-

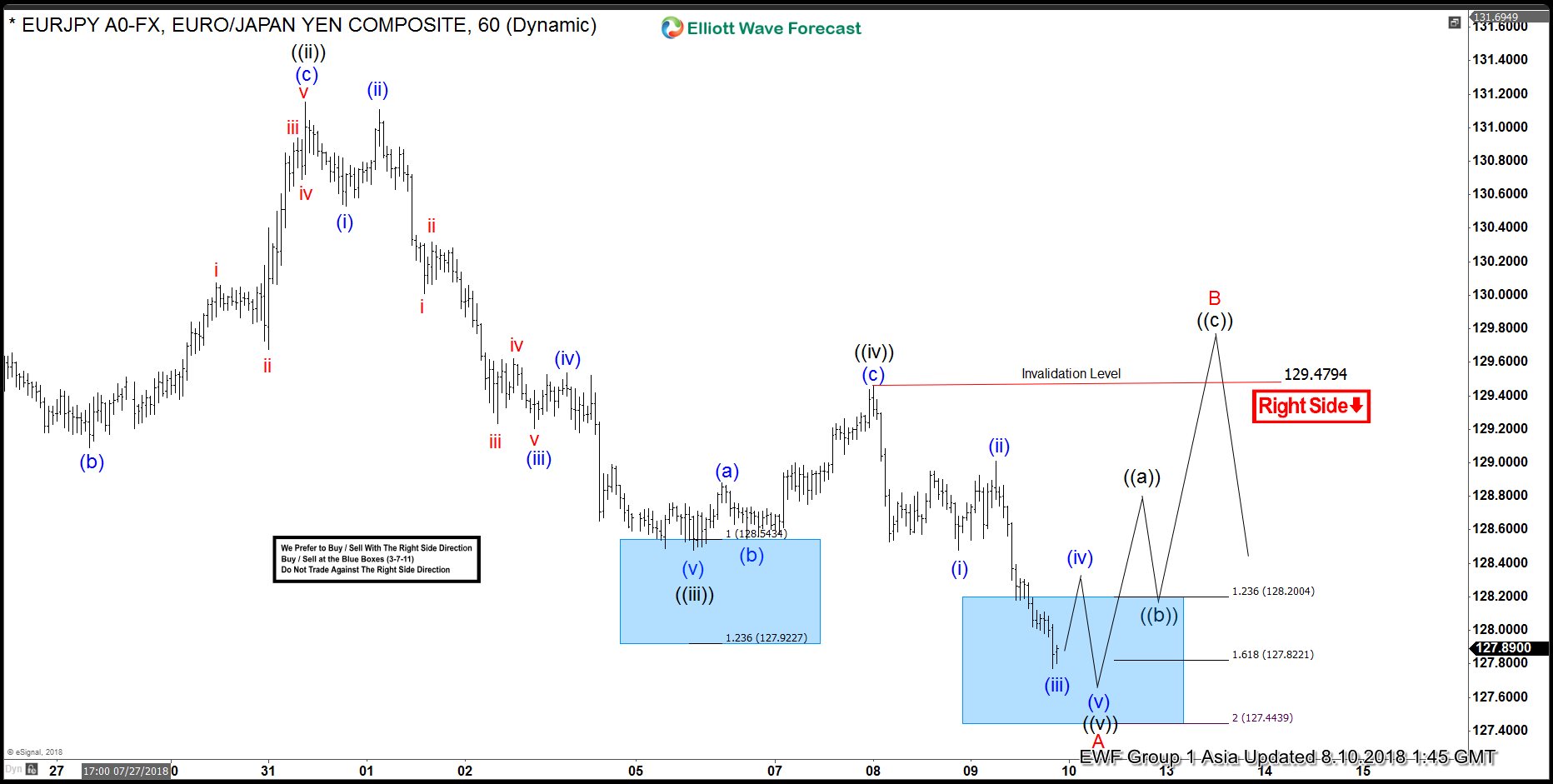

EURJPY Elliott Wave Analysis: Nearing 3 Wave Bounce?

Read MoreEURJPY short-term Elliott wave analysis suggests that the decline from 7/17/2018 peak (131.97) is unfolding as 5 leading diagonal structure in Minor wave A of a possible zigzag correction. The initial decline to 129.39 low ended Minute wave ((i)). Then Minute wave ((ii)) bounce ended at 131.13 as a Flat. Down from there, Minute wave […]

-

OIL Elliott Wave Analysis: Extending to the Downside

Read MoreOil ticker symbol: CL_F short-term Elliott wave analysis suggests that the bounce to $70.44 high ended intermediate wave (2). The internals of that bounce took place as Elliott wave double correction where Minor wave W ended in 3 swings at $69.92. From there, the pullback to $68.26 completed the Minor wave X in 3 swings. […]

-

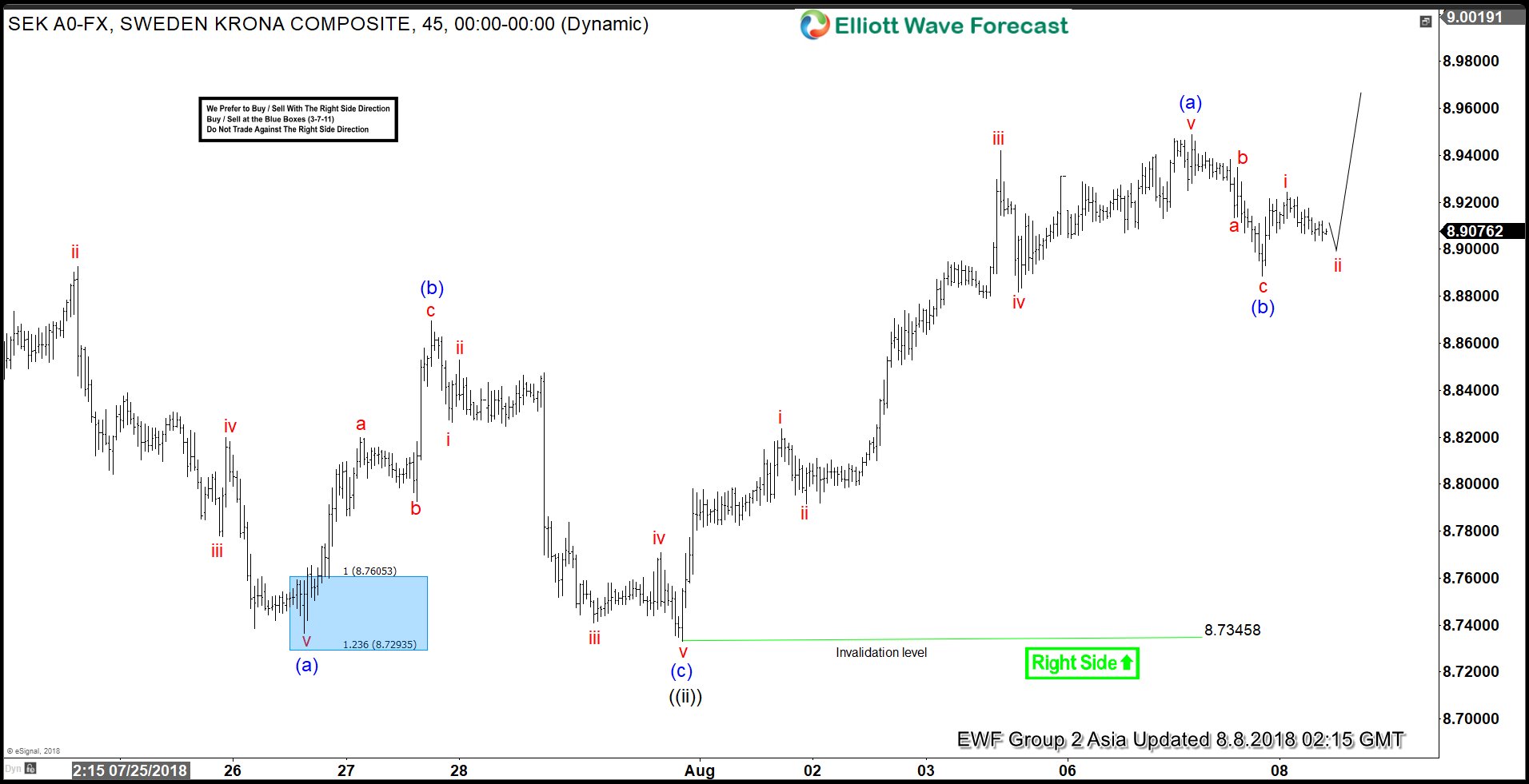

USDSEK Elliott Wave View: Starting C Leg Higher?

Read MoreUSDSEK short-term Elliott Wave view suggests that the decline to 8.7345 low ended Minute wave ((ii)) pullback. The internals of that pullback unfolded as Elliott wave Zigzag correction where Minutte wave (a) ended in 5 waves structure at 8.7377 low. Then the bounce to 8.8687 high ended Minutte wave (b) bounce in swings. The decline […]

-

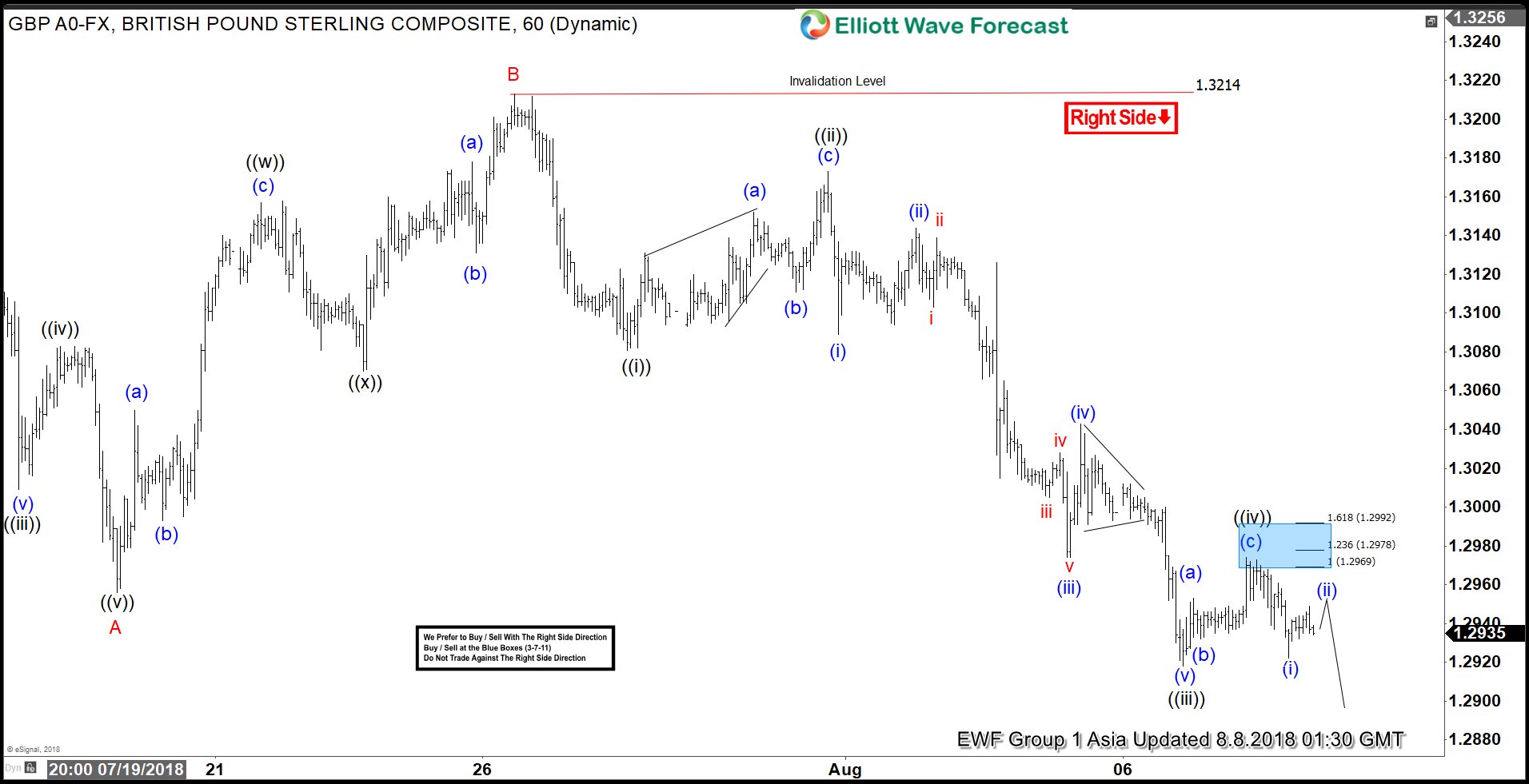

GBPUSD Elliott Wave Analysis: Right Side Calling Lower

Read MoreGBPUSD short-term Elliott Wave analysis suggests that the decline from 7/09/2018 peak (1.3361) is unfolding as Elliott wave zigzag when Minor wave A ended in 5 waves structure at 1.2956 low. Up from there, the bounce to 1.3214 high ended Minor wave B. The internals of that bounce unfolded as a Double three structure where […]

-

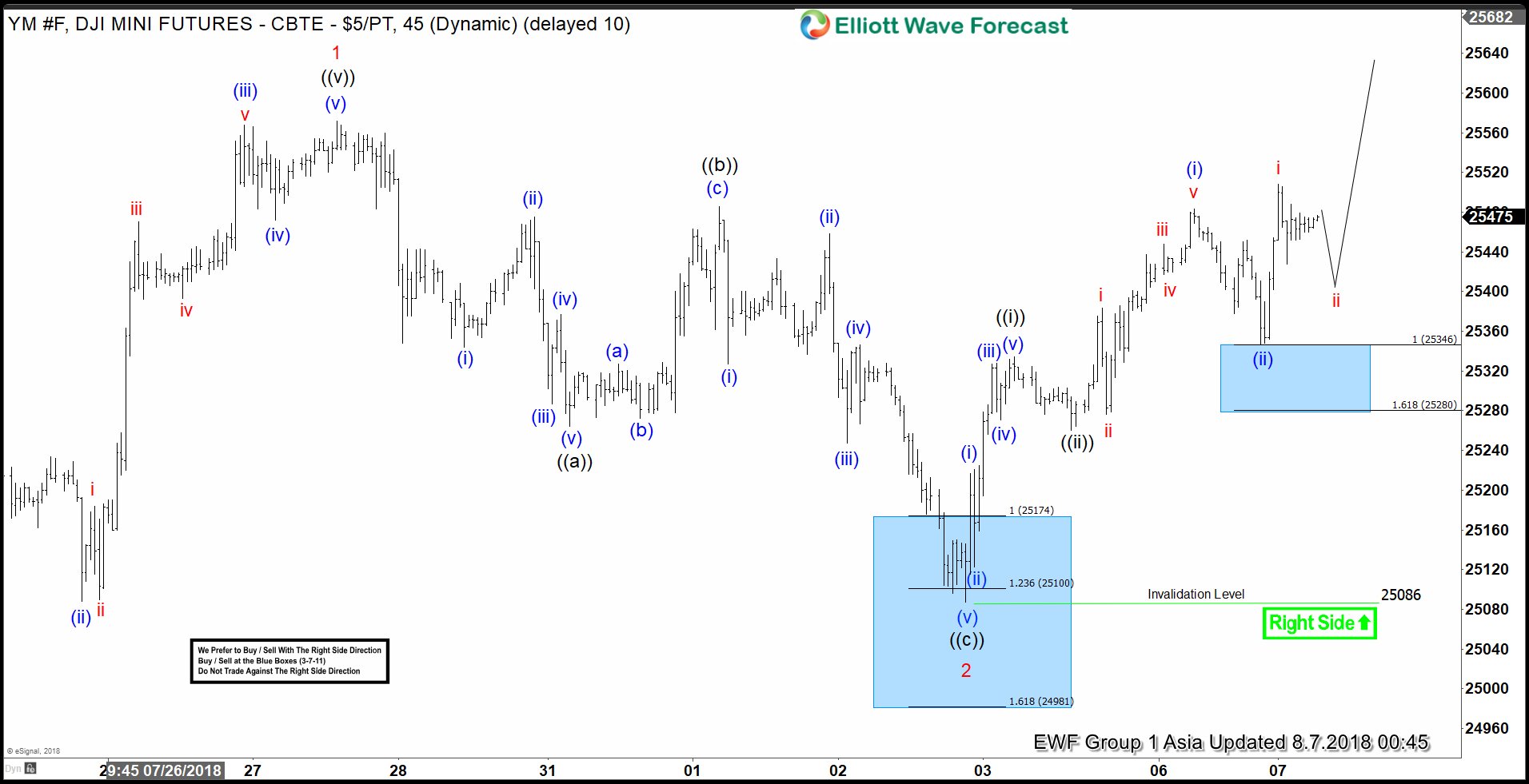

Dow Futures (YM_F) Elliott Wave View: Reacting Higher From Blue box

Read MoreDow Futures ticker symbol: YM_F short-term Elliott wave view suggests that the rally from 6/28/2018 low cycle to 25572 high on 7/27/2018 peak ended Minor wave 1. The internals of that rally higher took place as an impulse structure with sub-division of 5 waves structure in each leg higher. Down from there, the index corrected […]

-

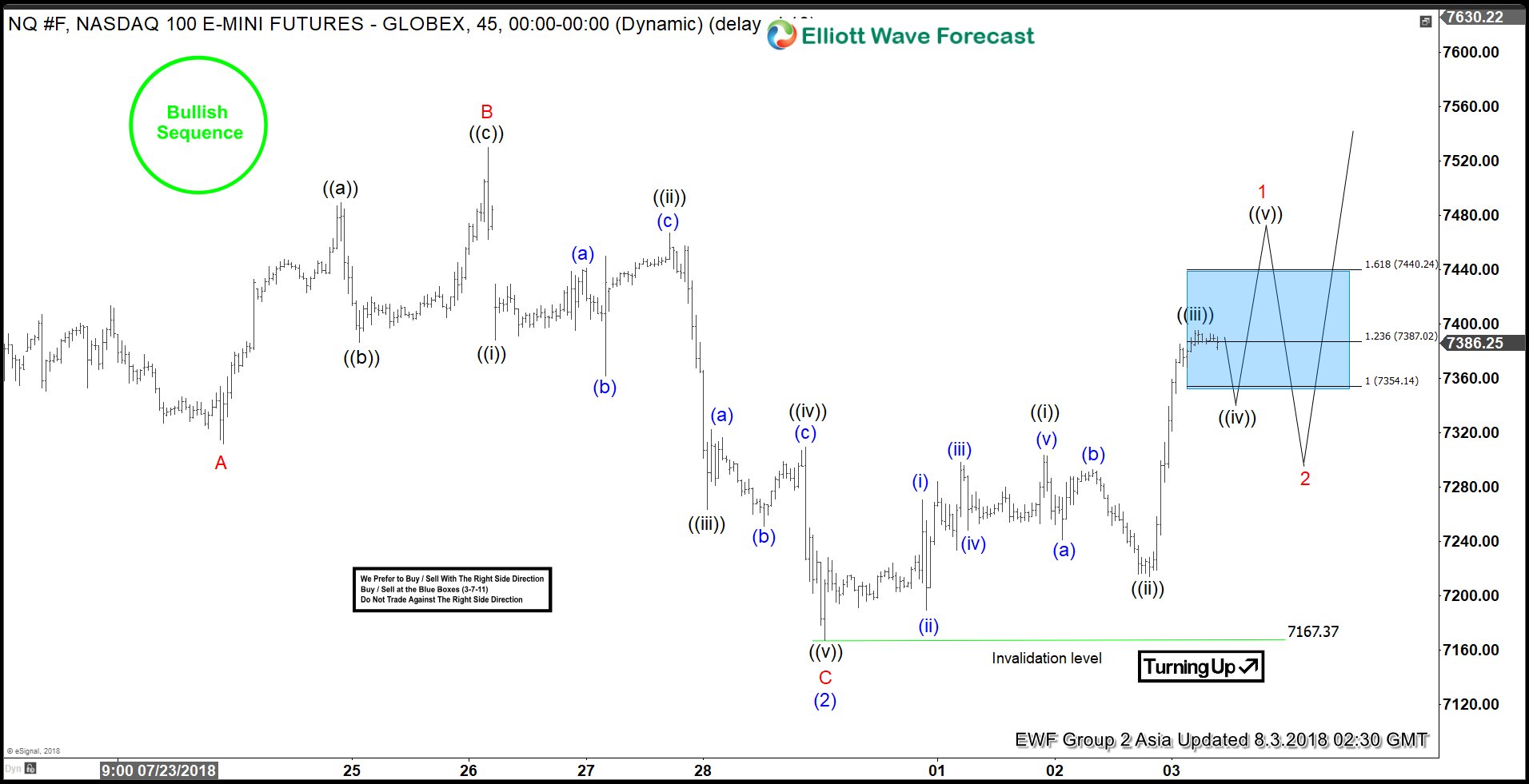

NASDAQ Elliott Wave Analysis: Ready To Rally Higher?

Read MoreNASDAQ futures: ticker symbol NQ_F short-term Elliott wave analysis suggests that the decline to $7167.37 low ended intermediate wave (2) pullback. The internals of that pullback unfolded as Elliott Wave Flat correction where Minor wave A ended at $7311.50 low. Above from there, the bounce to $7530 high ended Minor wave B bounce as Elliott […]