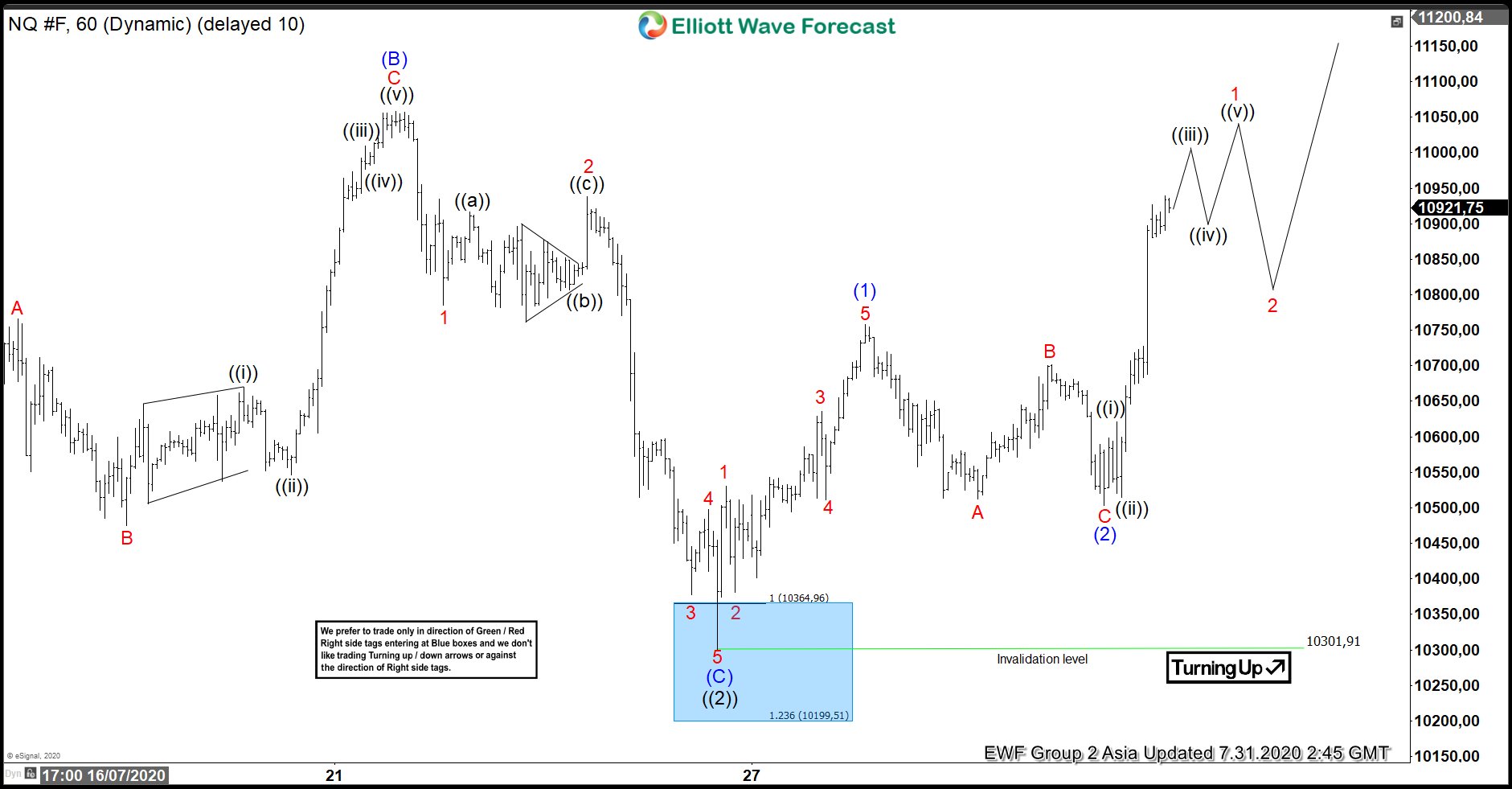

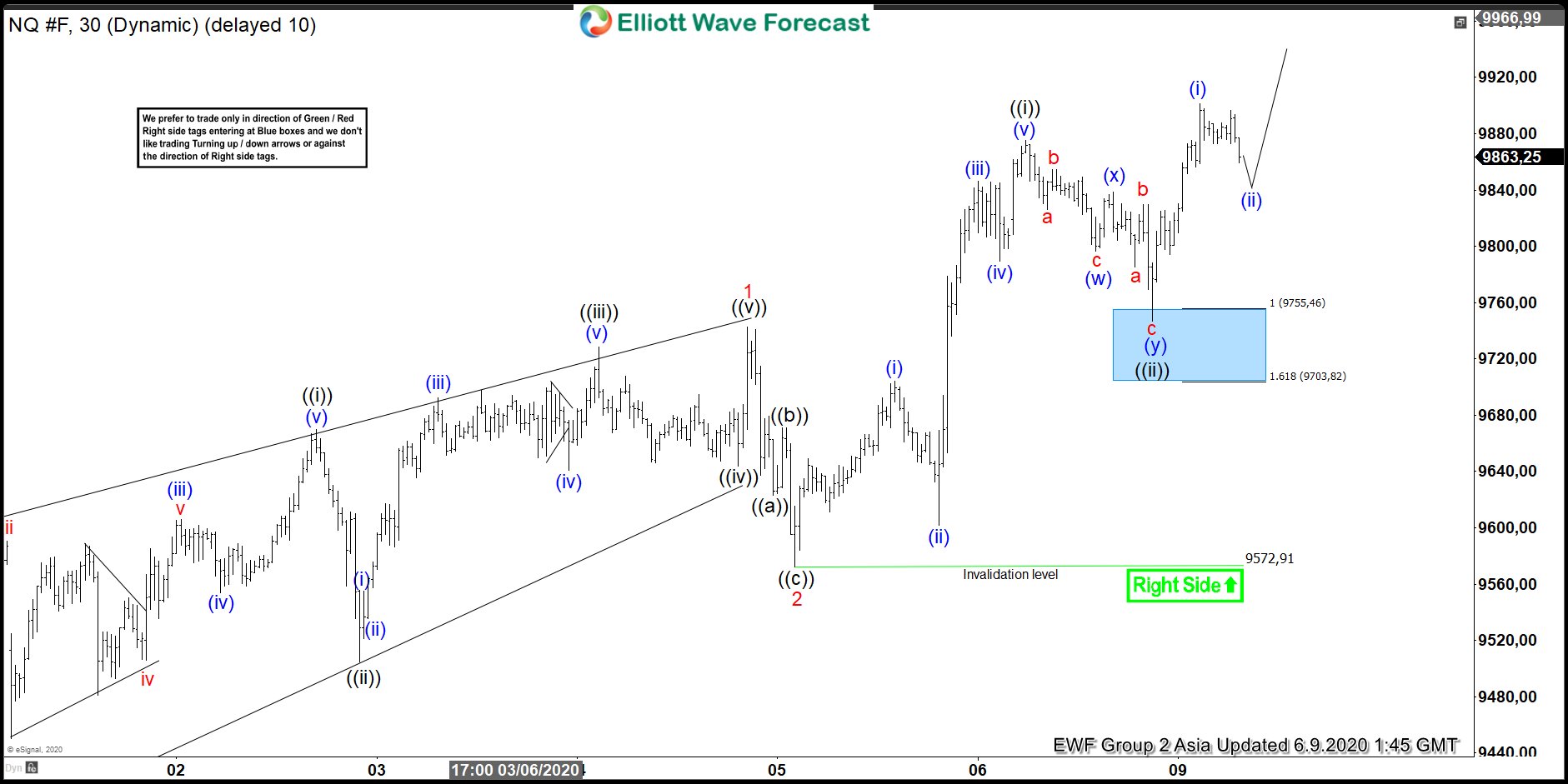

In this technical blog, we will look at the past performance of 1 hour Elliott Wave Charts of NASDAQ index, which we presented to members at elliottwave-forecast. In which, the rally from March 22 March 2020 low unfolded as an impulse structure with a higher high sequence favored more upside extension to take place. Therefore, we advised members not to sell the index & buy the dips in 3, 7, or 11 swings at the blue box areas. We will explain the structure & forecast below:

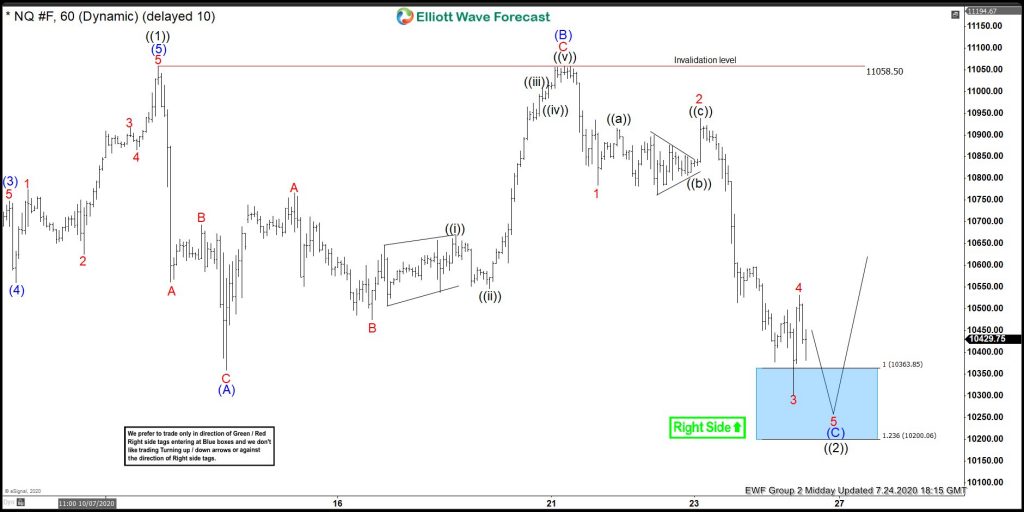

NASDAQ 1 Hour Elliott Wave Chart

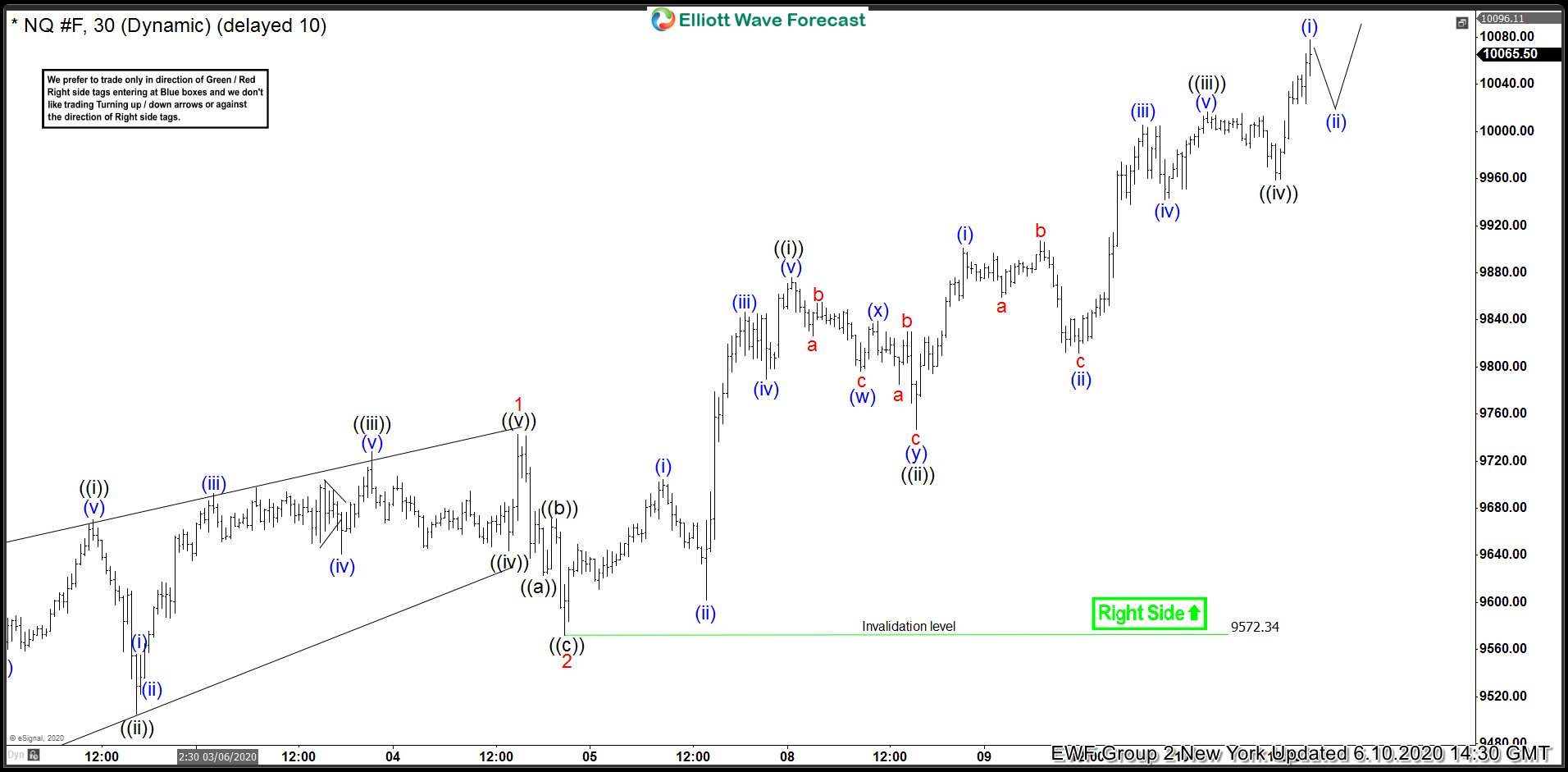

NASDAQ 1 Hour Elliott Wave Chart from 7/24/2020 Midday update. In which, the cycle from 29 June 2020 low ended wave ((1)) as 5 waves impulse structure at $11058.50 high. Down from there, the index made a pullback in wave ((2)). The internals of that pullback unfolded as Elliott Wave Flat Structure. Whereas, wave (A) ended in 3 swings at $10358.75 low. Wave (B) bounce also ended in 3 swings at $11058 high. Down from there, wave (C) unfolded in 5 waves structure. And managed to reach the $10363.85- $10200.06 100%-123.6% Fibonacci extension area of (A)-(B). From there, buyers were expected to appear for more upside or for 3 wave bounce at least.

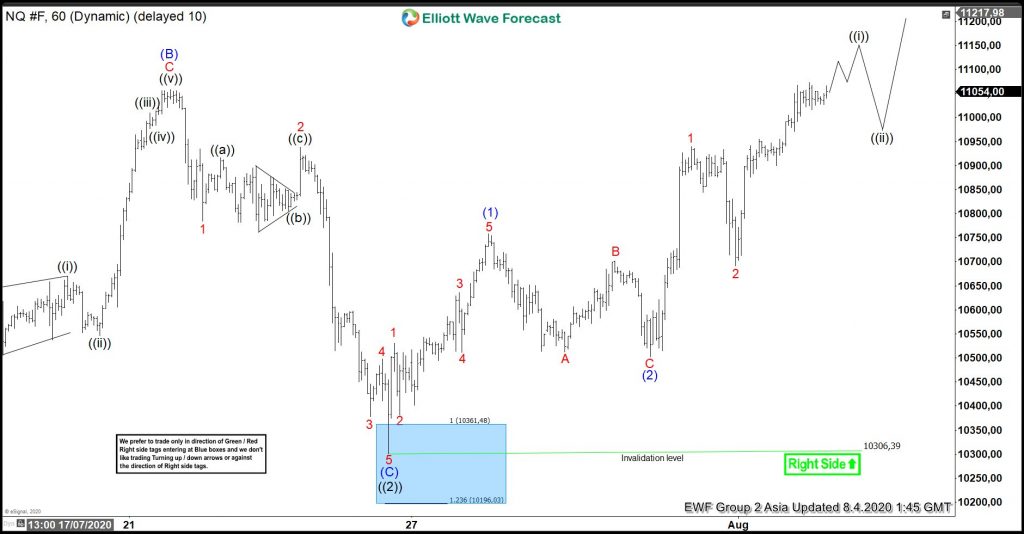

NASDAQ 1 Hour Elliott Wave Chart

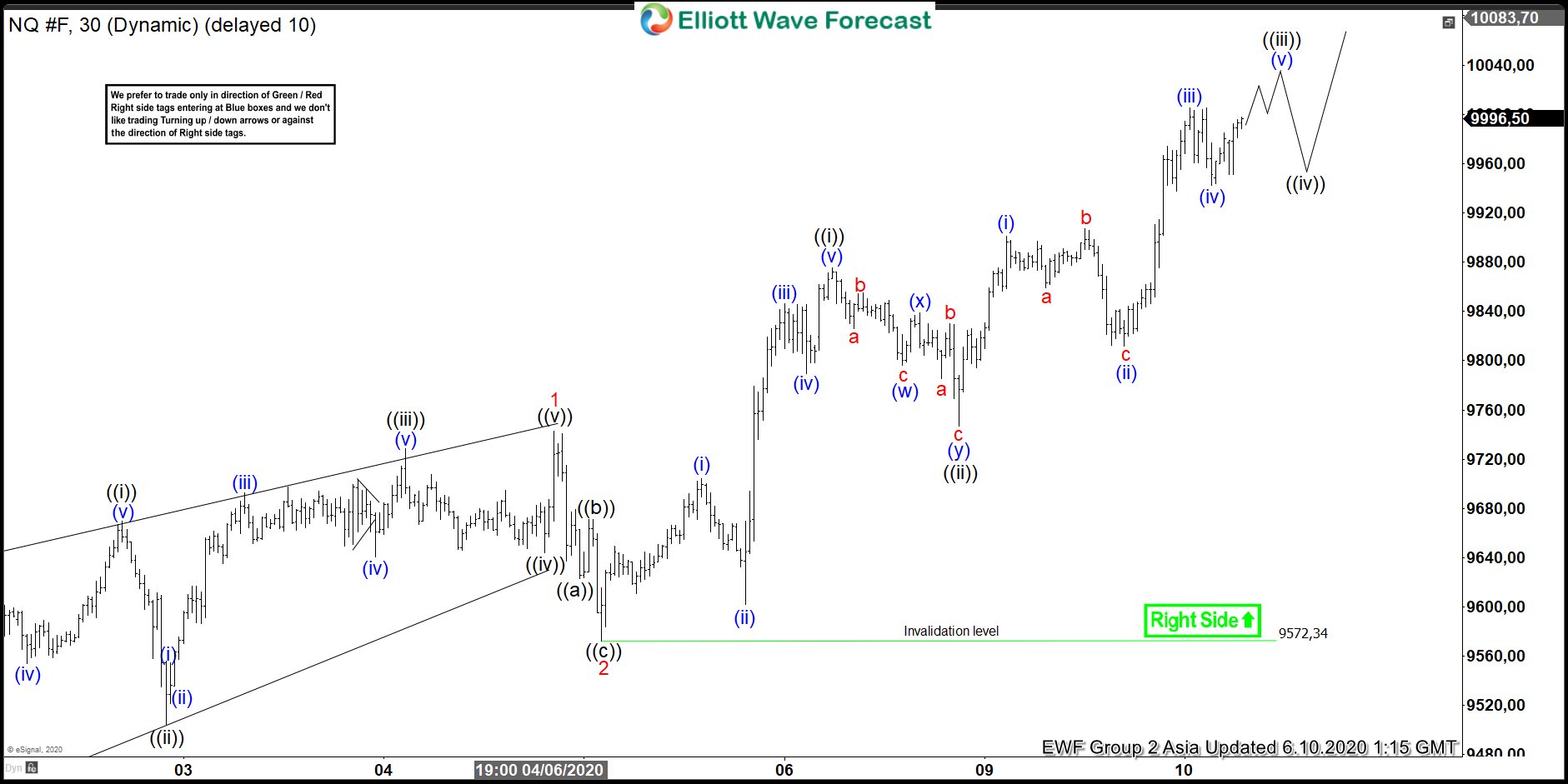

Here’s 1 Hour Elliott Wave Chart from 8/04/2020 Asia update. The index is showing a reaction higher taking place from the blue box area after ending the Flat correction at $10306.39 low. And breaking to new highs as expected. Allowed members to create a risk-free position shortly after taking the long positions.

If you are looking for real-time analysis in Bitcoin along with other Crypto-currencies then join us with a Free Trial for the latest updates & price action.

Success in trading requires proper risk and money management as well as an understanding of Elliott Wave theory, cycle analysis, and correlation. We have developed a very good trading strategy that defines the entry.

Stop loss and take profit levels with high accuracy and allows you to take a risk-free position, shortly after taking it by protecting your wallet. If you want to learn all about it and become a professional trader. Then join our service by taking a Free Trial.