SOXX is semiconductor ETF to provide concentrated exposure to the 30 largest US-listed semiconductor companies. This includes (i) manufacturers of materials with semiconductors that are used in electronic applications or in LED and OLED technology and (ii) providers of services or equipment associated with semiconductors.

SOXX Daily Chart

The market cycle began on December 2018 when SOXX found support at $144.79. The ETF got a bullish momentum and it is building an impulse that could end at any moment. The wave ((1)) of the impulse ended at $269.36. The pullback made a zig-zag correction completing at $167.79 as wave 2. Wave ((3)) started a powerful rally reaching $443.97 in less than a year. Wave ((4)) correction drop to 23.6% Fibonacci retracement from wave ((2)) at $386.02, doing an irregular flat structure. From May 2021, we are developing wave ((5)) to complete the whole cycle from 2018 and also a wave III of an upper degree. (If you want to learn more about Elliott Wave Theory, please follow these links: Elliott Wave Education and Elliott Wave Theory).

The market cycle began on December 2018 when SOXX found support at $144.79. The ETF got a bullish momentum and it is building an impulse that could end at any moment. The wave ((1)) of the impulse ended at $269.36. The pullback made a zig-zag correction completing at $167.79 as wave 2. Wave ((3)) started a powerful rally reaching $443.97 in less than a year. Wave ((4)) correction drop to 23.6% Fibonacci retracement from wave ((2)) at $386.02, doing an irregular flat structure. From May 2021, we are developing wave ((5)) to complete the whole cycle from 2018 and also a wave III of an upper degree. (If you want to learn more about Elliott Wave Theory, please follow these links: Elliott Wave Education and Elliott Wave Theory).

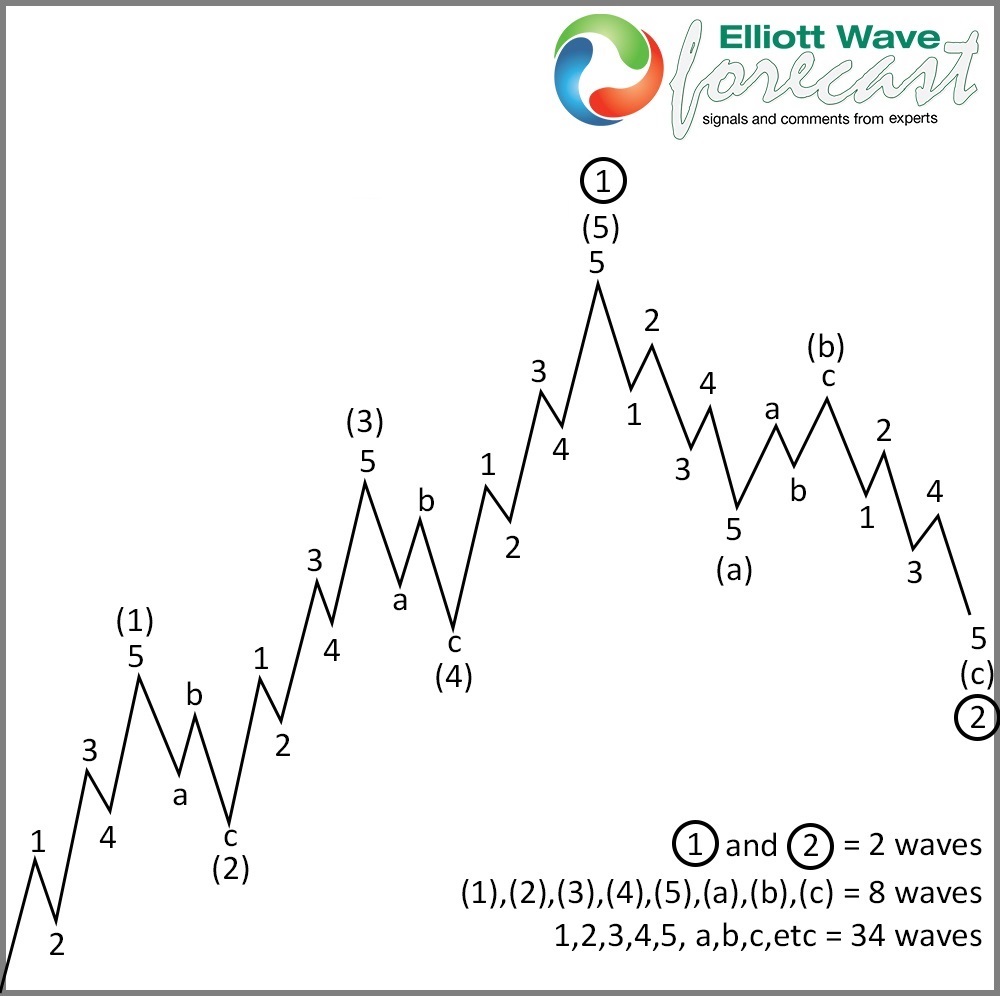

Elliott Wave Theory Motive Wave Structure

SOXX Last Wave and Target

SOXX began the last 5 swings at $386,02. Wave (1) ends at $476.53 with a Leading Diagonal structure, then pullbacks as wave (2) doing an irregular flat ending at $433.26. A nice rally born sending the ETF to $548.12 and complete the third swing. Actually, we have entered in a range phase that must be the wave ((4)). This wave ((4)) could done already at $514.92, but we cannot rule out visit to around $514.03 to complete a flat correction and then begin the last rally that we are expecting for.

Therefore, the rally should begin this December 2021 and we are targeted to $556.57 – $584.61 area. In that the cycle from 2018 should end and wave ((5)) of III. After completing this, we should see 3 or 7 swings correction that could send the ETF to around $375.00. Keep an eye to this movement that represent around the 30% of the SOXX.

Elliottwave Forecast updates one-hour charts 4 times a day and 4-hour charts once a day for all our 78 instruments. We do a daily live session where we guide our clients on the right side of the market. In addition, we have a chat room where our moderators will help you with any questions you have about what is happening in the market at the moment. Let’s trial 14 days for only $9.99 here: I want 14 days trial. Cancel Anytime.