Last year, our live trading room provides 69% return annually across the 3 groups that we cover. In Live Trading Room, we scan the market everyday to find any tradable setup. We believe every serious traders need to have a good trading system with specific rules. A complete system must include the following: 1. Conditions […]

-

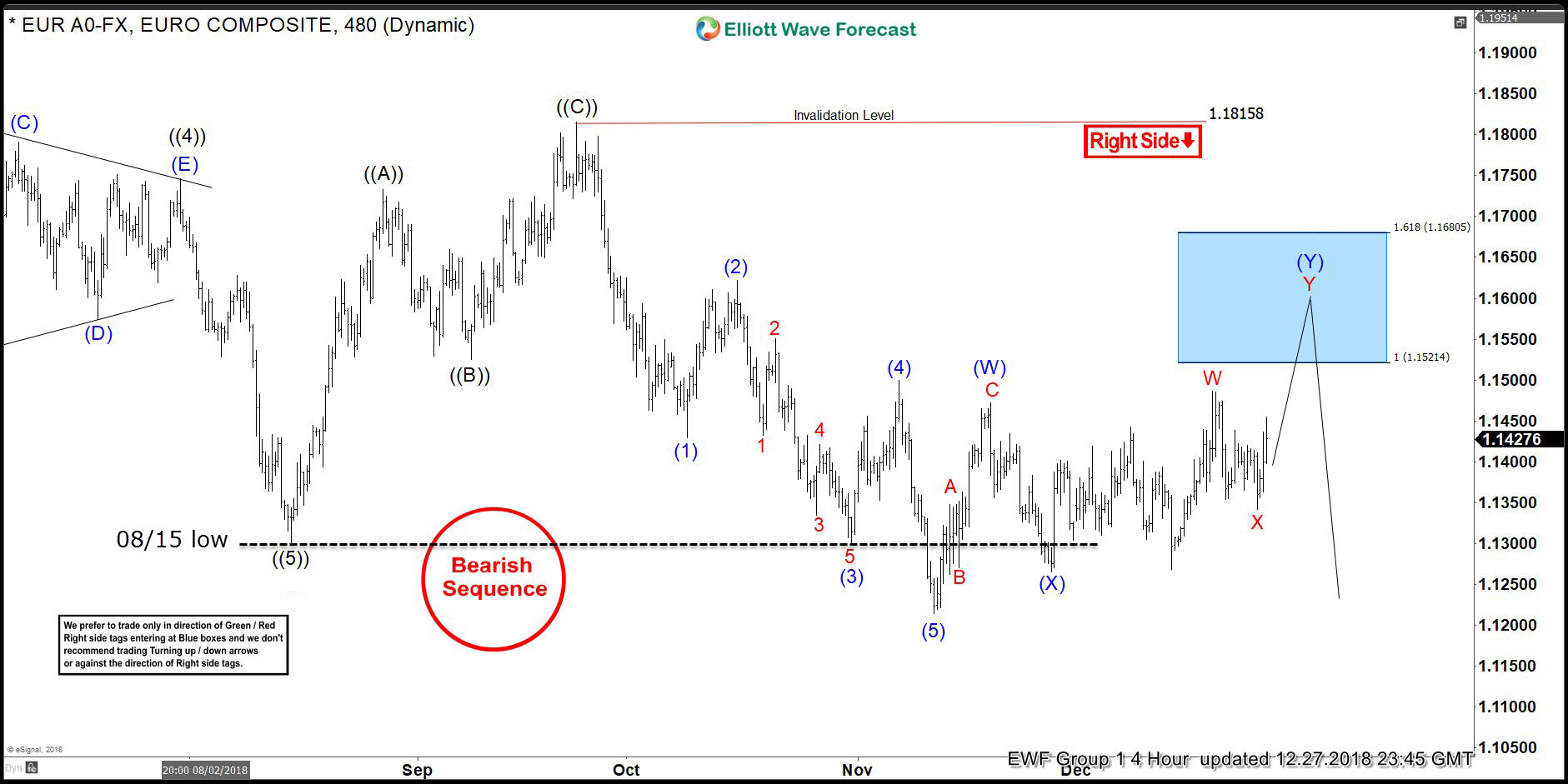

EURUSD Forecasting The Decline And Selling The Rallies

Read MoreHello fellow traders. Another instrument that we have been trading lately is EURUSD. In this technical blog we’re going to take a quick look at the Elliott Wave charts of EURUSD, published in members area of the website. As our members know, EURUSD has incomplete bearish sequences in the cycle from the 02/16 peak. Consequently, […]

-

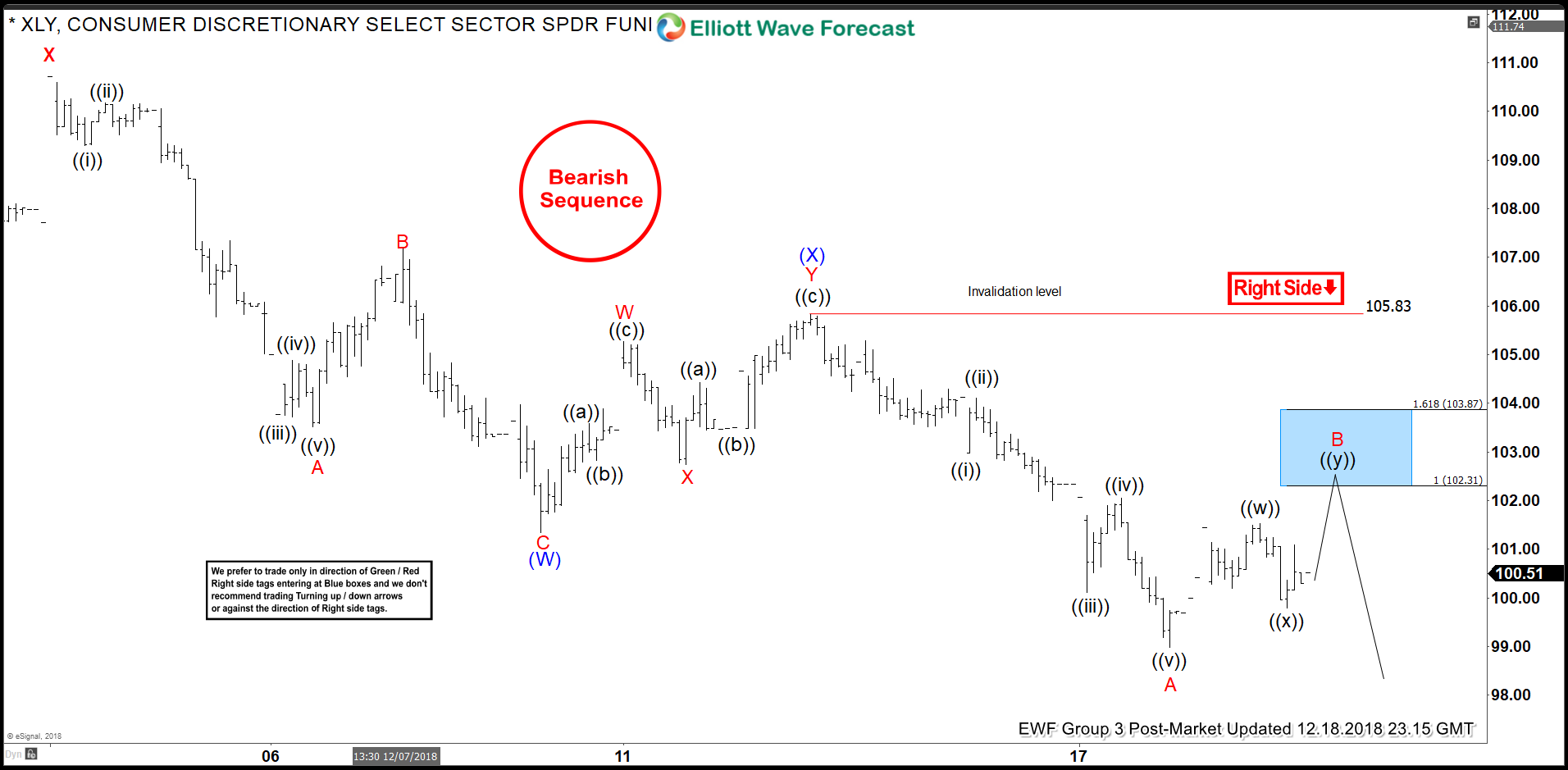

Elliottwave-Forecast.com Analysis Foretold the Reaction of XLY to FOMC Rate Decision

Read MoreTechnical based traders using EWF’s Blue Box System on 12/19/2018 executed a near perfect entry short in the Consumer Discretionary ETF – XLY before the FOMC rate decision. Prior to the actual trigger of the trade, Elliottwave-Forecast.com analysis showed our Group 3 Membership the ideal entry range. It is in these ranges of symmetrical extremes […]

-

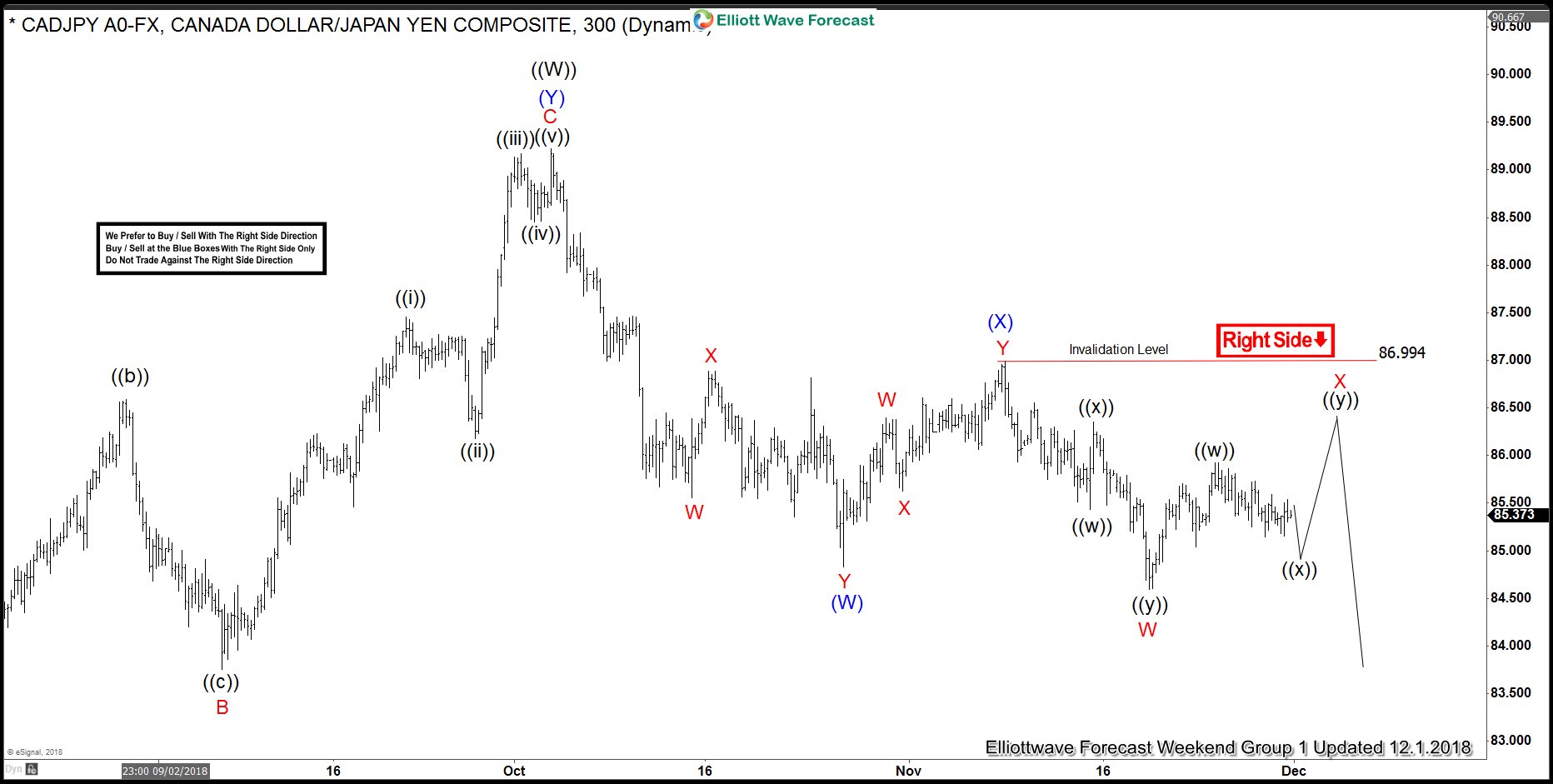

CADJPY Incomplete Bearish Sequence Called The Decline

Read MoreHello fellow traders. In this technical blog we’re going to take a quick look at the past Elliott Wave charts of CADJPY published in members area of The Website. As our members know CADJPY has the incomplete bearish sequences in the cycle from the October 3th peak. Break of 10/26 low has made the pair […]

-

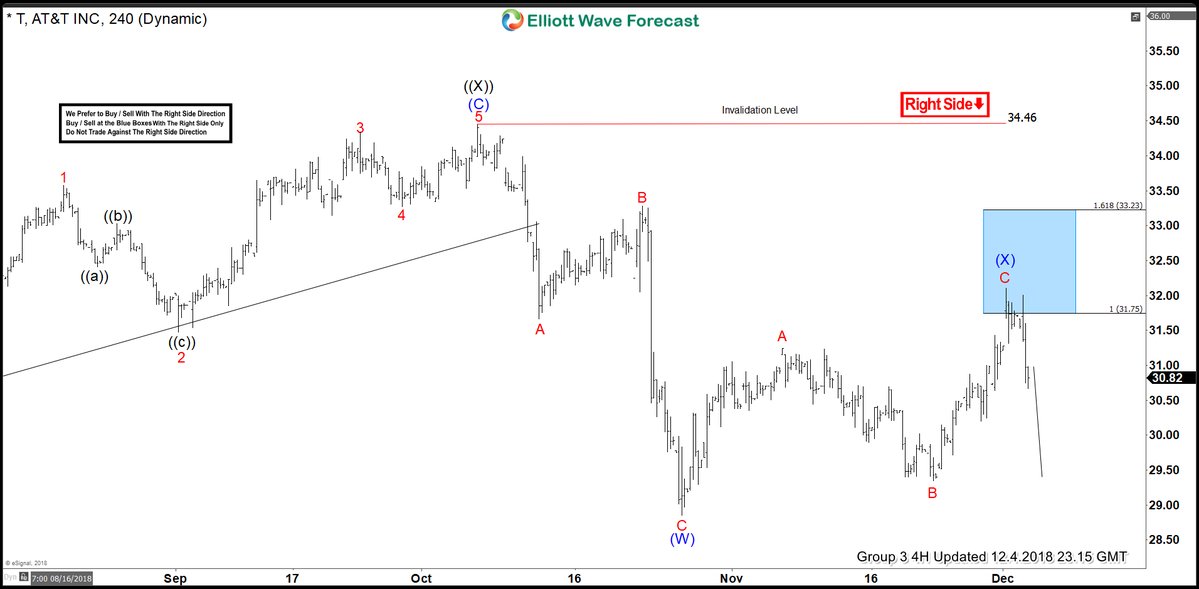

A Low Risk Trade In T Using Our Blue Box System

Read MoreIn this blog I want use the stock of AT&T (NYSE:T) to show you an outstanding example of our typical low risk trade setups using our Blue Box System. In our recent Group 3 Member Area updates we stated T to be Bearish on both the Daily and 4-Hour time frames. This cohesive directional call […]

-

USDX Forecasting The Rally After Pull Back

Read MoreHello fellow traders. In this technical blog we’re going to take a quick look at the Elliott Wave charts of USDX published in members area of The Website. As our members know, USDX has incomplete bullish sequences. Break of August 15th peak has made the structure incomplete to the upside, suggesting the USDX is bullish […]

-

Knowing Your Identity is Important to Trading Success

Read MoreIt’s important for financial market players to know their identity to be successful in the world of trading. A mistaken identity is often the cause of a failure for new aspiring traders. There are at least 3 distinct categories of financial market players and some combination of them: Investor Speculator Gambler 1. Investor An investor […]