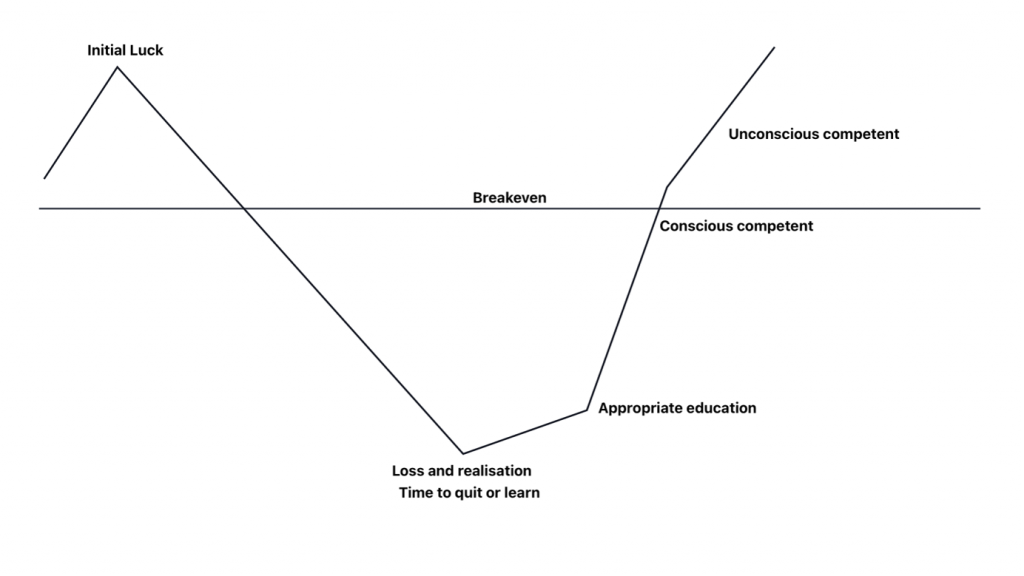

My journey to finding Elliott Wave and becoming profitable is a long and sad journey, it took countless losses and blowing up around 10 different accounts over 2 years to finally find an edge in the market. Now 4 years of experience under my belt I can offer some advice to other traders. What follows is my process of finding Elliott Wave theory after a drudging trading career to finally capture profits. I’ll also share some tips and tricks I’ve learned along the way from position management and trader mentality.

After leaving the military in 2018 and fulfilling my contract, I was in search of a high-stress exciting job to find a place to stay for years to come. The first thought that came to mind was to be a paramedic, and back in 2020 that was my goal. I began school for a paramedic program and worked in the hospital from 2018-2020. When the COVID-19 Pandemic hit, I decided that being a paramedic was definitely not for me, as it was mostly used in my area as a taxi service, the pay was not good, and the work was hard.

Being lost as to what to do next, one shift at the hospital I heard about trading and was instantly hooked, proclaiming on in April 2020 “I’m going to be a trader, mark my words!”. What followed that was a period of intense study to try and figure out how the markets worked, and how to extract profits from them. I was studying 8-12 hours a day, reading every trading book I could get my hands on, listening to every ‘Chat With Traders’ podcast, and taking every online trading course, including the Warrior Trading course.

I still have the giant binder I composed with notes from every book and video, with trading techniques ranging from MACD reversals, Stochastics trading, Candlestick patterns, and Higher-low/lower-high trades. After none of those worked, I started to research fundamental analysis and trading news events utilizing “hot stocks”. Starting each account with a low sum of money, I eventually lost those accounts, one at a time over a 2-year period.

Finding Elliott Wave.

At this time, I also decided to shift my degree to economics. I did this to start learning the inner workings of the market, which I just finished in May 2024. In reality though, nothing really helped me earn profits and radically change my accuracy besides Elliott Wave theory. This is because nearly all economic models have one glaring unknown calculation: Social Sentiment. If you look at the core equations for inflation (the driving factor of economic policy decisions). Then main multiple is the public perception of their dollars. Many of my professors admit that social sentiment is really the core of economic theory.

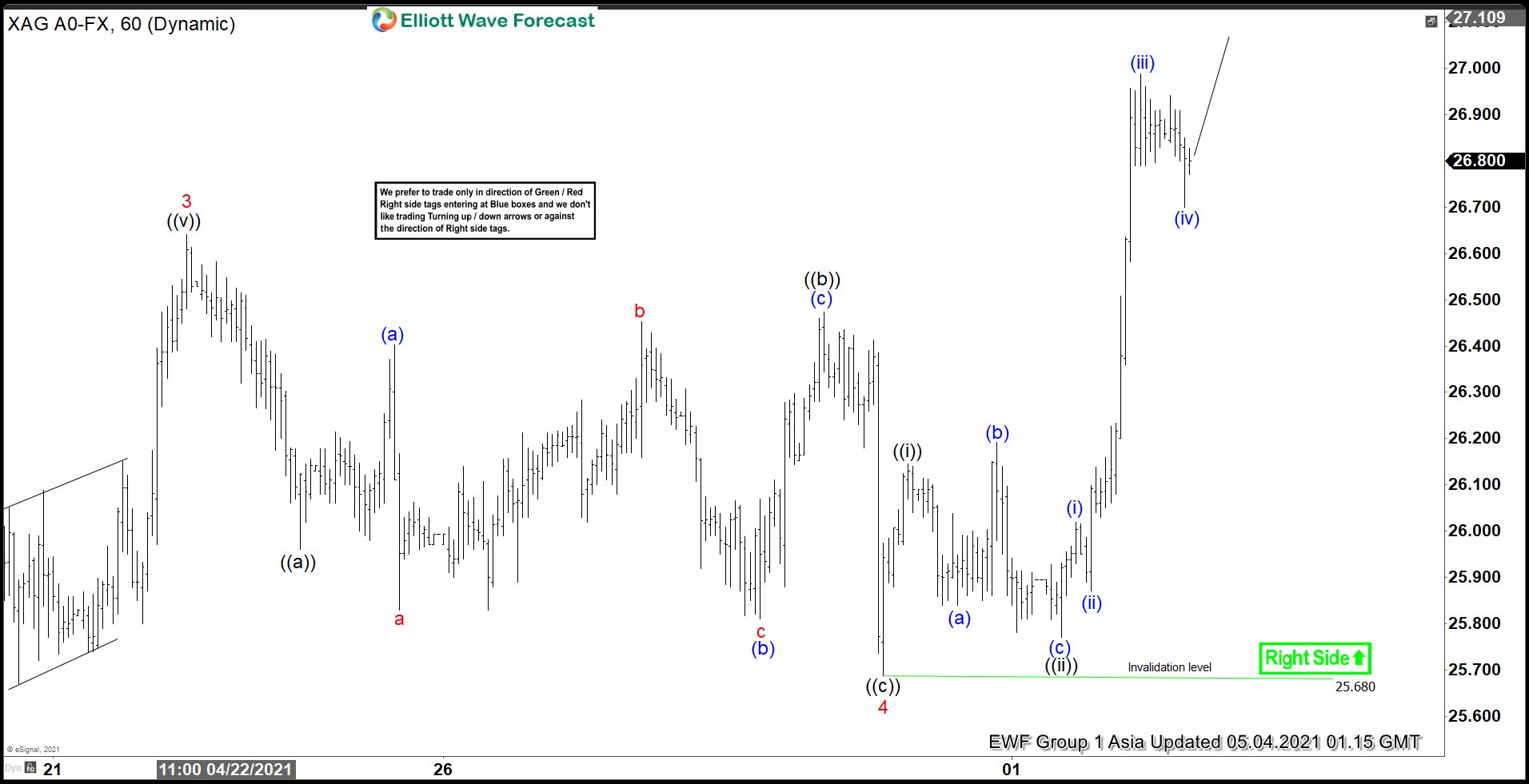

Elliott Wave theory, however, attempts to measure social sentiment in a series of wave reactions. Not only that, but these waves have a normal distribution of movement, as I’ve found through a variety of research (to be published August 2024 by the CMT Association). This proves that wave ratios can in fact be a reliable predictor of market prices. Elliott Wave Forecast expands on that even more, correlating every market together. It does that with a series of first- and second-degree correlations to provide a better “big picture” than others provide. Upon starting to trade with Elliott Wave theory I stopped losing money and began to break even. It wasn’t until I got about 1-year of experience under my belt counting and forecasting that I started to become profitable, that’s due to the following tips:

1. Expand your timeframe. – Elliott Wave theory is extremely hard to use for intraday trades, as the larger trend remains a powerful force in one direction, it doesn’t always predict the small wiggles correctly. I’ve found much better accuracy by changing my trades from 1-3 days to 5-60 days. It is also more relaxing too, as your position sizing is often smaller, and risk/reward rations much bigger. This gives more room for only trading the best setups too, instead of trading every wiggle.

2. Always use a stop loss, keep it close when you enter. – One mindset that is essential to be a trader is one of minimizing loss. Not only is it a good idea to keep risk around 2%, but if your stop loss is close. This means your risk/reward ratio is usually very big. Always go in with a plan, and always follow your plan, never hold a losing position through your stop-loss. You can re-enter at the next pivot with a new low-risk entry.

3. Let Profits Run. – Finding a profitable trade can be hard, especially in certain sideways markets. One strategy I use is always to sell half at my first target. Then, let the rest run with at least a break-even stop loss. This way you can capture parabolic moves in your favor. How often have you sold a position only to wish you held it longer over the coming weeks? When the market moves in your favor again, sell half again and now you hold ¼ of the position, let the last ¼ run.

4. Stick with a strategy – When I began to trade, I hopped around strategies often when they didn’t work. Some people, however, can get profitable from these strategies I failed at. It’s important not to hop-around with different strategies, and instead become a professional in one area. There are people who only trade 5 minutes a day and spend the rest of the day relaxing. People who follow every news story that pertains to copper and only trade copper. People who program algorithms for hundreds of hours and then let it run for years while profiting. It’s important to find your own niche and stick with it. Don’t quit something just because it wasn’t profitable for a few months when the potential is there.

As you can see, choosing and sticking with Elliott Wave for a time now has helped me to move further with cutting edge Elliott Wave research. Keep an eye out for me in Elliott Wave Forecast’s live chat as we navigate this market together, and feel free to ask me questions in the live chat on my market views.

About Elliott Wave Forecast

www.elliottwave-forecast.com Updates one-hour charts 4 times a day and 4-hour charts once a day for all our 78 instruments. We do a daily live session where we guide our clients on the right side of the market. In addition, we have a chat room where our moderators will help you with any questions you have about what is happening in the market.

Moreover, experience our service with a 14-day Trial for only $0.99. Cancel anytime by contacting us at support@elliottwave-forecast.com.