The Power of 3-7-11 and the Grand Super Cycle: How We Saw the Bullish Turn in April 2025 Back on April 9, 2025, while World Indices were dropping sharply and global sentiment had turned overwhelmingly bearish, we published an article that challenged the fear-driven narrative. We explained why selling was not the right approach and […]

-

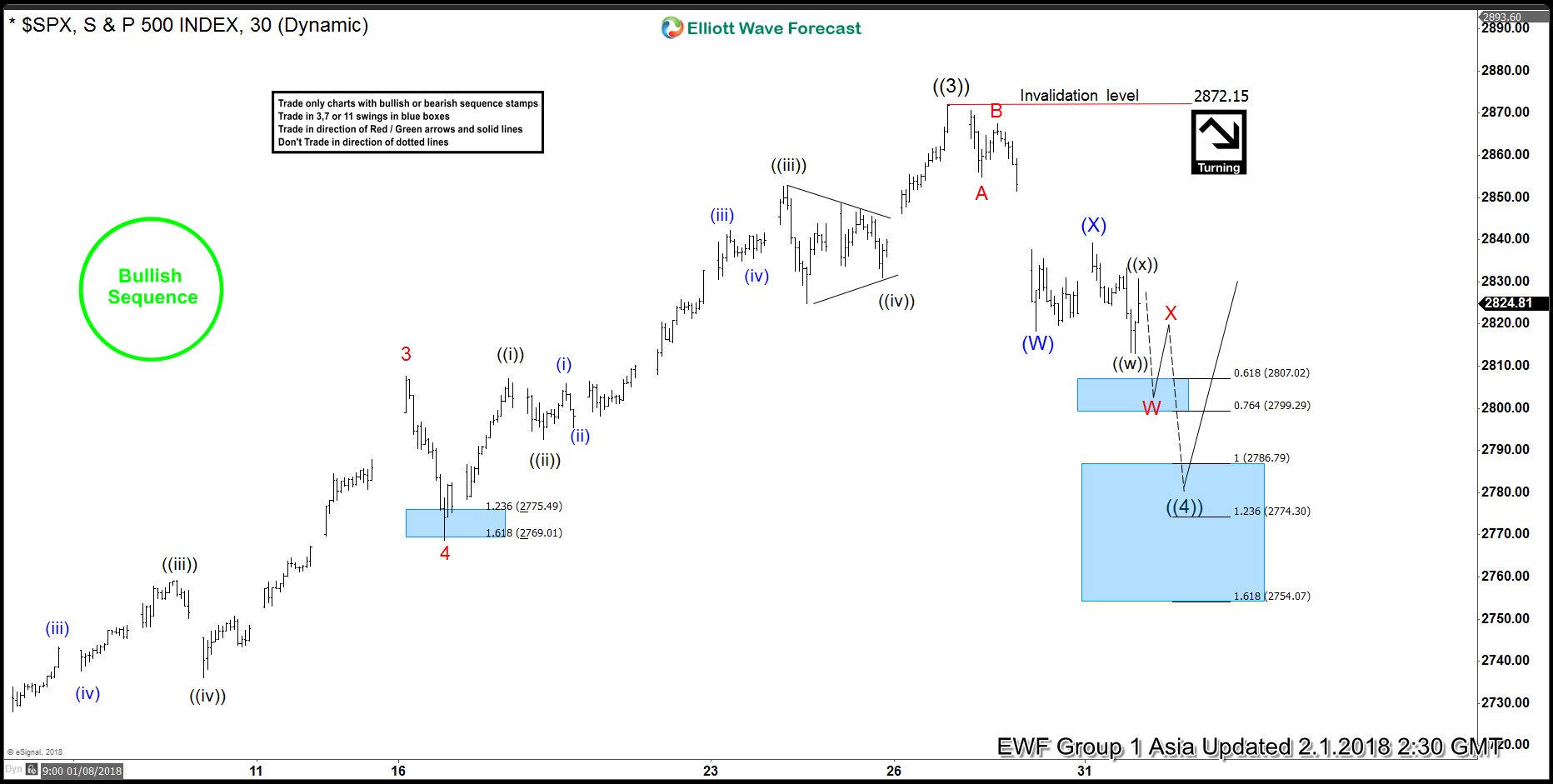

Elliott Wave Analysis: SPX Correction in Progress

Read MoreSPX Short Term Elliott Wave view suggests that the rally to 2872.15 ended Primary wave ((3)). Down from there, Primary wave ((4)) pullback is unfolding as a double three Elliott Wave structure where Intermediate wave (W) ended at 2818.27 and Intermediate wave (X) ended at 2839.26. Intermediate wave (Y) is in progress and while near term bounces stay […]

-

Elliott Wave Analysis: Dow Future in Correction

Read MoreDow Future Short Term Elliott Wave view suggests that the rally to 26690 ended Intermediate wave (3). Down from there, Intermediate wave (4) pullback is unfolding as a double three Elliott Wave structure where Minor wave W ended at 26121 and Minor wave X ended at 26314. Minor wave Y is in progress and while near term bounces […]

-

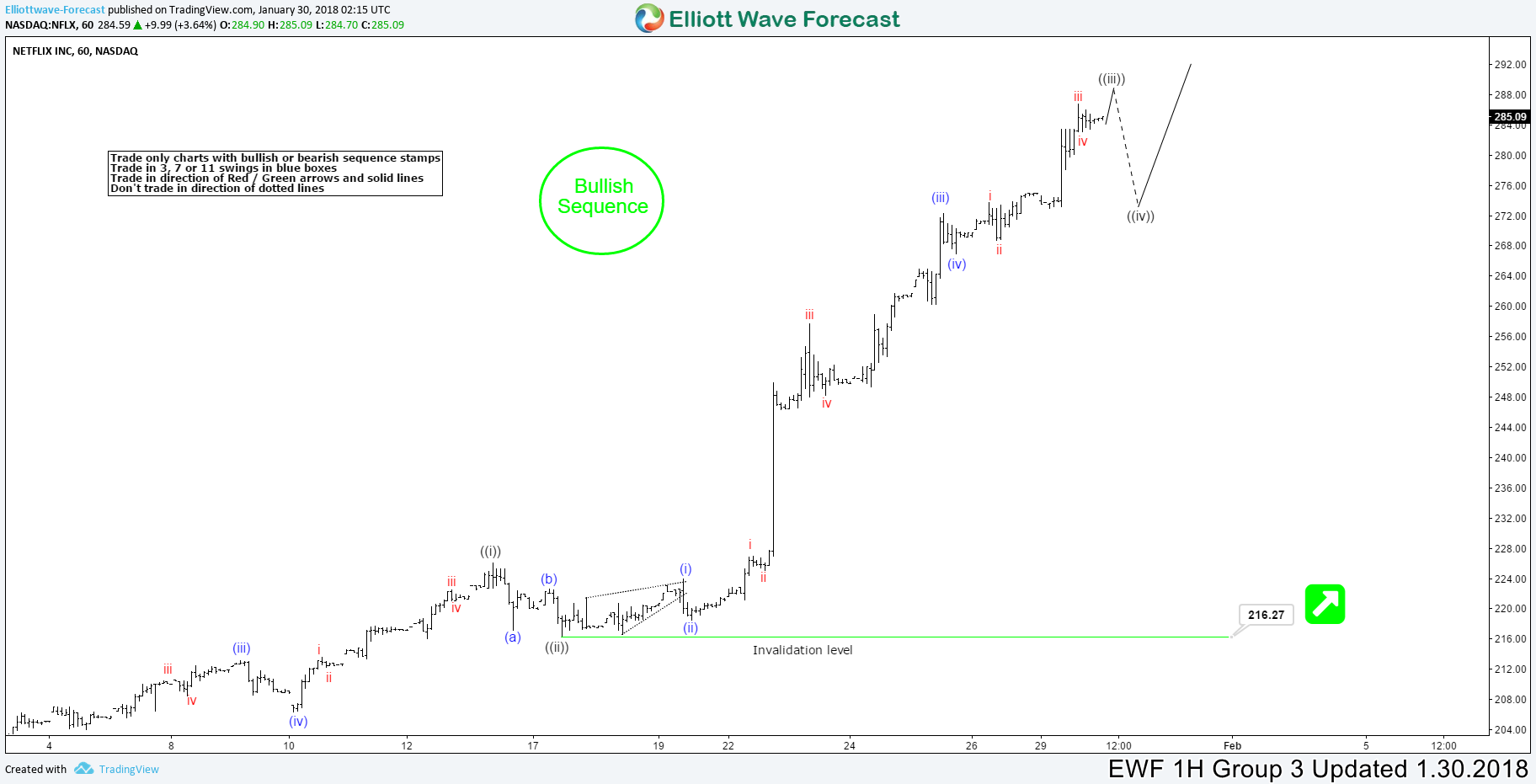

Netflix (NFLX) Extending higher as an Impulse

Read MoreNetflix stock symbol: (NFLX ) Short Term Elliott Wave view suggests that the cycle from December 06. 2017 low is extending higher as an Impulse sequence with extension in Minute wave ((iii)) higher. When each leg has an internal distribution of 5 waves thus favoring it to be an impulse. These 5 waves move higher should end either […]

-

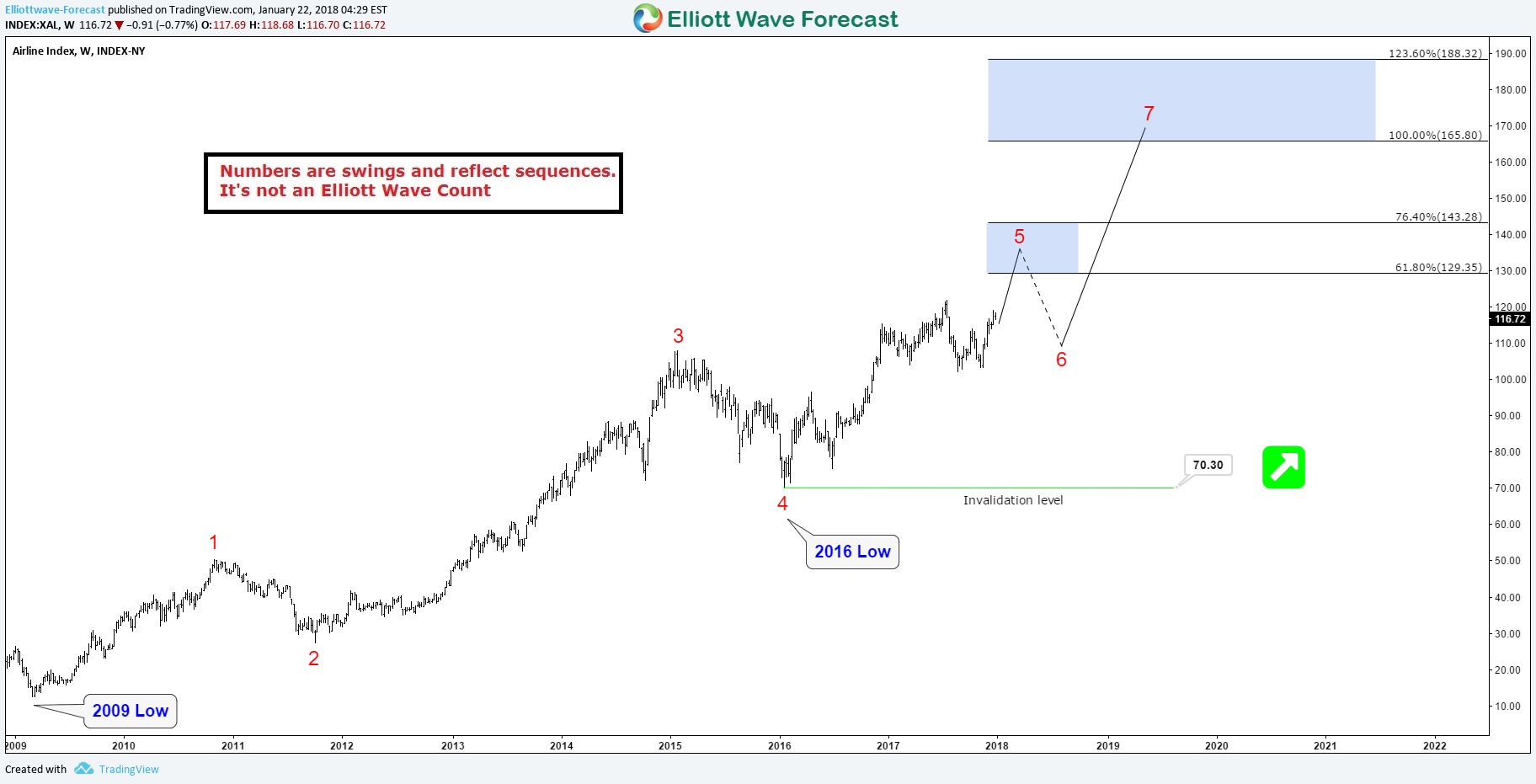

Prosperity Period for Airline Sector

Read MoreAir travel has become so commonplace that it would be hard to imagine life without it which made the airline industry is vital to our world. It contributes to global economy by connecting cities / countries and it enables the flow of goods / people. In the past, the airline industry was at least partly government […]

-

High Frequency Box Provided 12% Profit in Russell

Read MoreIn this blog post, I want to discuss with you one of our recent High-Frequency box in the Russell Index which provided us with 12% in profit. We have been calling the Russell Index higher from the daily chart for a very long time. We are still bullish American indices, therefore, we have no other […]

-

SPX Elliott Wave Analysis: More Upside Expected

Read MoreSPX Short Term Elliott Wave view suggests that Index is rallying as 5 waves impulse Elliott Wave structure from 12/2/2017 low. Up from 12/2/2017 low (2605.52), Minute wave ((i)) ended at 2665.19, Minute wave ((ii)) ended at 2624.75, Minute wave ((iii)) ended at 2807.54, and Minute wave ((iv)) ended at 2768.87. Index has since broken above Minute […]