The Power of 3-7-11 and the Grand Super Cycle: How We Saw the Bullish Turn in April 2025 Back on April 9, 2025, while World Indices were dropping sharply and global sentiment had turned overwhelmingly bearish, we published an article that challenged the fear-driven narrative. We explained why selling was not the right approach and […]

-

Goldman Sachs (NYSE: GS) – Bullish Trend is Still Intact

Read MoreSince the 2008 Financial Crisis, Goldman Sachs (NYSE: GS) established a new multi-year bullish trend which managed to break above 2007 peak after just 10 years joining the list of many other stocks which already achieved new all time highs in the previous years. GS has been moving within a bullish channel making higher highs […]

-

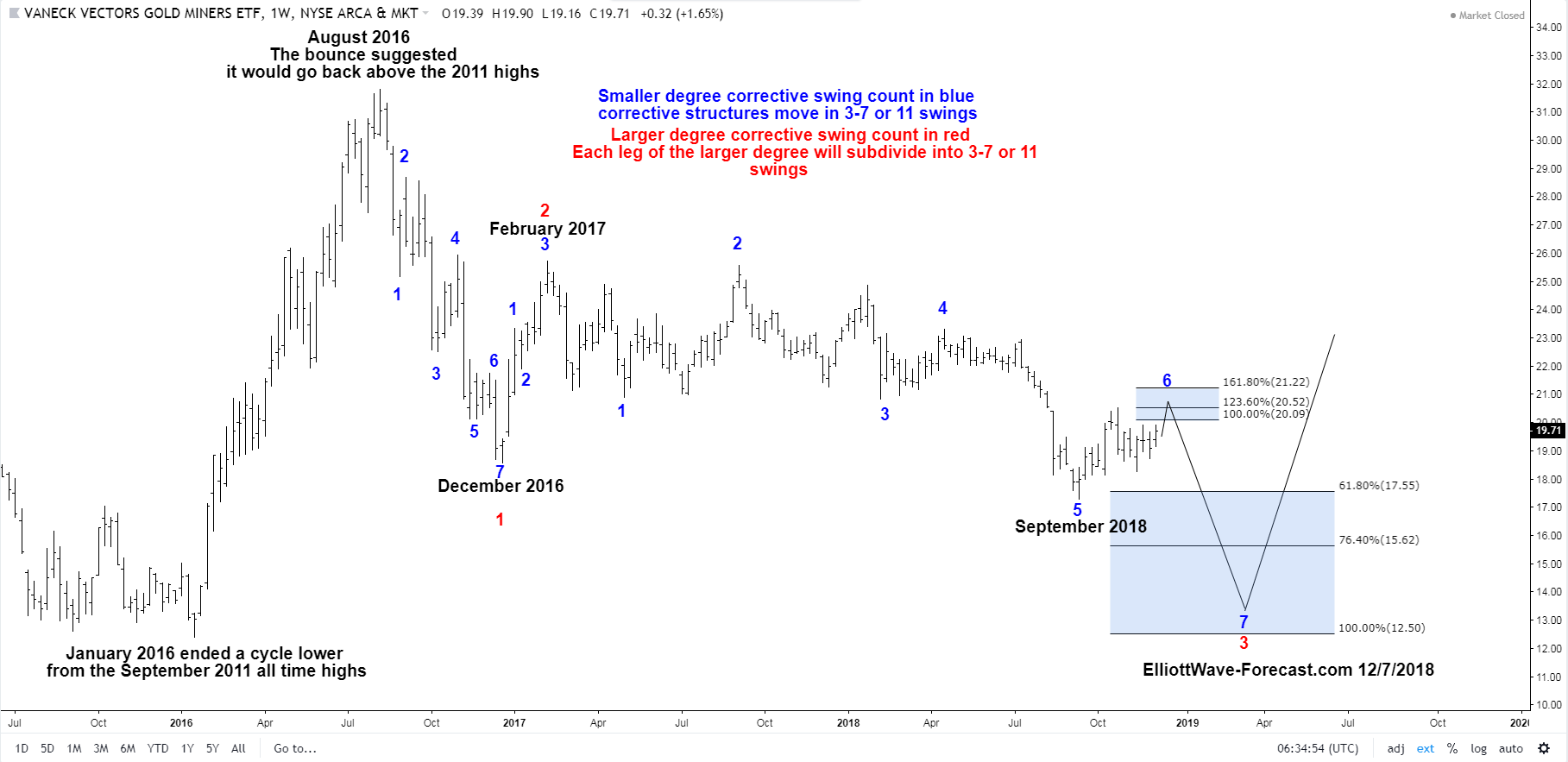

GDX Cycles from the January 2016 Lows

Read MoreGDX Cycles from the January 2016 Lows Firstly, the GDX ETF was created in 2006. From there it bounced higher into the September 2011 highs. This not shown on the chart however the price trend was obviously up. The pullback lower into the January 2016 lows corrected the cycle from the all time highs. The […]

-

An Industrial to Trade: Is BA a BUY Here?

Read MoreBA and the Trade Tensions Between China and Elliott wave As we all are well aware there are definitely heightened tensions on the global trading playing field these days. The markets have been whipping back in forth in exacerbated moves. Every hint or tweet about anything to do with trade, specifically, trade and China causes […]

-

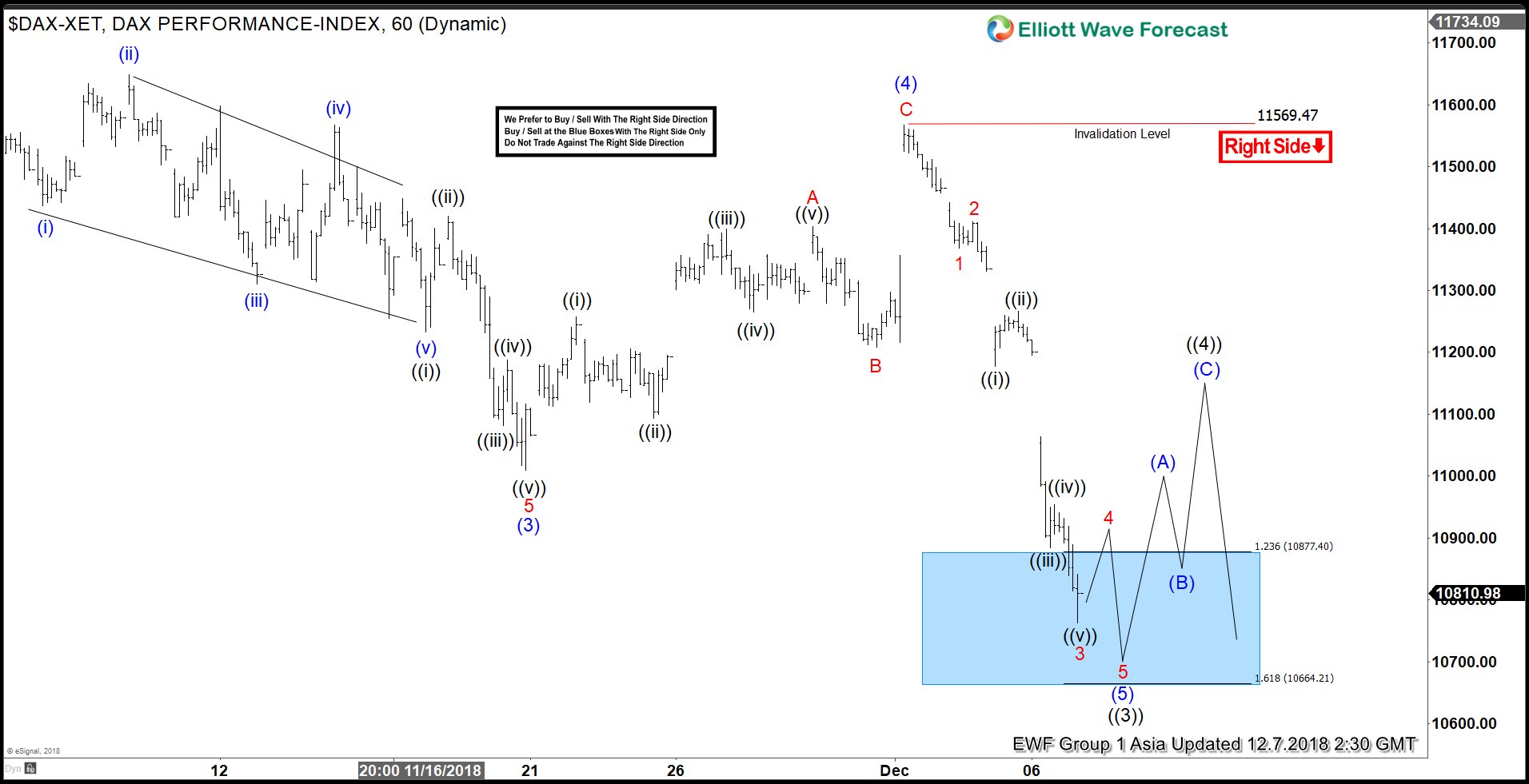

Elliott Wave View: DAX Looking for Further Downside

Read MoreDAX continues to make a new low and this week broke below 11/20 low (11009) suggesting that the move lower remains in progress. Near term Elliott Wave outlook calls for the decline to 11009.25 on 11/20 as Intermediate wave (3). From there, rally to 11566.97 ended Intermediate wave (4) as a zigzag Elliott Wave structure. […]

-

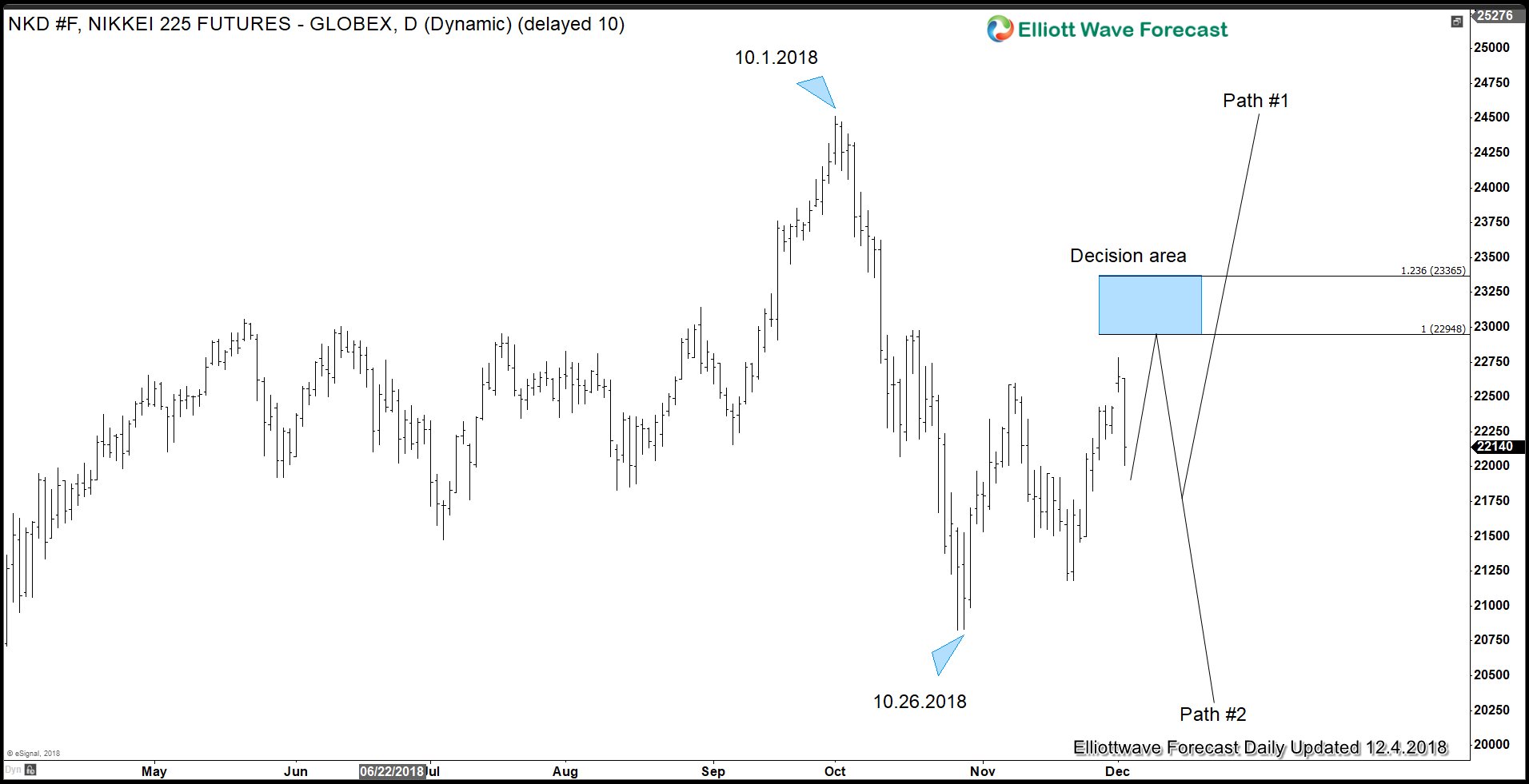

G20 Meeting Produces Trade War Truce between US and China – Will it last?

Read MoreDuring the dinner meeting at G20 summit in Buenos Aires last weekend, the U.S. and China agreed to suspend new tariffs for 90 days. The market reacts positively with stock market rallying around the world, creating a risk on environment for potential Santa Claus rally in December. However, has a real significant breakthrough made during […]

-

BABA Forecasting The Rally & Buying The Dips

Read MoreHello fellow traders. Another instrument that we have been trading lately is BABA Stock from Group 3. In this technical blog we’re going to take a quick look at the Elliott Wave charts of BABA, published in members area of the website. As our members know, BABA has been correcting larger cycle from the 59.5 […]