The Power of 3-7-11 and the Grand Super Cycle: How We Saw the Bullish Turn in April 2025 Back on April 9, 2025, while World Indices were dropping sharply and global sentiment had turned overwhelmingly bearish, we published an article that challenged the fear-driven narrative. We explained why selling was not the right approach and […]

-

Elliott Wave View: Nike (NKE) Extending to New All-Time High

Read MoreNike (NKE) continues to make a new all-time high and cycle from Oct 30 low is incomplete. DIps should find support in 3, 7, or 11 swing.

-

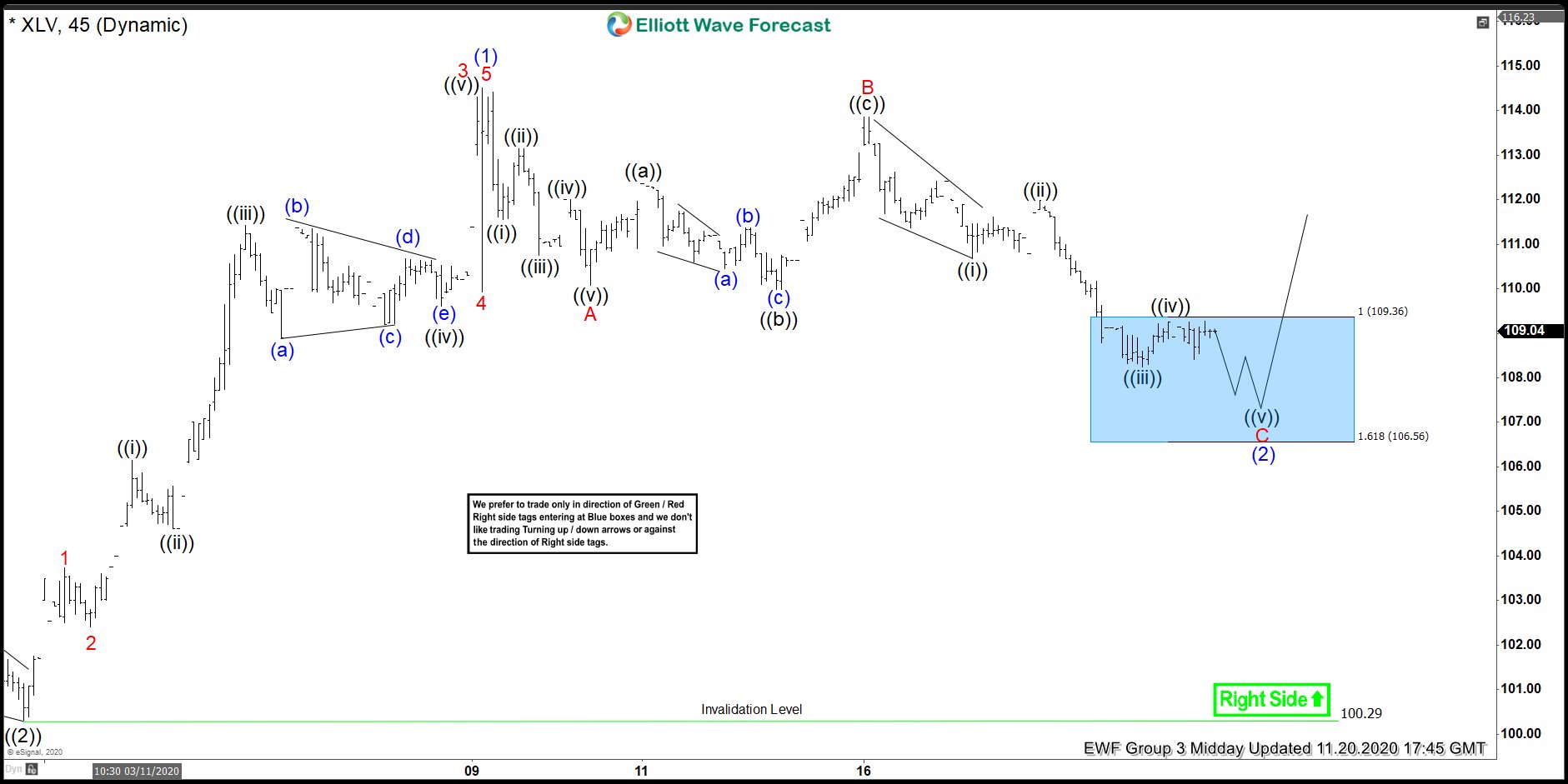

XLV Ended Elliott Wave Zigzag Correction & Bouncing

Read MoreIn this blog, we take a look at the past performance of 1 hour Elliott Wave charts of XLV In which our members took advantage of the blue box areas.

-

Elliott Wave View: S&P 500 (SPX) Pullback Should Be Supported

Read MoreSPX continues to be bullish against mid November low and pullback should be supported in 3, 7, 11 swing. This article and video look at Elliott wave path.

-

$FXB British Pound ETF Elliott Wave & Longer Term Cycles

Read More$FXB British Pound ETF Elliott Wave & Longer Term Cycles Firstly the British Pound Sterling tracking ETF fund FXB inception date was 6/21/2006. The bearish cycle lower from the November 2007 highs in FXB is the focus of this analysis. The British Pound Sterling has been the currency of the Bank of England since 1694. Considering that date […]

-

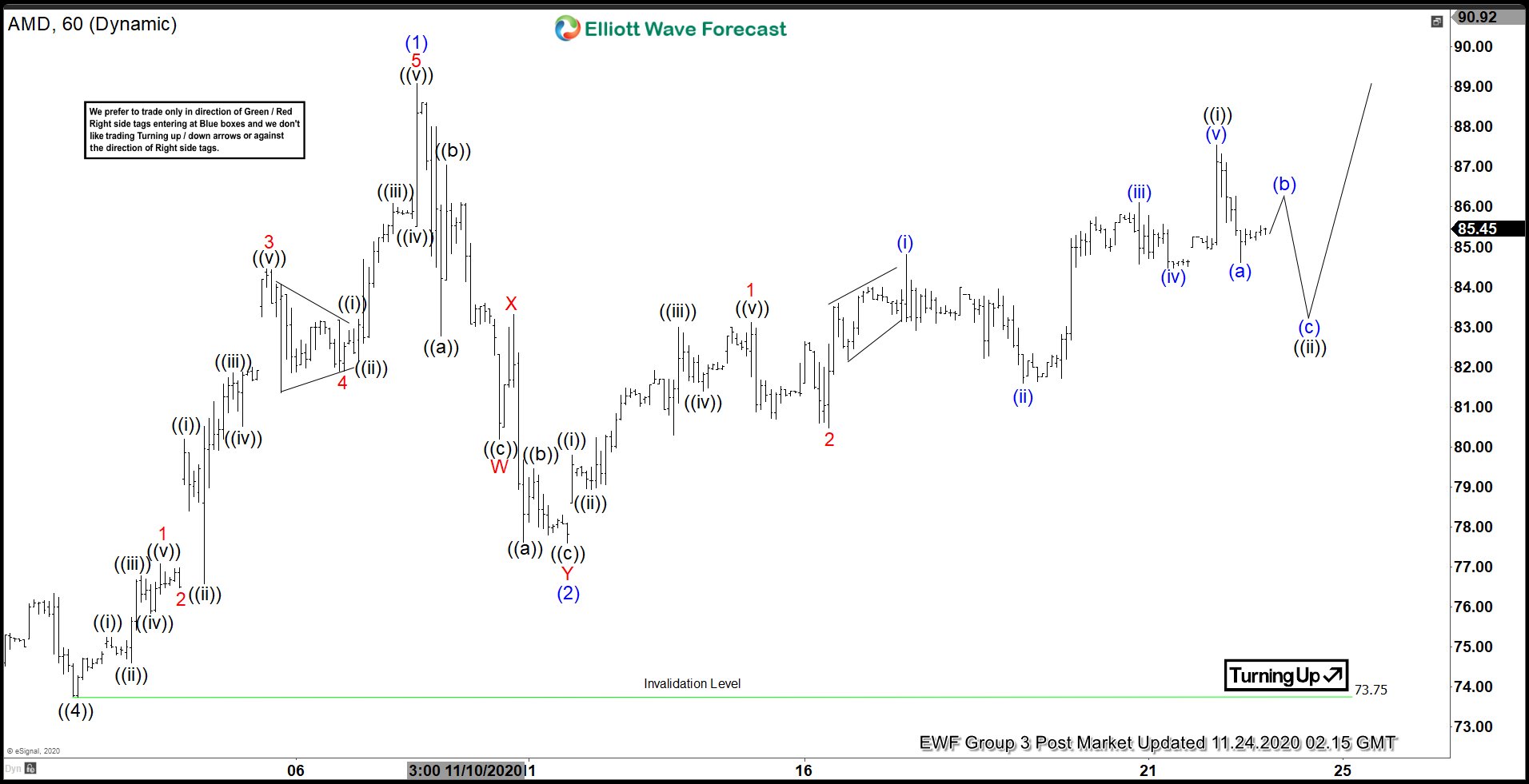

Drawing the Market in the Advanced Micro Devices Inc (AMD)

Read MoreIn this article we are going to review and analyze The Elliot’s Wave structure of the shares of Advanced Micro Devices Inc in the last days of November. Here’s the 1-hour AMD chart presented to our members on November 24th. After finishing a cycle as wave (2) at 77.56, we could see 5 waves up […]

-

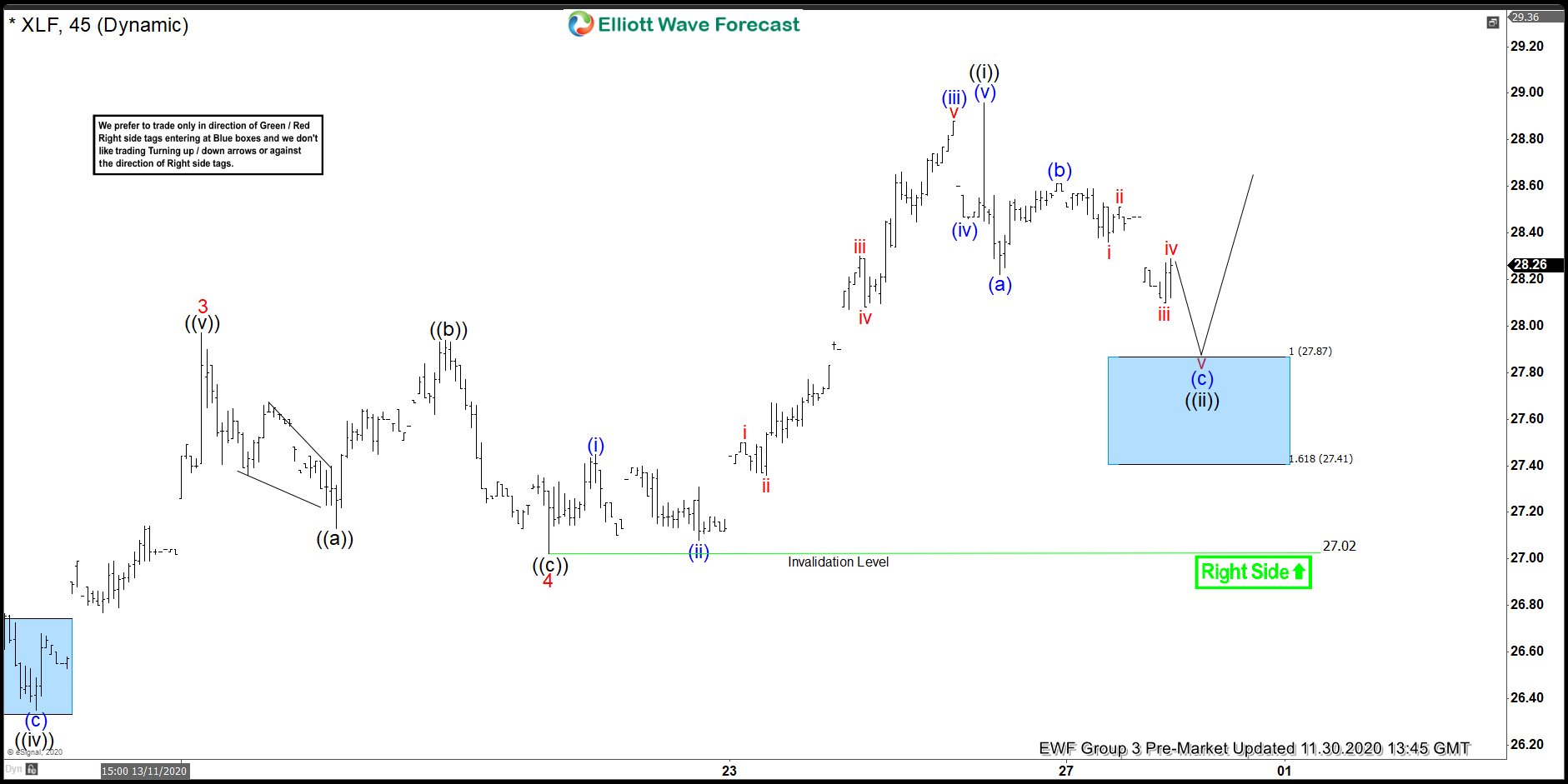

XLF Forecasting The Rally From Elliott Wave Blue Box Areas

Read MoreIn this blog, we take a look at the past performance of 1 hour Elliott Wave charts of XLF In which our members took advantage of the blue box areas.