The Power of 3-7-11 and the Grand Super Cycle: How We Saw the Bullish Turn in April 2025 Back on April 9, 2025, while World Indices were dropping sharply and global sentiment had turned overwhelmingly bearish, we published an article that challenged the fear-driven narrative. We explained why selling was not the right approach and […]

-

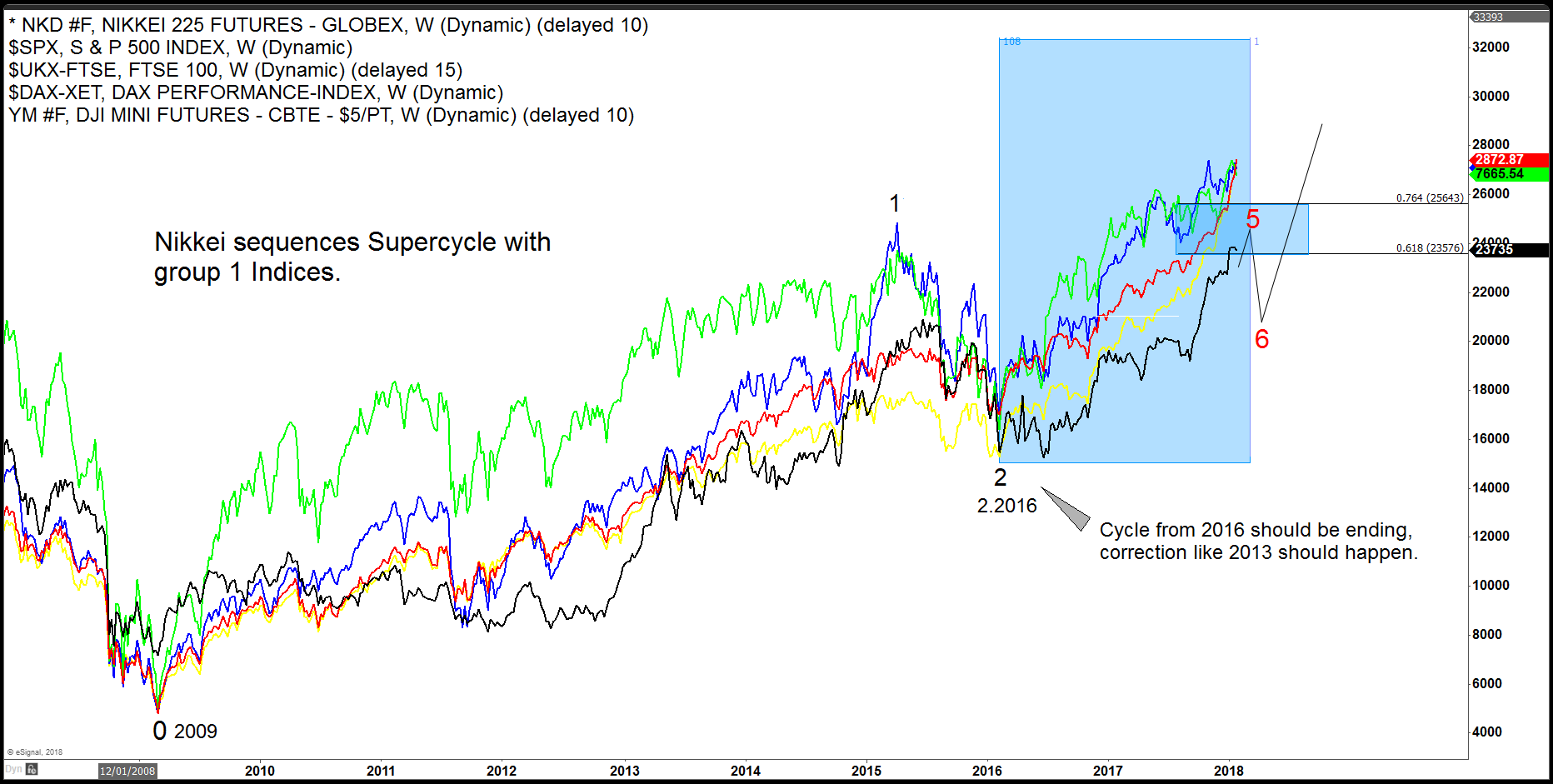

World Indices: When to Start Buying Them Again

Read MoreThe World Indices have shown a sideways to lower year in 2018. The last Quarter alone World Indices lost their gains, for example, the SPX or the Dow Jones. Other World indices peaked earlier than others this year and some of them did not produce new highs again. There is a lot of speculation going around […]

-

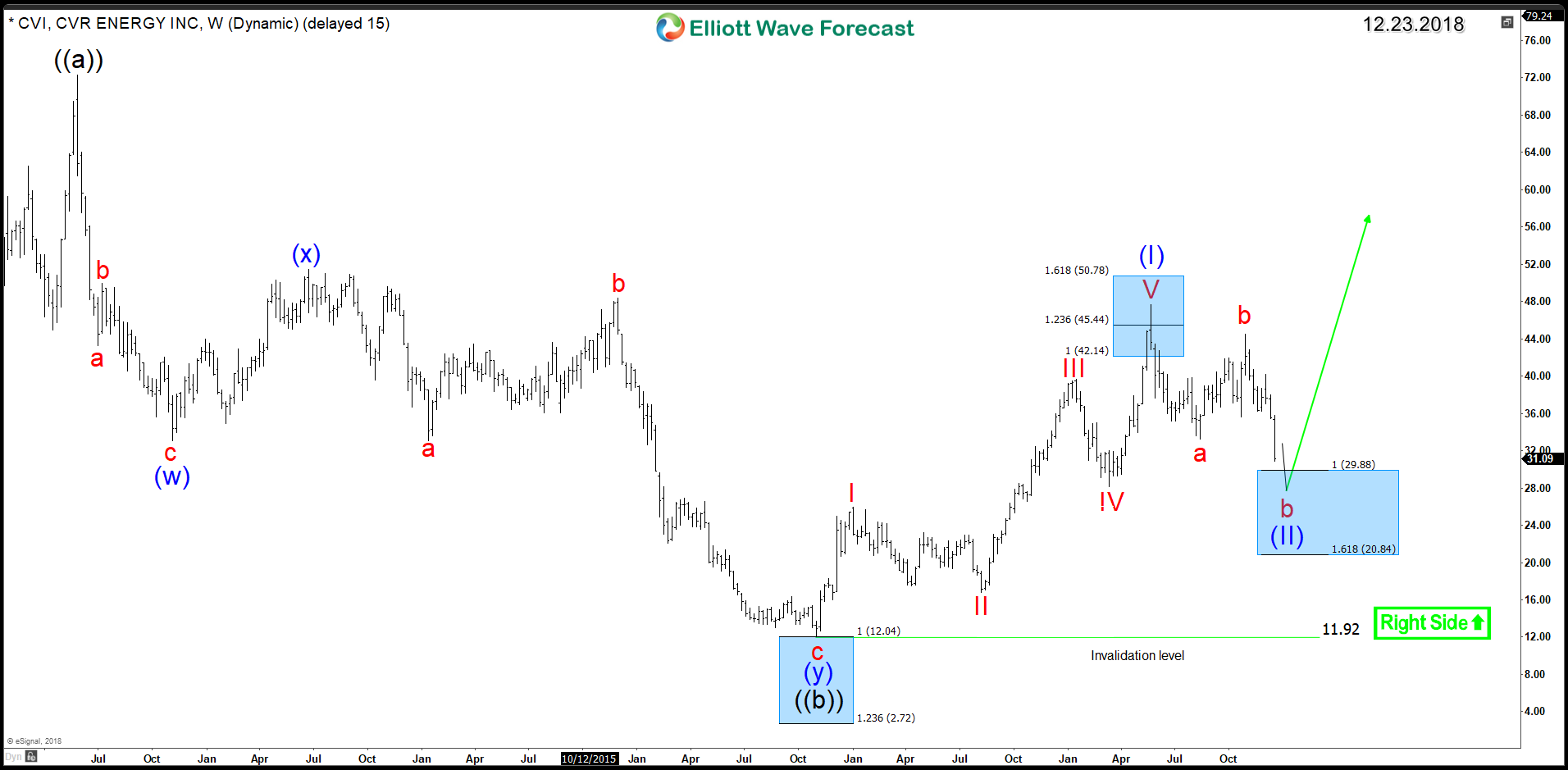

CVR Energy (NYSE:CVI) – Another 5 Waves Rally To Follow

Read MoreCVR Energy (NYSE:CVI) is presenting one of the best technical structure in Energy market despite the recent scary 40% drop in Oil prices. At Elliottwave Forecast, we believe in the One Market Concept therefore we always look for answers around other instruments within the market. Since 2016 low, CVI did advance in a bullish 5 waves impulsive […]

-

Can Aggressive Elliott Wave View In Nikkei Will Play Out?

Read MoreNikkei short-term Elliott wave view suggests that the cycle from 10/01/2018 peak is showing 5 swings bearish sequence. This favor more downside to 19073-16773 100%-123.6% Fibonacci extension area to be reached in 7 swings before support for bigger 3 wave bounce is seen at least. The decline from 10/01 peak is showing overlapping price action […]

-

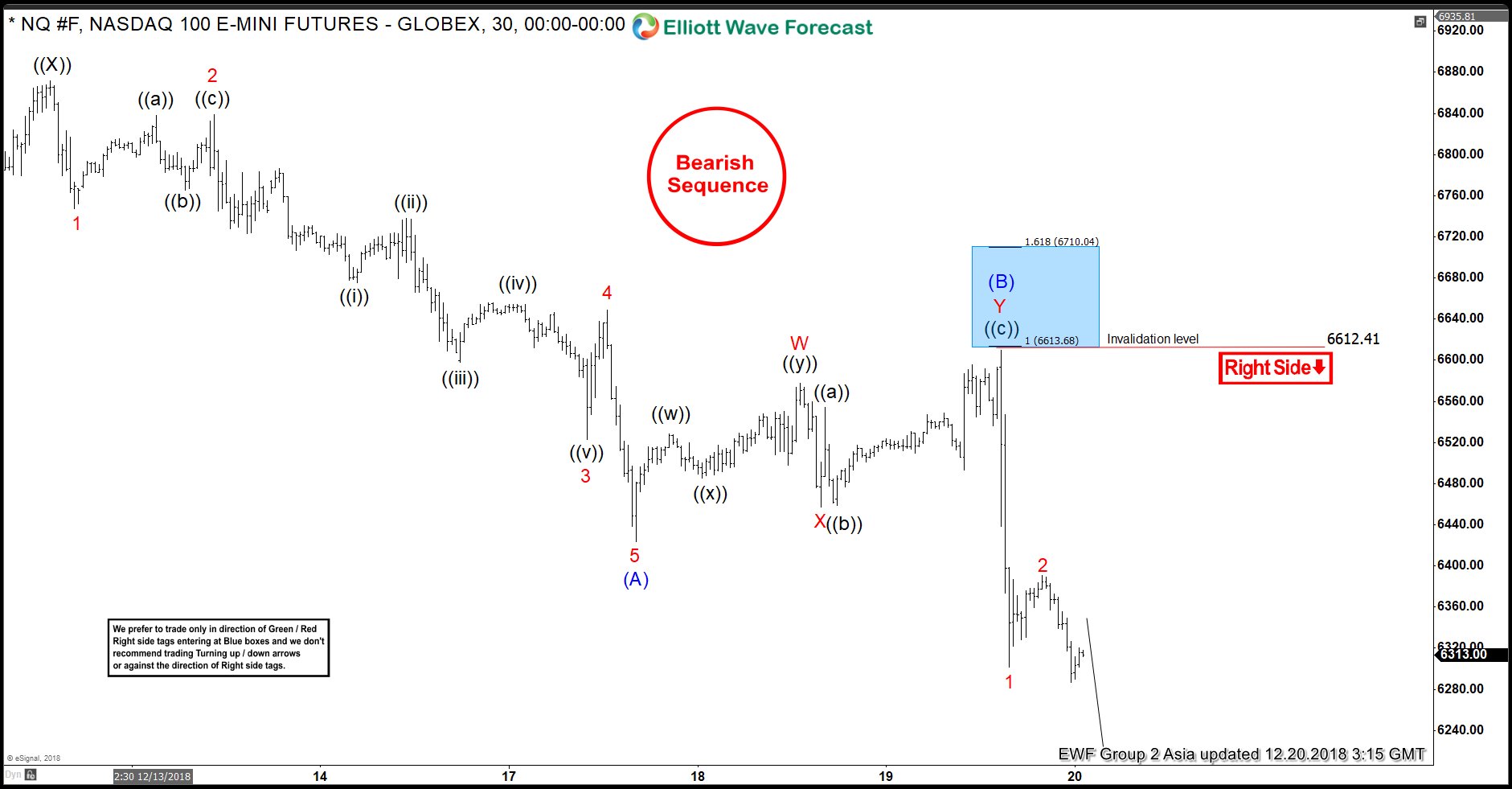

Elliott Wave View: NASDAQ Futures Calling For Further Decline

Read MoreNASDAQ ticker symbol: $NQ_F short-term Elliott wave view suggests that a bounce to $6897 high ended Primary wave ((X)). Down from there, the decline is unfolding as a zigzag structure within primary wave ((Y)) where an initial decline to $6772.25 low ended Minor wave 1. Minor wave 2 bounce ended at $6864.75 high, Minor wave […]

-

Elliott Wave Analysis: Netflix Reacted Lower from Blue Box

Read MoreHello fellow traders, In this blog, we will have a look at some short-term Elliott Wave charts of Netflix which we presented to our members in the past. You see the 1-hour updated chart presented to our clients on the 12/12/18. Netflix ended the cycle from 12/03/18 peak in black wave ((W)) at 12/10/18 low (260.22). Above from […]

-

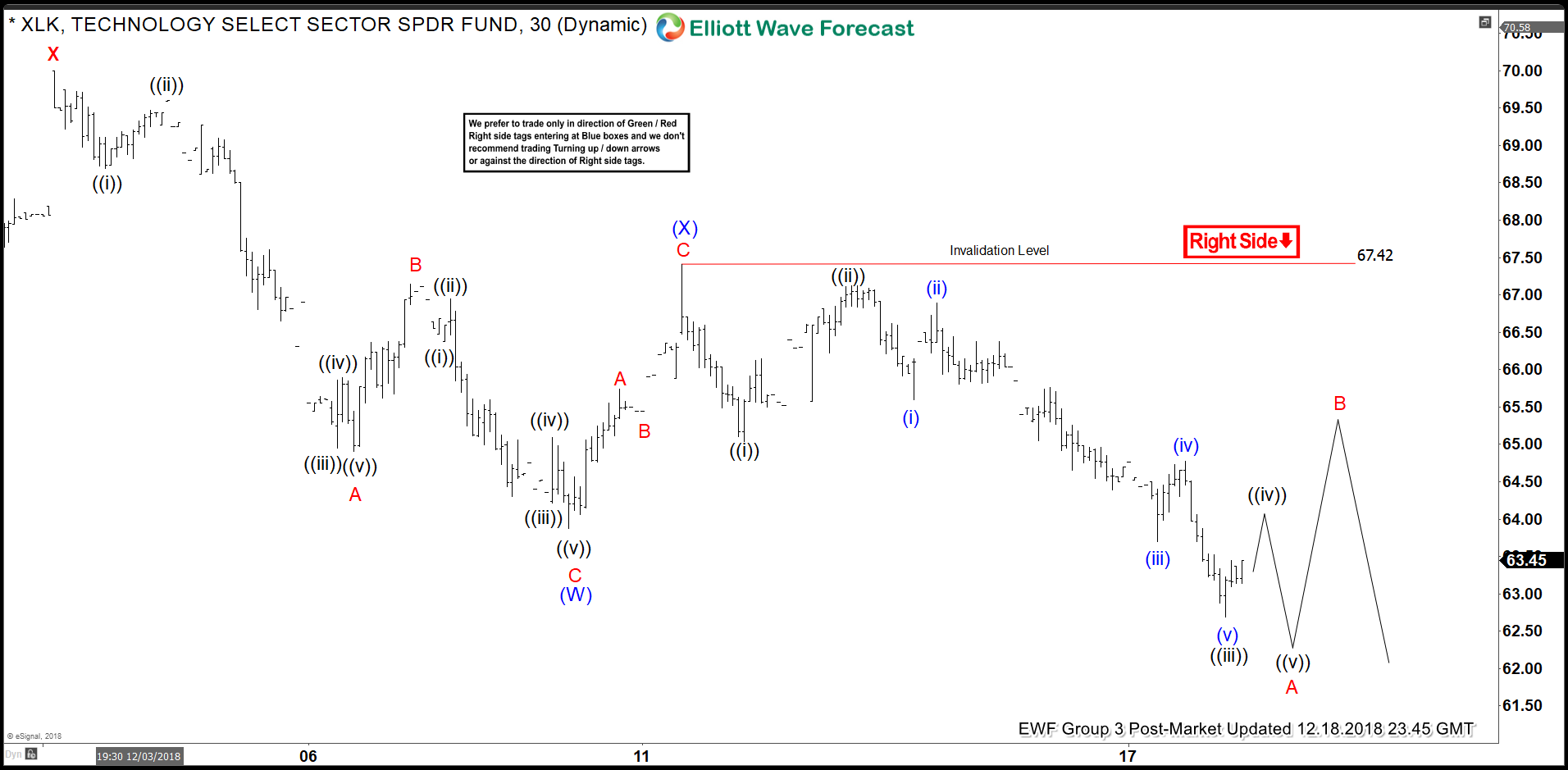

XLK Lower Low Sequence Can Help Trying To Reach Its Extreme?

Read MoreTechnology Sector ETF: ticker symbol XLK short-term Elliott Wave view suggests that a bounce to $70 ended cycle degree wave “x” bounce on 12/03/2018 peak. Down from there, the ETF has broken to new low below 11/20/2018 low $63.38 confirming the cycle degree wave “y”. And with this break below $63.38 low the sequence from […]