Galaxy Digital Holdings Ltd. (NASDAQ: GLXY) operates as a leading force in the digital asset ecosystem, providing crucial financial services for the institutional crypto market. As Bitcoin decisively breaks into new all-time highs, Galaxy has ridden this wave of institutional adoption, confirming a powerful bullish regime for the entire sector.

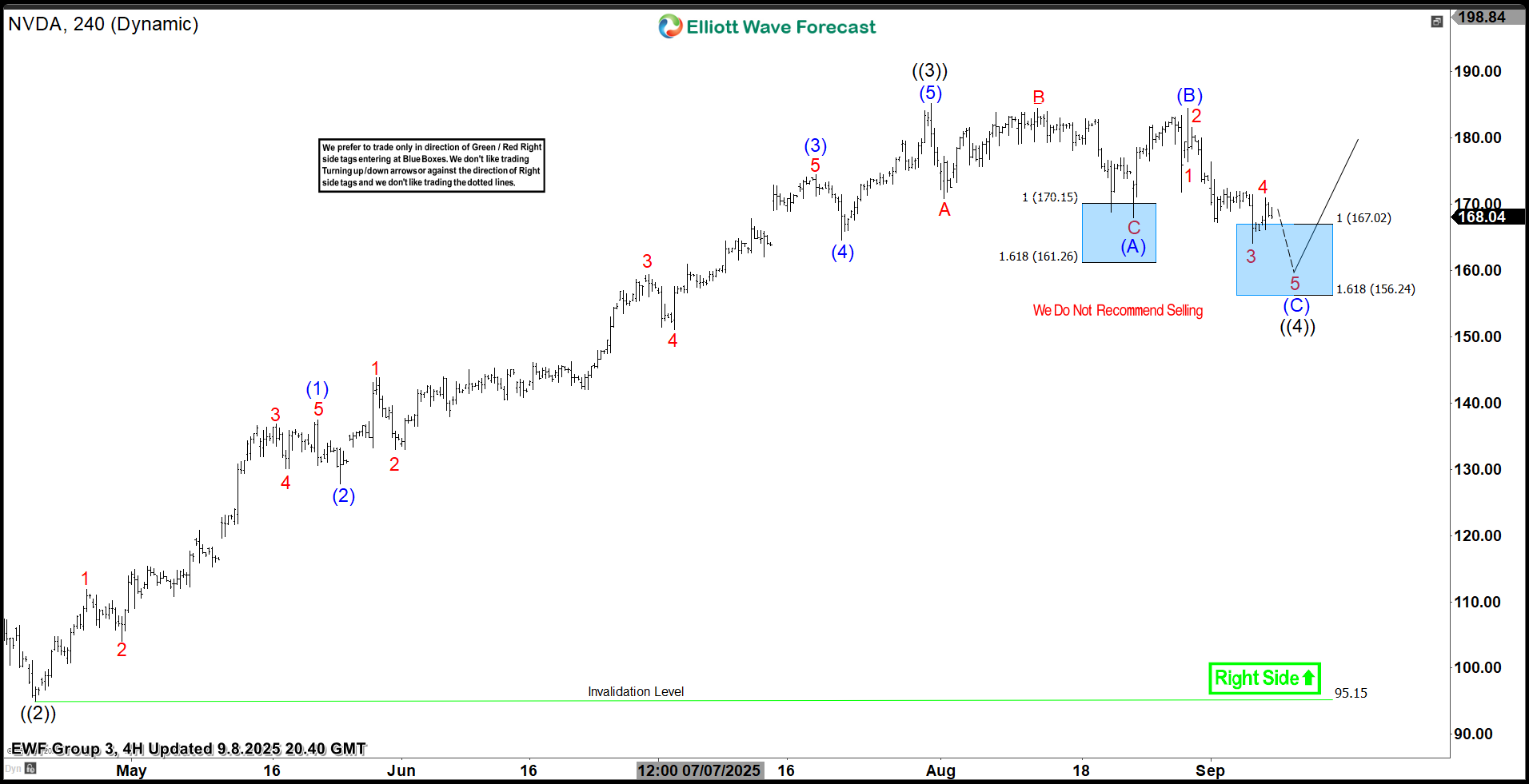

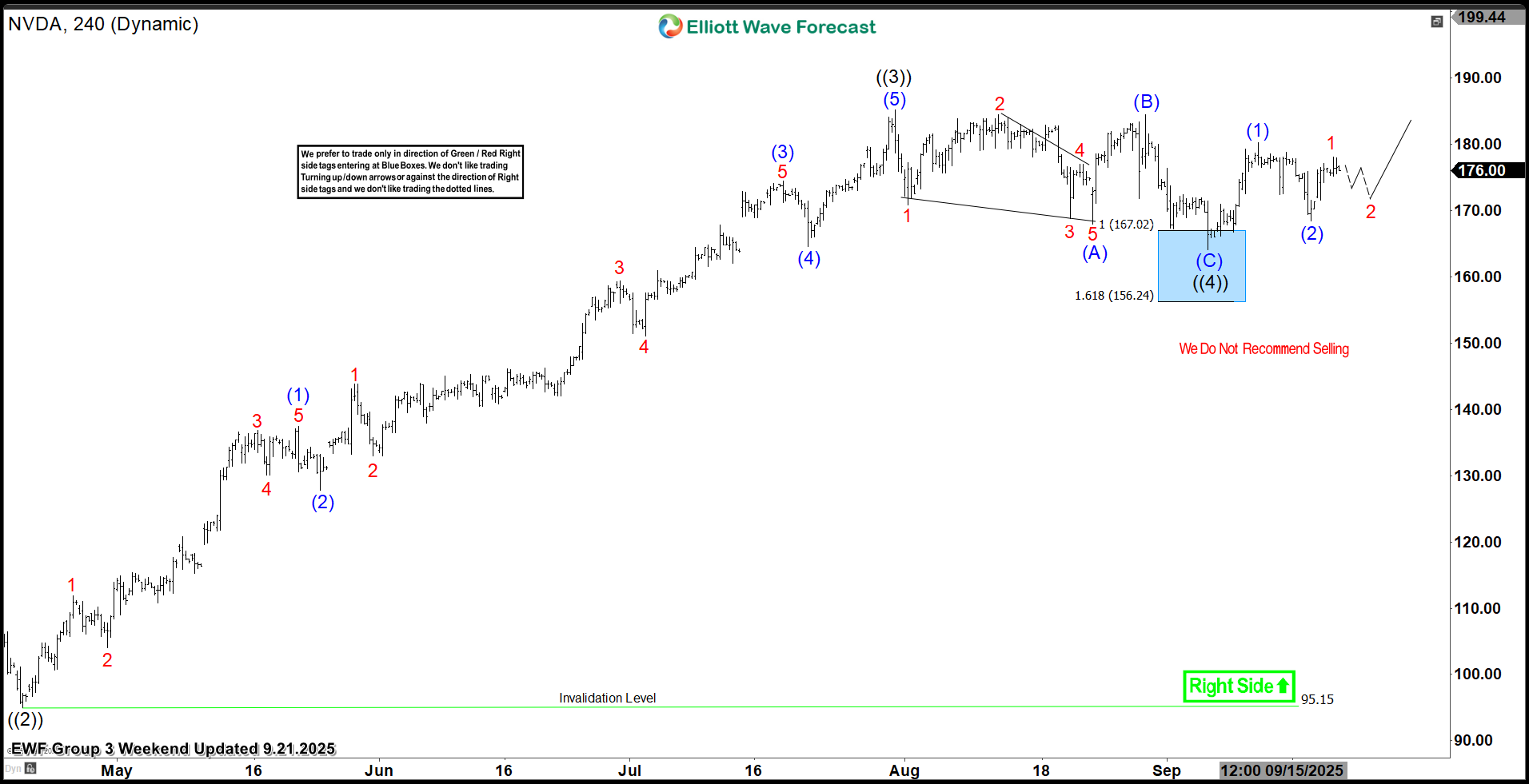

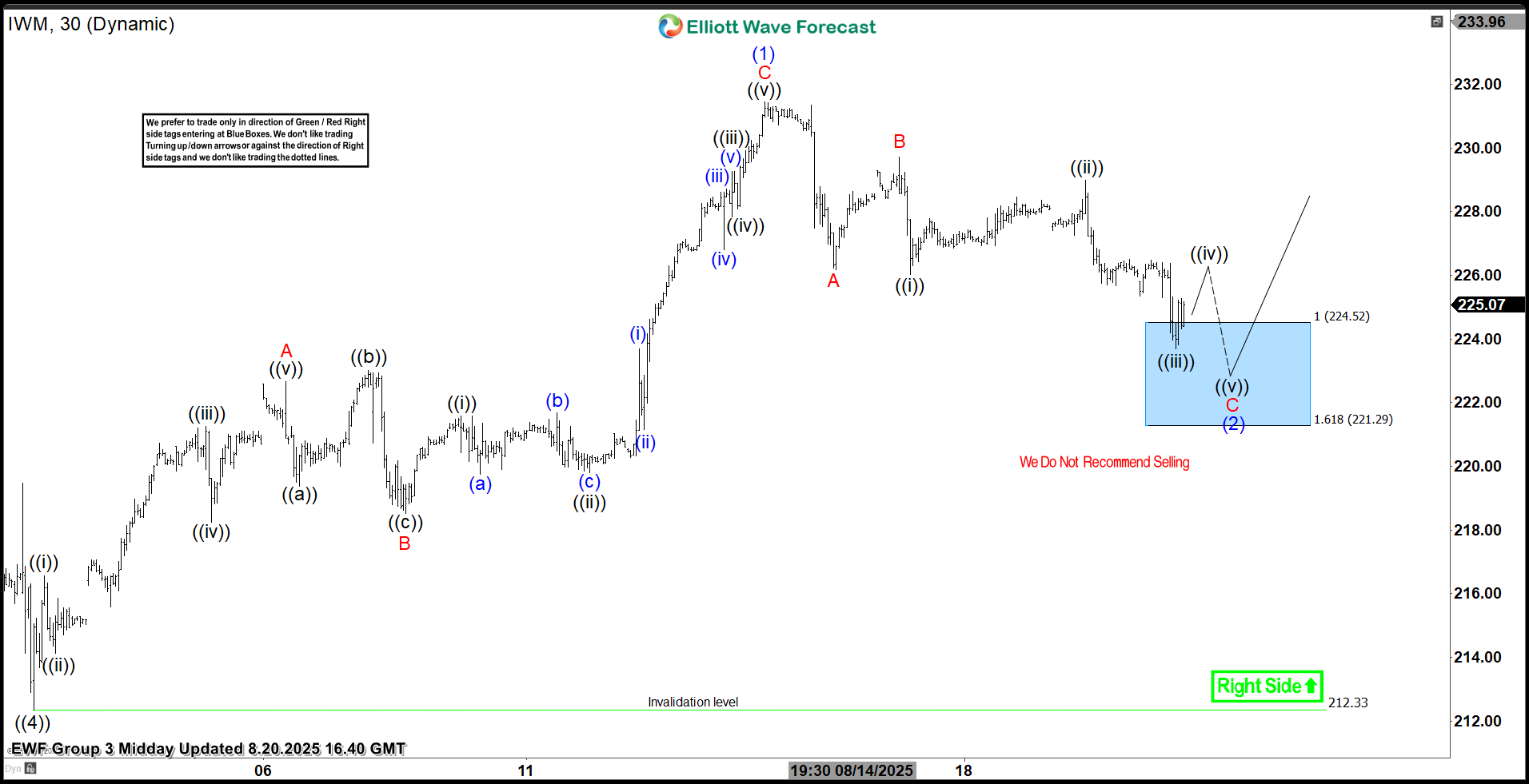

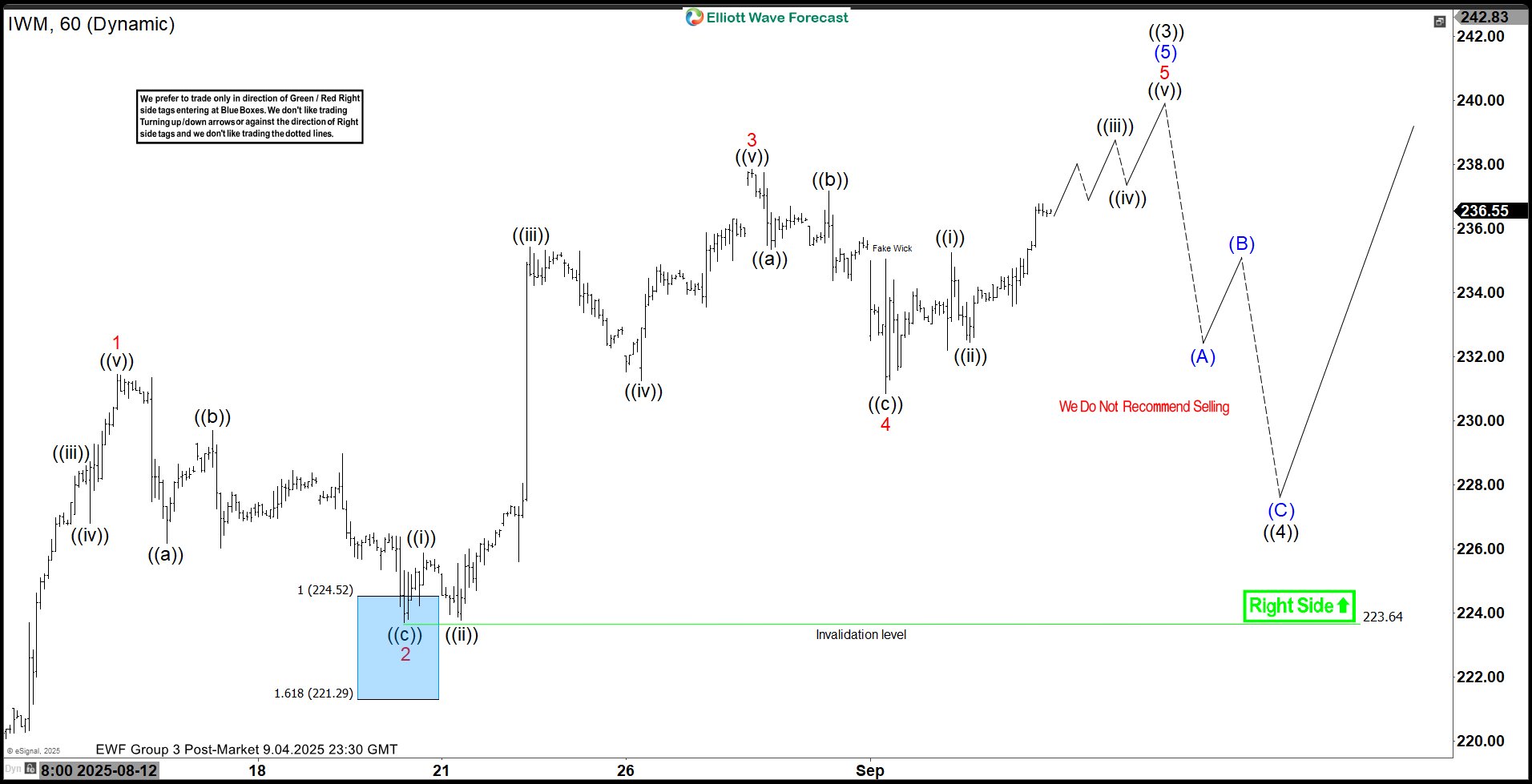

Today, we dissect the Elliott Wave pattern shaping GLXY’s trajectory. Furthermore, our analysis provides a clear technical roadmap with specific targets for its continued ascent. The convergence of a dominant sector tailwind and a clear wave structure creates a compelling technical opportunity.

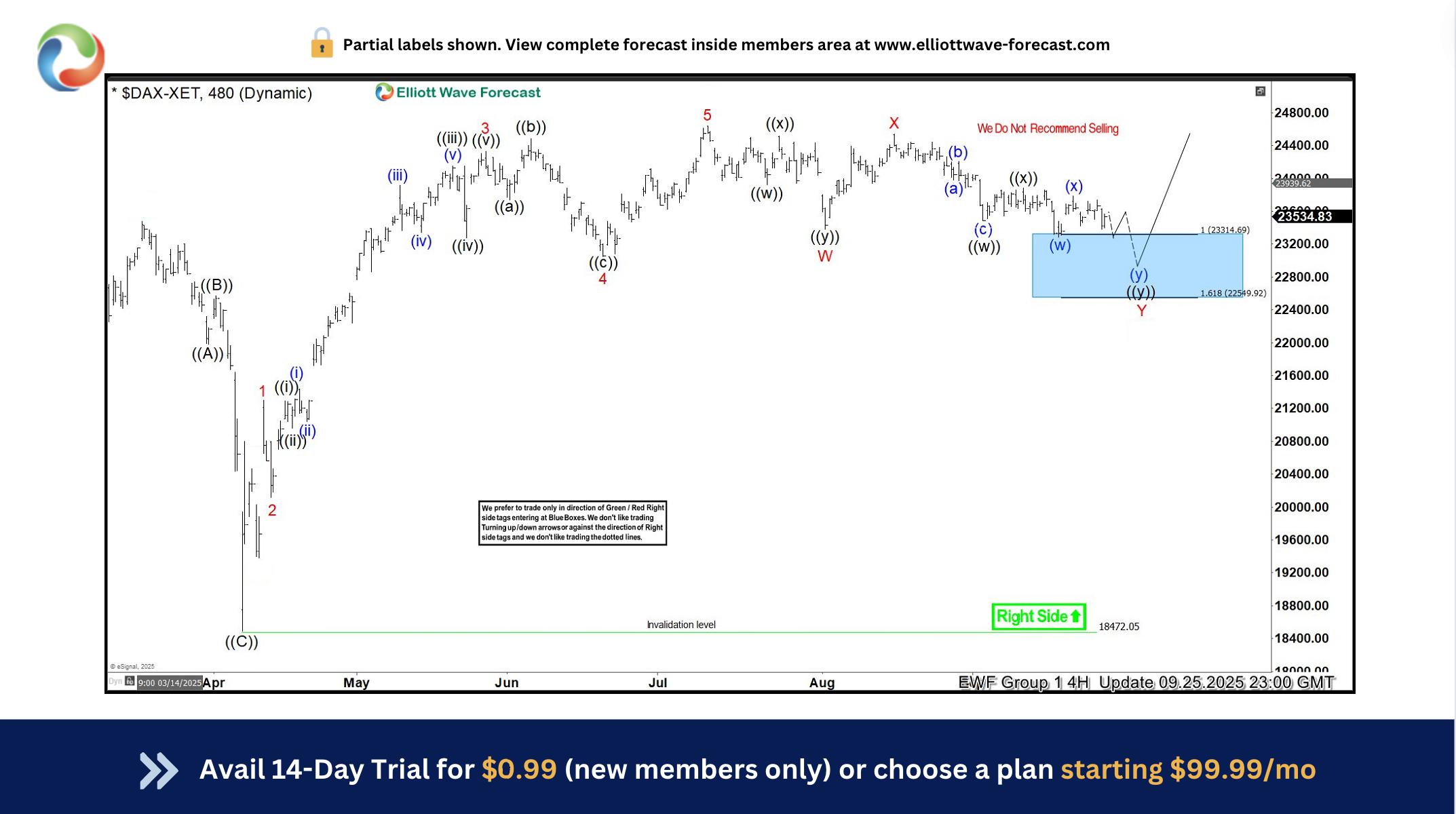

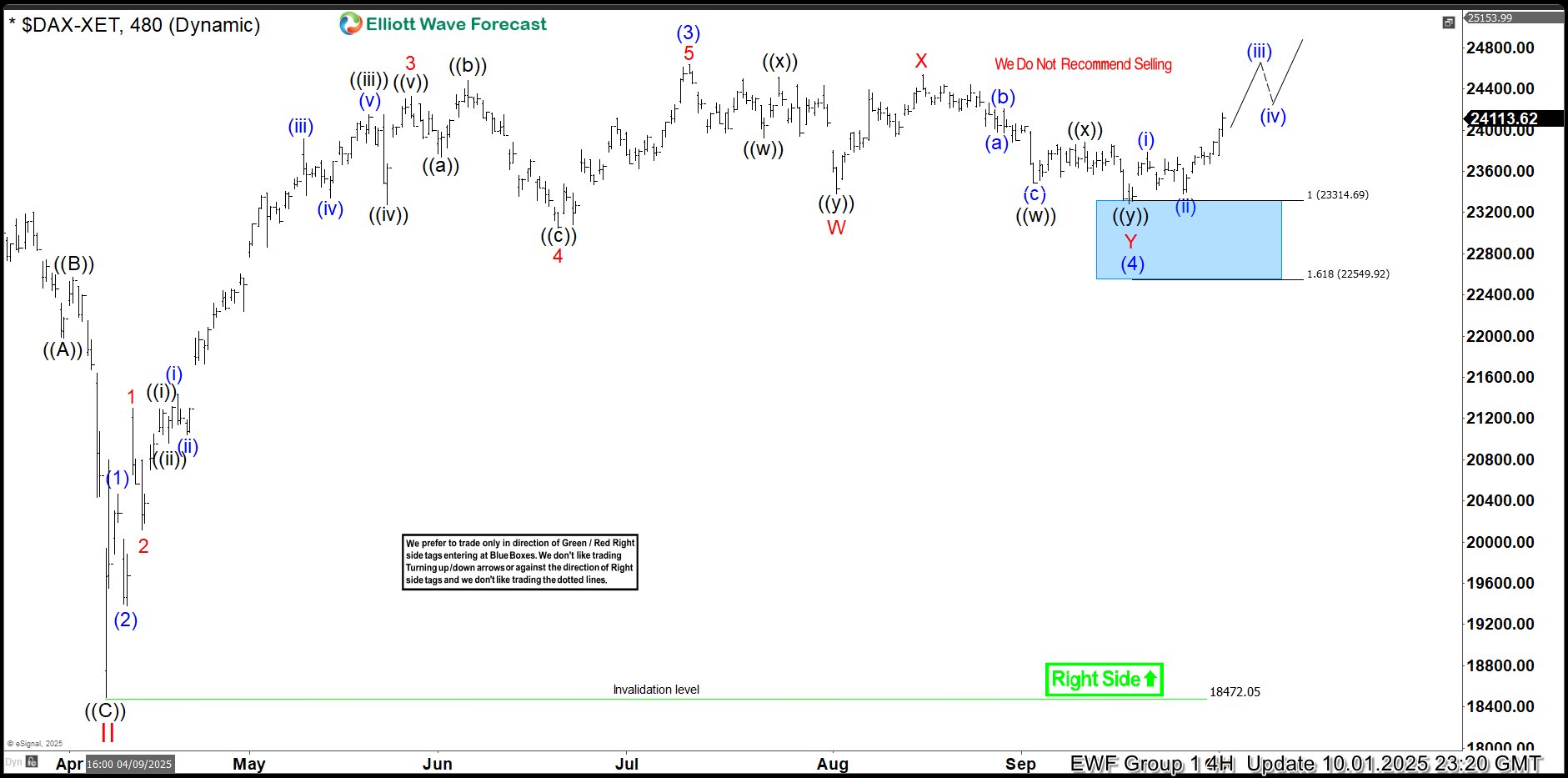

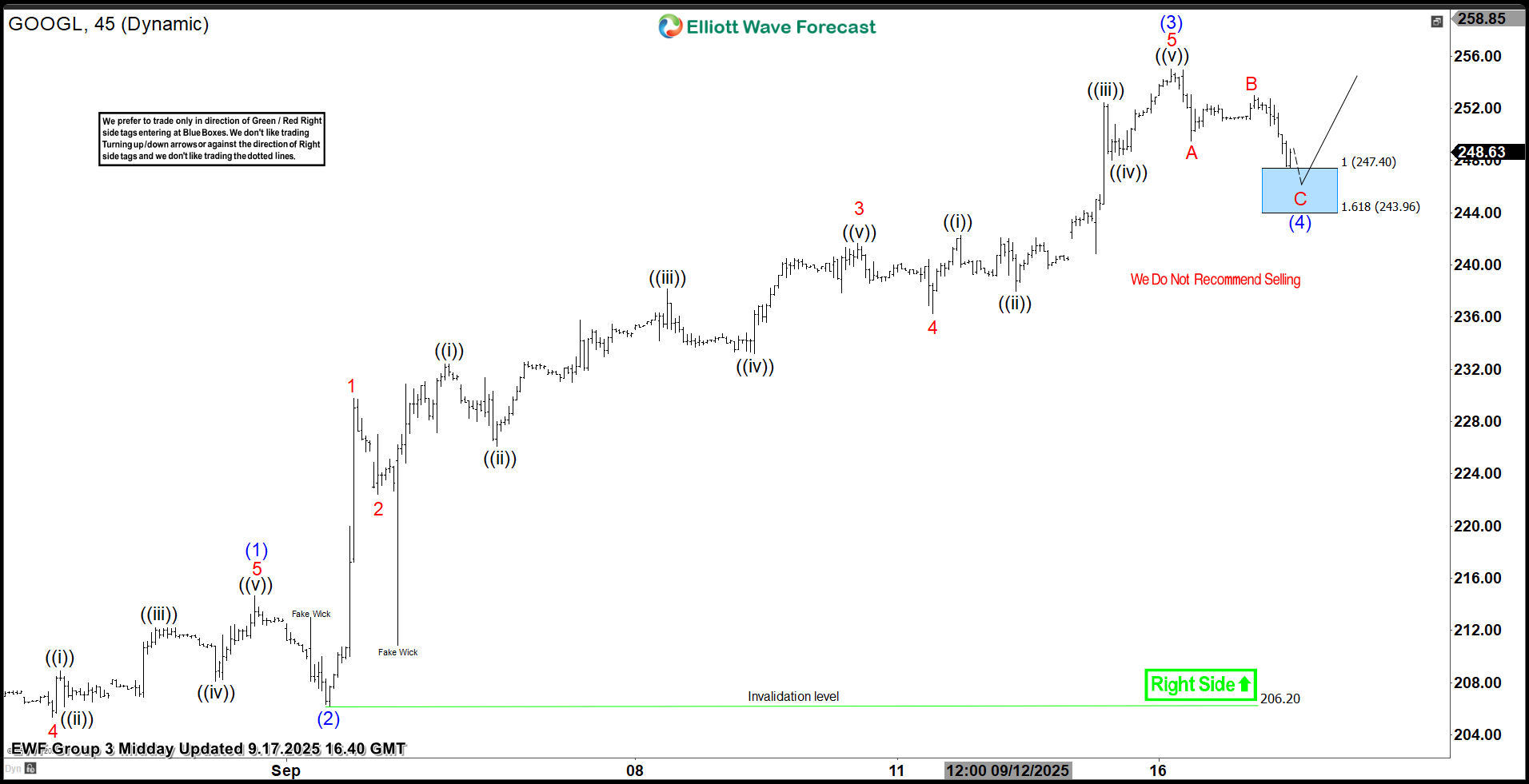

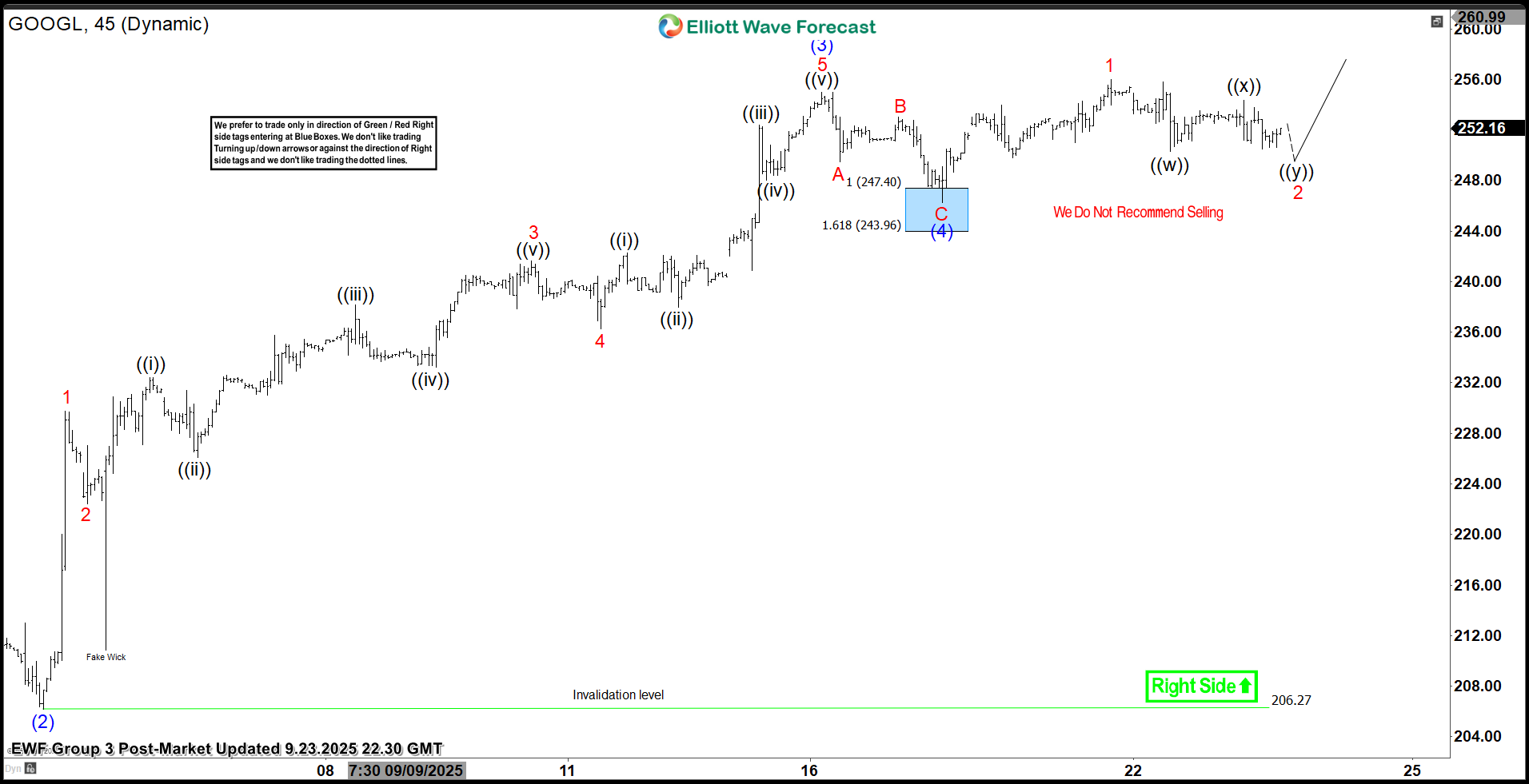

Elliott Wave Analysis

GLXY Weekly Chart 10.07.2025

Conclusion

GLXY’s powerful upward framework will uphold the stock during any short-term declines. As a result, investors can systematically use these dips to establish positions across daily and weekly charts.Use our Elliott Wave strategy for optimal timing. Ideally, enter positions after the stock completes a 3, 7, or 11-swing corrective sequence. Furthermore, our extreme Blue Box system pinpoints these entries with high precision. Ultimately, this methodology provides clarity and confidence for capturing the next leg higher.

Explore our system to gain deeper insights into this methodology.