The Power of 3-7-11 and the Grand Super Cycle: How We Saw the Bullish Turn in April 2025 Back on April 9, 2025, while World Indices were dropping sharply and global sentiment had turned overwhelmingly bearish, we published an article that challenged the fear-driven narrative. We explained why selling was not the right approach and […]

-

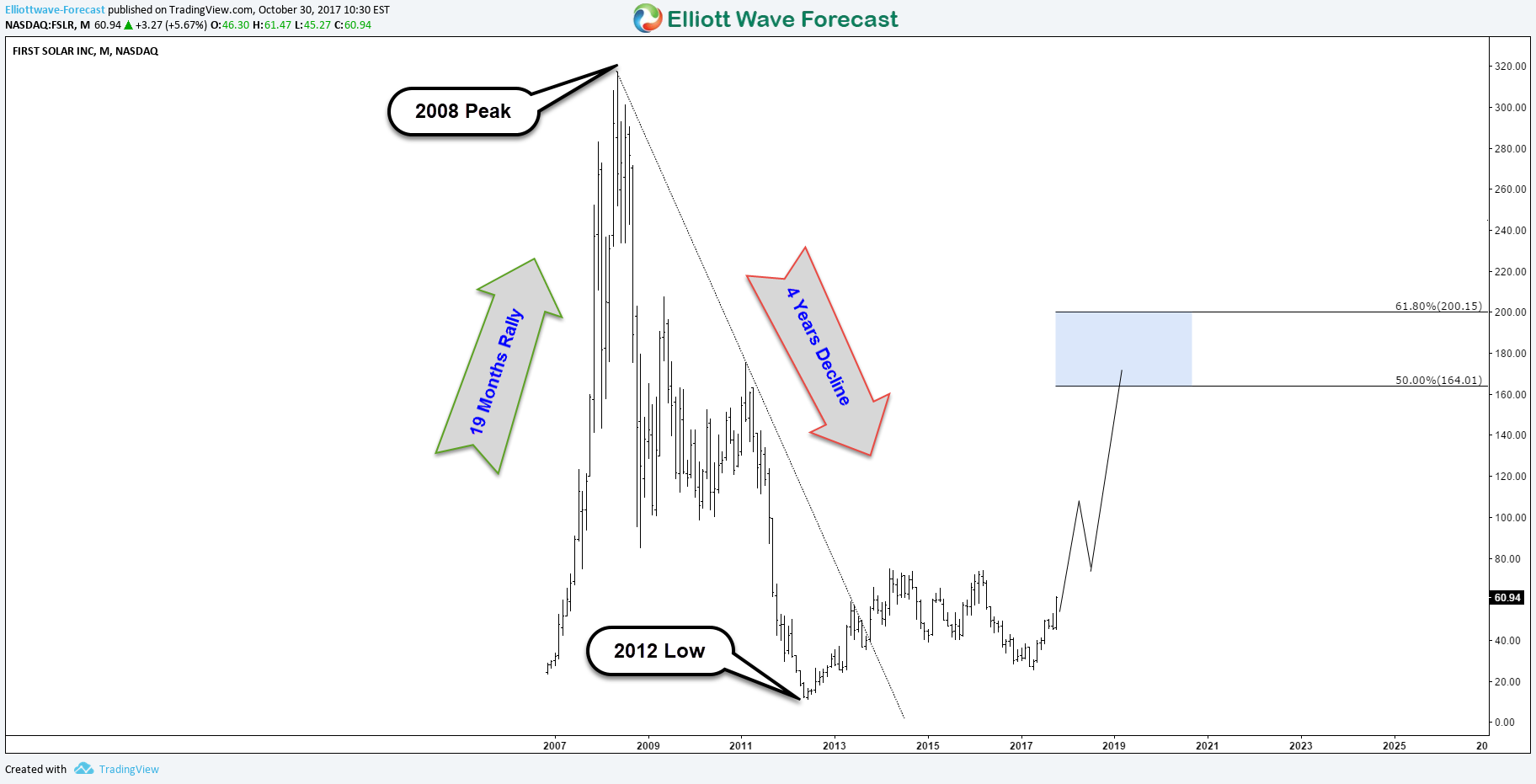

First Solar FSLR Recovery in Progress

Read MoreFirst Solar (NASDAQ: FSLR) designs and manufactures solar modules using a proprietary thin film semiconductor technology. The company has developed, financed, engineered, constructed and currently operates many of the world’s largest grid-connected PV power plants. First Solar relies almost entirely on utility-scale projects which accounts for over half of the U.S. solar market and can be affected by the […]

-

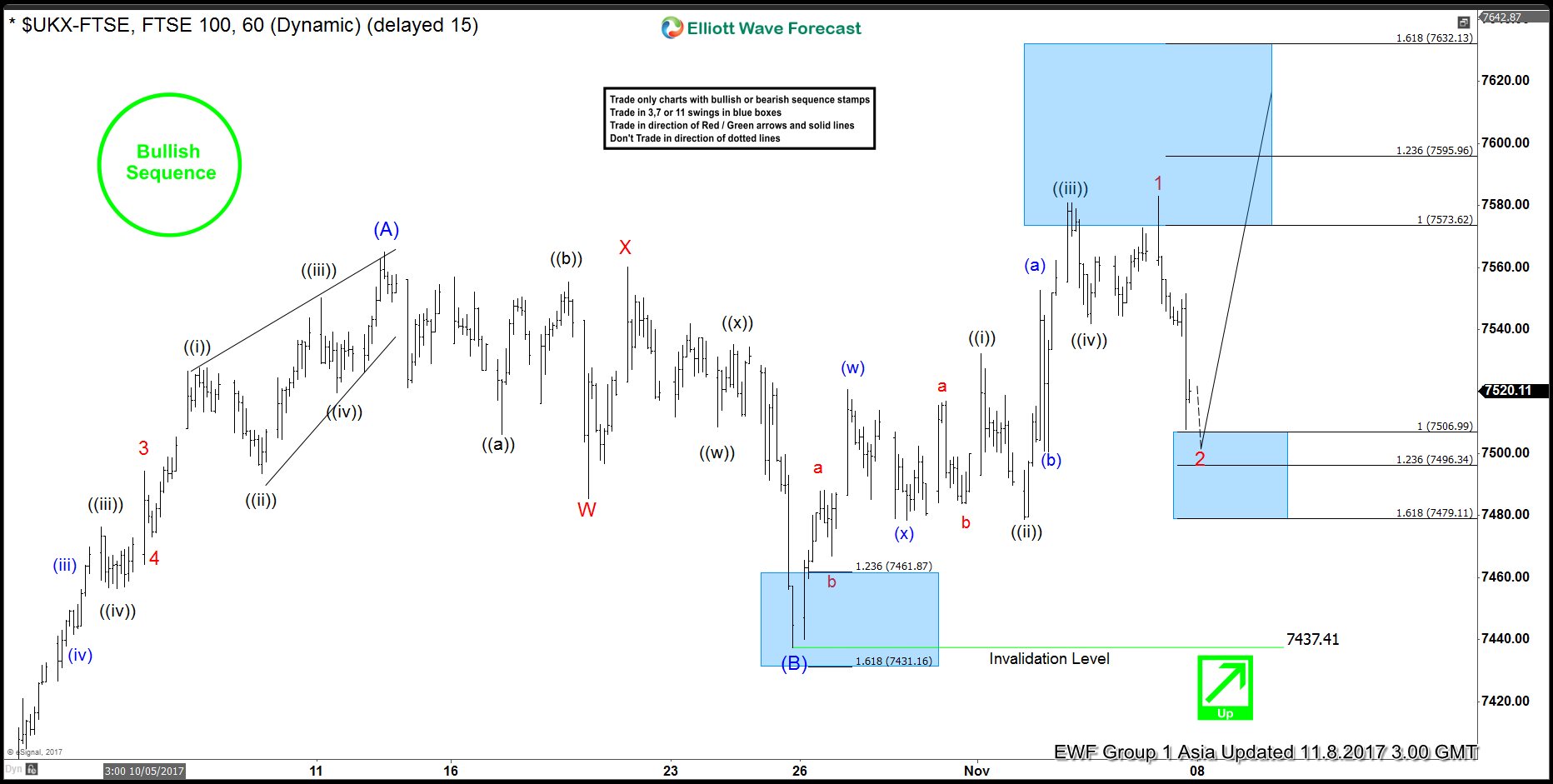

FTSE Short-Term Elliott Wave Analysis 11.8.2017

Read MoreShort term FTSE Elliott Wave view suggests that decline to 7199.5 ended Primary wave ((4)). Up from there, the rally is unfolding as a zigzag Elliott Wave structure where Intermediate wave (A) ended at 7565.11 and pullback to 7437.42 ended Intermediate wave (B). Internal of Intermediate wave (A) unfolded as an impulse Elliott Wave structure where Minor […]

-

FTSE Forecasting The Path using Elliott Wave

Read MoreHello fellow traders. In this technical blog we’re going to take a quick look at the past Elliott Wave charts of FTSE published in members area of www.elliottwave-forecast.com. In further text we’re going to count the swings, explain the Elliott Wave view. As our members know, we were explaining that FTSE is having incomplete bullish swings […]

-

FTSE Short-Term Elliott Wave Analysis

Read MoreShort term FTSE Elliott Wave view suggests that Primary wave ((4)) ended with the decline to 7199.5. The rally up from there is unfolding as a zigzag Elliott Wave structure where Intermediate wave (A) ended at 7565.11 and Intermediate wave (B) ended at 7437.42. Intermediate wave (A) is subdivided as an impulse Elliott Wave structure where Minor […]

-

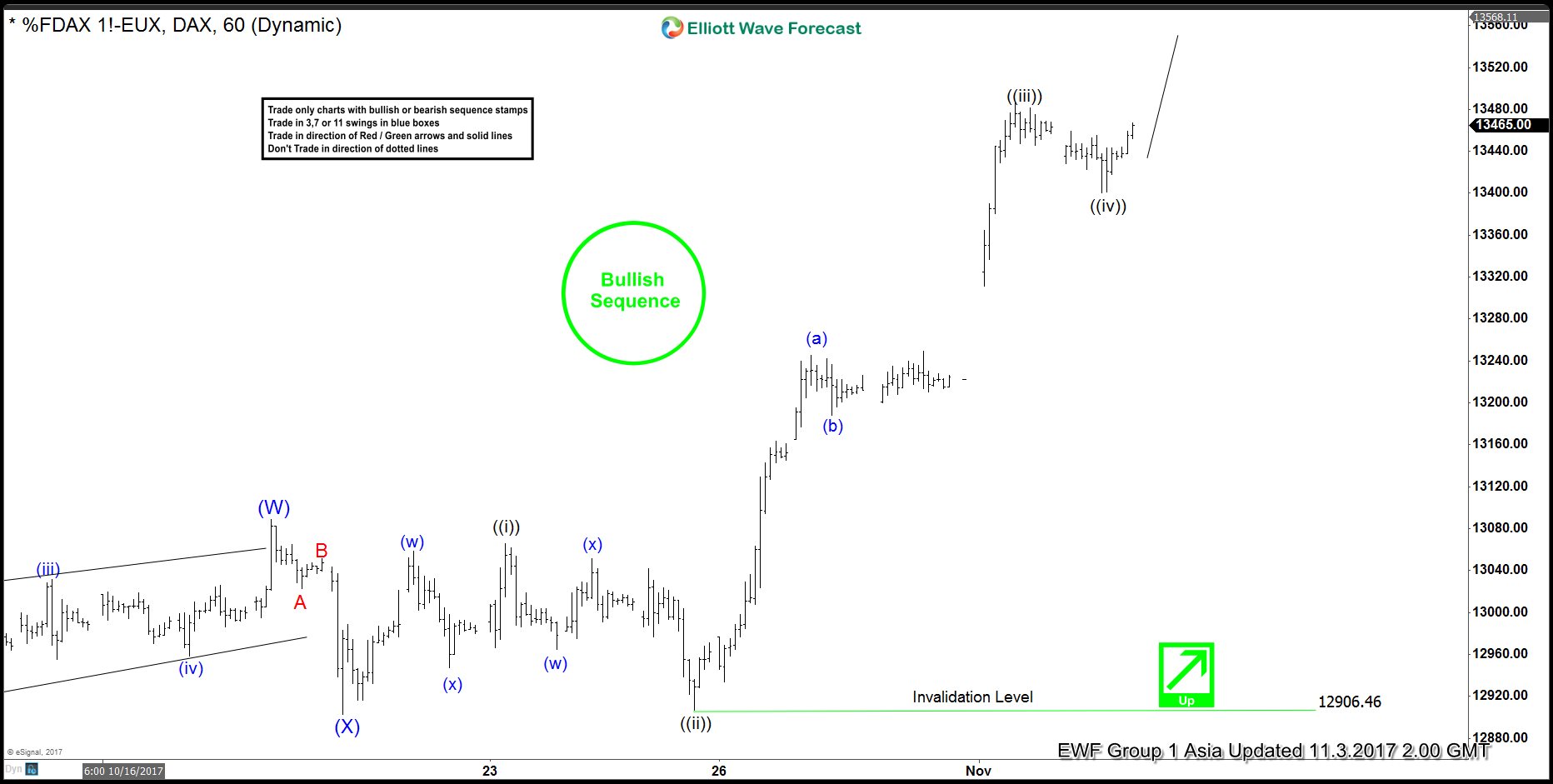

DAX Short-Term Elliott Wave Analysis 11.3.2017

Read MoreDAX rally from 8/29 low is unfolding as a double three Elliott Wave structure where Intermediate wave (W) ended at 13089 and Intermediate wave (X) ended at 12903. Up from there, the rally from 12903 low appears to be unfolding as an impulse. Minute wave ((i)) ended at 13066, and Minute wave ((ii)) ended at 12906.5. […]

-

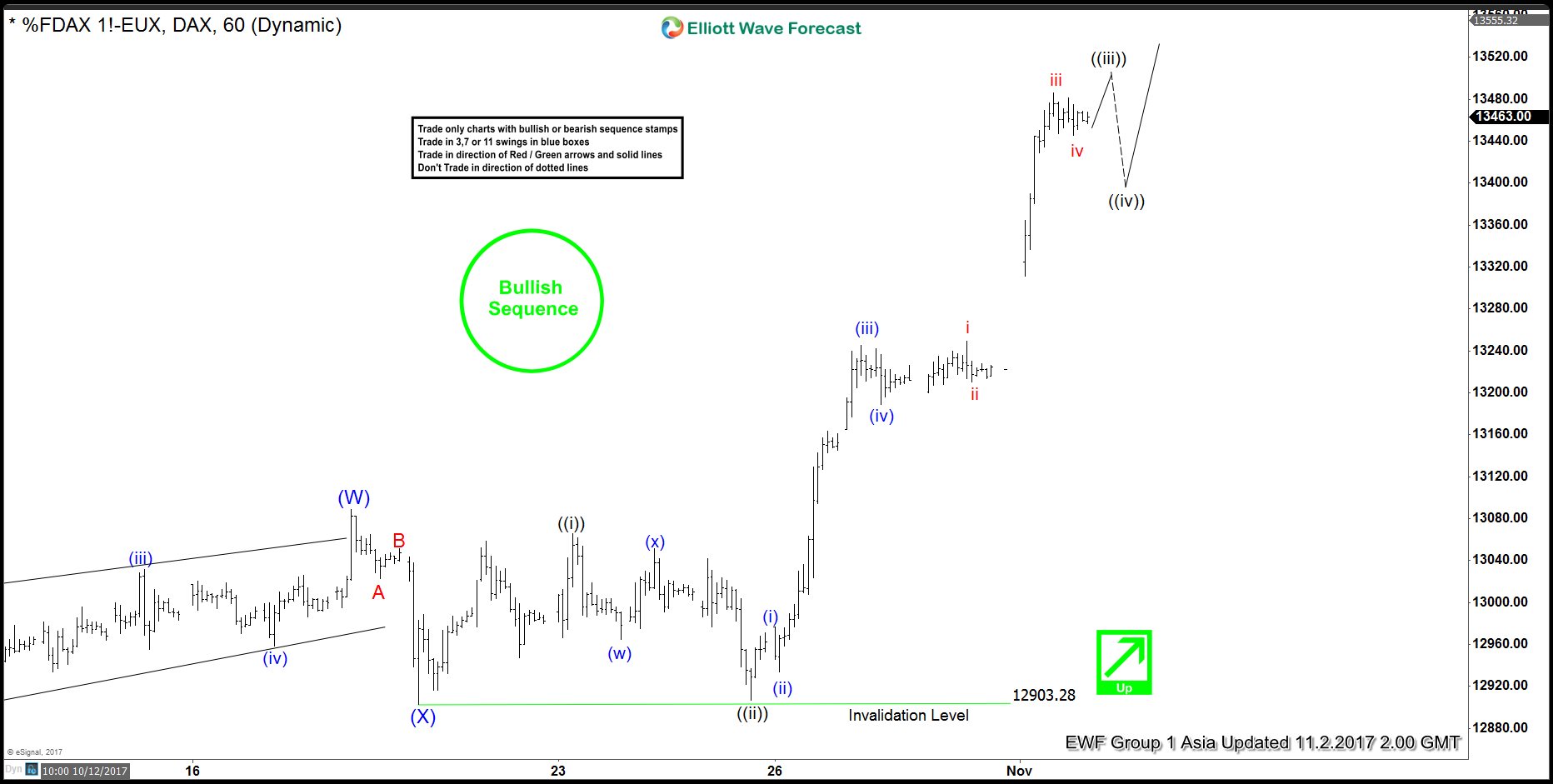

DAX Intra-Day Elliott Wave Analysis

Read MoreThe rally in DAX from 8/29 low is unfolding as a double three Elliott Wave structure where Intermediate wave (W) ended at 13089 and pullback to 12903 ended Intermediate wave (X). Up from there, the rally from 12903 low looks to be unfolding as an impulse. Minute wave ((i)) ended at 13066 and pullback to 12906.5 ended Minute […]