Last year, our live trading room provides 69% return annually across the 3 groups that we cover. In Live Trading Room, we scan the market everyday to find any tradable setup. We believe every serious traders need to have a good trading system with specific rules. A complete system must include the following: 1. Conditions […]

-

CHFJPY Forecasting The Rally & Buying The Dips At The Blue Box Area

Read MoreCHFJPY is another instrument that has given us trading opportunity lately . The pair is showing impulsive sequences in the cycle from the September 20th low. Recently it made clear 3 waves pull back and found buyers at the blue box as we expected. In this technical blog we’re going to take a quick look […]

-

11 Best ESG ETFs to Buy in 2024

Read MoreEnvironmental, social, and governance funds, commonly known as ESG funds are increasing in popularity amongst investors. These pools of funds include companies based on their ESG practices alongside their financial performance. ESG investing is also called responsible investing as it is all about investing in companies that perform better and create more value. The ESG […]

-

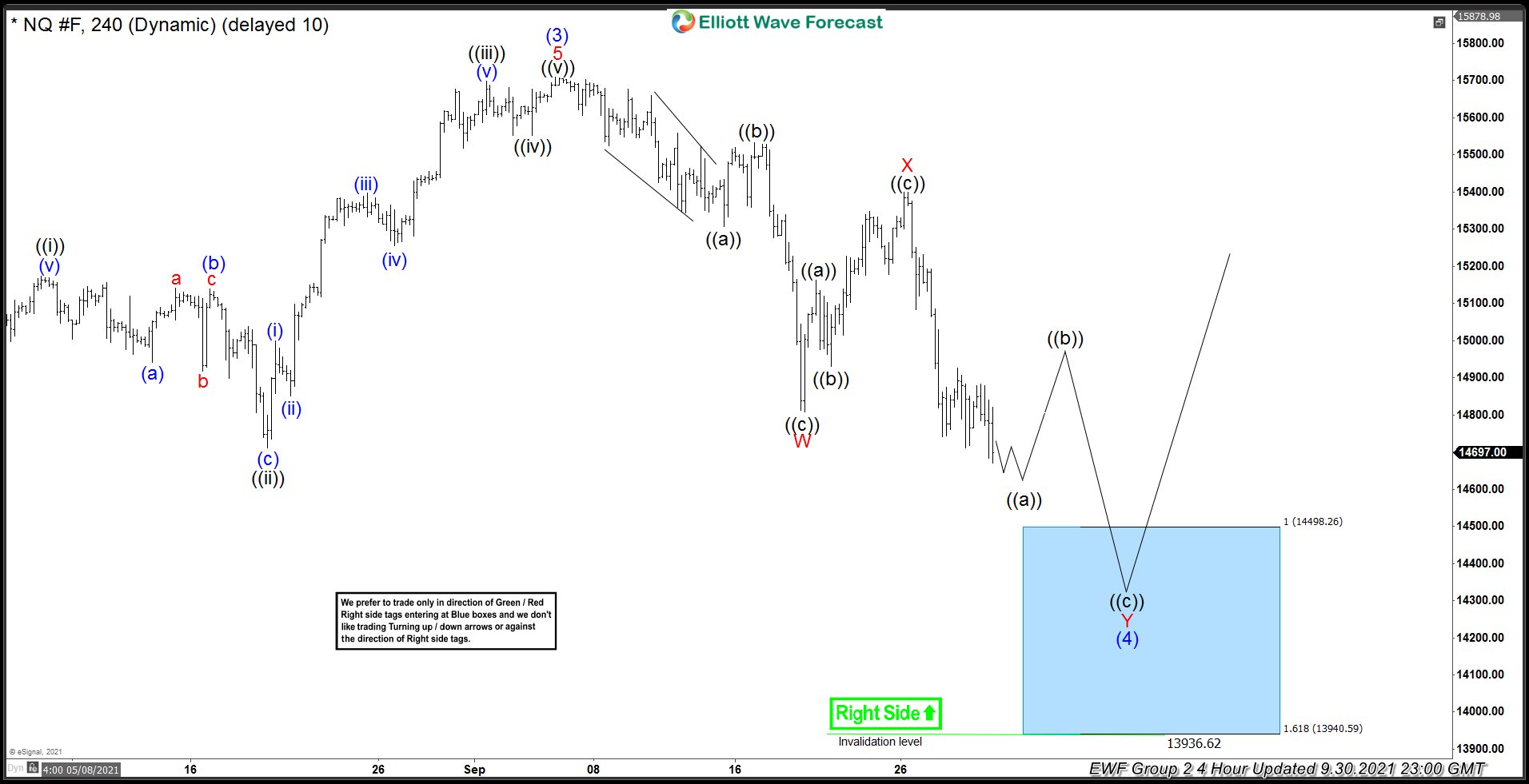

NASDAQ ( $NQ_F ) Buying The Dips After Elliott Wave Double Three

Read MoreNASDAQ is another instrument that has given us good trading opportunity lately . The index is showing impulsive and clear bullish trend that is calling for continuation of the rally. Recently it made clear 7 swings pull back and found buyers at the blue box as we were expecting . Pull back unfolded as Elliott […]

-

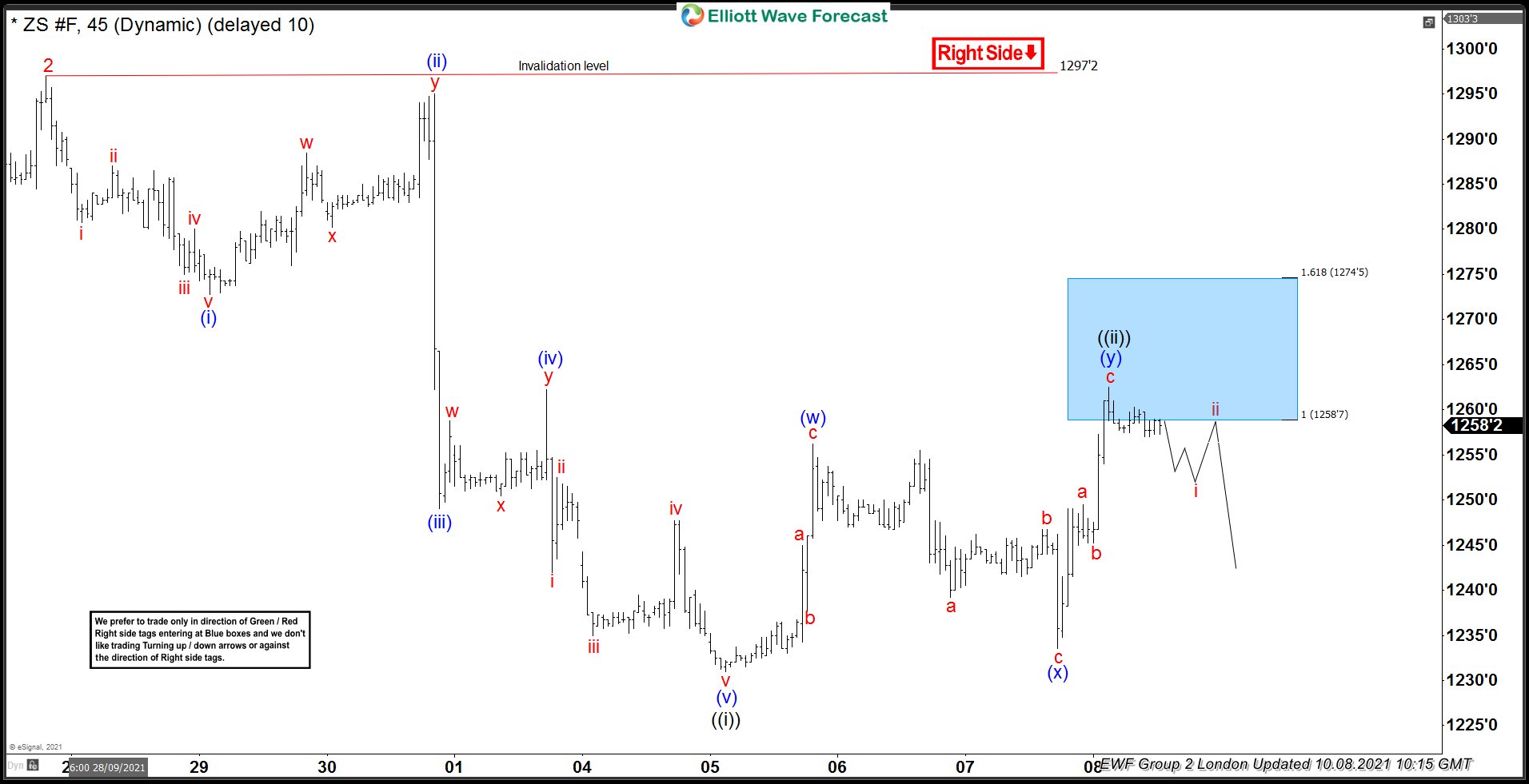

Soybeans Futures ( $ZS_F ) Forecasting The Path & Selling The Rallies

Read MoreIn this technical article we’re going to take a look at the Elliott Wave charts of Soybeans Futures ( $ZS_F ) presented in members area of the Elliottwave-Forecast . Soybeans Futures has a incomplete bearish sequences in the cycle from the May peak. We got a short tern recovery that has unfolded as Elliott Wave […]

-

GBPAUD Found Buyers After Elliott Wave Zig Zag

Read MoreHello fellow traders. In this technical blog we’re going to take a quick look at the Elliott Wave charts of GBPAUD, published in members area of the website. As our members know, we’ve been calling rally in the Forex Pair. The pair made pull back that has had a form of Elliott Wave Zig Zag […]

-

IYR Forecasting The Path & Buying The Dips At The Blue Box

Read MoreIn this technical blog we’re going to take a quick look at the Elliott Wave charts of IYR ETF from the Group 3 , published in members area of the Elliottwave-Forecast. As our members know, we’ve been calling rally in the ETF due to impulsive bullish sequences within the cycle from the March 2020 low. […]