The Power of 3-7-11 and the Grand Super Cycle: How We Saw the Bullish Turn in April 2025 Back on April 9, 2025, while World Indices were dropping sharply and global sentiment had turned overwhelmingly bearish, we published an article that challenged the fear-driven narrative. We explained why selling was not the right approach and […]

-

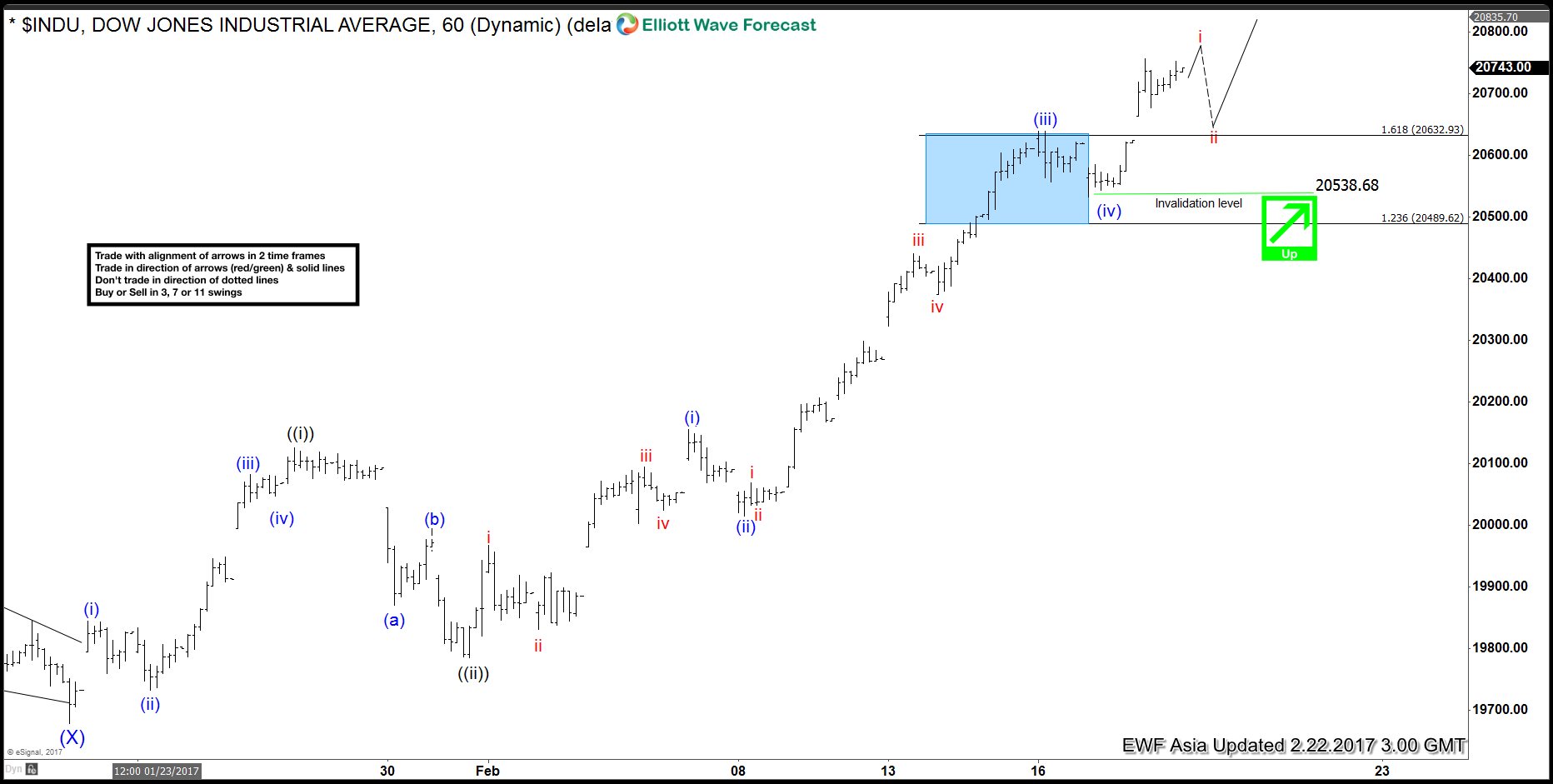

DJIA Elliott Wave View: Wave ((iii)) in progress

Read MoreShort term Elliott wave view in DJIA (Dow Jones Industrial Average) suggests that the rally from 1/19 low is unfolding as a 5 waves Elliott wave impulse structure where Minute wave ((i)) ended at 20125.28, Minute wave ((ii)) ended at 19784.7, and Minute wave ((iii)) remains in progress. Internal of wave ((iii)) is showing an extension and […]

-

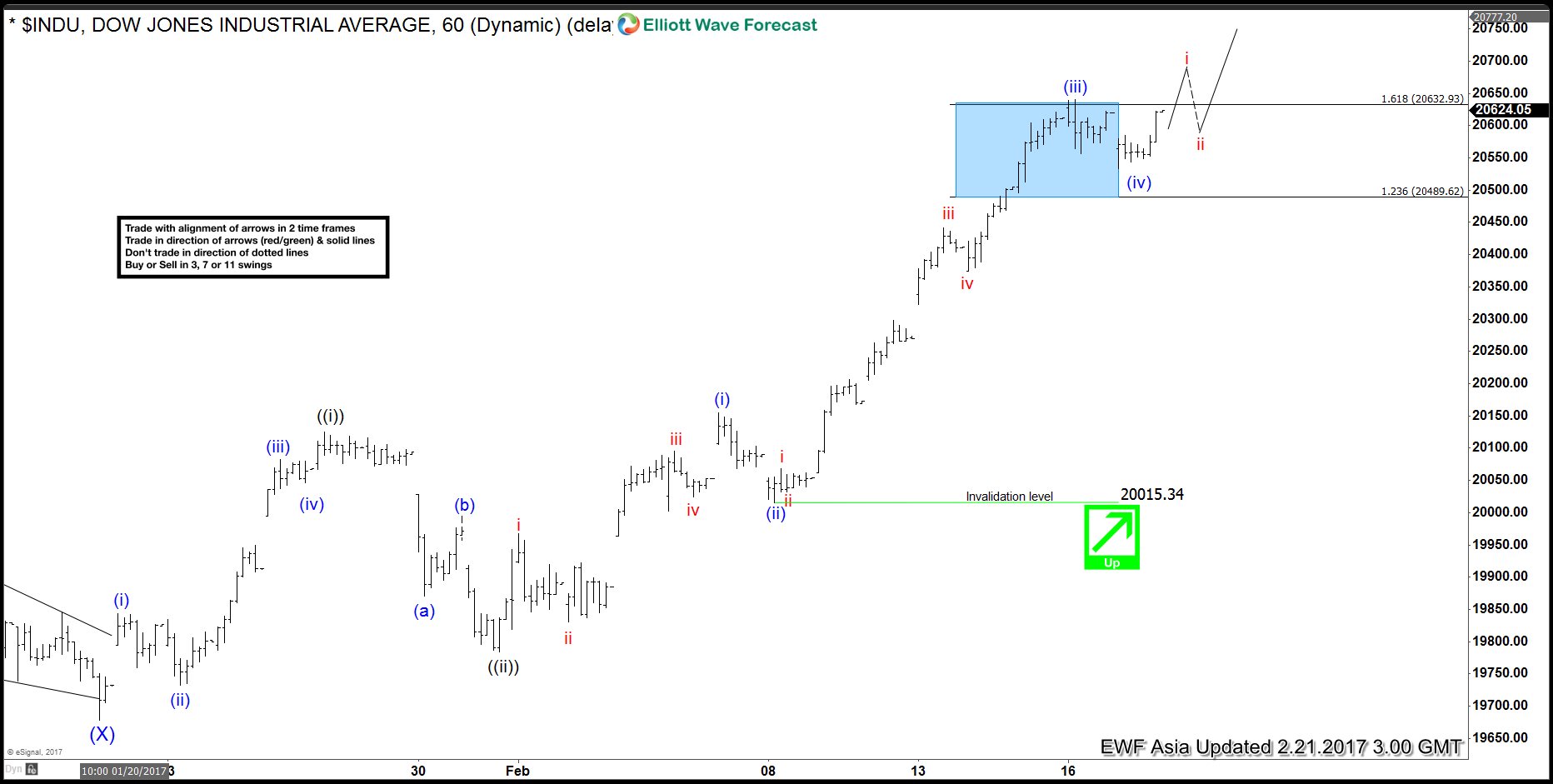

DJIA Elliott Wave View: Marching higher

Read MoreShort term Elliott wave view in DJIA (Dow Jones Industrial Average) suggests that the rally from 1/19 low is unfolding as a 5 waves Elliott wave impulse structure where Minute wave ((i)) ended at 20125.28, Minute wave ((ii)) ended at 19784.7, and Minute wave ((iii)) remains in progress. Internal of wave ((iii)) shows an extension and […]

-

DeutscheBank Elliott Wave Analysis Still Calling Higher

Read MoreIn September 2016 , the media was calling for the collapse of DeutscheBank as its shares were dropping to new all time lows and Investors were worried about another financial crisis . However in our previous article , we were expecting a recovery for Deutsche Bank stock as the technical picture was pointing to an ending diagonal taking […]

-

DAX Index: Bullish Elliott Wave Sequence

Read MoreDAX Index has recovered most of the losses that it saw between 1/26/2017 and 2/7/2017. Index continued the rally today and made a new high above 2/15 (11846) which makes it 5 swings up from 2/7/2017 (11460) low and opens another extension higher. We have labelled the rally from 11460 – 11846 as red wave W […]

-

INDU: Elliott Wave Structure showing more upside

Read MoreIn the Elliott wave Theory, the main idea is an advance in 5 waves followed by 3 waves back, this is seen most of the times in Indexes and right now INDU (Dow) is showing a possible 5 waves advance since the low at 1.19.2017. As of right now, we should be ending the wave ((iii)) in […]

-

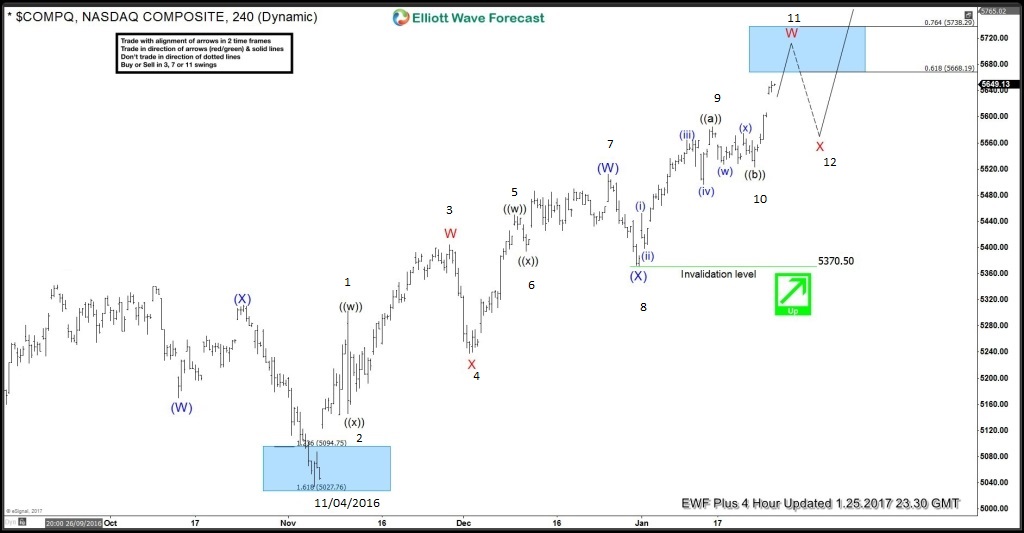

NASDAQ Composite: Elliott Waves calling higher

Read Morein this technical blog, we are going to take a quick look at past performance of NASDAQ Composite charts from January 2017, which we presented to the clients at elliottwave-forecast.com. Below is the 4 hour chart from January 18,2017, showing the sequence of higher highs in the index from November 04,2016 lows. Also if we […]