-

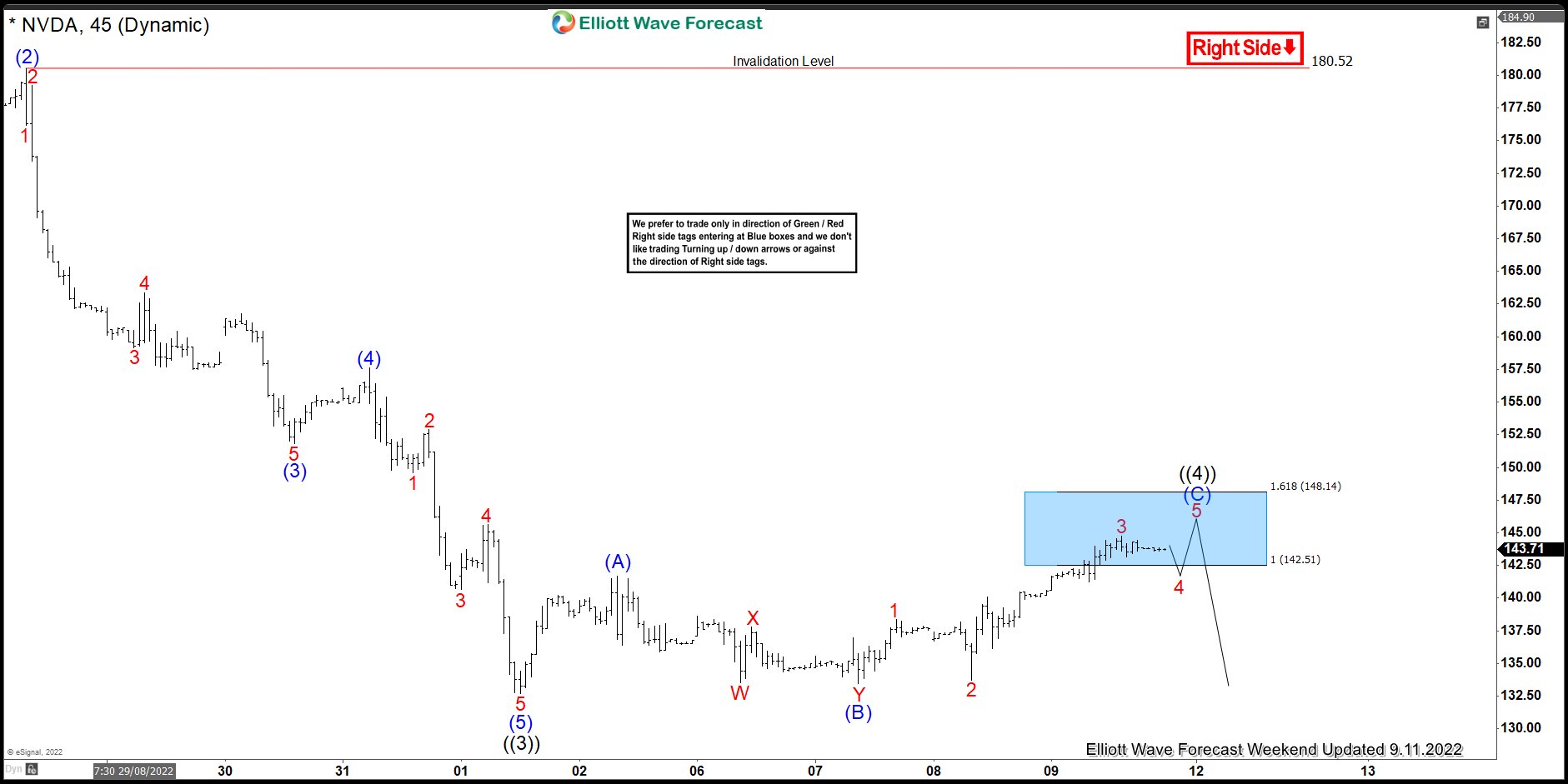

NVDA Reacting Lower Perfectly From Blue Box Area

Read MoreIn this technical blog, we will look at the past performance of 1-hour Elliott Wave Charts of NVDA. In which, the decline from 05 August 2022 high is unfolding as an impulse sequence and showed a lower low sequence within the bigger cycle from November 2021 peak. Therefore, we knew that the structure in NVDA is incomplete […]

-

EURUSD Resume Downside After Finding Sellers At Blue Box

Read MoreIn this blog, we take a look at the past performance of EURUSD charts. In which, the pair provided a selling opportunity at the blue box area.

-

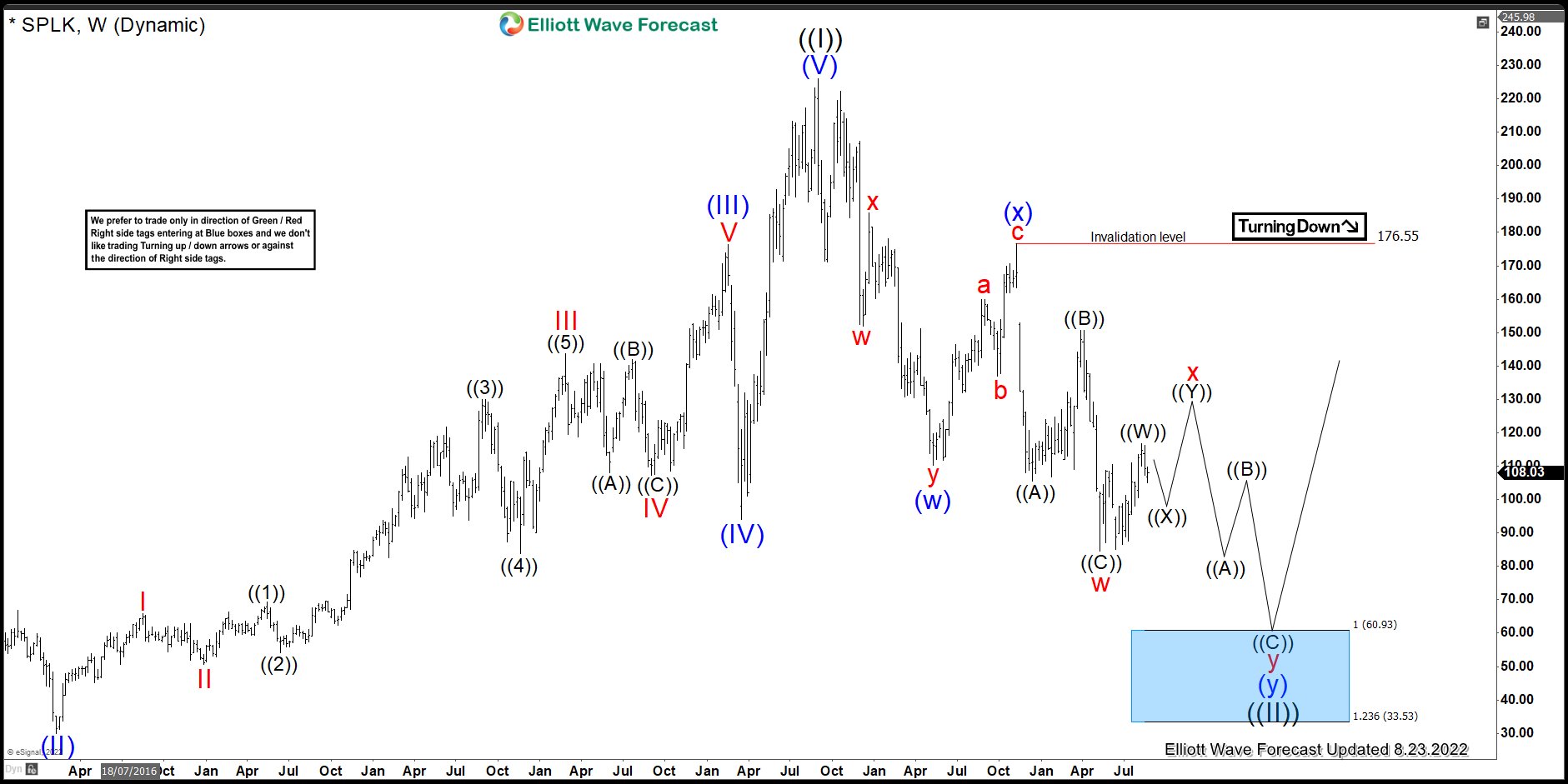

Splunk Incorporation ( SPLK) Elliott Wave Forecast Analysis

Read MoreSplunk Inc ticker symbol: SPLK engages in the development and marketing of cloud software solutions. Its products include Splunk cloud, Splunk light, and Splunk enterprise. It also offers solutions for Information Technology operations, security, internet-of-things, application analytics, business analytics, and industries. The company was founded by Erik M. Swan, Michael J. Baum, and Robin K. […]

-

ZOOM (ZM) Entering Into The Bigger Extreme Area

Read MoreZoom Video Communications, Inc ticker symbol: ZM engages in the provision of a video-first communications platform. The firm offers meetings, chat, rooms and workspaces, phone systems, video webinars, marketplace, and developer platform products. It serves the education, finance, government, and healthcare industries. Its platform helps people to connect through voice, chat, content sharing, and face-to-face […]

-

CRWD Can Still See The Extreme From November 2021 Peak

Read MoreCrowdStrike Holdings, Inc ticker symbol CRWD. provides cybersecurity products and services to stop breaches. It offers cloud-delivered protection across endpoints, cloud workloads, identity, and data. Threat intelligence, managed security services, IT operations management, threat hunting, Zero Trust identity protection, and log management. CrowdStrike serves customers worldwide. In this technical blog, we will be going to […]

-

Nifty Index Reacting Lower From Elliott Wave Hedging Area

Read MoreIn this technical blog, we will look at the past performance of 1 hour Elliott Wave Charts of the Nifty index. In which, the decline from April 2022 high ended in a higher degree wave ((Y)) at 15183.40 low. And made a bounce higher in wave ((X)). The bounce from the lows unfolded in a […]