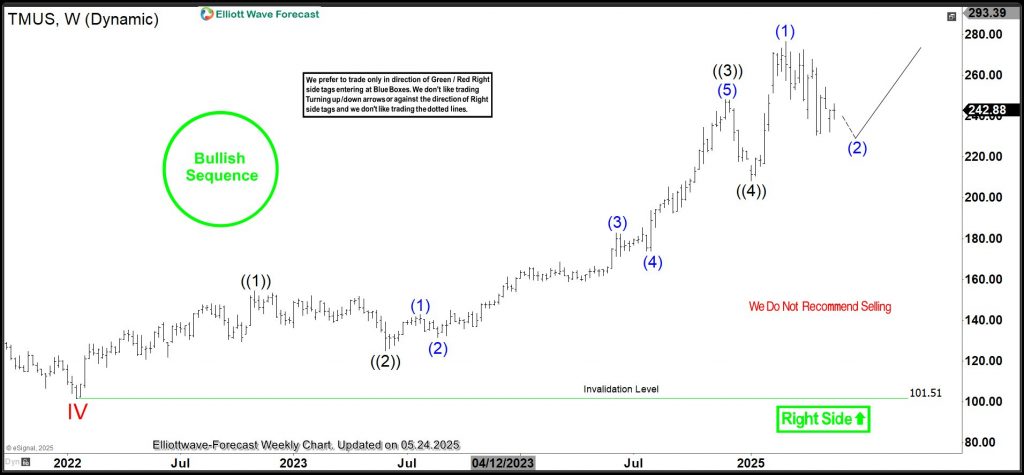

TMUS remains in an all-time bullish sequence. The recent dip appears to have found support in the blue box. The resultant bounce could advance to $300 thus, keeping the buyers in control.

T-Mobile US (NASDAQ: TMUS) is a leading U.S. wireless carrier, known for its aggressive pricing and nationwide 5G network. Headquartered in Bellevue, Washington, it is majority-owned by Deutsche Telekom. Since merging with Sprint in 2020, T-Mobile has become the third-largest U.S. telecom provider. It is listed on the NASDAQ-100 and S&P 500 indices.

TMUS has been the best stock investment since its launch in the secondary market in April 2007. Its stock price initially dropped from around $34 to a low of $7.75 in January 2010. However, the stock has risen significantly since that low, establishing a clear, all-time bullish sequence. This all-time bullish cycle appears incomplete. Wave I and II ended in May 2011 and June 2012 at roughly $25 and $7.60, respectively. From the June 2012 low, wave III emerged, concluding in July 2021 at $150. A pullback for wave IV followed, ending in January 2022 at $101, providing buyers with an opportunity to purchase during the dip.

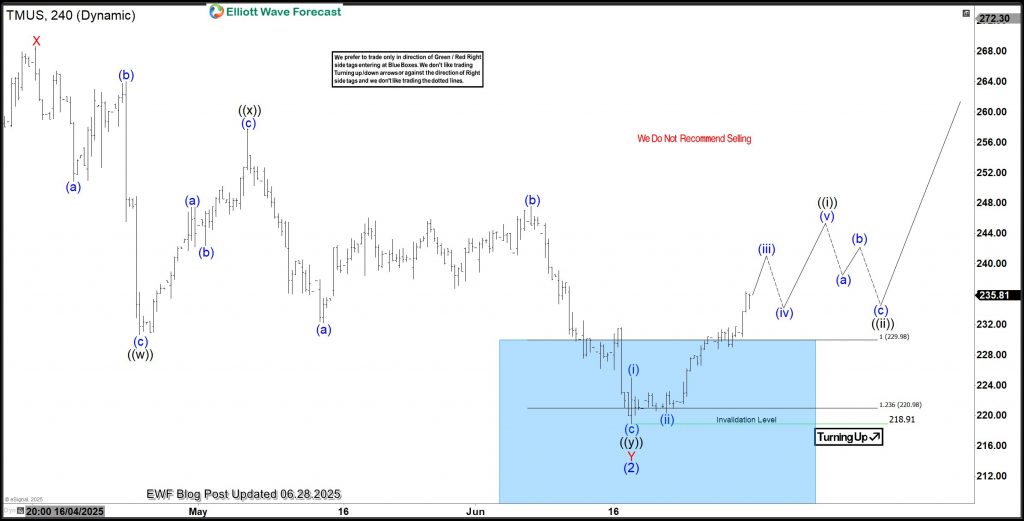

From the low of January 2022, wave V started and has been very strong. Waves ((1)), ((2)), and ((3)) of V ended in November 2022 at $154, June 2023 at $125, and March 2025 at $276.5 respectively. The stock peaked at the March 2025 high of $275.5, where wave ((3)) ended. From that peak, wave ((4)) of V pullback emerged. In such a clean and clear bullish sequence, we like to stay buyers from the blue box.

TMUS Elliott Wave Analysis – 17th November, 2025

Wave ((4)) pullback evolved as a simple zigzag structure with the extreme zone at 205.62-171.20. Meanwhile, from the blue box, buyers were expected to react and push prices higher by a 3-swing before lower, or a complete recovery for wave ((5)) of III toward $300 or higher. This is a typical example of how we analyze and trade the market with Elliottwave-forecast members. If this bounce progresses, buyers from the blue box should take partial profit at $230 and adjust the other half of the position to the wave ((4)) low or the entry price at $205.6. Buyers can hold the remaining position with a target at $300.

About Elliott Wave Forecast

At www.elliottwave-forecast.com, we update one-hour charts four times daily and four-hour charts once daily for all 78 instruments. We also conduct daily live sessions to guide clients on the right side of the market. Additionally, we have a chat room where moderators answer market-related questions. Experience our service with a 14-day trial for only $9.99. Cancel anytime by contacting us at support@elliottwave-forecast.com.