The Power of 3-7-11 and the Grand Super Cycle: How We Saw the Bullish Turn in April 2025 Back on April 9, 2025, while World Indices were dropping sharply and global sentiment had turned overwhelmingly bearish, we published an article that challenged the fear-driven narrative. We explained why selling was not the right approach and […]

-

$SLV Ishares Silver Trust Larger Cycles and Elliott Wave

Read More$SLV Ishares Silver Trust Larger Cycles and Elliott Wave Firstly there is data back to when the ETF fund began in 2006 as seen on the weekly chart shown below. The fund made a low in 2008 at 8.45 that has not since been taken out in price. It could have been up until The point […]

-

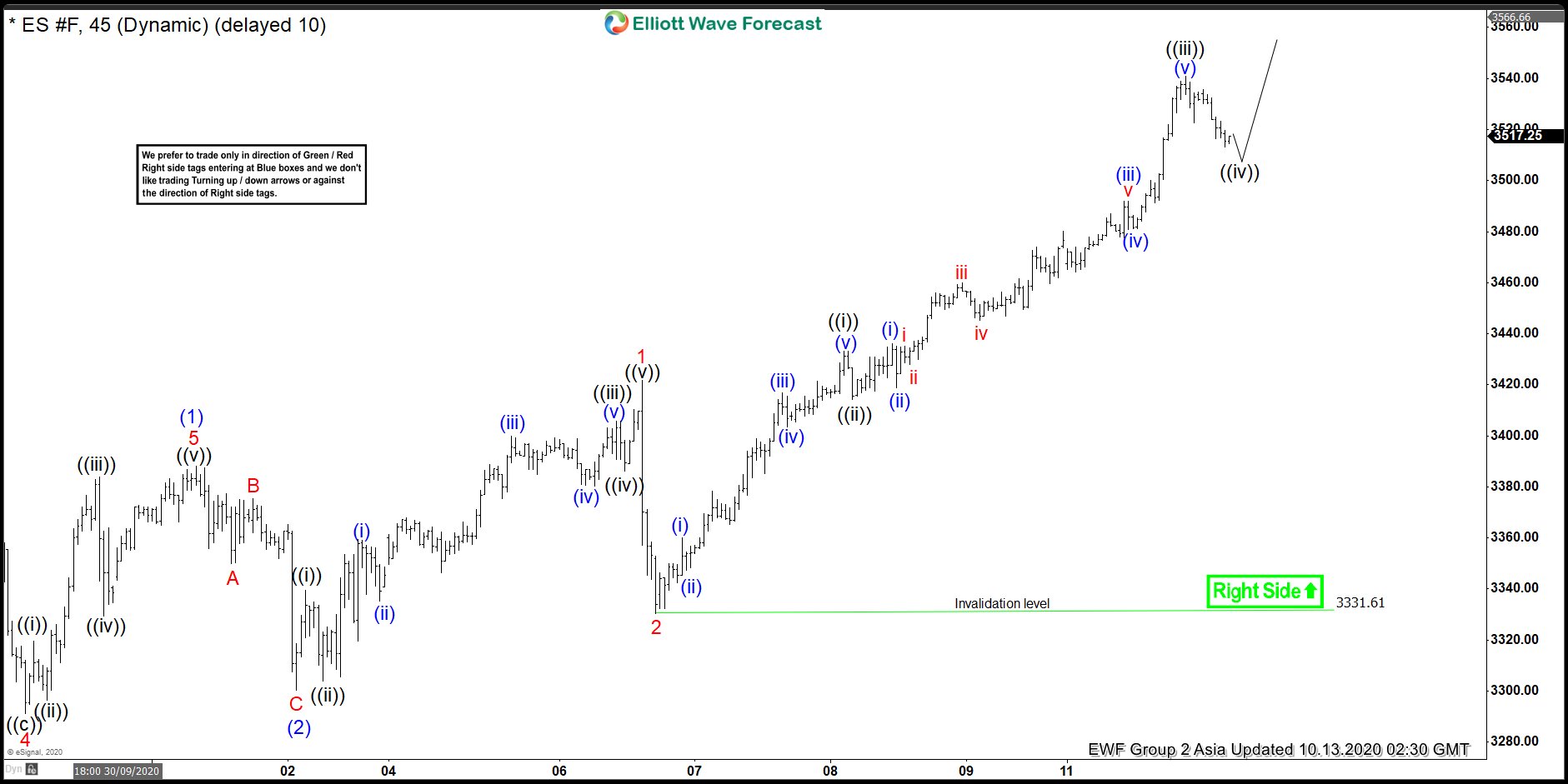

SP500 E-Mini Futures (ES_F) Extending Higher Into Wave 5

Read MoreES_F is showing an impulse rally from the 9/24/2020 low & showing a higher high sequence. This article and video look at the Elliott wave path.

-

$MC : Luxury Giant LVMH Should Continue Trading Higher

Read MoreMoët Hennessy Louis Vuitton, commonly known as LVMH, is a French multinational luxury goods company. Headquartered in Paris, LMVH was formed 1987 through a merger of the fashion house Louis Vuitton (founded in 1854) with Moët Hennessy (established in 1971). The company controls and manages 75 prestigious brands under the umbrellas of 6 branches: Perfumes […]

-

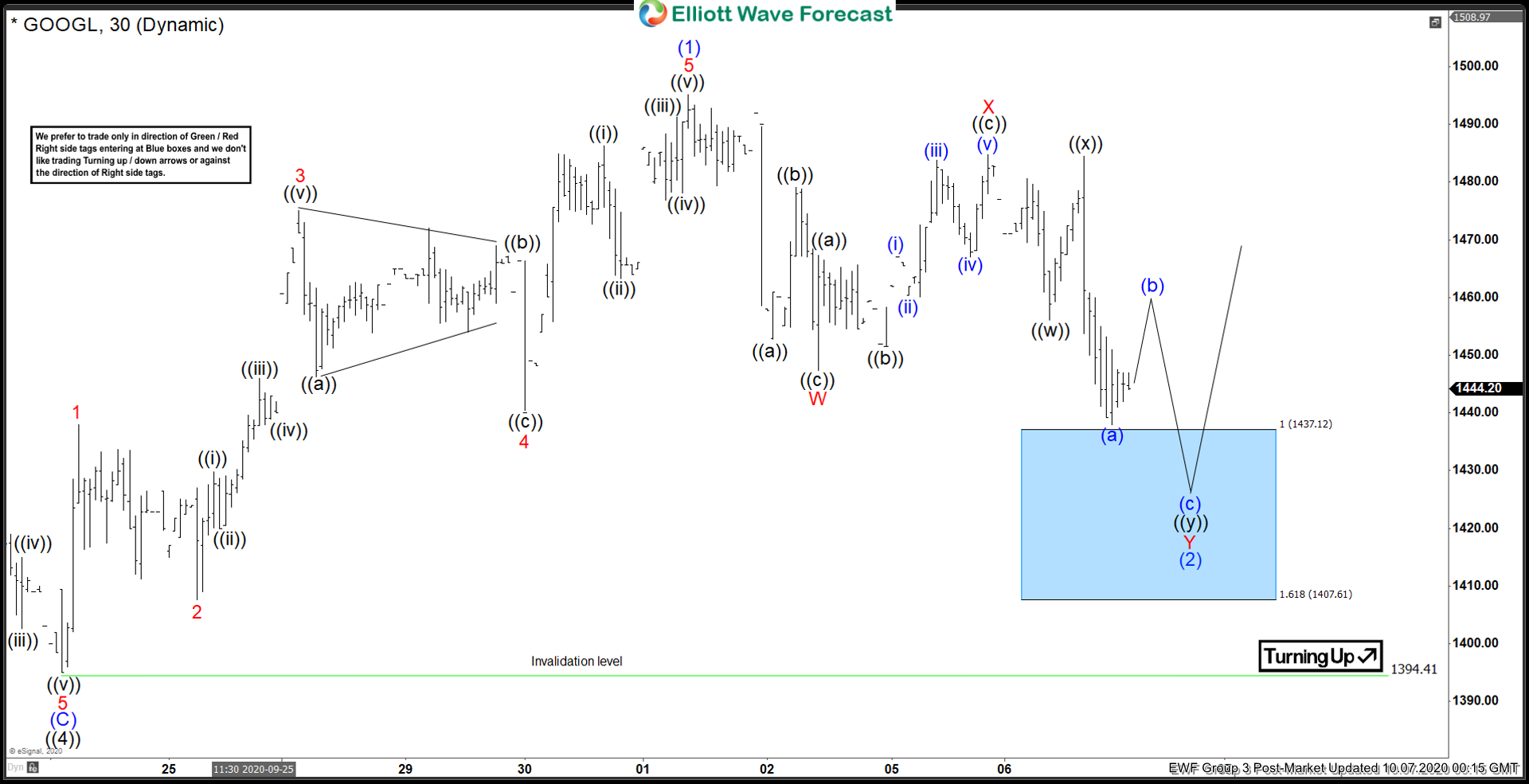

Google Made A Good Reaction Higher From Elliott Wave Blue Box Area

Read MoreIn this blog, we take a look at the past performance of 1 hour Elliott Wave charts of Google, In which our members took advantage of the blue box areas.

-

Elliott Wave View: Impulsive Rally in IBEX

Read MoreIBEX rally from September 25 low looks impulsive and should continue to see further upside. This article and video look at the Elliott Wave path.

-

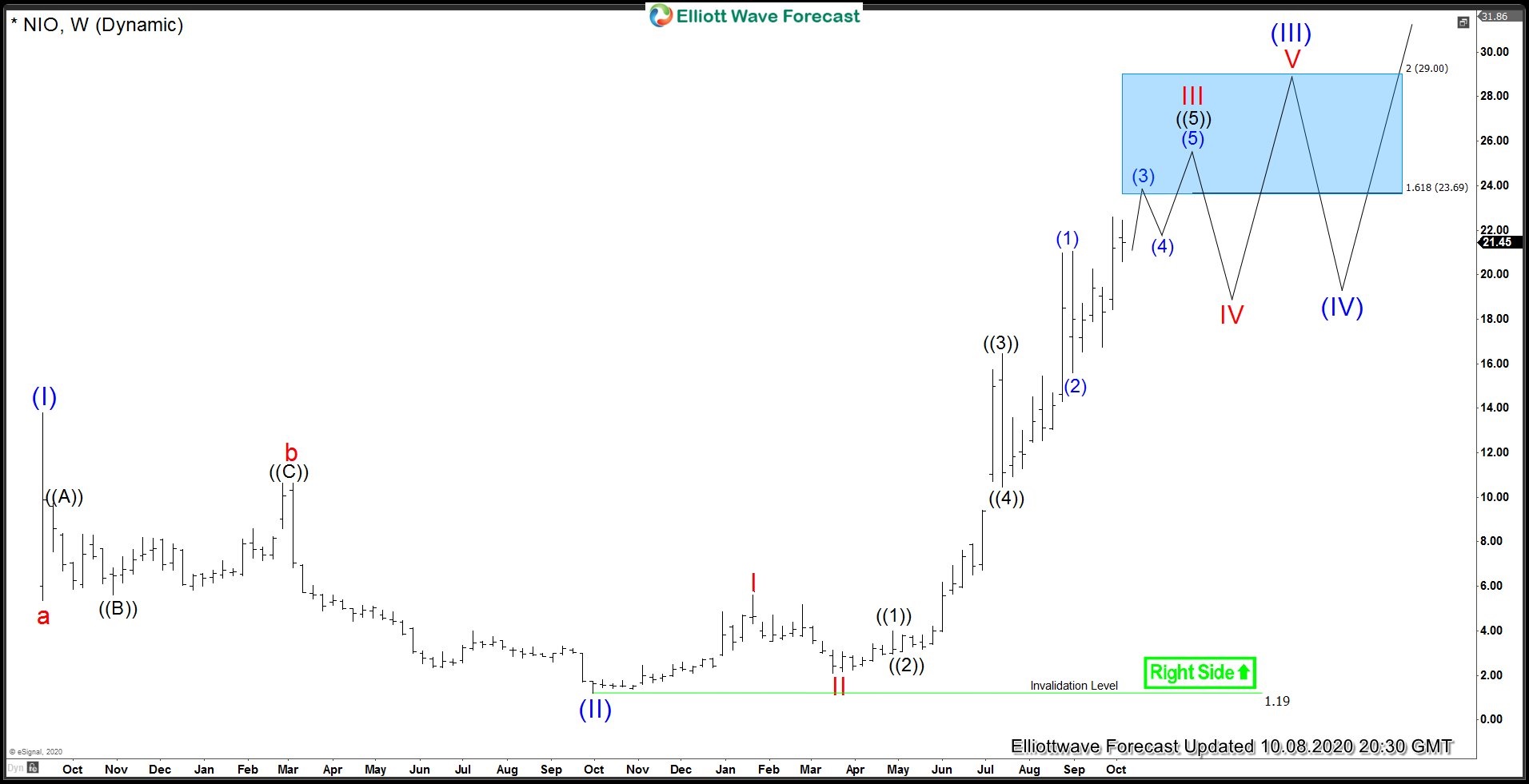

NIO Rally Reaching 161.8 Fibonacci Extension. Next Targets?

Read MoreNIO Inc. is a pioneer in China’s premium electric vehicle market. The company designs, jointly manufactures, and sells smart and connected premium electric vehicles, driving innovations in next generation technologies in connectivity, autonomous driving and artificial intelligence. Back in August of this year, we called for the stock to rally to a new high before starting […]