-

Elliott Wave View: Further Upside in USDJPY

Read MoreUSDJPY shows incomplete sequence from January 6 low favoring more upside. This article and video looks at the Elliott Wave structure.

-

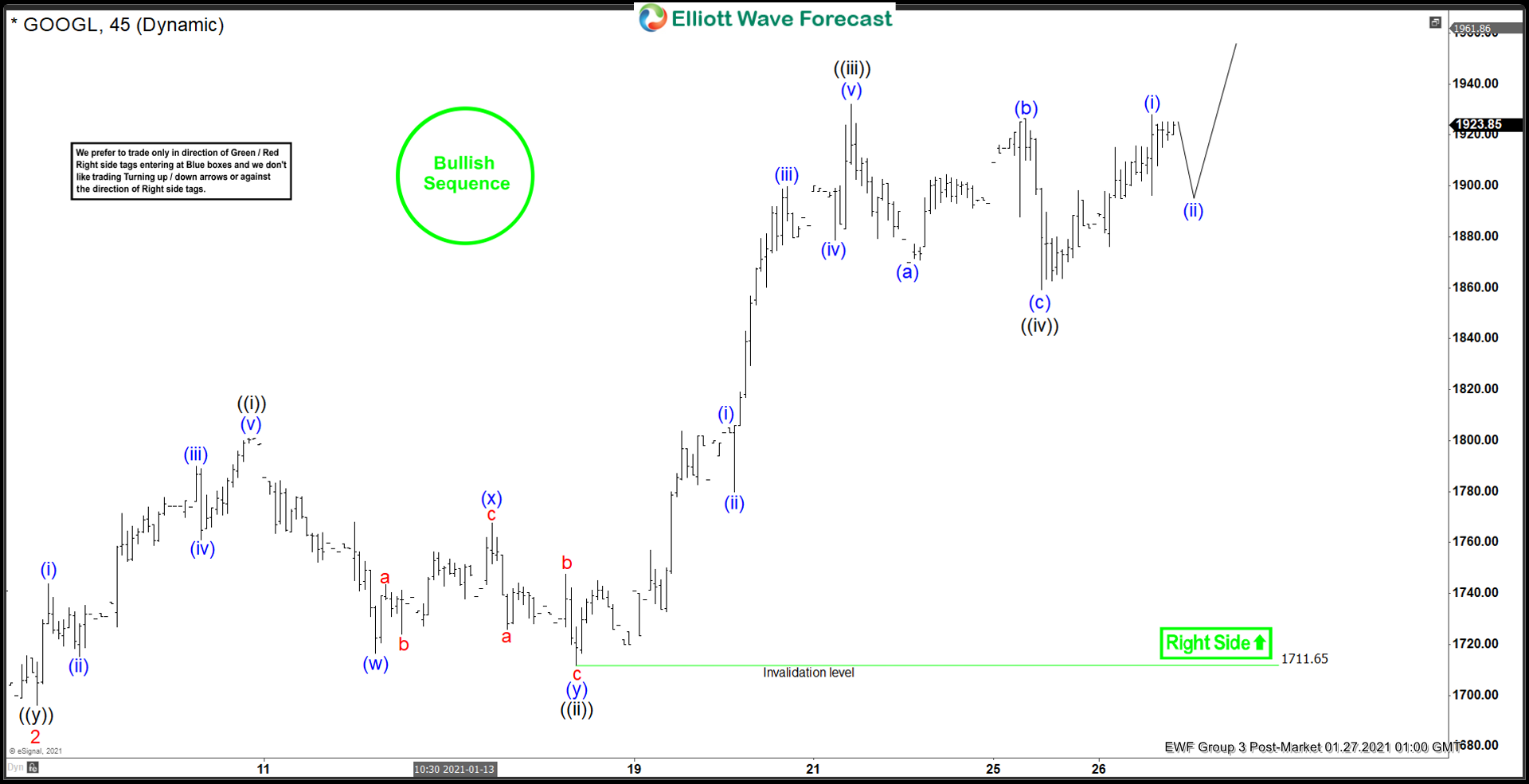

Elliott Wave View: Alphabet (GOOGL) Impulsive Rally Incomplete

Read MoreAlphabet (GOOGL) shows incomplete impulsive structure from December 21 low favoring more upside. This article and video look at the Elliott Wave path.

-

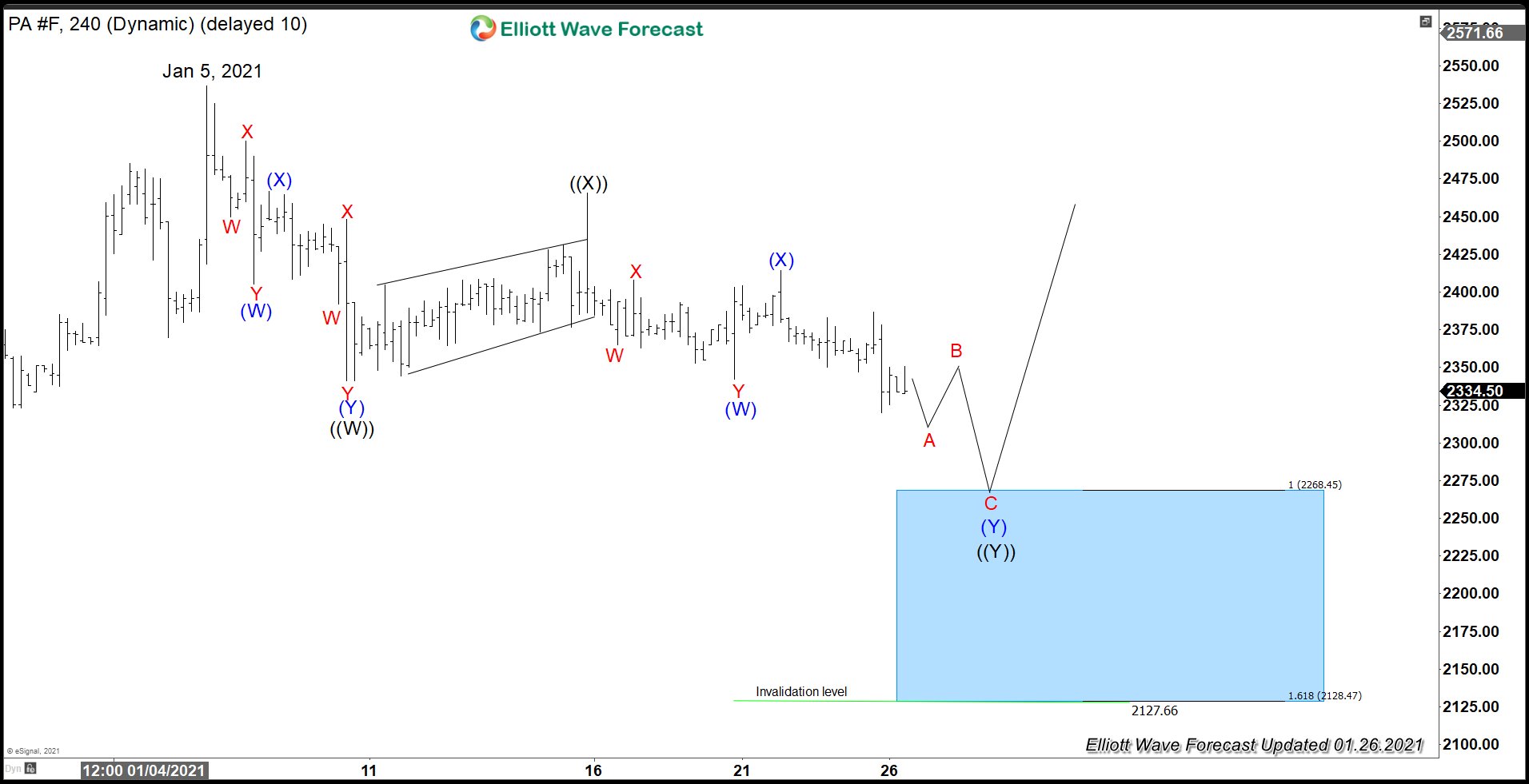

Supply Deficit in Palladium May Continue to Support Price

Read MorePalladium market continues to be in short supply for 9 straight years. The gap between mine supply and consumption in 2020 was around 1 million ounce of palladium. The chart below shows the deficit from 2011-2019 Palladium is used by automakers in catalytic converter manufacturing to clean greenhouse exhaust fumes. COVID-19 pandemic in 2020 further […]

-

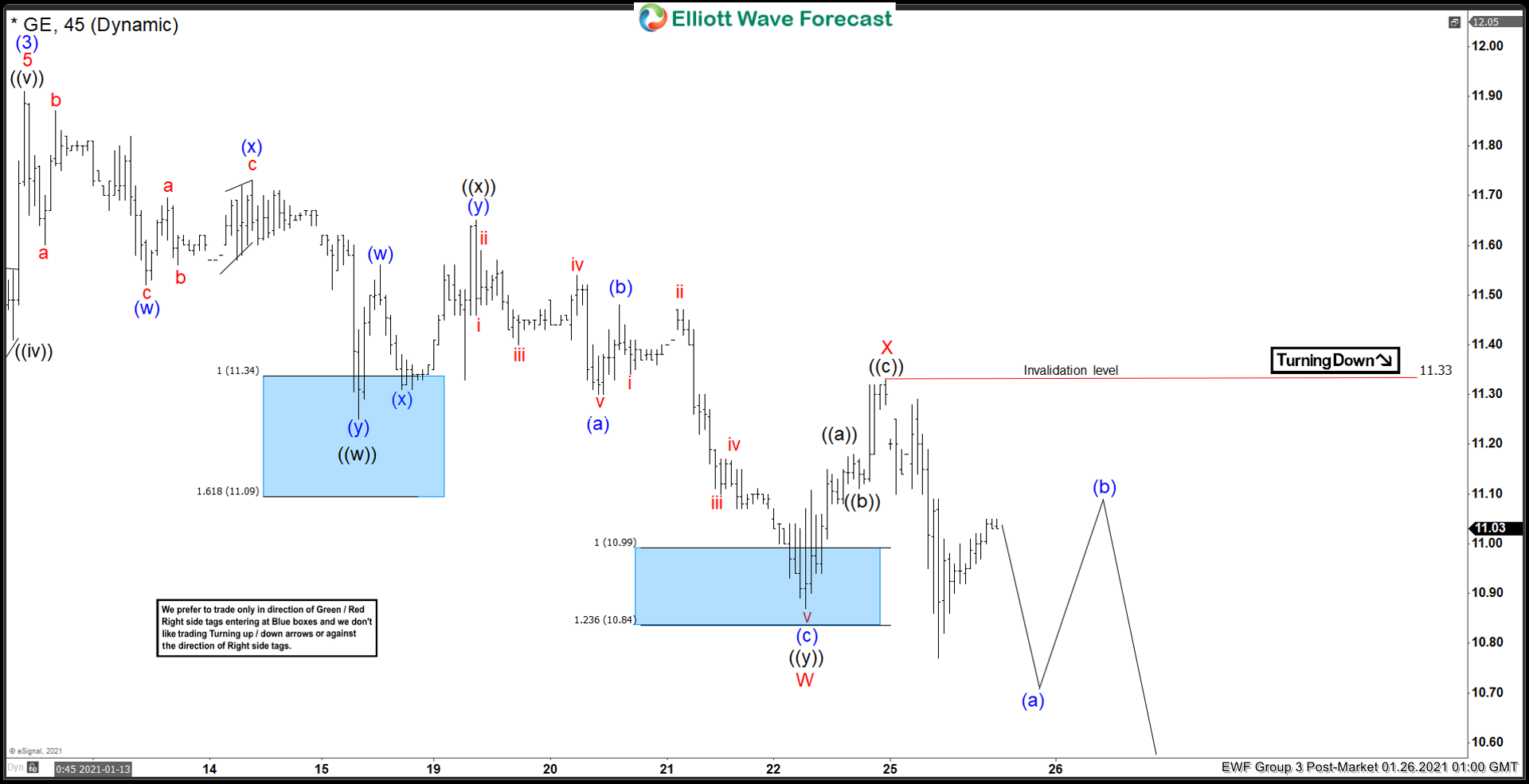

Elliott Wave View: General Electric (GE) Has Further Downside in Correction

Read MoreGeneral Electric (GE) shows incomplete sequence from January 13 peak & the stock can see more downside. This article & video look at the Elliott Wave path.

-

Elliott Wave View: Impulsive Rally in NZDUSD

Read MoreNZDUSD rally from January 18 low looks impulsive and pair can see further upside while dips stay above there. This blog looks at Elliott Wave path.

-

Elliottwave View: SPX Upside Move Has Resumed

Read MoreS&P 500 (SPX) extends to new all-time high and more upside is favored. This article and video look at the Elliott Wave path.