The Power of 3-7-11 and the Grand Super Cycle: How We Saw the Bullish Turn in April 2025 Back on April 9, 2025, while World Indices were dropping sharply and global sentiment had turned overwhelmingly bearish, we published an article that challenged the fear-driven narrative. We explained why selling was not the right approach and […]

-

SPX Short-term Elliott Wave Analysis 2.14.2015

Read MoreSPX Index made a new high above 12/29 peak which opens another extension higher from 10/15 low. Move up from 2080 low is also taking the form of a (( w )) – (( x )) – (( y )) Elliott wave structure when Index is ending the 5th swing. Area between 2098 – 2111 […]

-

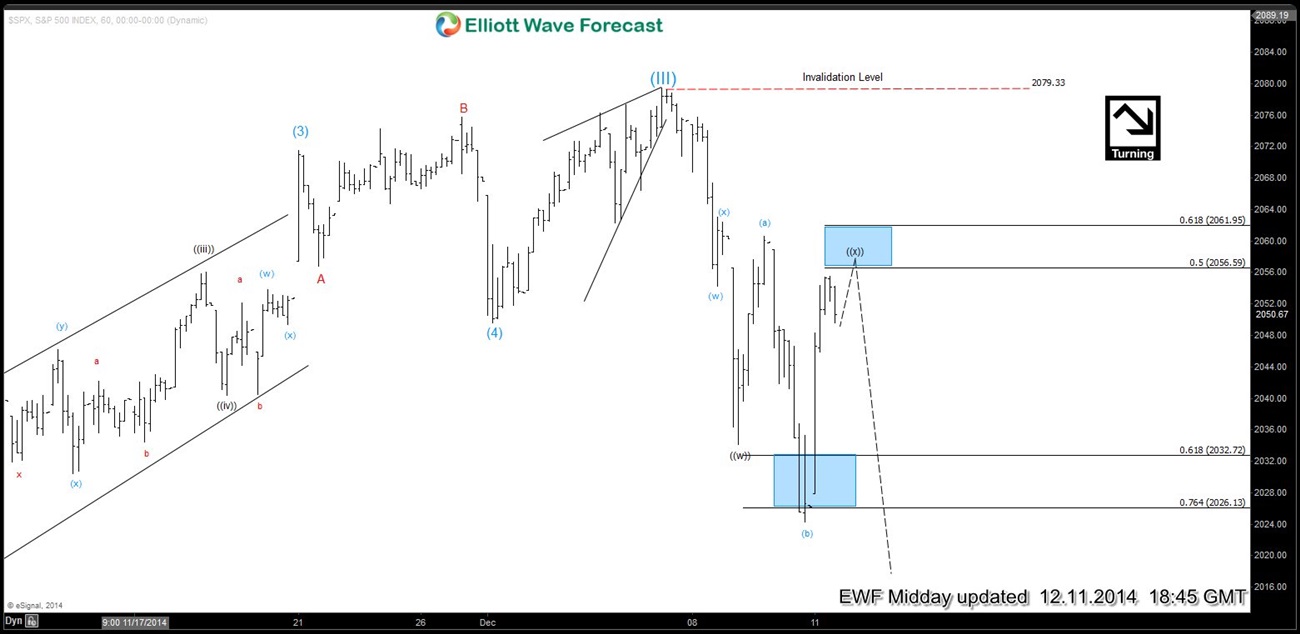

SPX Short-term Elliott Wave Analysis 12.11.2014

Read MorePreferred Elliott Wave view suggests Index has ended a cycle at least from Mid-October low and perhaps a larger daily cycle as well. Initial decline from the highs was in 3 waves that we have labelled as wave (( w )) and ended at 2034. After that we saw a sharp recovery to 2060 followed […]

-

SPX Short-Term Elliott Wave Analysis 12.9.2014

Read MoreSPX500 cycle from Mid-October low is mature and expected to end soon. Index has met minimum requirements of the structure which makes it even more vulnerable but we don’t like to pick tops or bottoms in Elliottwave-Forecast and the fact that Index provided divergence in RSI with the new low we saw today, we still […]

-

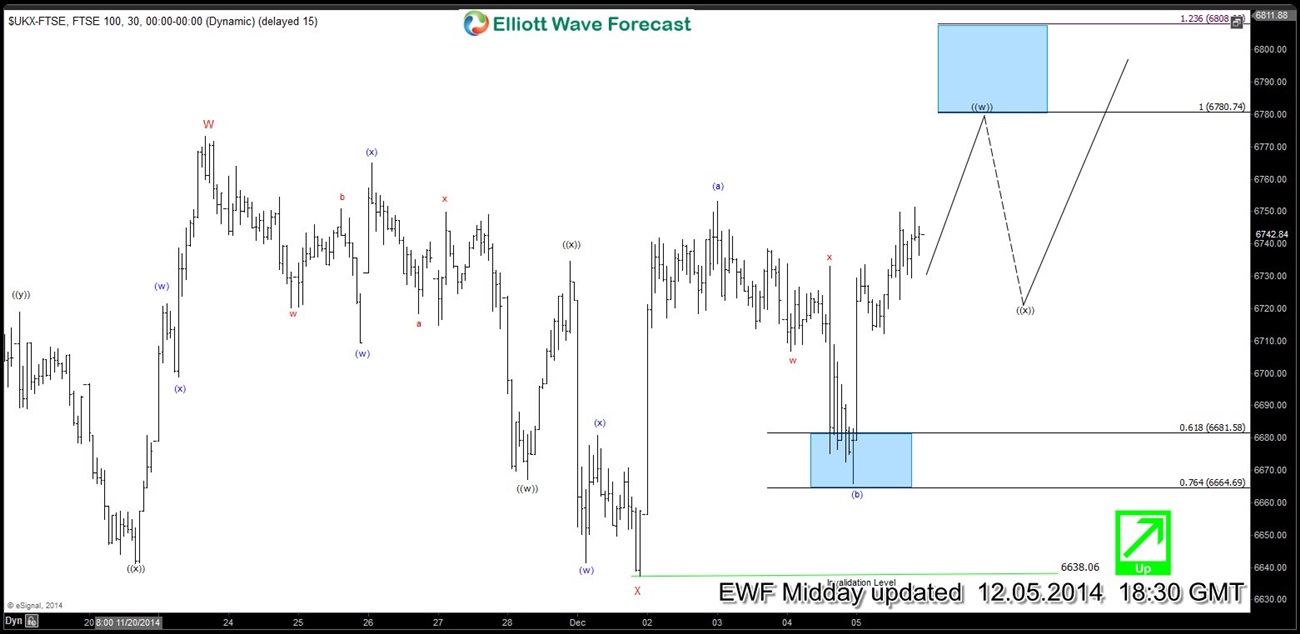

$FTSE Short-term Elliott Wave Analysis 12.5.2014

Read MoreIn our previous chart of the day updates posted on December 1 and December 2 , we were expecting the Index to rally and find buyers in the dips. Index pulled back in wave (b) as per preferred Elliott wave view and we think it’s over at 6665. Near-term focus is on 6780 – 6807 […]

-

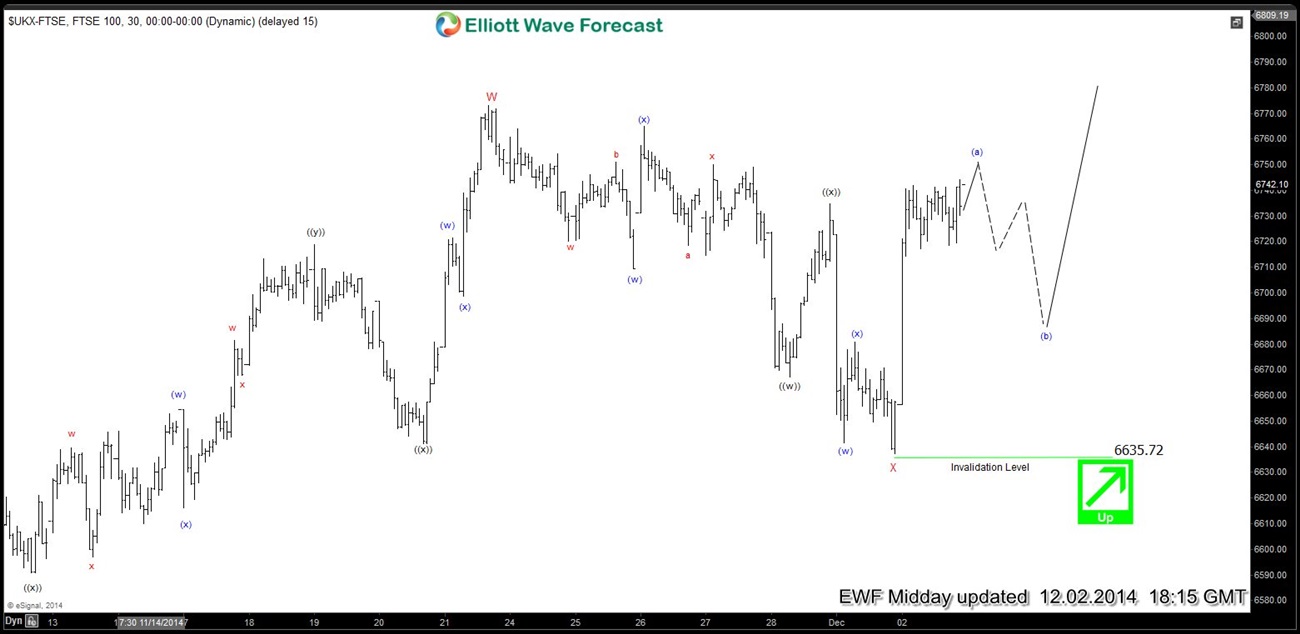

$FTSE Short-term Elliott Wave Analysis 12.2.2014

Read MoreIn yesterday’s post we said FTSE dip was corrective and should find buyers soon for the next leg higher. Index rallied as expected and we think wave X low is in place at 6636. Rally from 6636 low is taking the form of an Elliott wave impulse which we have labelled as wave (a). Once […]

-

FTSE Short-term Elliott Wave Analysis 12.1.2014

Read MoreIndex has been trending higher since forming a secondary low at 6448 i.e. wave (X). It has tested 0.618 – 0.764 ext area of (W)-(X) and has completed wave W of ( Y) at 6773. Wave “X” pull back is in progress as a 7 swing Elliott wave structure. Levels of interest on the downside are […]