with potential lockdown measures. There’s no question that people need to brace for […]