The Power of 3-7-11 and the Grand Super Cycle: How We Saw the Bullish Turn in April 2025 Back on April 9, 2025, while World Indices were dropping sharply and global sentiment had turned overwhelmingly bearish, we published an article that challenged the fear-driven narrative. We explained why selling was not the right approach and […]

-

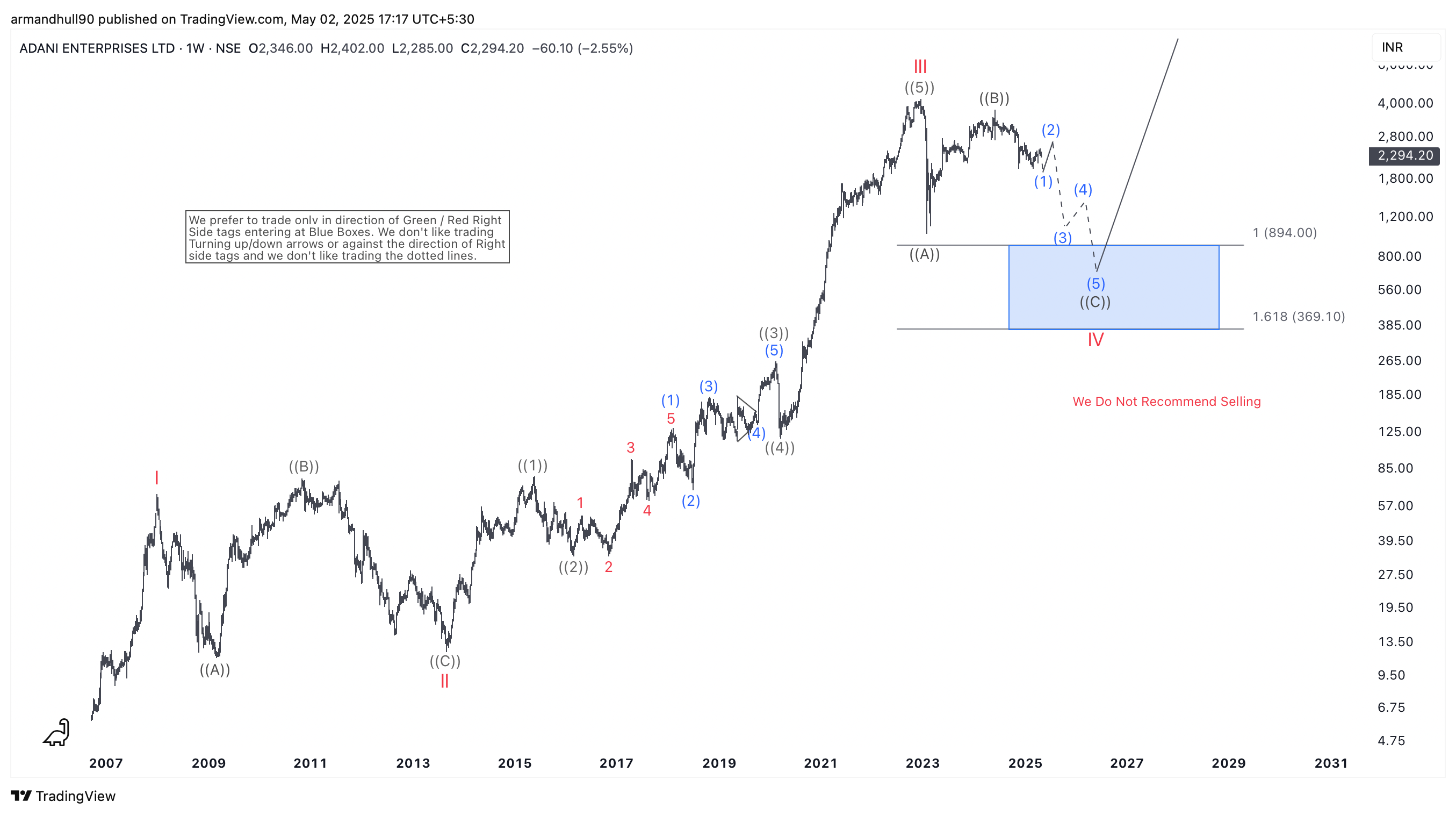

Adani Enterprises Elliott Wave Forecast: Wave IV Correction Undergoing

Read MoreAdani Enterprises Elliott Wave Analysis: Wave IV Pullback Could Offer a Major Buying Opportunity Adani Enterprises is undergoing a deep correction. Our Elliott Wave analysis suggests this is part of a higher-degree Wave IV pullback. The stock saw a strong rally in Wave III, which peaked in 2022. Since then, the price has been correcting […]

-

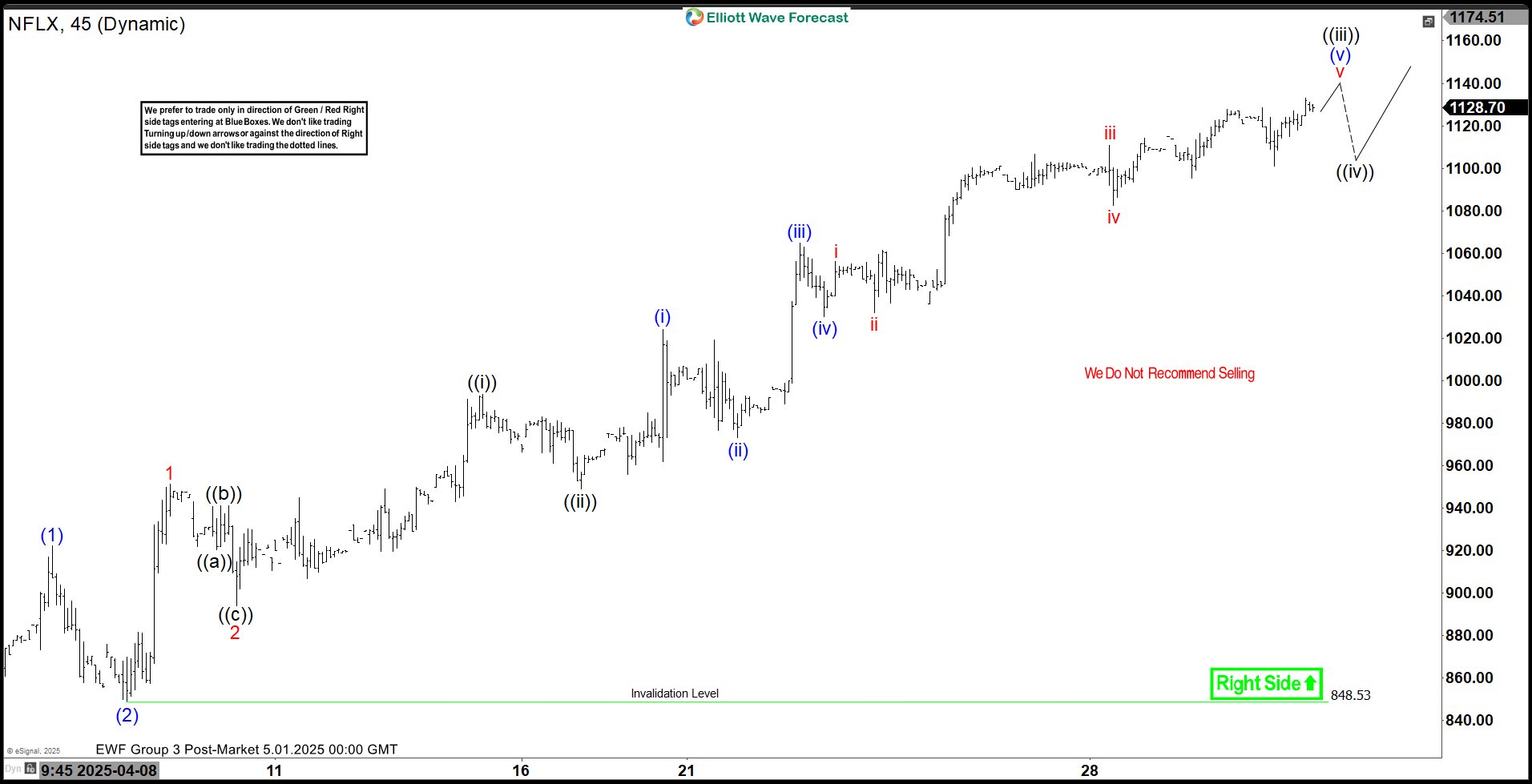

Elliott Wave Forecast: Netflix (NFLX) Hits New Highs Post-Tariff War

Read MoreNetflix (NFLX) has managed to hit new all-time high after the tariff war announcement. This article and video look at the Elliott Wave path.

-

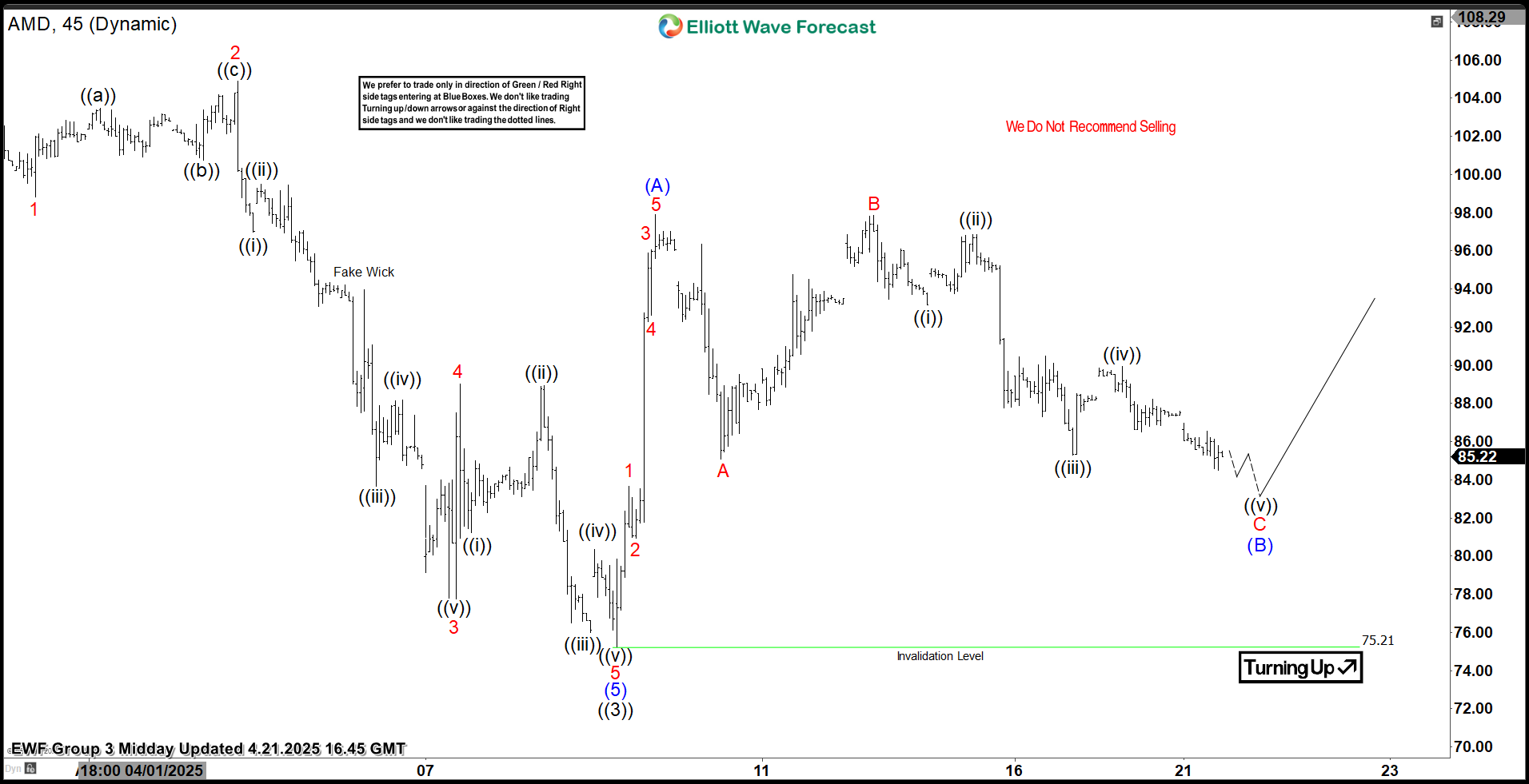

AMD Elliott Wave Calling the Rally after ABC Pull Back

Read MoreHello fellow traders. In this technical article we’re going to look at the Elliott Wave charts of AMD Stock published in members area of the website. As our followers know, the stock is trading within the cycle from the 75.21 low. Recently, we forecasted the end of the short-term pull back (B) in blue and called […]

-

Dow Futures (YM_F) Elliott Wave Calling the Rally After 3 Waves Pull Back

Read MoreHello fellow traders. In this technical article we’re going to look at the Elliott Wave charts of Dow Futures (YM_F) published in members area of the website. As our members know, YM_F is trading within the cycle from the 36635 low. Recently, we forecasted the end of the short-term pull back and called for a further […]

-

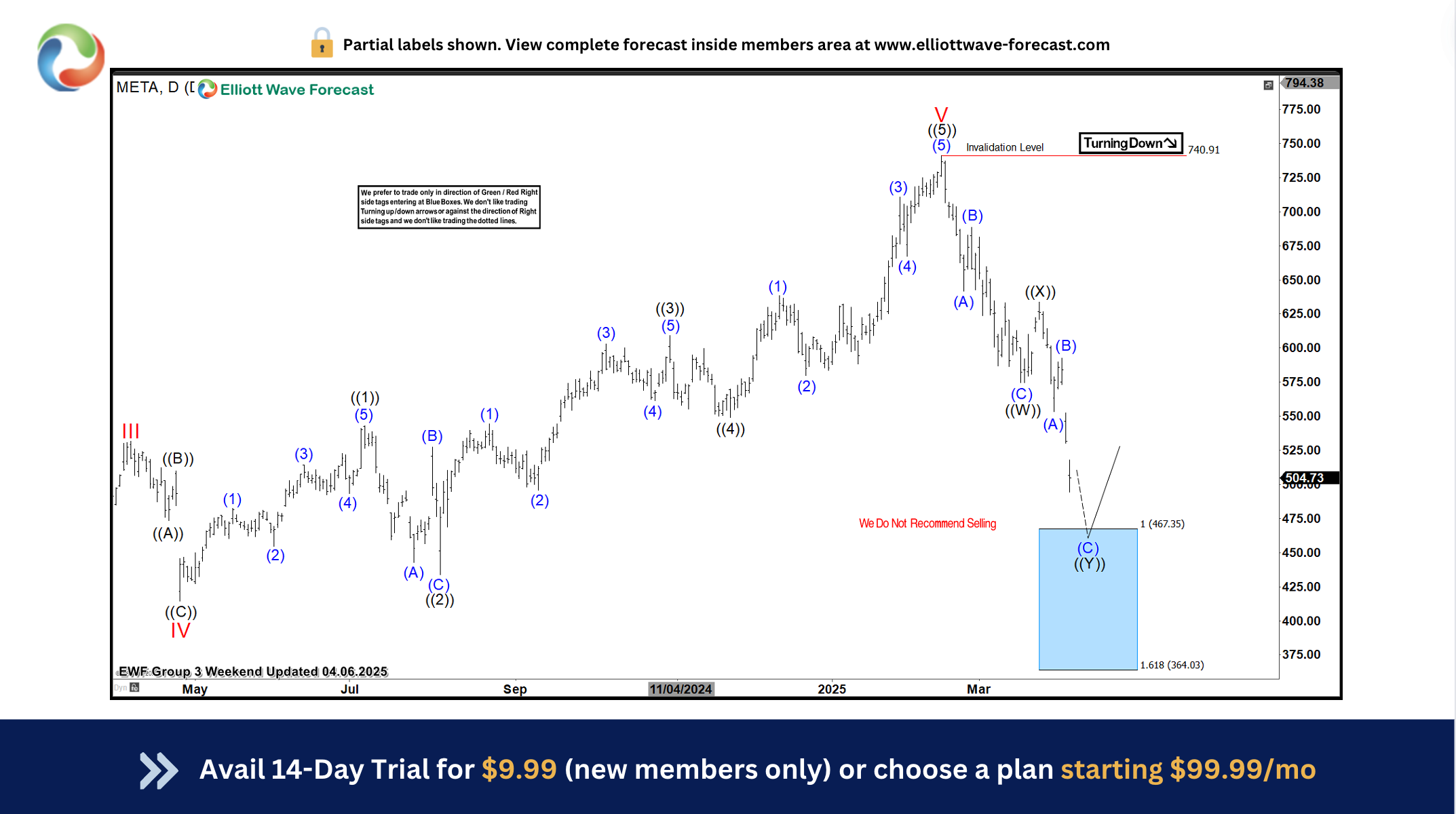

The Blue Box Area Blog: Meta Elliott Wave Reactions

Read MoreIn this blog, we have looked at the META ( Facebook ) managed to reach the blue box area & provided very good reaction higher.

-

Royal Caribbean Cruises (RCL) Eyes Bullish Breakout Above $300

Read MoreRoyal Caribbean Cruises Ltd (NYSE: RCL), a top global cruise company, has overcome challenges and is poised for more growth. Since the 2020 crash, the stock has achieved remarkable growth, surging over +1000% and reaching new all-time highs. This impressive rally underscores its bullish momentum and resilience in overcoming past challenges. This article explores Elliott Wave […]