Hello traders ! In this technical article, we’re going to take a quick look at the Elliott Wave charts of GOLD (XAUUSD ) , published in the members area of the website.

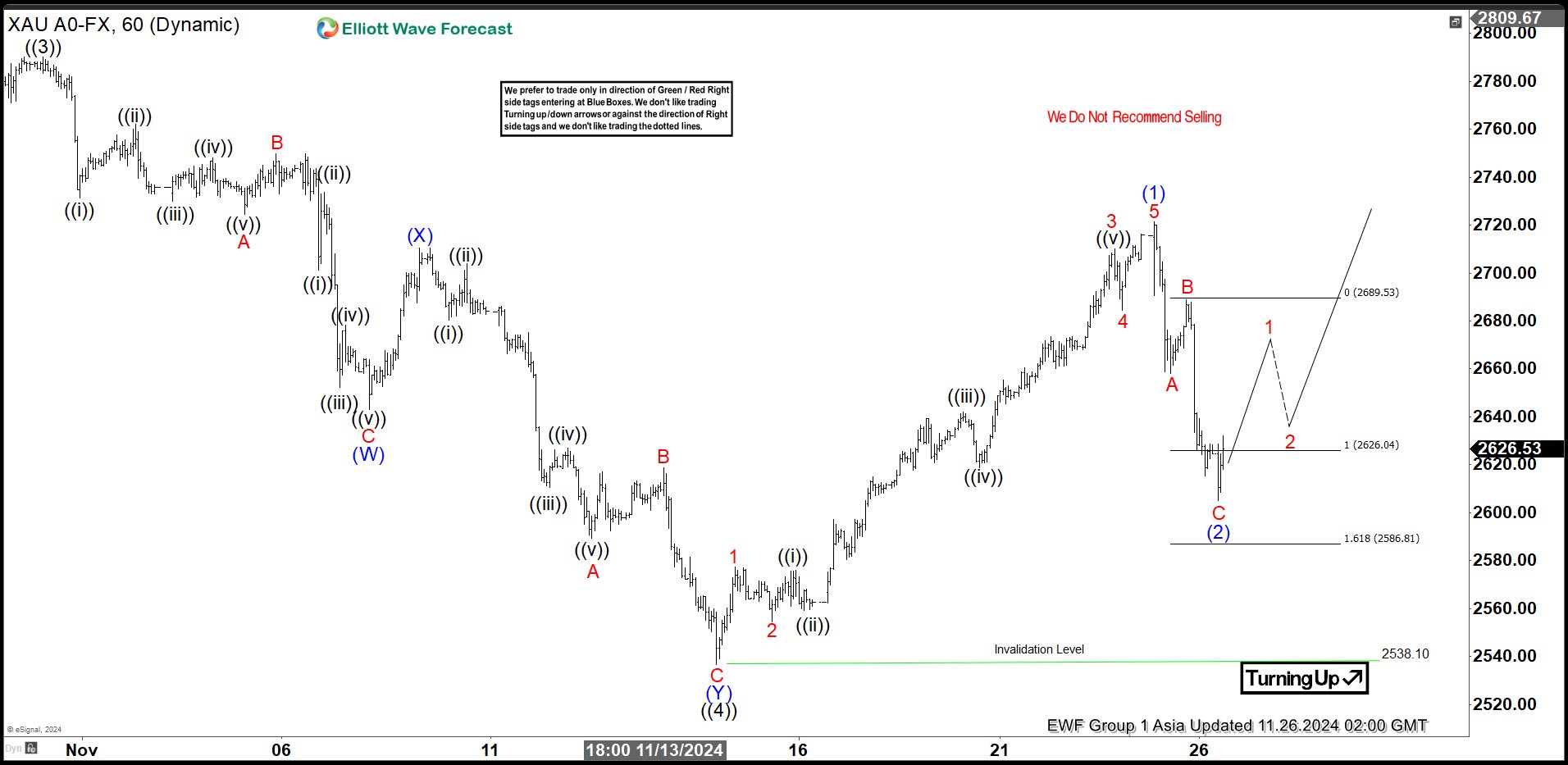

As our members know, XAUUSD has been showing impulsive bullish sequences in the cycle from 2579.36. We continue to favor the long side in this commodity. Recently, GOLD pulled back and found buyers at the equal legs area.

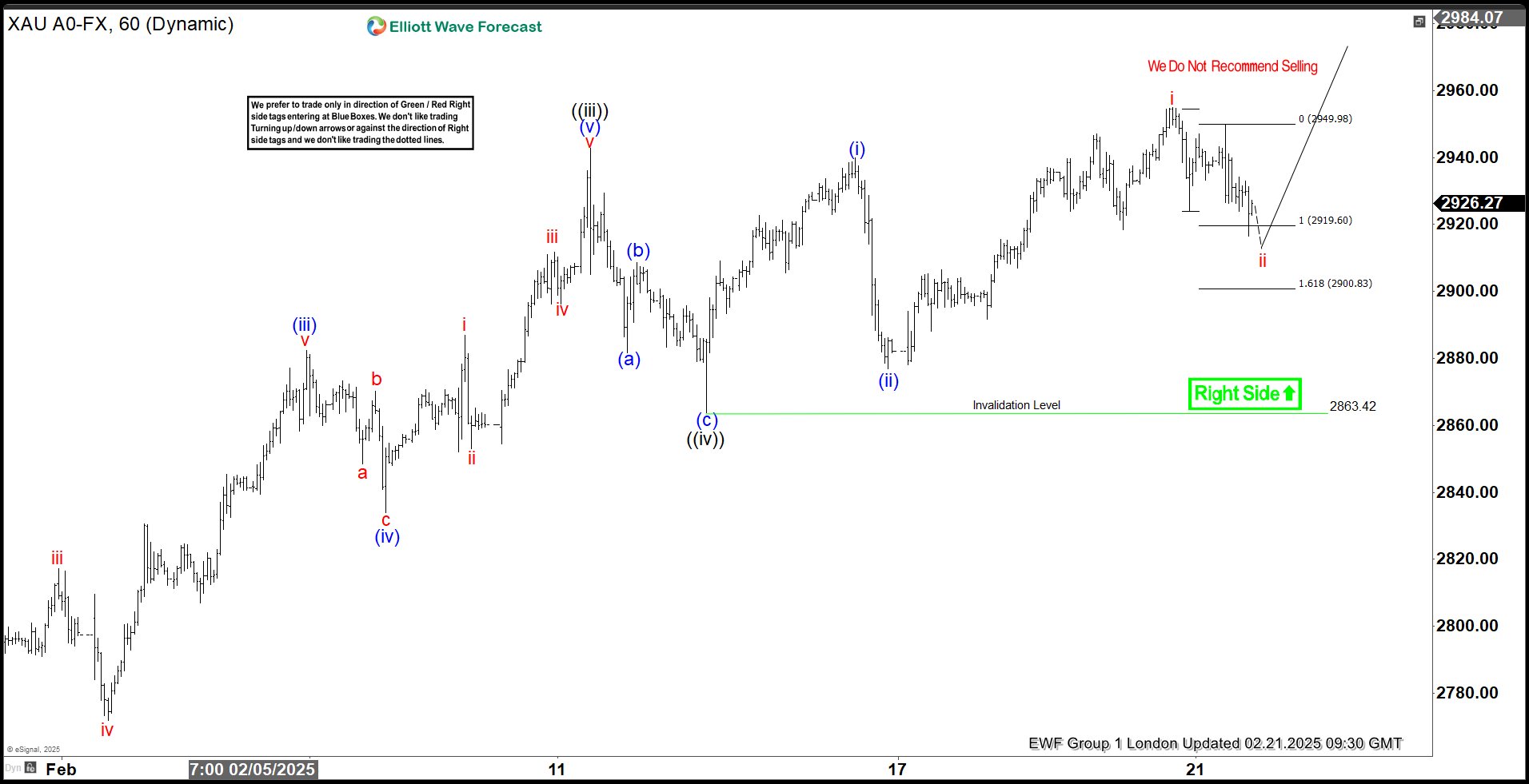

GOLD XAUUSD 1-Hour Elliott Wave Analysis: February 21, 2025

GOLD remains bullish as long as it holds above the 2863.42 pivot in the first degree. Currently, it is showing three waves down from the peak, reaching the extreme zone at 2919.6–2900.83. We expect buyers to step in at this area, leading to either a continuation toward new highs or at least a three-wave bounce.

90% of traders fail because they don’t understand market patterns. Are you in the top 10%? Test yourself with this advanced Elliott Wave Test

XAUUSD 1-hour chart showing bullish structure and key support zone

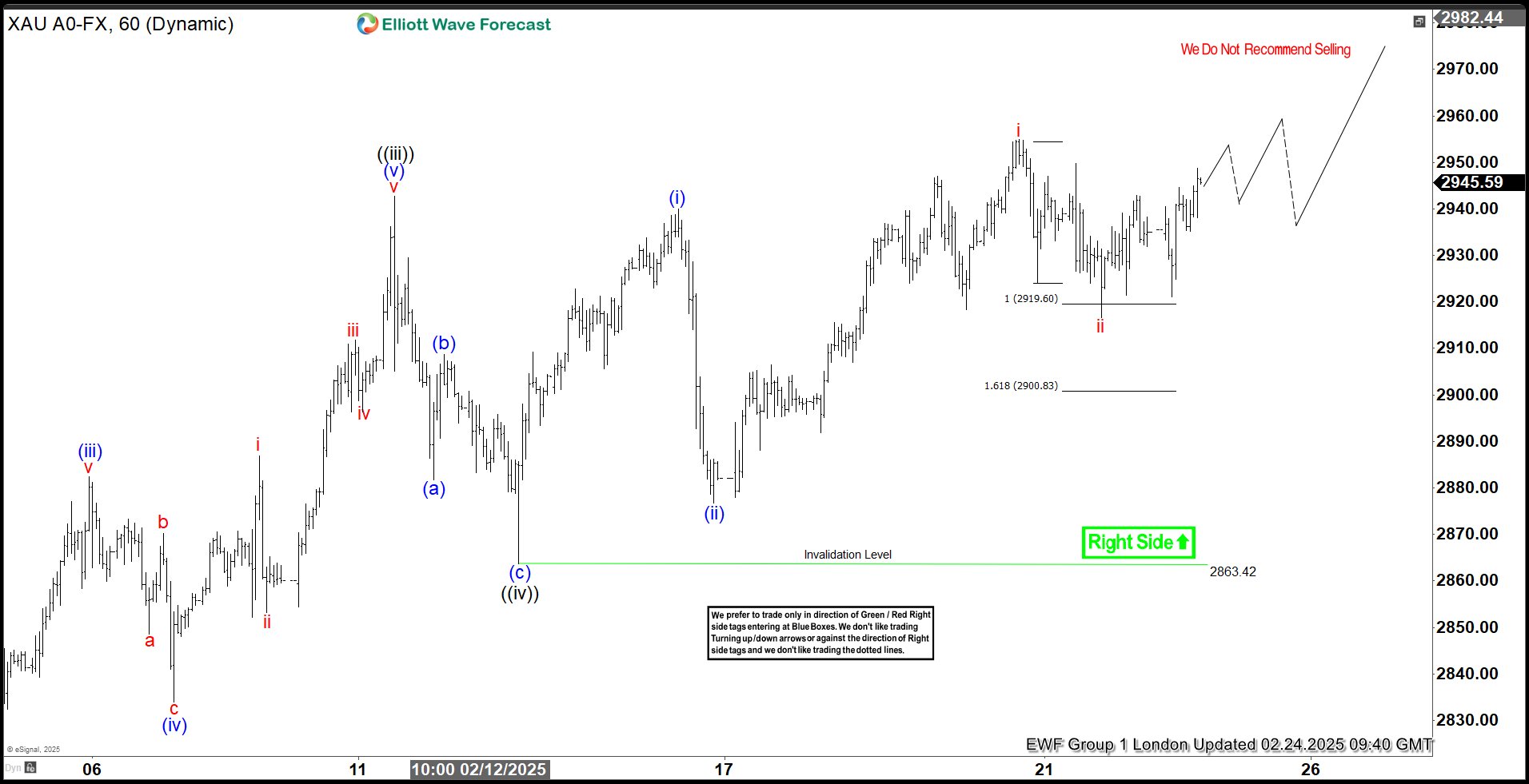

XAUUSD 1-Hour Chart Update: February 24, 2025

GOLD is showing us nice reaction from the equal legs area (2919.6–2900.83) . The commodity completed 3 waves down at the 2917.16 low. As expected, buyers stepped in, pushing prices higher. Now, we’d like to see a break above the February 20th peak to confirm further upside extension. A break above this level would open the door for a potential move toward the 2994.7+ area.

Reminder for members: Our chat rooms in the membership area are available 24 hours a day, providing expert insights on market trends and Elliott Wave analysis. Don’t hesitate to reach out with any questions about the market, Elliott Wave patterns, or technical analysis. We’re here to help.

XAUUSD reacting from equal legs support zone

Elliott Wave Forecast Trading Services

Thank you for exploring our GOLD Forecast with us. While we analyze 78 instruments, it’s important to remember that not every chart represents a trading recommendation. For official trading signals, we invite you to join our Live Trading Room, where we provide actionable insights in real-time. If you’re not yet a member, take advantage of our 14-day trial to unlock new trading opportunities.

Over the years, we’ve developed a reliable trading strategy that clearly defines entry, stop loss, and take profit levels. By joining us, you’ll gain access to expert guidance and the chance to refine your trading skills

Why Join Our Trading Community?

📈 Elevate your trading with Elliott Wave Forecast!

💻 Ask unlimited questions during trading hours (Monday to Friday). Our Chat Rooms are an excellent place to learn, with continuous support from our market experts!

🔍 Explore our expert insights and real-time analysis covering Forex, Indices, Commodities, Cryptocurrencies, Stocks, and ETFs across 78 instruments.

📊 Gain exclusive access to our Official Trading Recommendations in the Live Trading Room, where seasoned experts provide valuable insights and guidance on new trading opportunities.

💰 For just $9.99, unlock a wealth of knowledge and experience with our 14-day Trial. Experience firsthand our proven trading strategy, which accurately defines Entry, Stop Loss, and Take Profit levels, empowering you to make informed decisions with confidence.

👉 Ready to take the next step? Get your 14-day Trial in just a few clicks! Click here to start your Trial today!