Hello fellow traders. In this technical article we’re going to take a quick look at the Elliott Wave charts of Bitcoing BTCUSD , published in members area of the website. As many of our members are aware, the crypto has given us good buying opportunities recently. BTCUSD is showing impulsive bullish sequences in the cycle from the 52598 low , that are calling for a further strength. In the further text we are going to explain the Elliott Wave Forecast.

BTCUSD Elliott Wave 1 Hour Chart 12.10.2024

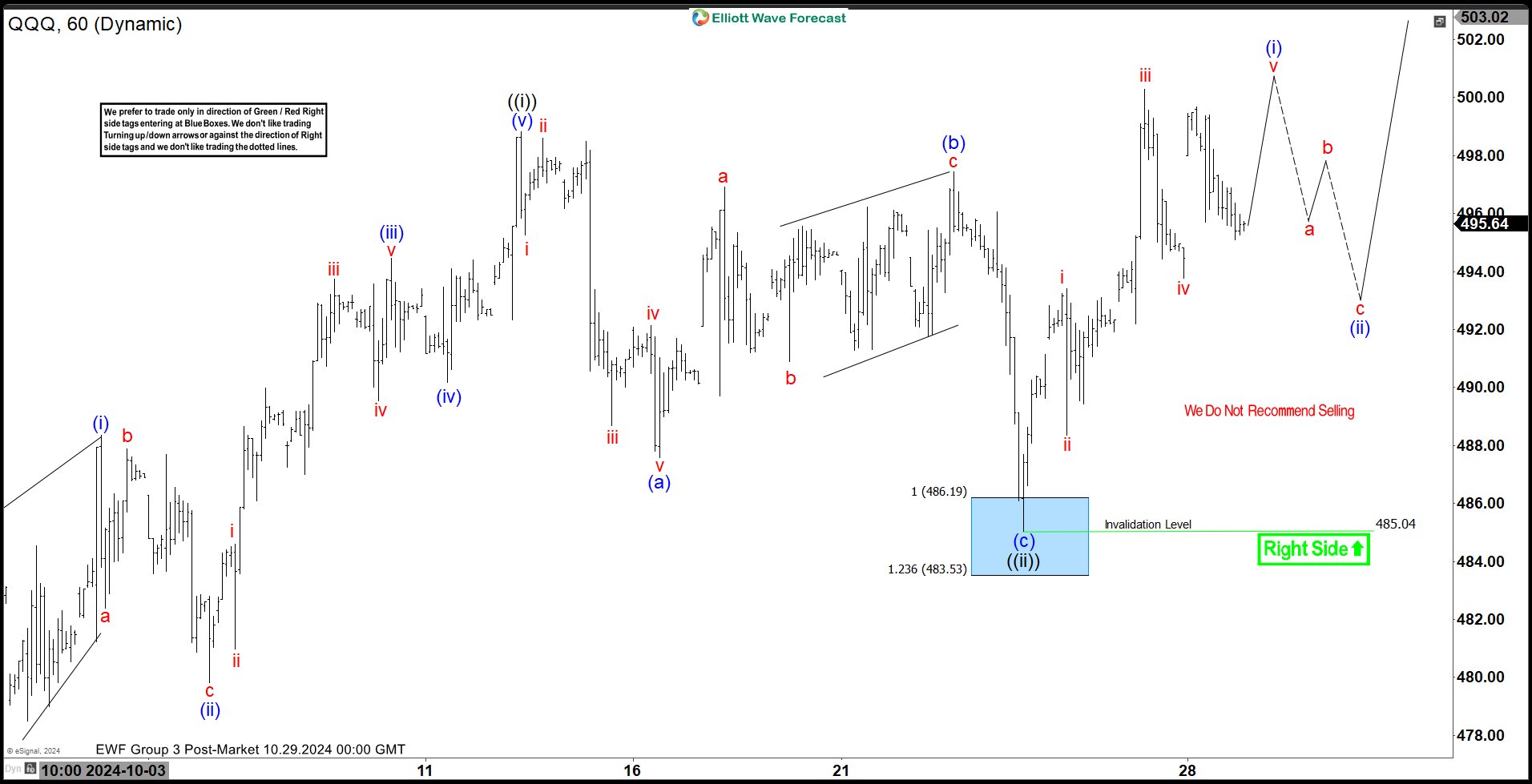

BTCUSD completed wave 4 (red) at the 92154 low and wave ((ii)) (black) at the 94275 low. Both corrections formed Elliott Wave Zig Zag patterns. Currently, we are near completing the intraday pullback (ii) (blue). As long as the price stays above the 94275 low, and more importantly above the 92154 low, we expect further strength in the crypto. This could ideally lead to new highs. We advised against selling

Official trading strategy on How to trade 3, 7, or 11 swing and equal leg is explained in details in Educational Video, available for members viewing inside the membership area.

BTCUSD Elliott Wave 1 Hour Chart 12.13.2024

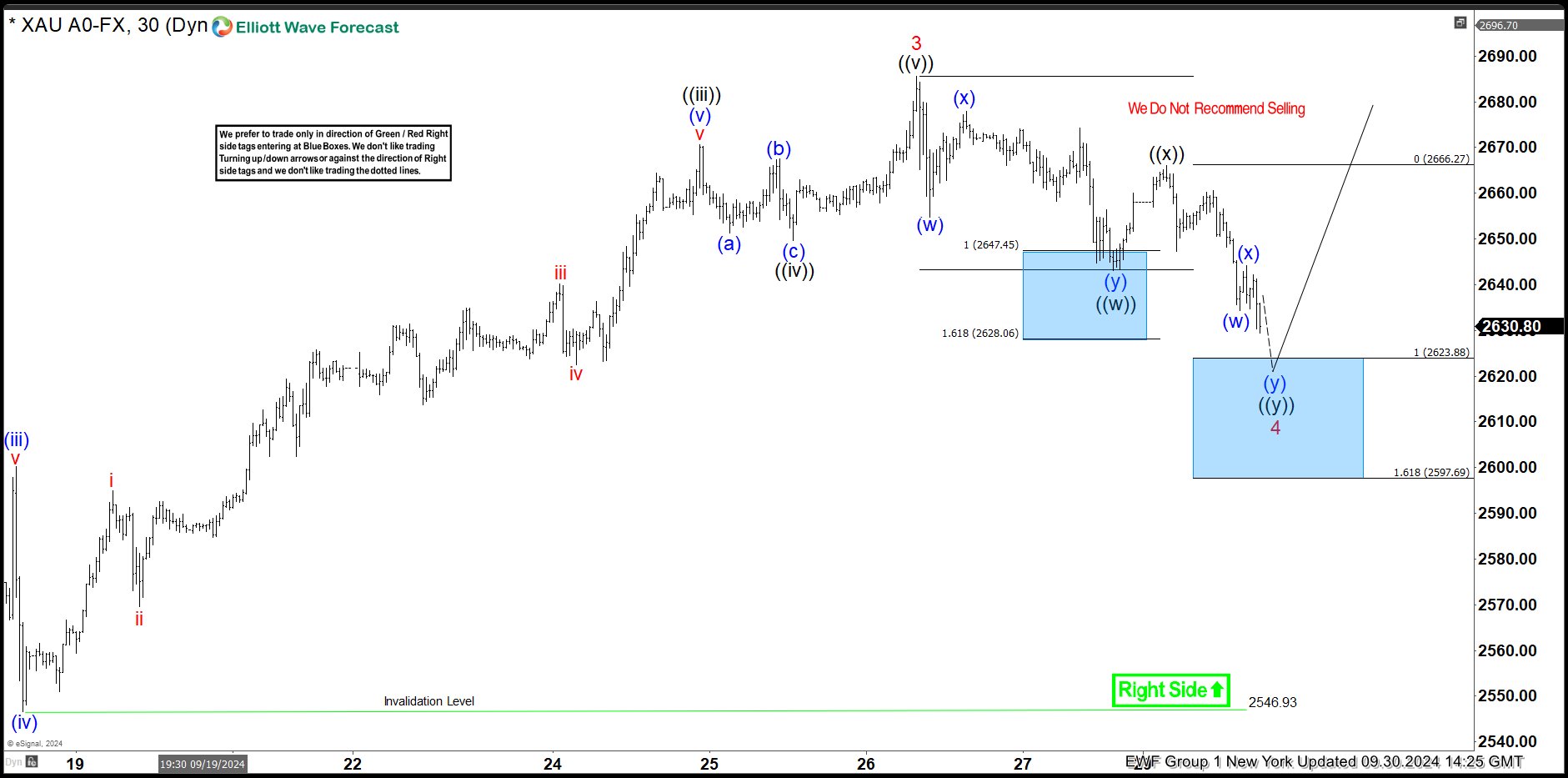

Bitcoin held above the 94275 low and rallied further, as expected. The current view suggests that we completed a 5-wave rally from the 94275 low, labeled as (i) blue. We may see a 3-wave pullback toward the 50-61.8% Fibonacci zone, around 98392-97406, before more upside. The next target area to the upside is between 106326 and 110716.

Keep in mind, the market is dynamic. The presented view could change over time. You can check the latest charts and target levels in the membership area of the site. The best instruments to trade are those with incomplete bullish or bearish swings. These are listed in the Sequence Report, and the best ones are shown in the Live Trading Room.

Dear traders, before you sign up, reach out to our sales department at vlada@elliottwave-forecast.com. We’ll make sure you’re getting the best deal possible with exclusive discounts and offers. Don’t hesitate—send us an email and let’s get you some savings