-

Elliott Wave View: New Bullish Cycle on Dow Futures (YM)

Read MoreDow Futures has resumed higher and made all-time high. This article and video look at the Elliott Wave path of the Index.

-

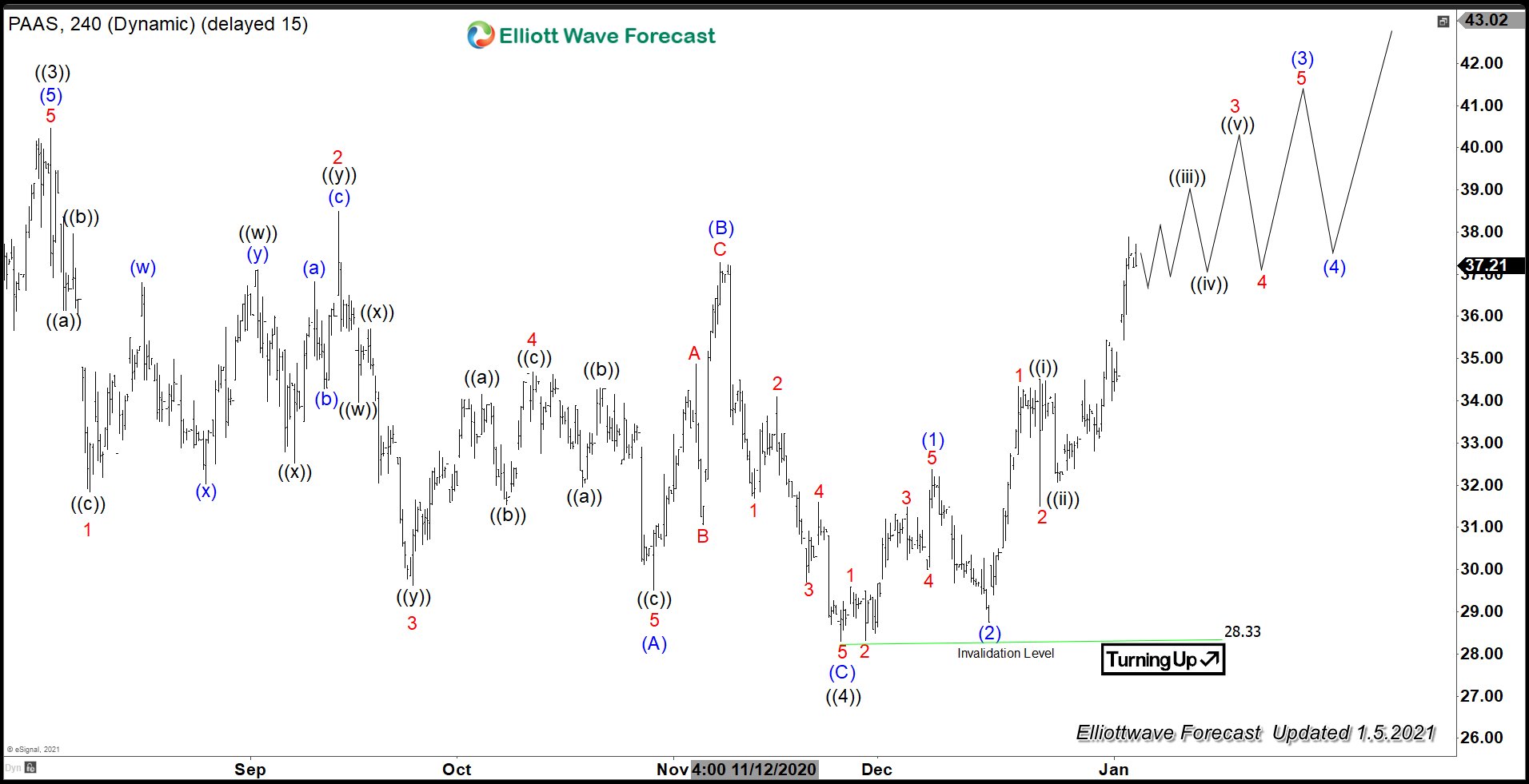

Pan American Silver (PAAS) Has Resumed Rally Higher

Read MoreIn our last article on Pan American Silver Corporation (ticker: PAAS) dated November 25 last year, we suggest that the stock is about to end correction and resumes higher. This is the chart we provided last November looking for buyers at the blue box. Fast forward to the new year, the stock failed to reach […]

-

Elliott Wave View: Is Gold Bottom in Place?

Read MoreGold (XAUUSD) rally from December 1 low looks impulsive suggesting the metal can see further upside. This article & video look at the Elliottwave path.

-

Elliott Wave View: Support Areas for Russell 2000

Read MoreRussell is currently correcting in a double three (double zigzag). This article and video look at potential support areas using Elliott Wave.

-

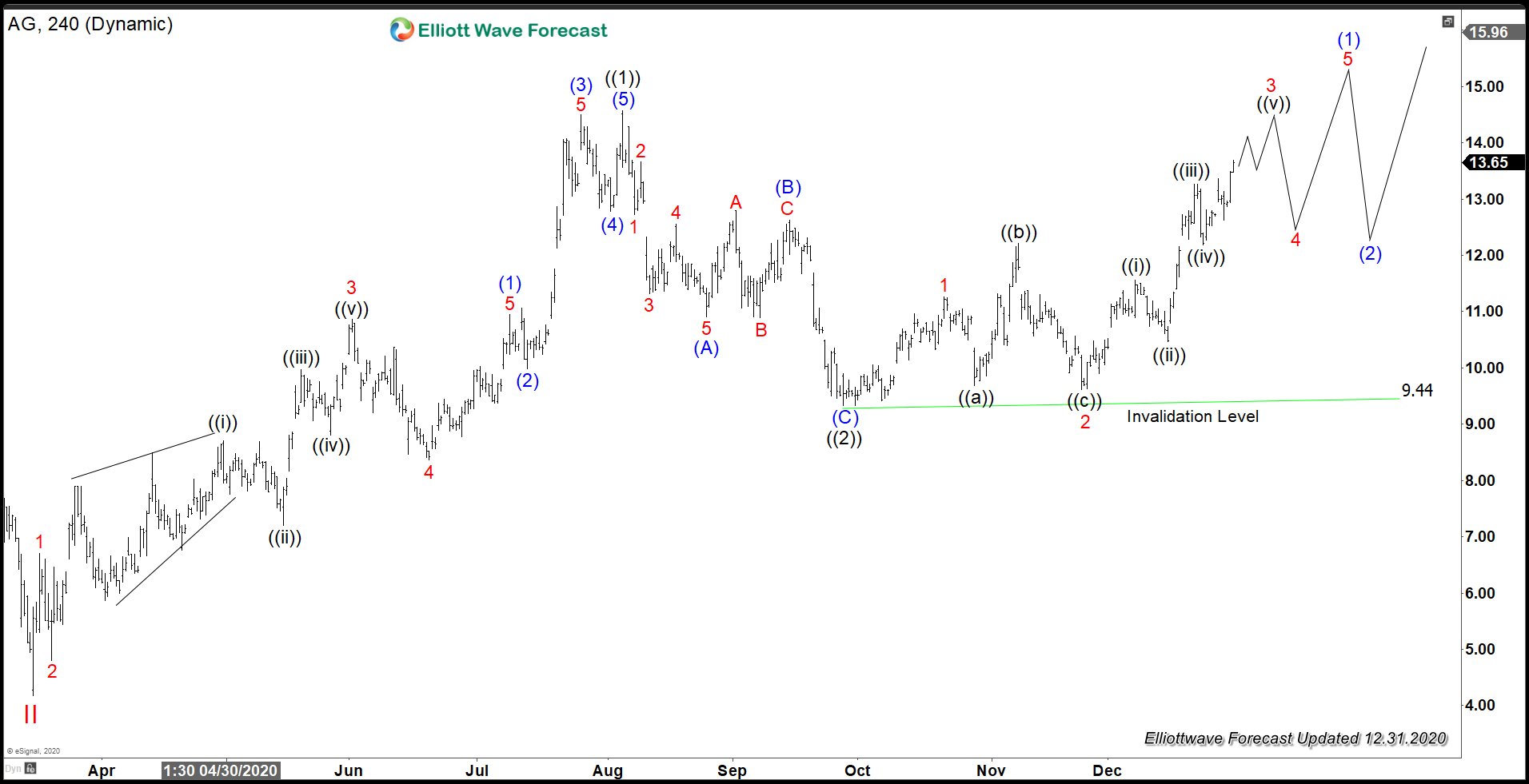

First Majestic Looking to Outperform in 2021

Read MoreFirst Majestic Silver (symbol: $AG) is one of the purest Silver miners in the market. It’s one of the best primary silver producers with healthy balance sheet and ample cash flow. This year, one of the most prominent mining and billionaire investors Eric Sprott has invested C$ 78 million to get a 2.3% stake in […]

-

Elliott Wave View: Dow Futures (YM) Remains Bullish as We End Year 2020

Read MoreDow Future is near all-time high as we end year 2020. Structure of the Index remains bullish as this article and video explains using Elliott Wave.