The Power of 3-7-11 and the Grand Super Cycle: How We Saw the Bullish Turn in April 2025 Back on April 9, 2025, while World Indices were dropping sharply and global sentiment had turned overwhelmingly bearish, we published an article that challenged the fear-driven narrative. We explained why selling was not the right approach and […]

-

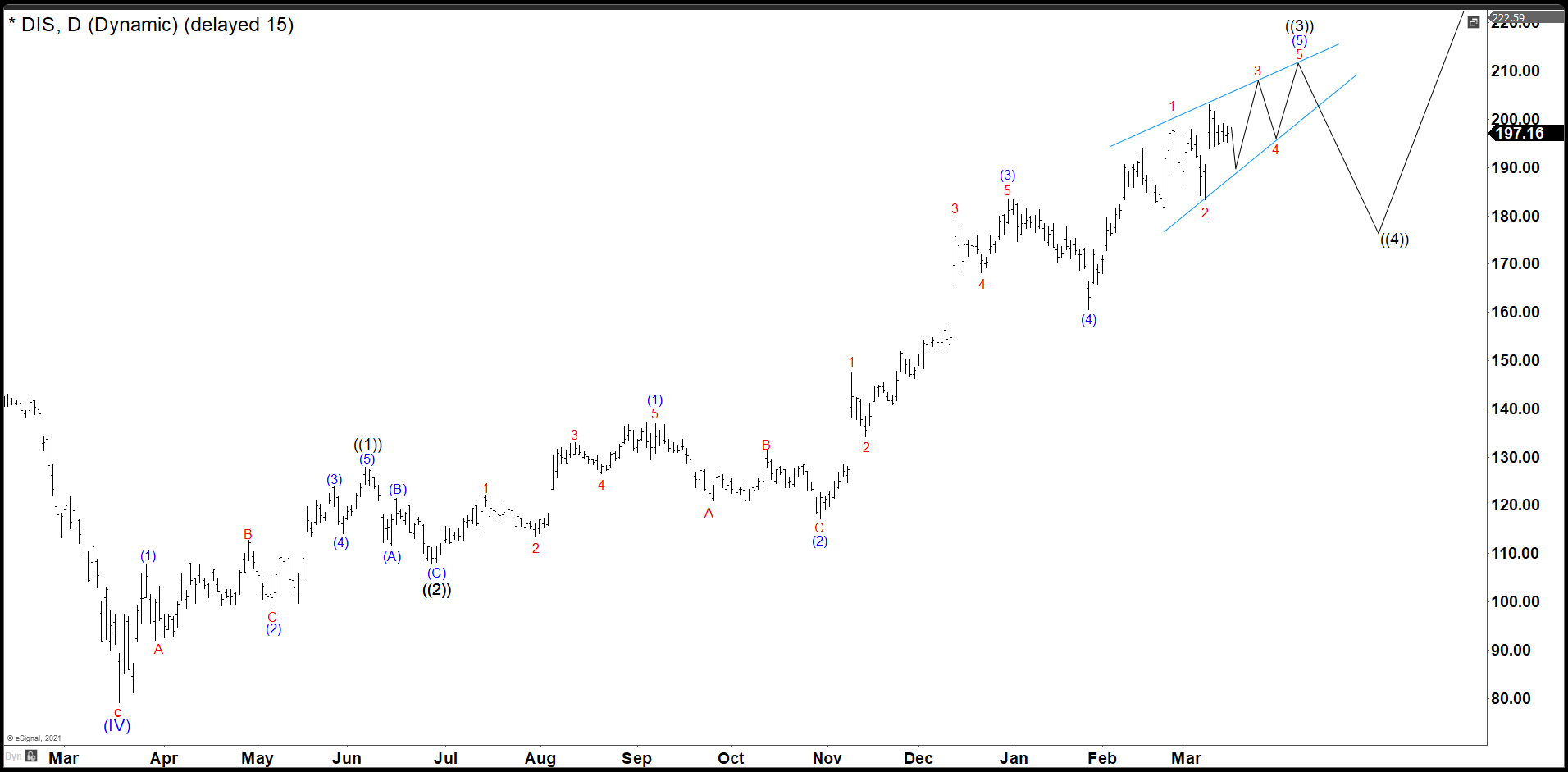

Disney Has Extended the Bullish Momentum In Wave (5)

Read MoreSince the crash of March 2020, all stocks have tried to recover what they lost, and Disney was no exception. Disney did not only recover the lost, but It also reached historic highs. Now, we are going to try to build an impulse from the March 2020 lows with a target around $230. Target measured […]

-

Jaguar Health Inc ($JAGX) Looking To Move Higher

Read MoreSPACs have exploded in popularity in 2020 with many investors hopping on board the next hottest trend. Jaguar Health is one of those companies that have joined in with the SPAC craze as well as boasting plant based prescription medicine. In addition, the technicals are strong on this chart. Lets take a look at their […]

-

Elliott Wave View: Further Upside Expected in Eurostoxx

Read MoreEurostoxx has resumed higher in impulsive structure and should see further upside. This article and video look at the Elliott Wave path.

-

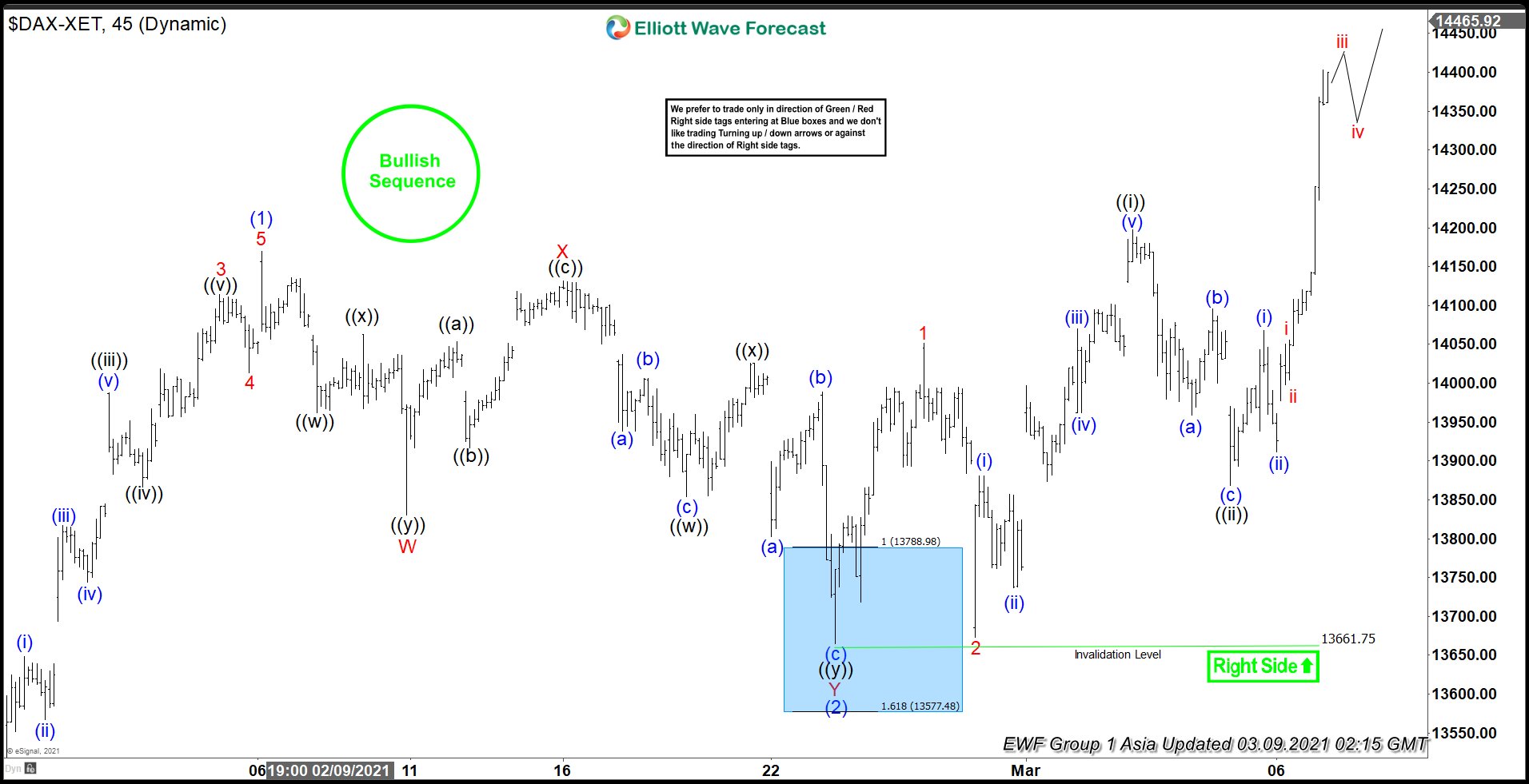

DAX Finds Buyers in Blue Box and Continues Higher

Read MoreIn this blog, we are going to take a look at the DAX index. The short term Elliott Wave view on the index shows a correction in ((4)) at 13310.95 on February 28, 2020. Internally, we have wave (W) at 13599.78. A rally followed in (X) at 13925.73. Wave (Y) followed lower and completed the […]

-

Elliott Wave View: S&P E-Mini Futures (ES) Resumes Higher

Read MoreS&P E-Mini Futures (ES) has started to turn higher impulsively looking for new-all time high. This article and video look at the Elliott Wave path.

-

Disney Is Doing A Possible Irregular Flat Correction

Read MoreSince the crash of March 2020, all stocks have tried to recover what they lost and Disney was no exception. Disney did not only recover the lost, but It also reached historic highs. Now, we are going to try to build an impulse from the March 2020 lows with a target around $230. Target measured […]