The Power of 3-7-11 and the Grand Super Cycle: How We Saw the Bullish Turn in April 2025 Back on April 9, 2025, while World Indices were dropping sharply and global sentiment had turned overwhelmingly bearish, we published an article that challenged the fear-driven narrative. We explained why selling was not the right approach and […]

-

EURSEK Medium Term Elliottwave Analysis 12.1.2015

Read MoreThis is a medium term Elliottwave Analysis video on $EURSEK. Looking at the Daily chart, the pair looks to be correcting at least 8/13/2012 cycle. From 12/16/2014 peak, so far two swings can be counted and another swing lower is favored towards 8.88 – 8.96 area, provided that pivot at 9.731 stays intact. EWF currently covers 50 instrument ranging from forex, indices, […]

-

NZDCAD Medium Term Elliottwave Analysis 11.25.2015

Read MoreThis is a medium term Elliottwave Analysis video on $NZDCAD. Pair looks to be correcting the decline from 10/27 peak. So far two swings can be counted and another swing higher is ideal towards 0.88 area before the decline resumes. As far as 0.9015 pivot is holding, pair is expected to resume the weekly move […]

-

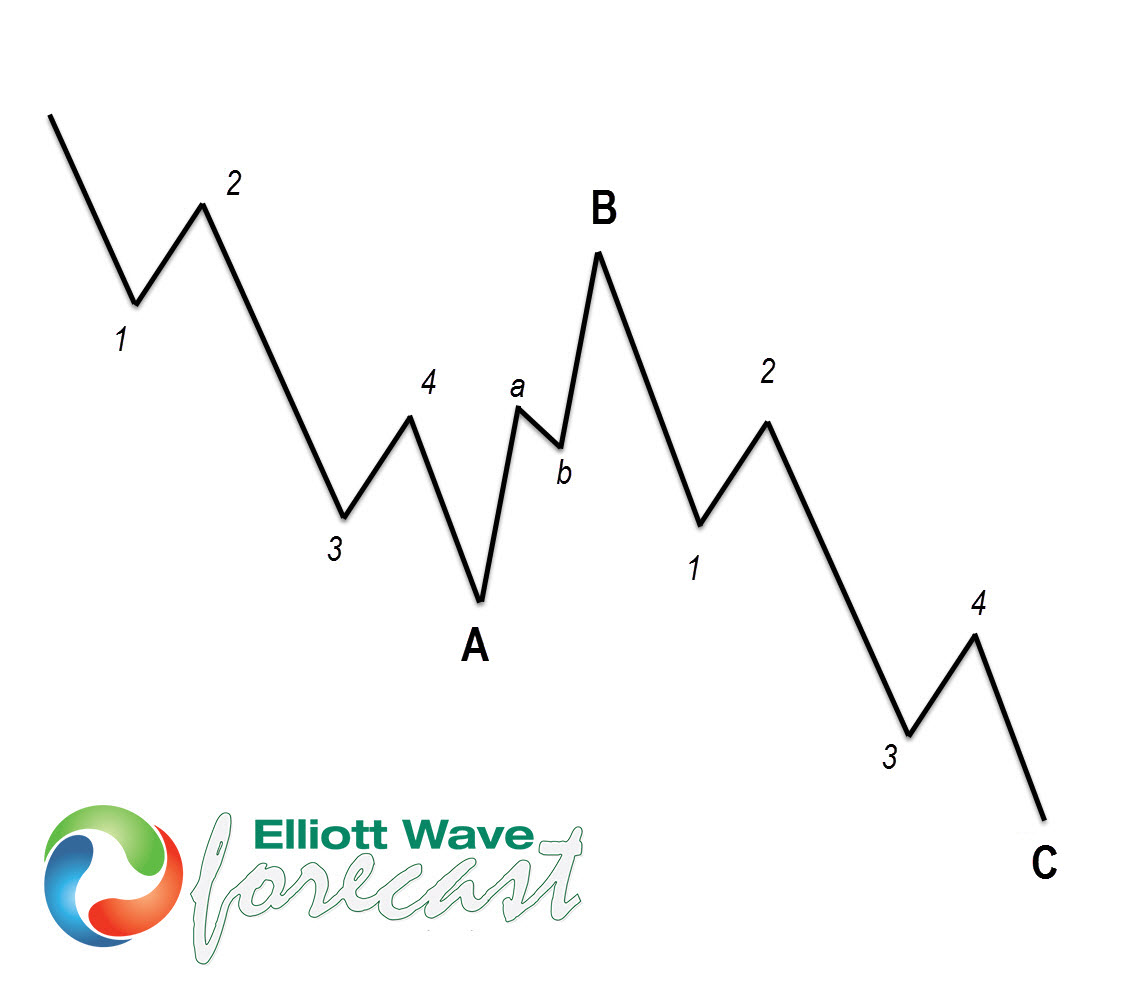

ABC (Zig-Zag) Elliott Wave Structure

Read MoreSee Eric Morera explain an ABC (Zig-Zag) Elliott Wave Structure in an interview with Dale Pinkert (@ForexStopHunter). He goes over the 5 key rules that we use at Elliottwave-Forecast.Com to define an ABC structure. Learn to spot what is and what is not an ABC structure with the help of this video.

-

Interview with Eric Morera: ABC (Zig-Zag) Elliott Wave Structure

Read MoreSee Eric Morera explain an ABC (Zig-Zag) Elliott Wave Structure in an interview with Dale Pinkert (@ForexStopHunter). He goes over the 5 key rules that we use at Elliottwave-Forecast.Com to define an ABC structure. Learn to spot what is and what is not an ABC structure with the help of this video.

-

$AUD/CHF Medium Term Elliottwave Analysis 11.17.2015

Read MoreThis is a medium term Elliottwave Analysis video on $AUD/CHF. The pair has reached 100% from 8/6/2012 high (1.0348) and looks to be correcting this cycle. From 1/12/2015 low of 0.5654, we can count two swings, and another swing higher is likely towards 0.863 – 0.912 area in the next few months. Short term, a pullback is possible towards […]

-

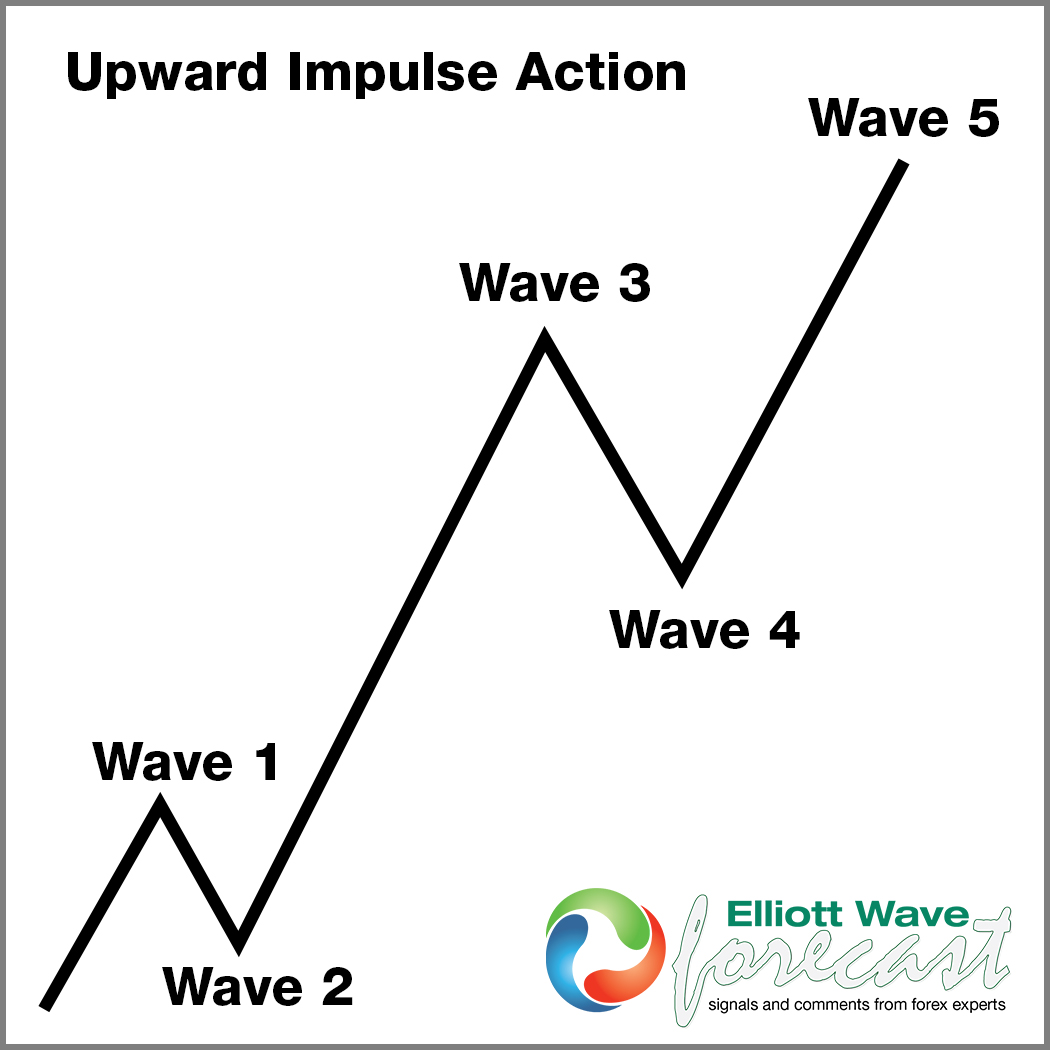

EWP The 5 waves Structure: Interview with Eric Morera

Read MoreIn this interview by Dale Pinkert at Nov 11, 2015 with our chief currency strategist and founder Eric Morera, we cover the rules and idea of 5 impulsive waves in Elliottwave Theory. Eric explained in this video that in today’s world, trend doesn’t only move in 5 waves, but trend also moves in 3 waves. It’s different […]