-

AT&T ( T ) Buying Elliott Wave Dips Into The Direction Of Right side

Read MoreIn this Technical blog, we are going to take a quick look at the past performance of AT&T ticker symbol: T Elliott Wave charts that we presented to our clients. We are going to explain the structure and the forecast. As our members knew, we were pointing out that the right side of the market remains higher in […]

-

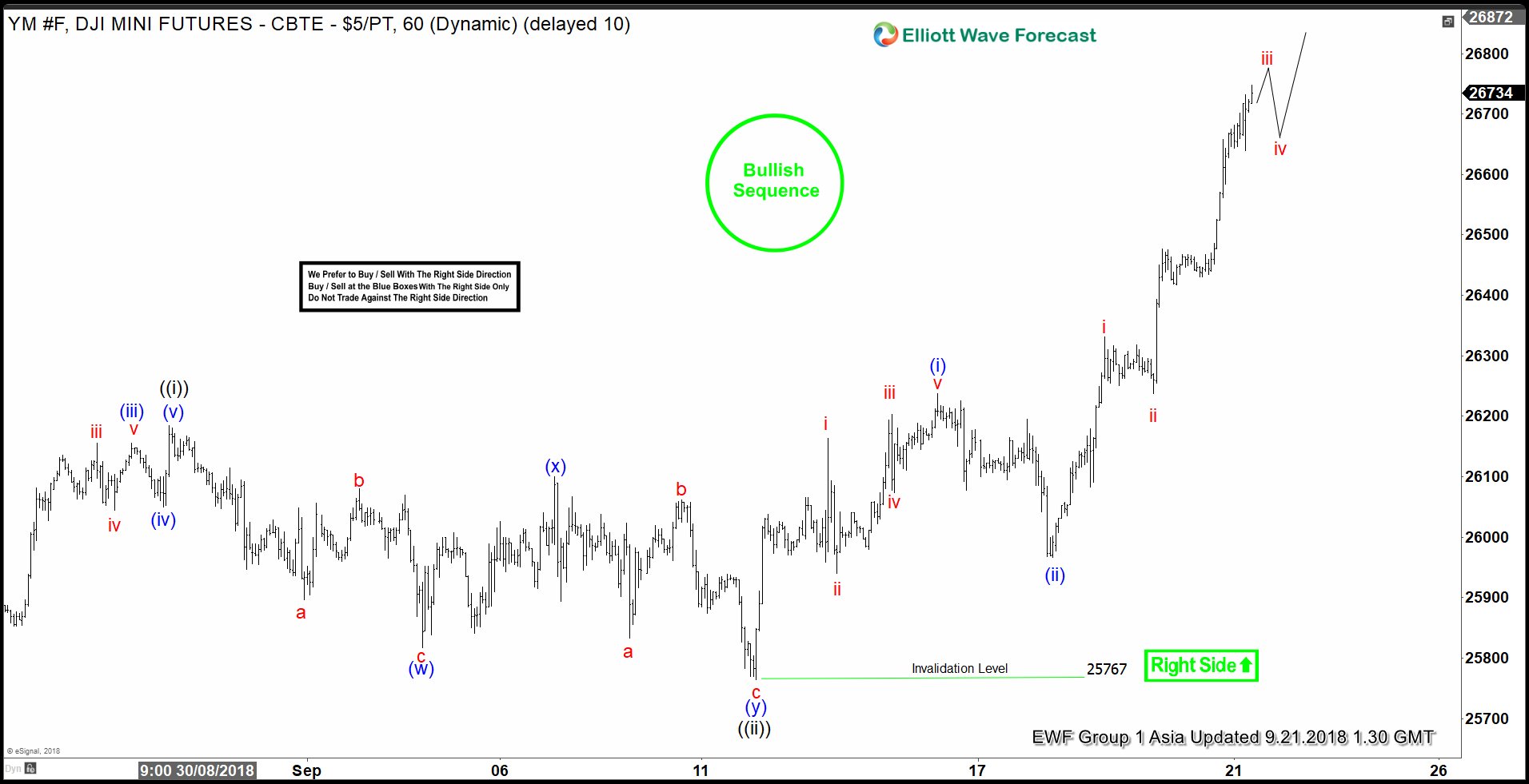

Elliott Wave: DJIA Mini Futures Nesting Higher Within Wave 3

Read MoreDJIA Mini Futures mid-term Elliott wave view suggests that the cycle from 2/05/2018 low is nesting higher as impulse structure & already managed to make new all-time highs. While shorter-cycles suggests that index should be extending higher in lesser degree wave ((iii)) of 3 still looking for more upside extension. The initial rally in index […]

-

Netflix Elliott Wave View: Dips Expected To Remain Supported

Read MoreNetflix ticker symbol: $NFLX short-term Elliott wave analysis suggests that the pullback to $335.67 low ended intermediate wave (2) pullback. The internals of that pullback unfolded as a Flat correction. Where Minor wave B bounce ended in 3 swings at $374.09 high. Down from there, Minor wave C unfolded in 5 waves impulse structure. And […]

-

EURAUD Elliott Wave View: Reaching Support Zone

Read MoreEURAUD short-term Elliott wave view suggests that the rally to 1.6353 high ended intermediate wave (1) higher. The internals of that degree unfolded as impulse structure with lesser degree cycles showing the sub-division of 5 waves structure. Below from 1.6353 high, the pair is doing an intermediate wave (2) pullback in 3, 7 or 11 […]

-

AMAZON Elliott Wave View: Close To Finding Support?

Read MoreAMAZON ticker symbol: AMZN short-term Elliott wave view suggests that the rally to $2050.50 high ended intermediate wave (1) as impulse structure. Down from there, the instrument is doing a pullback in intermediate wave (2). The internals of that pullback unfolding in 3 swing structure with the sub-division of 5-3-5 structure in lesser degree cycles […]

-

NKE Ready To Start The Next Leg Higher?

Read MoreNike Ticker symbol: NKE short-term Elliott wave view suggests that the pullback to $75.06 low ended intermediate wave (2). Above from there, the stock has rallied to new all-time highs confirming the next leg higher in intermediate wave (3). The internals of intermediate wave (3) higher is unfolding as Elliott wave impulse structure with the sub-division of […]