The Power of 3-7-11 and the Grand Super Cycle: How We Saw the Bullish Turn in April 2025 Back on April 9, 2025, while World Indices were dropping sharply and global sentiment had turned overwhelmingly bearish, we published an article that challenged the fear-driven narrative. We explained why selling was not the right approach and […]

-

Elliott Wave View: ASX 200 Looking for Support

Read MoreASX 200 has reached 100% in 3 swing from Oct 19 peak and can see support for 3 waves bounce at least. This article and video look at the Elliott Wave path.

-

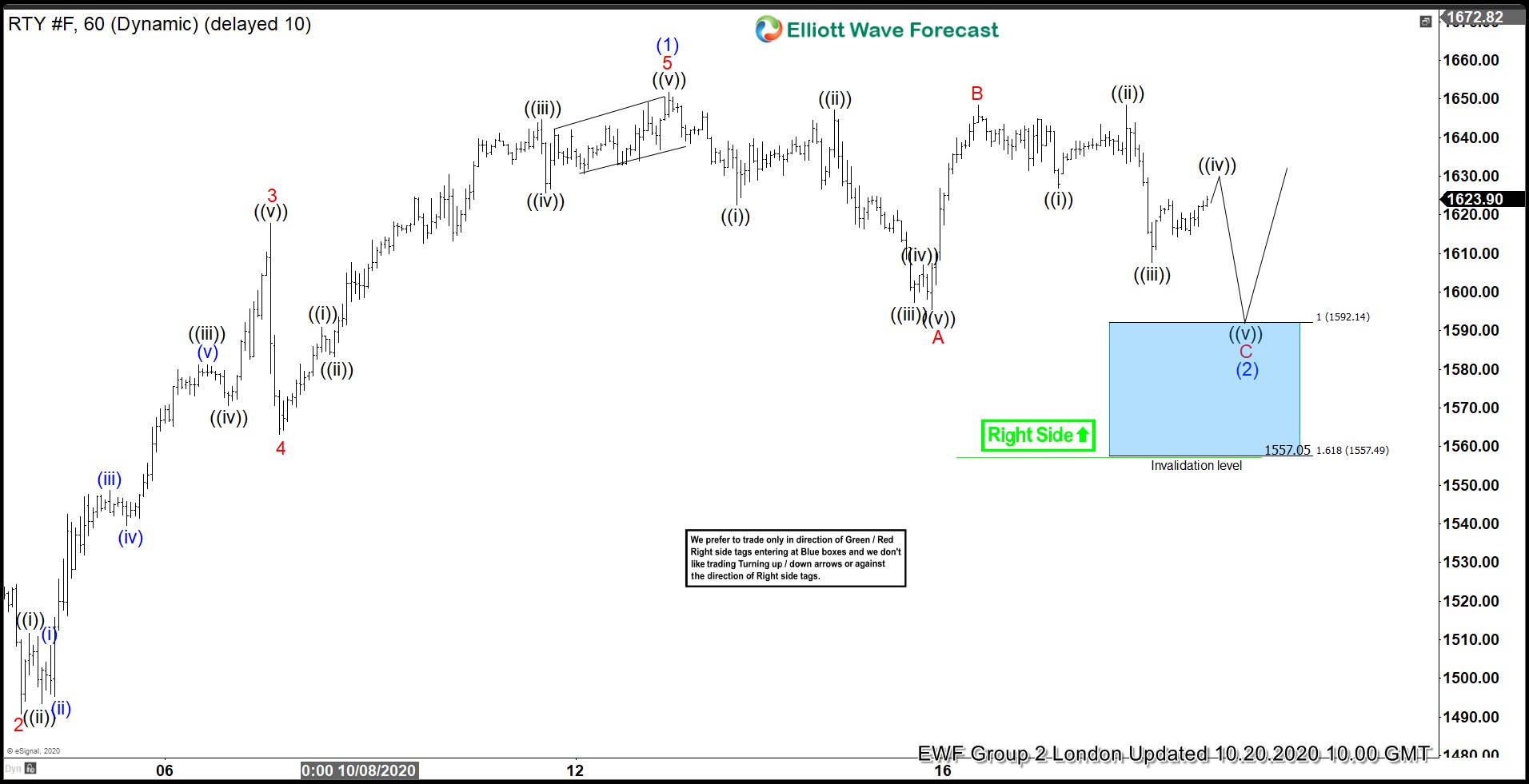

Russell ($RTY #F) Working with the Right Side and The Blue Box

Read MoreDrawing The Blue Box in the Russell In the London updated, the Russell showed possible flat correction to complete the wave (2). That is because wave B reaction was strong near to the level of (1), classic movement for a flat structure and we looked for 3 or 5 swings down as an impulse to […]

-

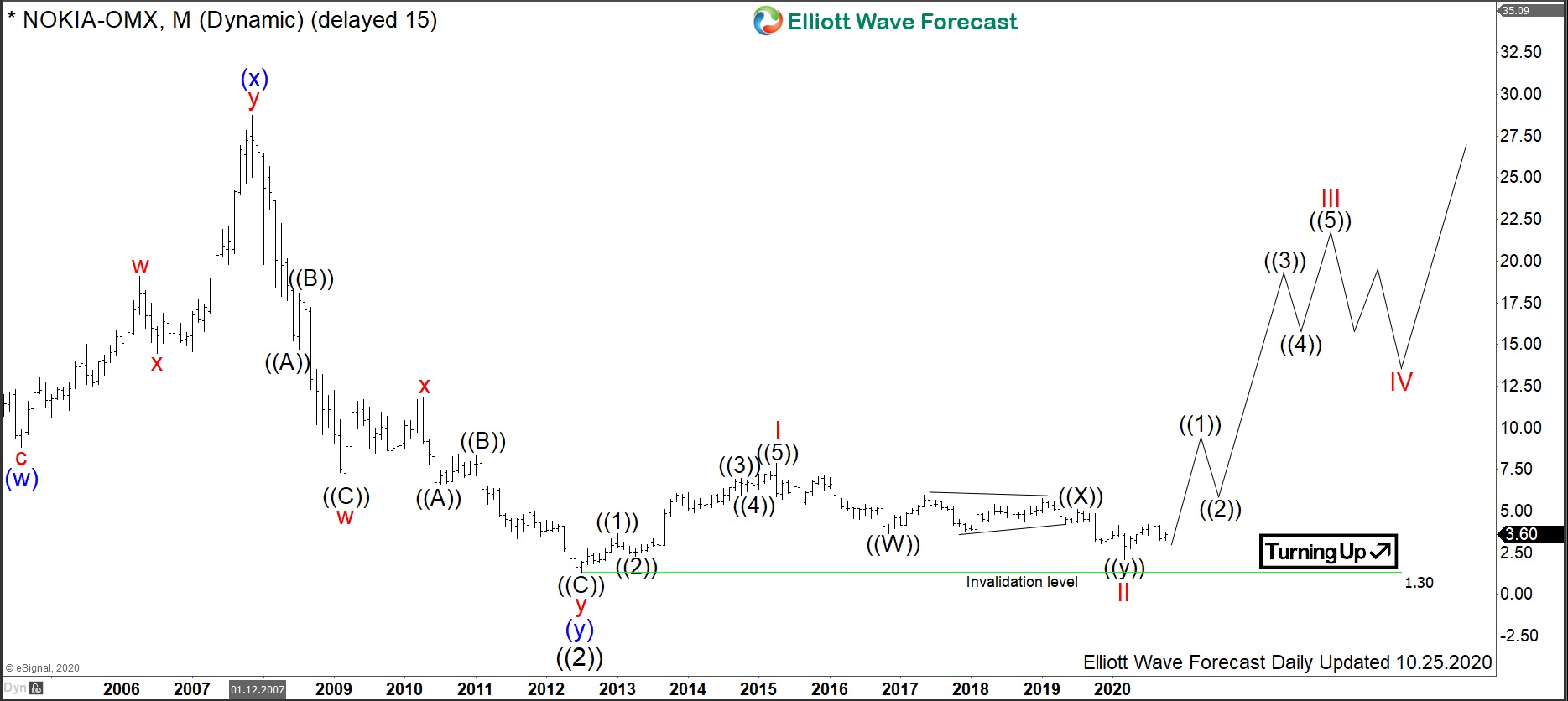

$NOKIA : Telecommunications Mammoth Nokia To Rise Again

Read MoreNokia is a Finnish multinational telecommunications, consumer electronics and information technology company. Founded 1865, it is headquartered in Espoo, Finland. Investors can trade it under the ticker $NOKIA at Nasdaq Nordic OMX and at Euronext Paris. The company is a part of Euro Stoxx 50 (SX5E) index. Also, one can trade Nokia under the ticker $NOK […]

-

Wayfair Inc. ($W) Bullish Trend Intact

Read MoreCOVID-19 has changed the permanently investing world, with certain sectors poised to take advantage of the pandemic for years to come. Online retail is hot and isn’t cooling down any time in the years ahead. Some select names have rallied sharply off the March 2020 lows and Wayfair is one of those names. Wayfair has […]

-

Elliott Wave View: Oil Futures (CL) Looking to End Flat Correction

Read MoreOil is doing an expanded Flat correction before it resumes higher. This article and video look at the short term Elliott Wave path.

-

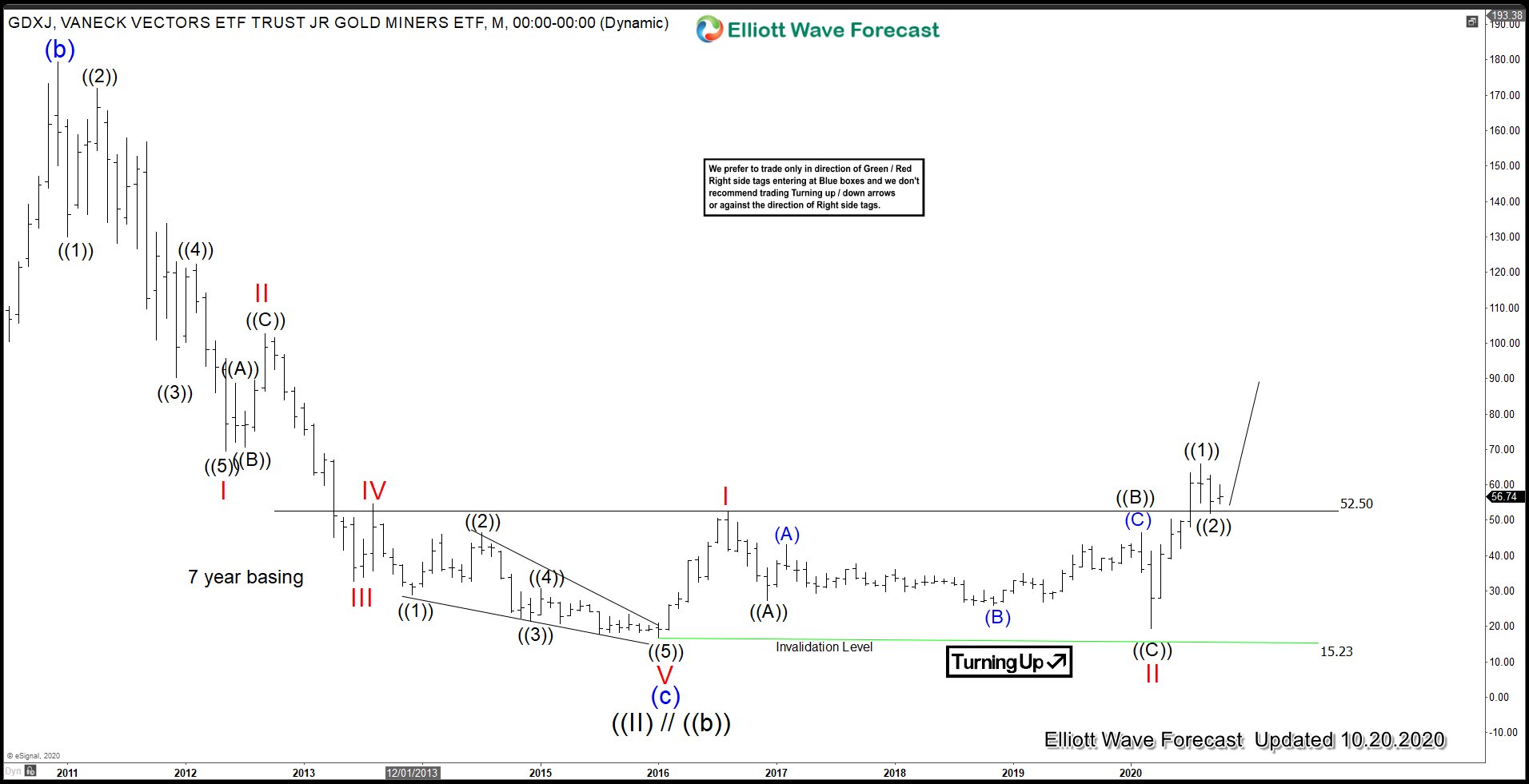

GDXJ (Gold Miners Junior) Correction Maybe Completed

Read MoreGold and related Index such as Gold Miners Junior (GDXJ) maybe ready to make the next move higher. The next important catalyst in the market is the US election and the second Coronavirus relief package. Nancy Pelosi and Treasury Secretary Steven Mnuchin continue to have discussion about the size and language of the stimulus bill. […]