Last year, our live trading room provides 69% return annually across the 3 groups that we cover. In Live Trading Room, we scan the market everyday to find any tradable setup. We believe every serious traders need to have a good trading system with specific rules. A complete system must include the following: 1. Conditions […]

-

NQ_F: Forecasting Elliott Wave ((iii)) Higher In NASDAQ Futures

Read MoreHello Traders, in this blog we will see how we were able to forecast in advance the wave ((iii)) higher in NQ_F. Nasdaq has been one of the weakest Indices within 2022 and has been seeing a relief bounce rally as of recent. We will see below how here at Elliott Wave Forecast were able […]

-

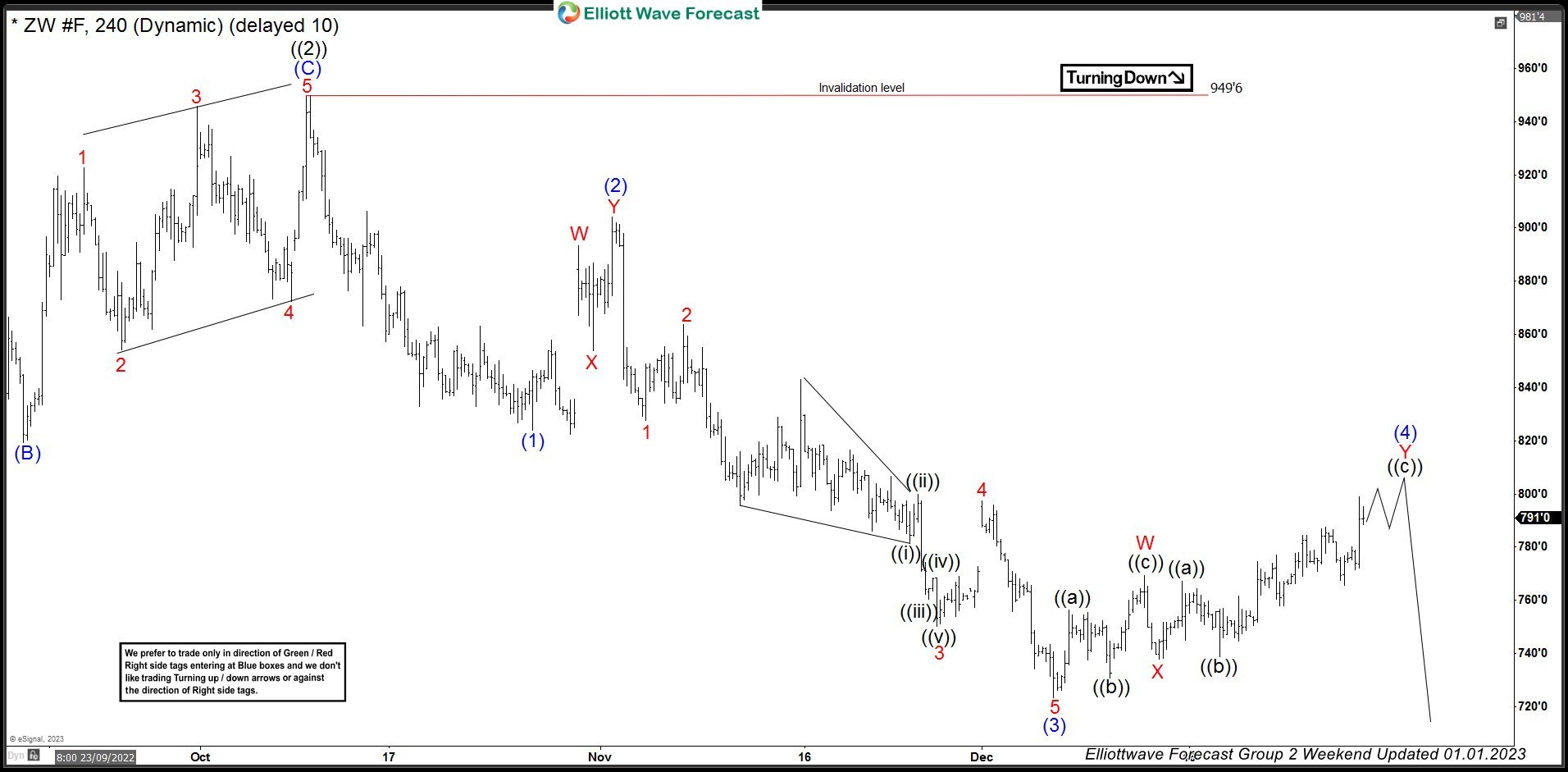

Wheat ($ZW_F) Forecasting The Decline After Elliott Wave Double Three

Read MoreHello fellow traders. In this technical article we’re going to take a look at the Elliott Wave charts charts of Wheat Futures ($ZW_F) published in members area of the website. As our members know Wheat Futures is trading within the cycle from the 950’6 peak. Recently ZW_F made short term recovery that has unfolded as […]

-

LTCUSD – Forecasting the wave (5) within second dimension correlation

Read MoreOne of the well known facts of the market are correlations between instruments. However that rule does not apply every time in every instrument. Here at Elliott Wave Forecast we call a first degree correlation when 2 instruments move together according to how they are related. For example everyone knows that if the USDX is […]

-

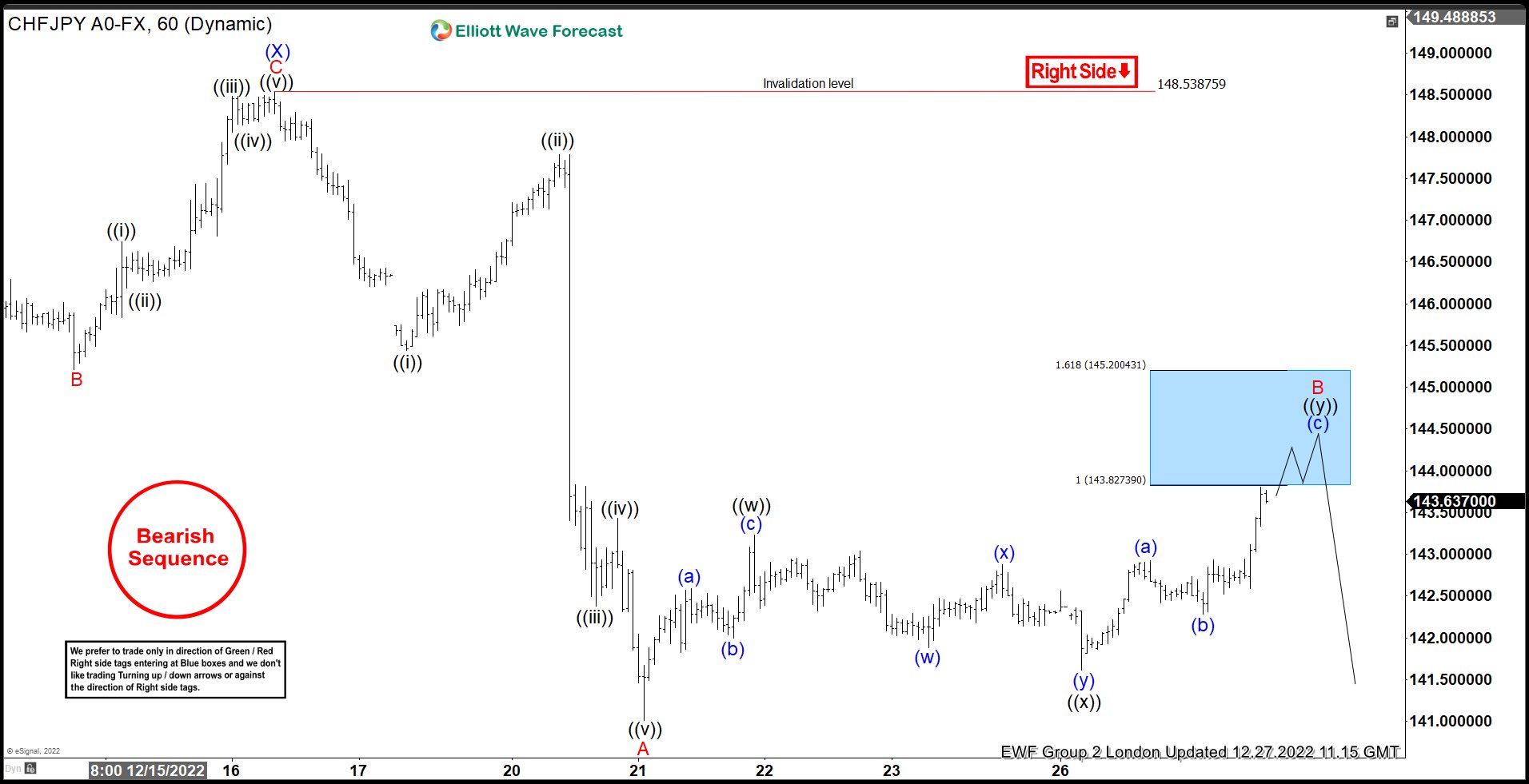

CHFJPY Selling The Rallies After Elliott Wave Double Three

Read MoreHello fellow traders. In this technical article we’re going to take a look at the Elliott Wave charts charts of CHFJPY published in members area of the website. Recently the pair made short term recovery against the 148.53 8 peak that has unfolded as Elliott Wave Double Three Pattern. It made clear 7 swings from […]

-

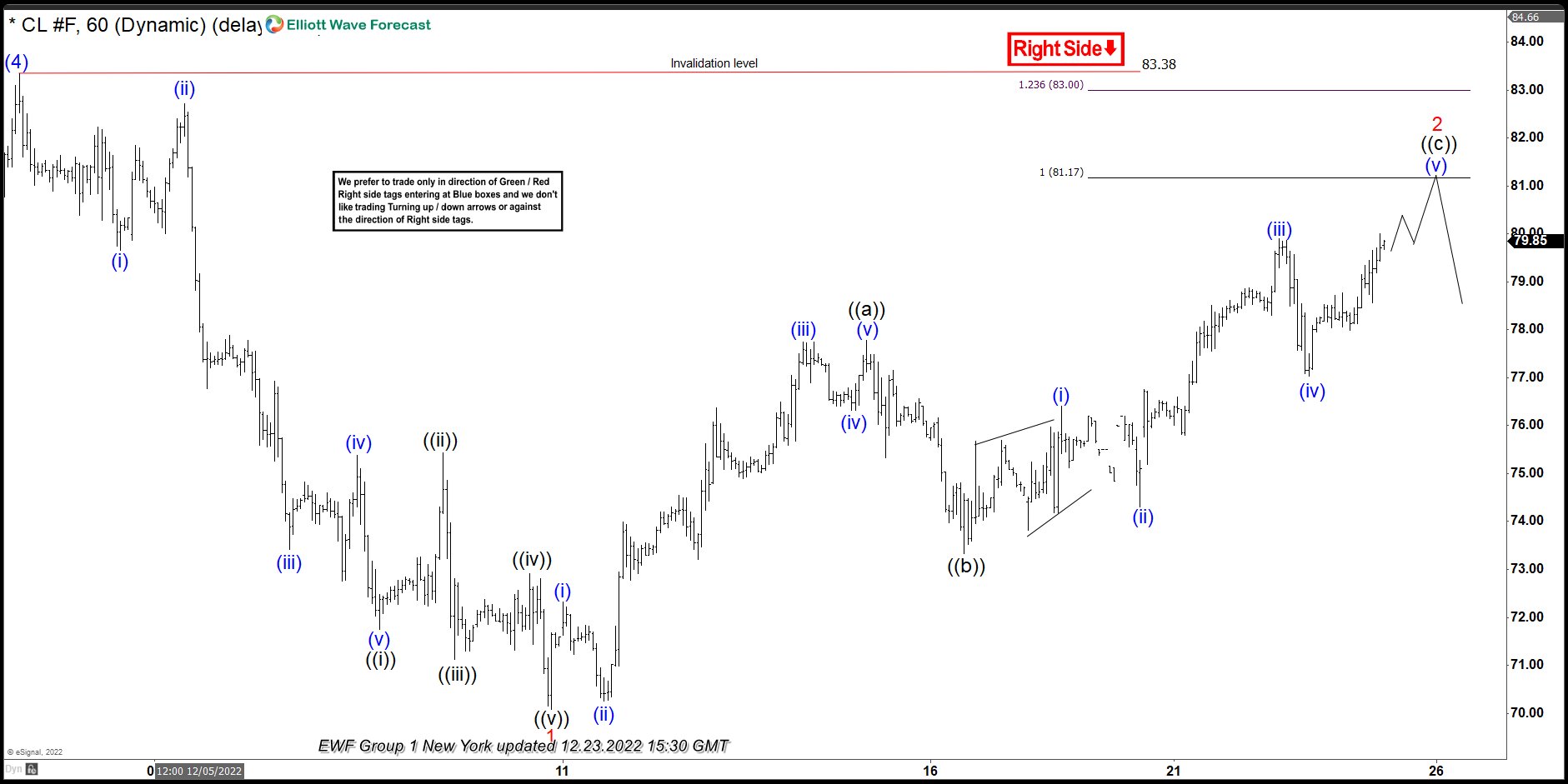

OIL ( $CL_F ) Forecasting The Decline After Elliott Wave Zig Zag

Read MoreHello fellow traders. In this technical blog we’re going to take a quick look at the Elliott Wave charts of OIL Futures ( $CL_F). As our members know, OIL has already reached the extremes from the March 2022 peak at 86.29-63.36 area. The commodity made reaction from there. However shortly after we got break of Sep […]

-

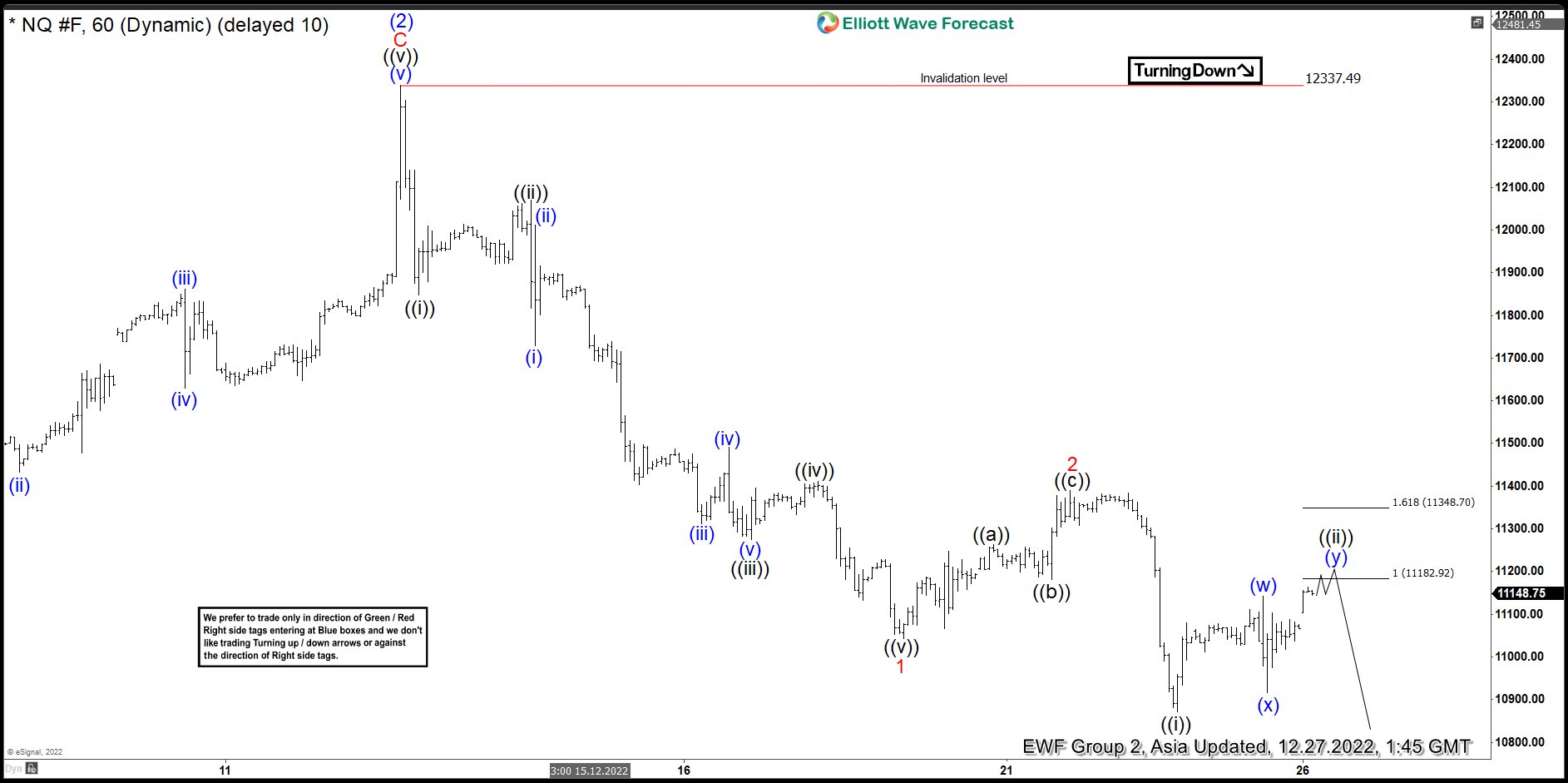

NASDAQ Reacting Lower From Elliott Wave Equal Legs Area

Read MoreIn this technical blog, we will look at the past performance of the 1-hour Elliott Wave Charts of NASDAQ ticker symbol: $NQ_F. In which, the decline from 13 December 2022 high ended 5 waves in an impulse sequence and showed a lower low sequence in a lower time frame charts. Therefore, we knew that the […]