The Power of 3-7-11 and the Grand Super Cycle: How We Saw the Bullish Turn in April 2025 Back on April 9, 2025, while World Indices were dropping sharply and global sentiment had turned overwhelmingly bearish, we published an article that challenged the fear-driven narrative. We explained why selling was not the right approach and […]

-

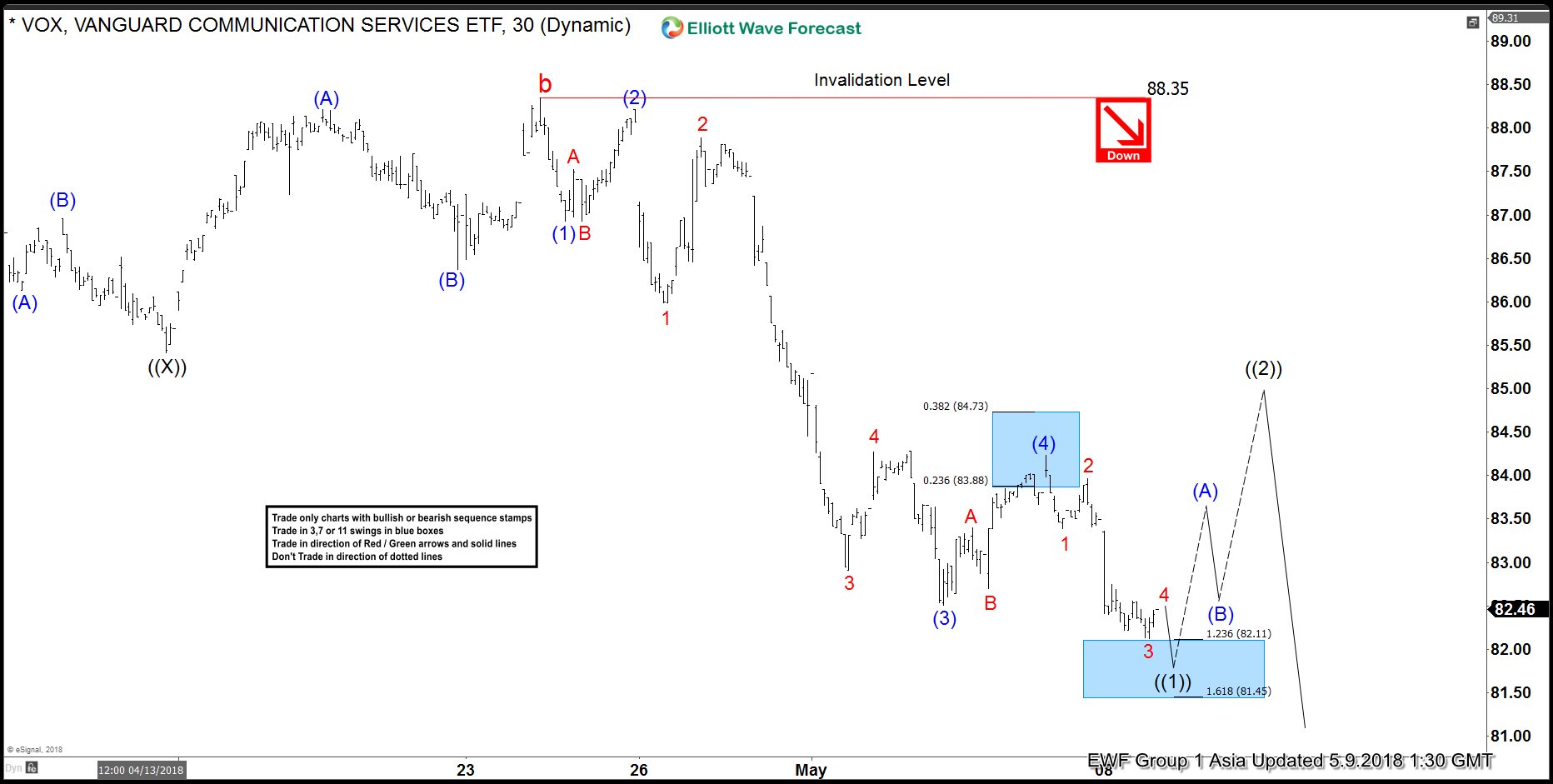

VOX Elliott Wave View: Calling For A Bounce Soon

Read MoreVanguard communication services ETF ticker symbol: VOX short-term Elliott Wave view suggests that the bounce to 88.35 on 4/24/2018 high ended cycle degree wave “b”. Below from there, the cycle degree wave “c” remain in progress as an Impulse Elliott Wave structure looking for more downside extensions. Down from 88.35 high, Primary wave ((1)) is in progress as […]

-

FTSE Showing Impulse Elliott Wave Structure

Read MoreFTSE short-term Elliott Wave view suggests that the decline to 3/26/2018 low 6866.94 ended the cycle degree wave “b”. Above from there, the index is rallying higher in a strong Impulse Elliott Wave structure with extension in the 3rd wave. It’s important to note that an impulse structure should have internal subdivision of lesser degree 5 […]

-

Industrial Select Sector XLI Corrective Structure Still calling Lower

Read MoreThe Industrial Select Sector SPDR Fund XLI tracks a market-cap-weighted index of industrial-sector stocks drawn from the S&P 500. Industries in the Index include aerospace and defense, building products, construction and engineering, electrical equipment, commercial services and supplies, airlines, marine, etc. It provides investors with broad US industrial exposure that’s cheap to hold and extremely […]

-

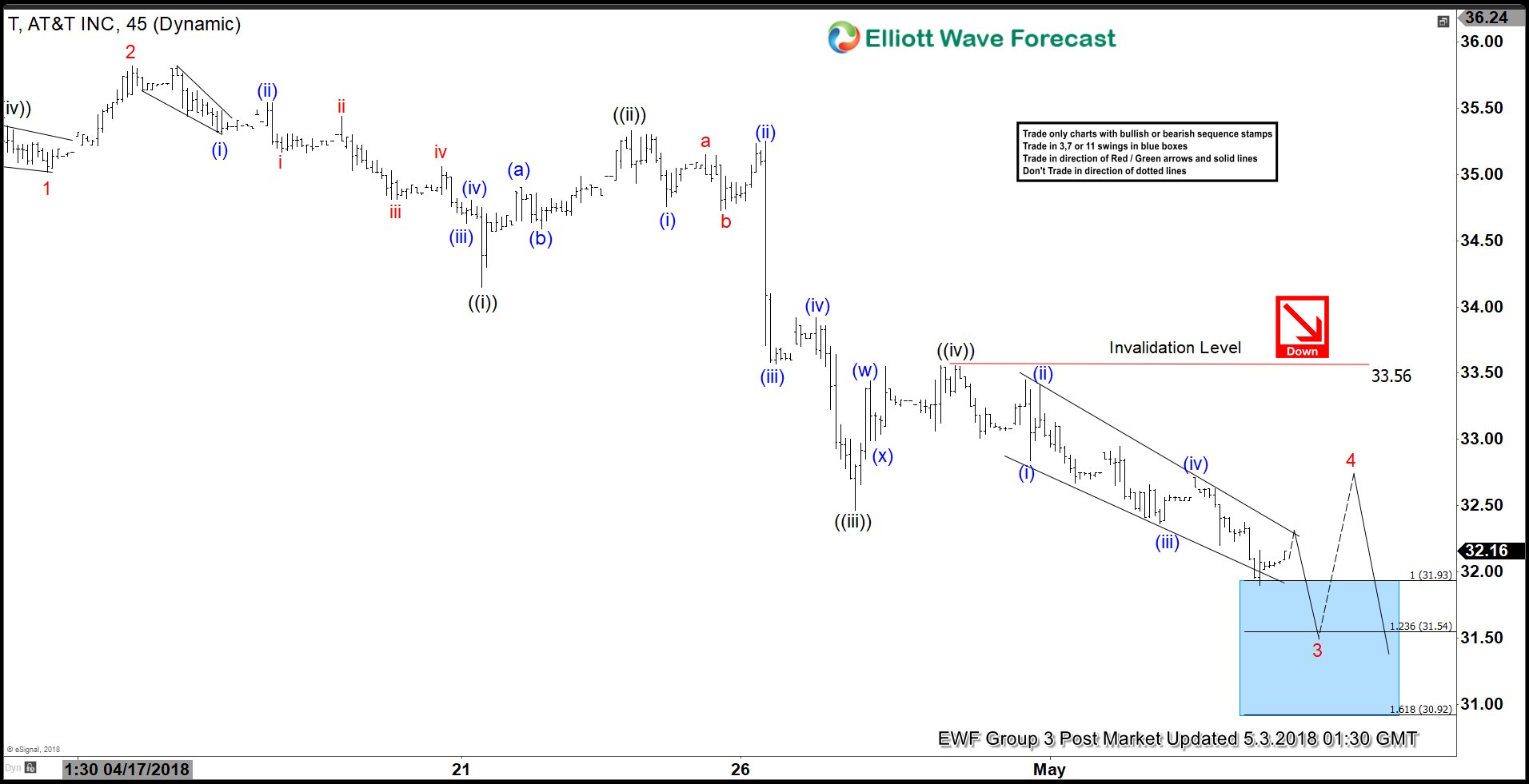

AT&T Elliott Wave View: Calling For 3 Wave Bounce

Read MoreAT&T ticker symbol $T short-term Elliott Wave view suggests that the decline from 4/10 peak is unfolding as an Impulse Elliott Wave structure. In the impulsive structure, wave 1, 3, and 5 should show 5 waves internal subdivision. Down from 4/10 peak ($36.39), Minor wave 1 ended in 5 waves structure at 35.02 low. Minor wave […]

-

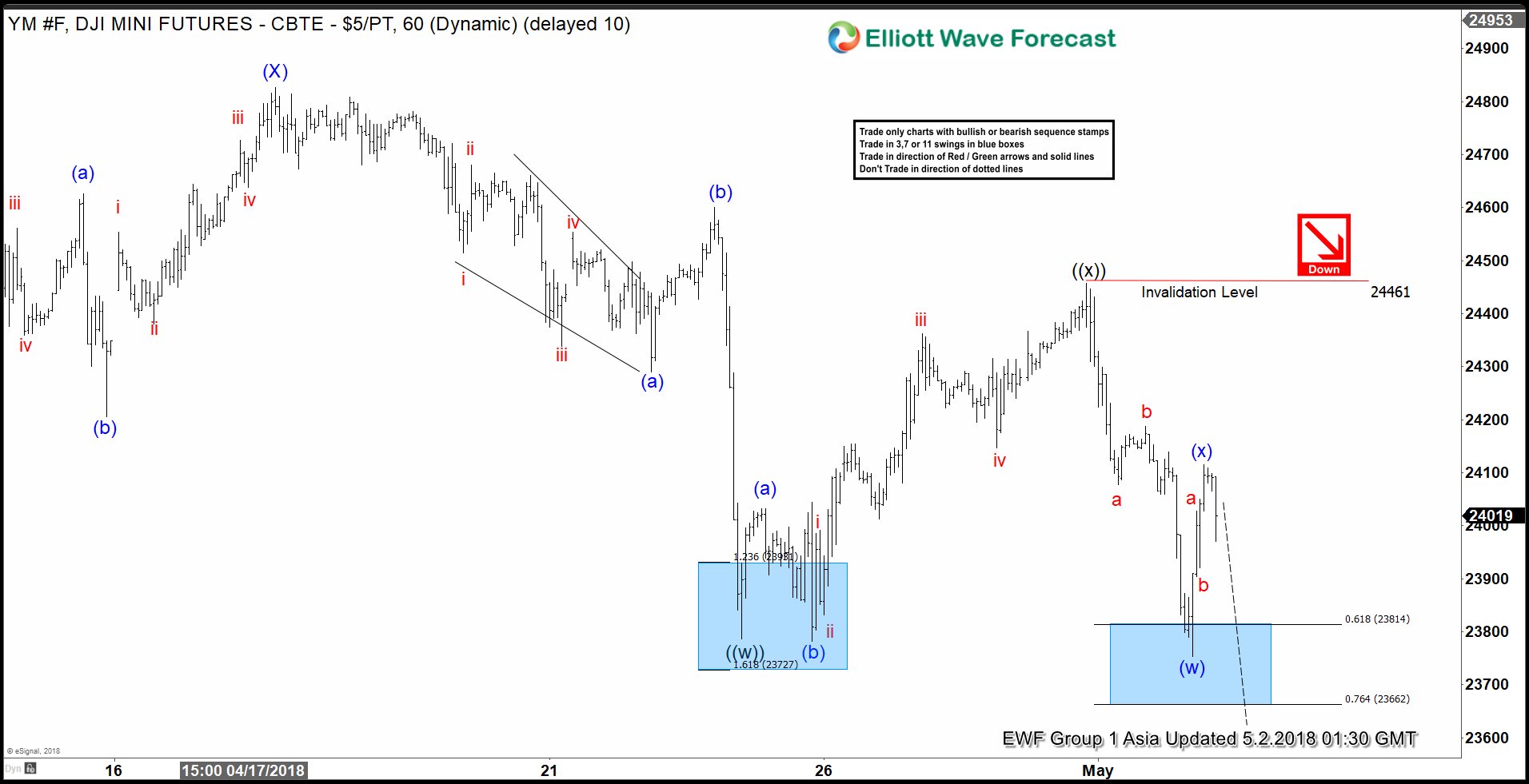

Dow Jones Elliott Wave View: Calling Lower

Read MoreDow Jones Elliott Wave view in short-term cycles suggests that the rally to 24827 on 4/17/2018 high ended Intermediate wave (X). Below from there, Intermediate wave (Y) remains in progress as overlapping structure suggesting that the move lower is corrective in nature. The move lower from 24827 peak is proposed to be unfolding as an Elliott […]

-

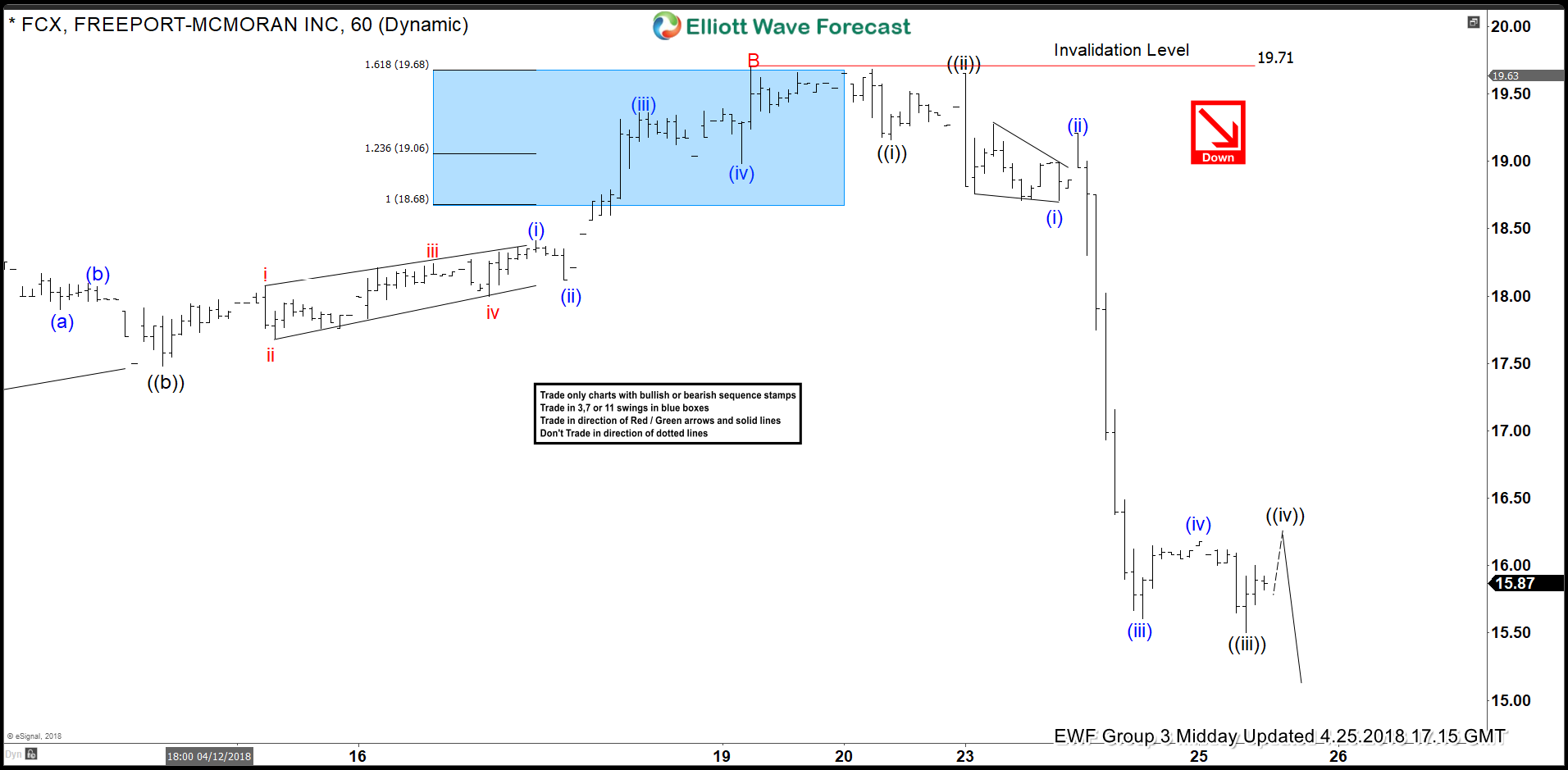

FCX Elliott Wave View: Extending Lower As Impulse

Read MoreFCX Elliott Wave view in short-term cycles suggest that the cycle from January 25th, 2018 peak is unfolding as Elliott wave flat correction. When Minor wave A ended in 3 swings at 16.51 and bounce to 19.71 April 19 high ended Minor wave B. Below from there, the stock reacted lower strongly and made new lows […]