-

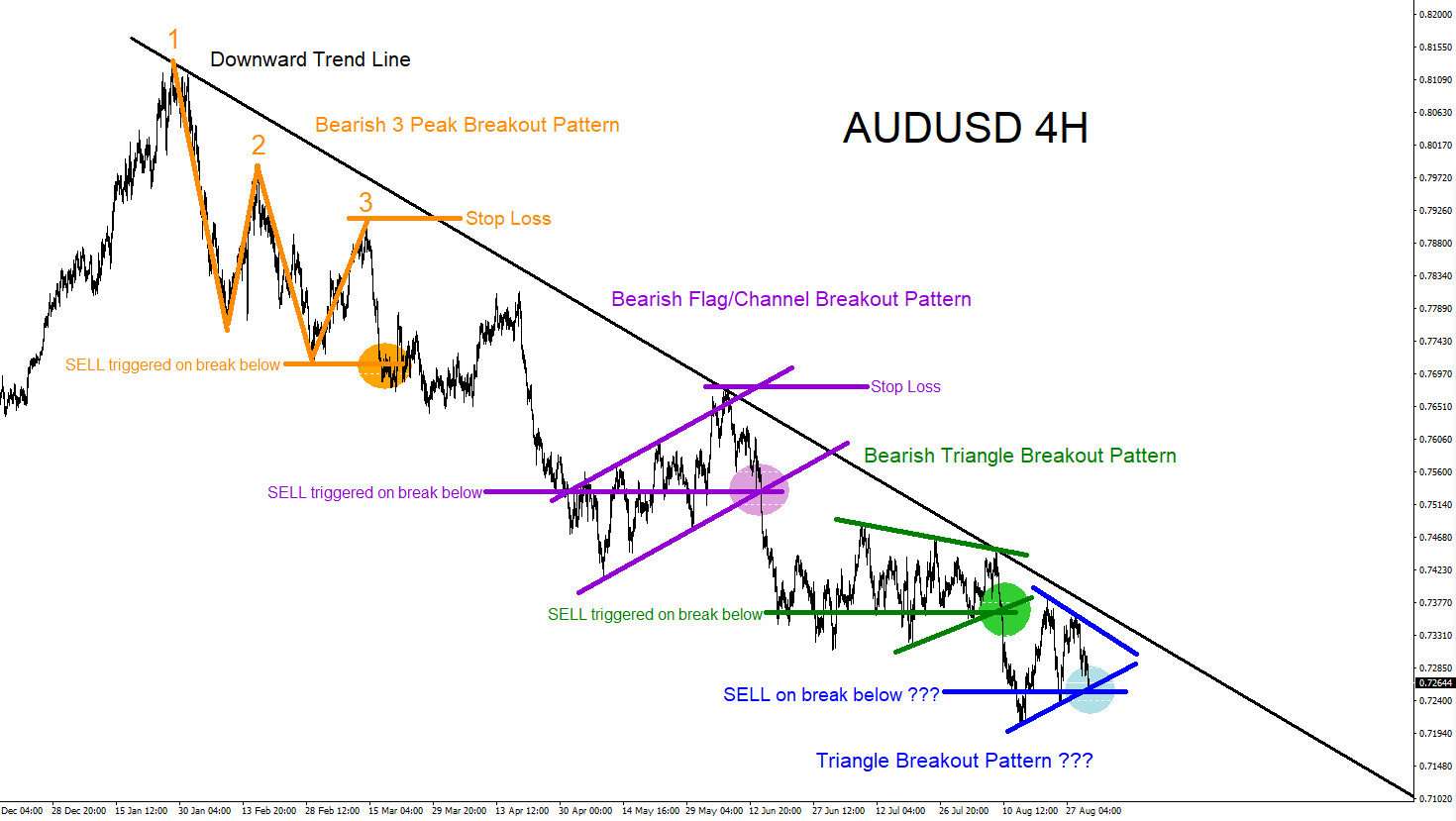

AUDUSD : Another Extension Lower?

Read MoreAUDUSD Technical Analysis 8.30.2018 AUDUSD Possible SELL/SHORT Trade Setup: Since January 2018 AUDUSD has been trending lower and there were various market bearish patterns that were signalling for the pair to move lower. Traders should continue to follow the trend and continue to look for possible signals for any selling opportunities. At the moment AUDUSD […]

-

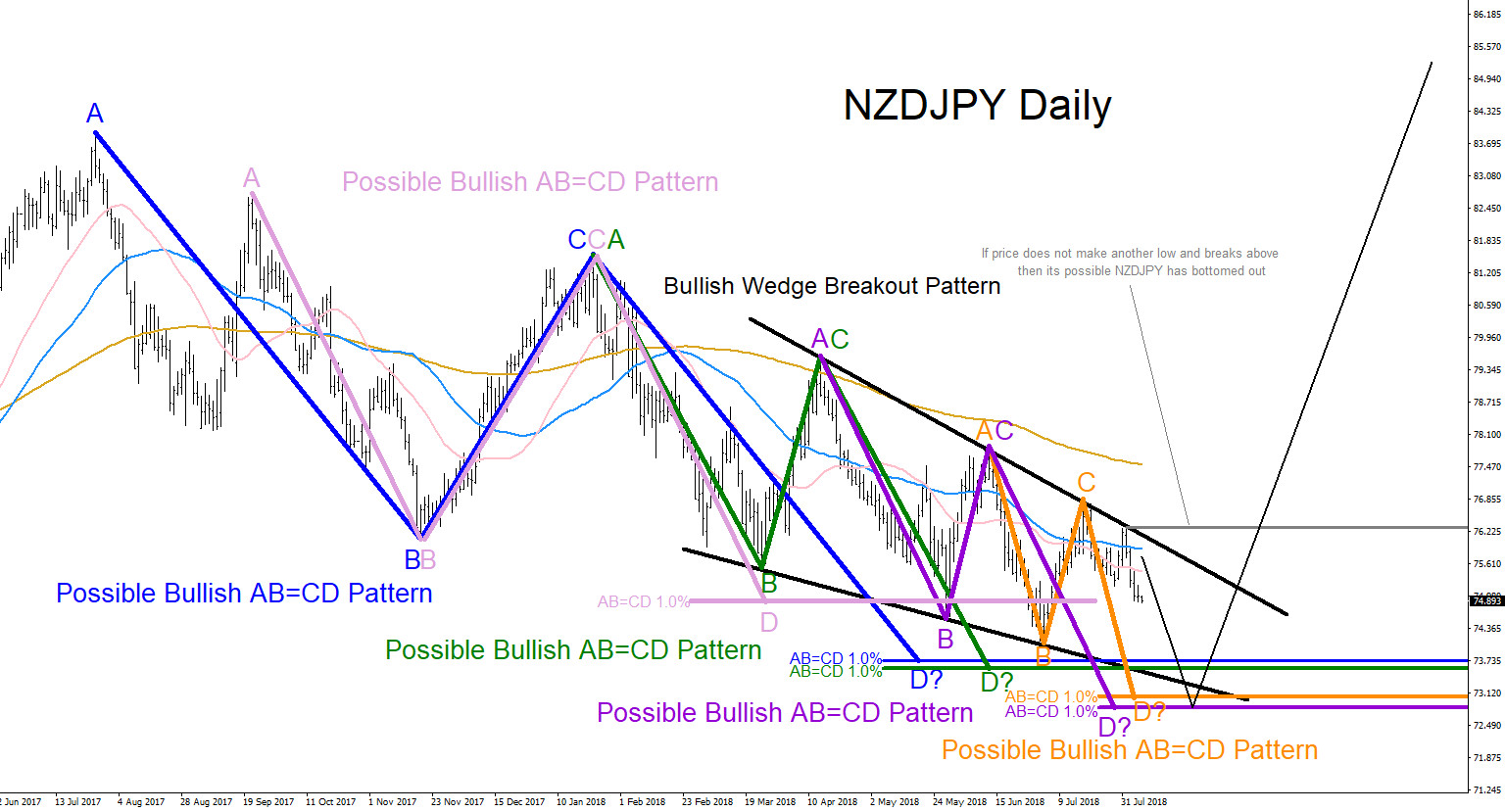

NZDJPY : AB=CD Equal Legs Pattern

Read MoreNZDJPY Technical Analysis August 7/2018 NZDJPY is on a lower low lower high sequence since July 27/2017. Looking at the Daily time frame chart we can clearly see a series of AB=CD bullish patterns which can possibly signal that a potential bounce higher can happen if the pair can hit the pattern reversal BUY trigger […]

-

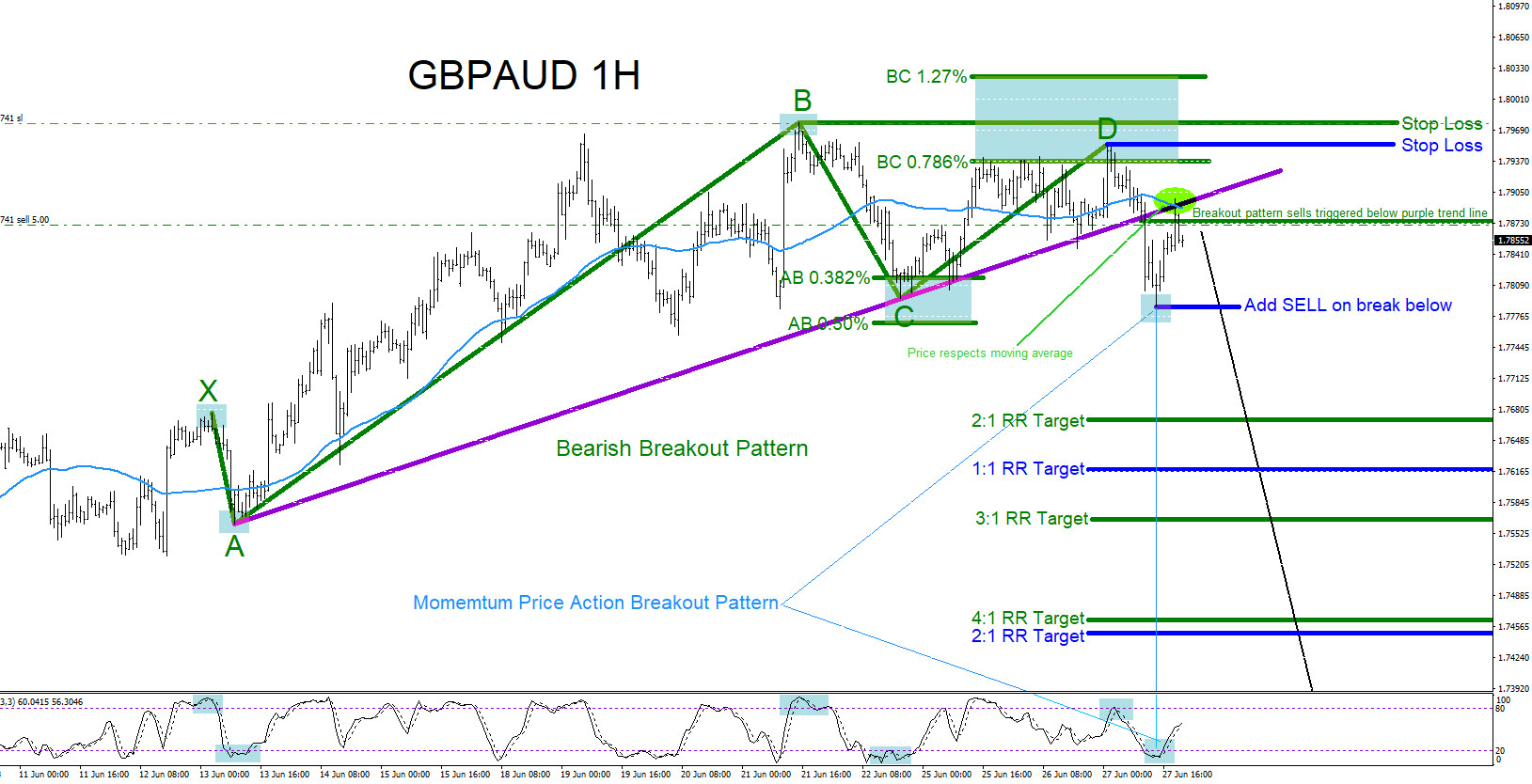

GBPAUD : Down Side Trade Set Up

Read MoreGBPAUD Technical Analysis 6.28.2018 GBPAUD Possible SELL/SHORT Trade Setup: GBPAUD on the 1 hour chart has broken out of a possible bearish pattern and a Momentum Price Action Breakout Pattern can be forming where bears can potentially push the pair lower. Traders should be watching to see if price respects the 50 Simple Moving Average […]

-

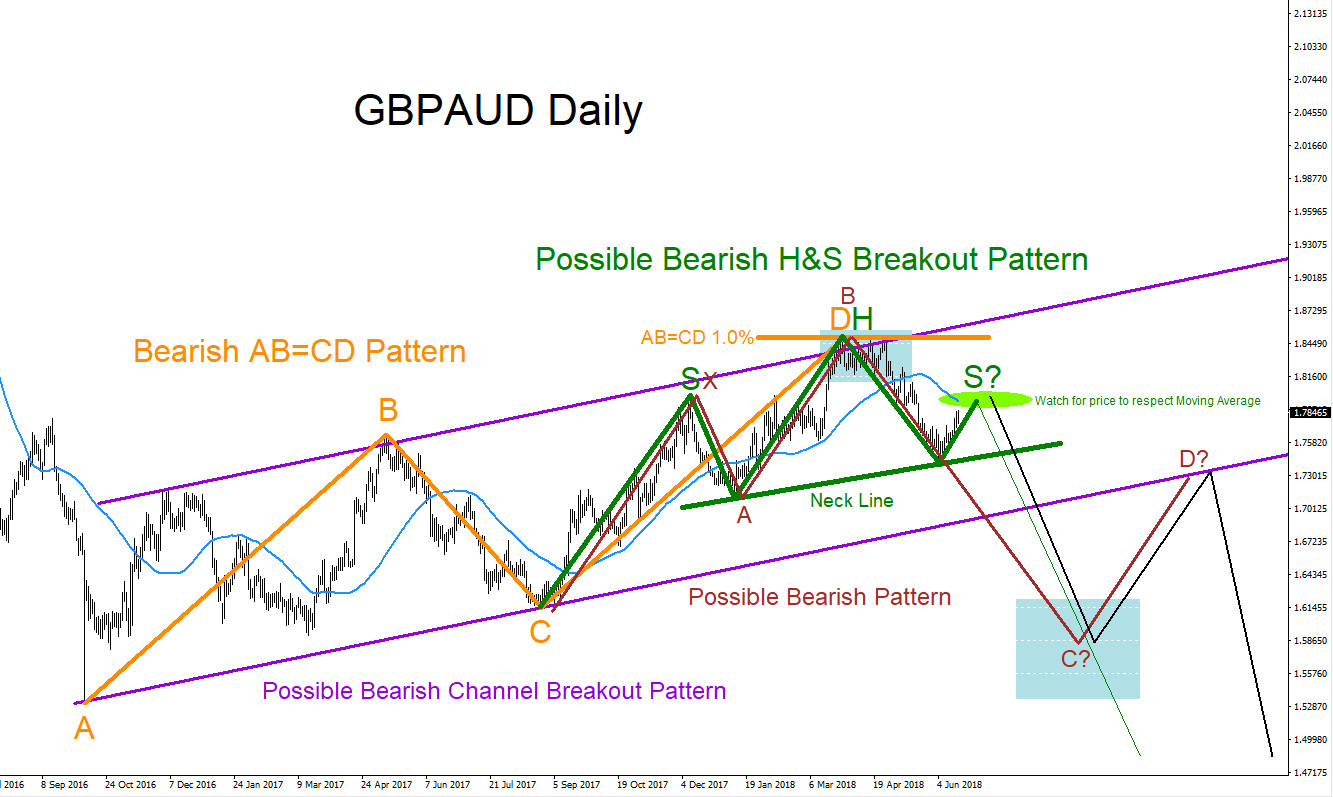

GBPAUD : Possible Bearish Scenario

Read MoreGBPAUD Technical Analysis June 18/2018 GBPAUD Possible SELL/SHORT Trade Setup: GBPAUD on the Daily chart has clear possible bearish patterns which can be signalling for a move lower in the coming days and weeks. Traders should be watching to see if price will respect the 50 Simple Moving Average (Turquoise) and reverse off lower in […]

-

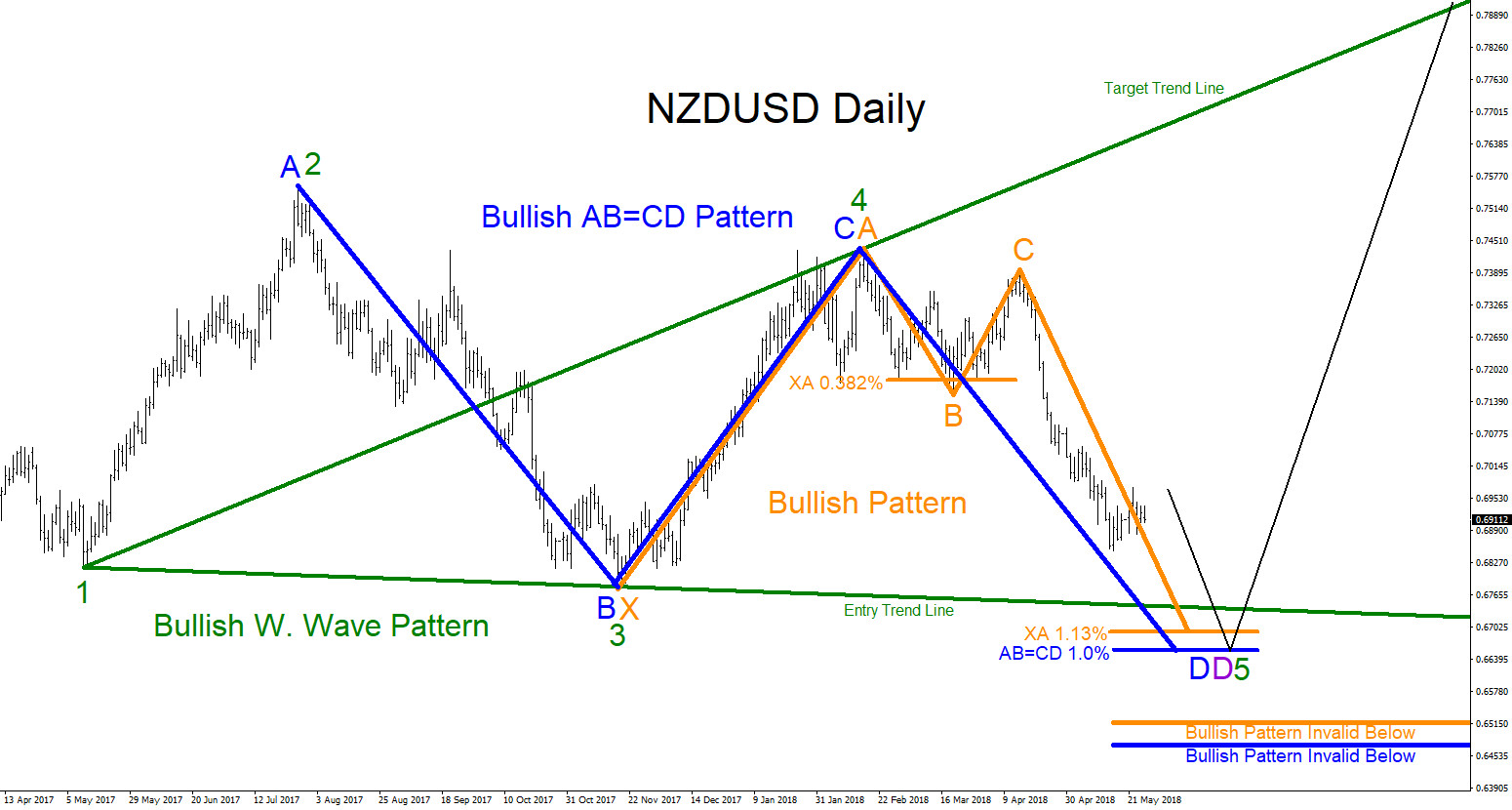

NZDUSD : Possible Reversal Higher?

Read MoreNZDUSD Technical Analysis 5.25.2018 NZDUSD at the current moment looks to be in a 3 swing move lower (Daily chart) starting from the July 27/2017 highs. Expect price to continue lower and break below the November 17/2017 lows. If breaks lower, the next level of interest where NZDUSD can find support and possibly reverse and […]

-

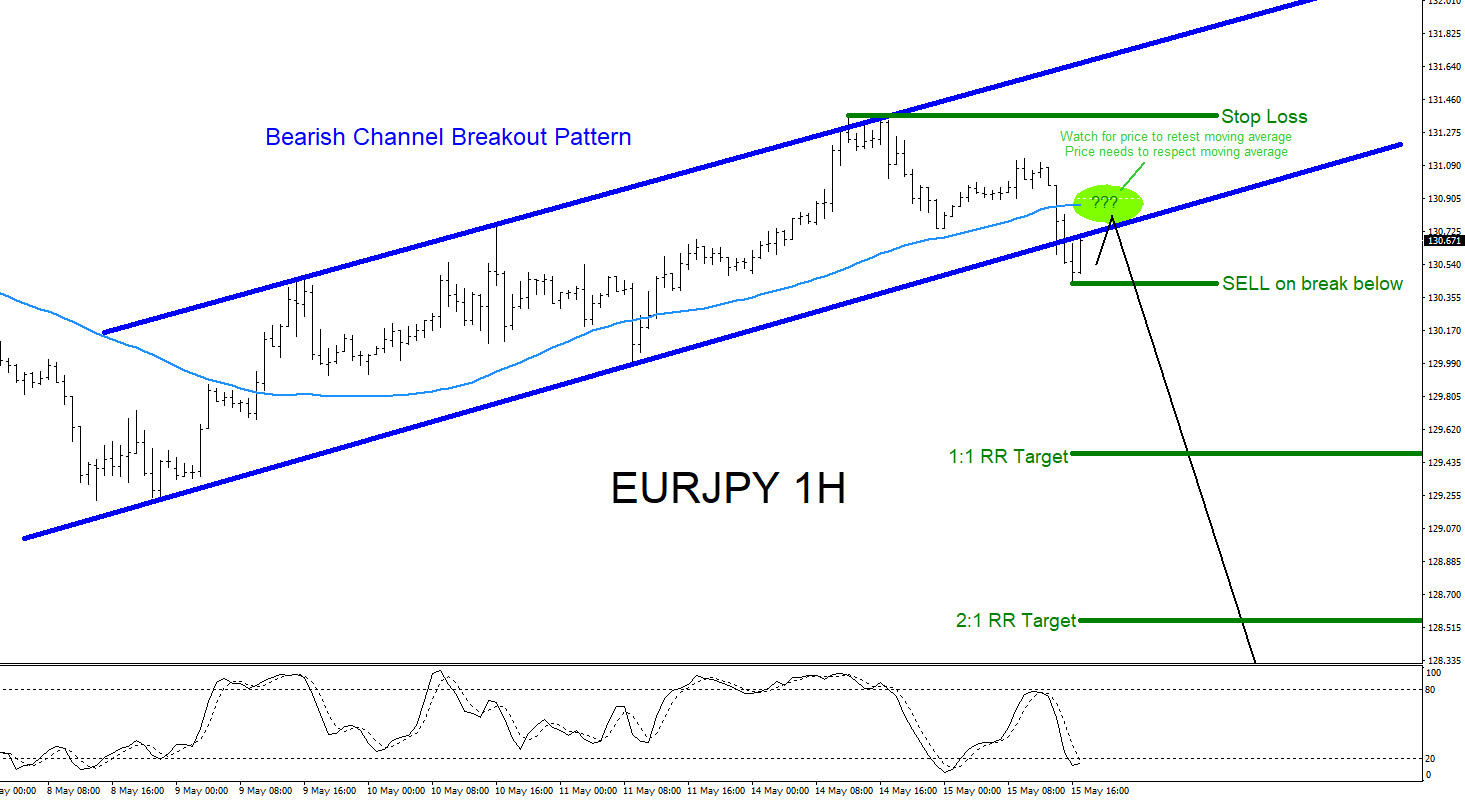

EURJPY : Will Bears Push the Pair Lower?

Read MoreEURJPY Technical Analysis 5.16.2018 EURJPY Possible SELL/SHORT Trade Setup: EURJPY on the 1 hour chart is breaking out of a possible bearish channel pattern and a Momentum Price Action Breakout Pattern can be forming where bears can potentially push the pair lower. Traders should be watching to see a retest and also watch to see […]