The Power of 3-7-11 and the Grand Super Cycle: How We Saw the Bullish Turn in April 2025 Back on April 9, 2025, while World Indices were dropping sharply and global sentiment had turned overwhelmingly bearish, we published an article that challenged the fear-driven narrative. We explained why selling was not the right approach and […]

-

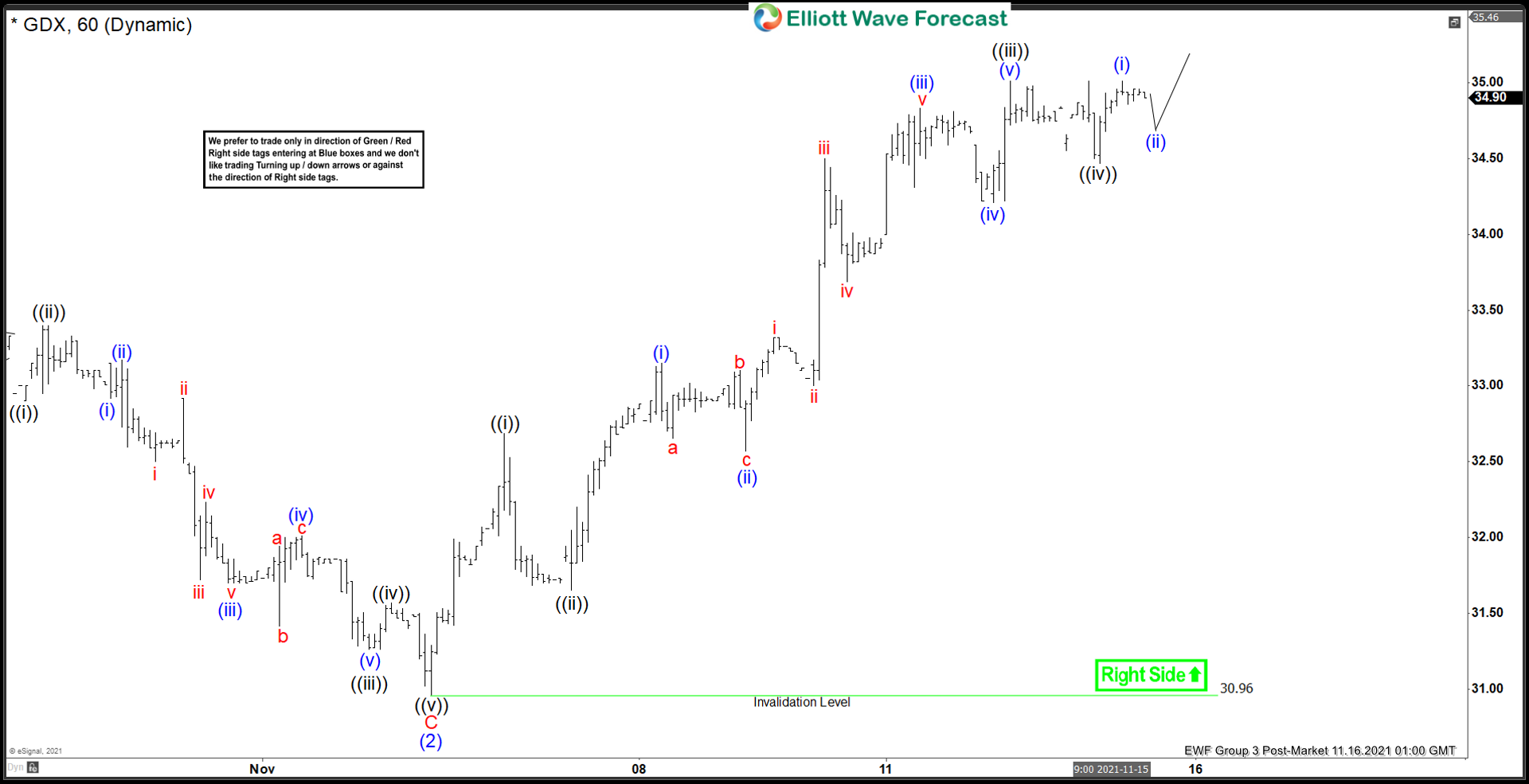

Elliott Wave View: GDX Starts New Bullish Cycle

Read MoreGDX shows incomplete sequence from October 4 low favoring more upside. This article and video look at the Elliott Wave path.

-

PG Should Continue Rally To Complete The Cycle From March 2020

Read MoreSince the crash of March 2020, all stocks have tried to recover what they lost and PG was no exception. PG did not only recover the lost, but it also reached historic highs. We tried to build an impulse from wave II with a first target to $154.00, but market movements of last months have […]

-

Disney No Rally For A While Until Double Correction Is Done

Read MoreSince the crash of March 2020, all stocks have tried to recover what they lost, and Disney was no exception. Disney did not only recover the lost, but It also reached historic highs. Now, we are going to try to build an impulse from the March 2020 lows with a target around $230. Target measured […]

-

Best Quantum Computing Stocks to Buy in 2024

Read MoreQuantum technology is approaching the mainstream. A quantum computer offers computational power that is 100 million times faster than regular computers today. A detailed study issued under Harvard Business Review explains quantum technology as below: Quantum translates, in the world of commercial computing, to machines and software that can, in principle, do many of the […]

-

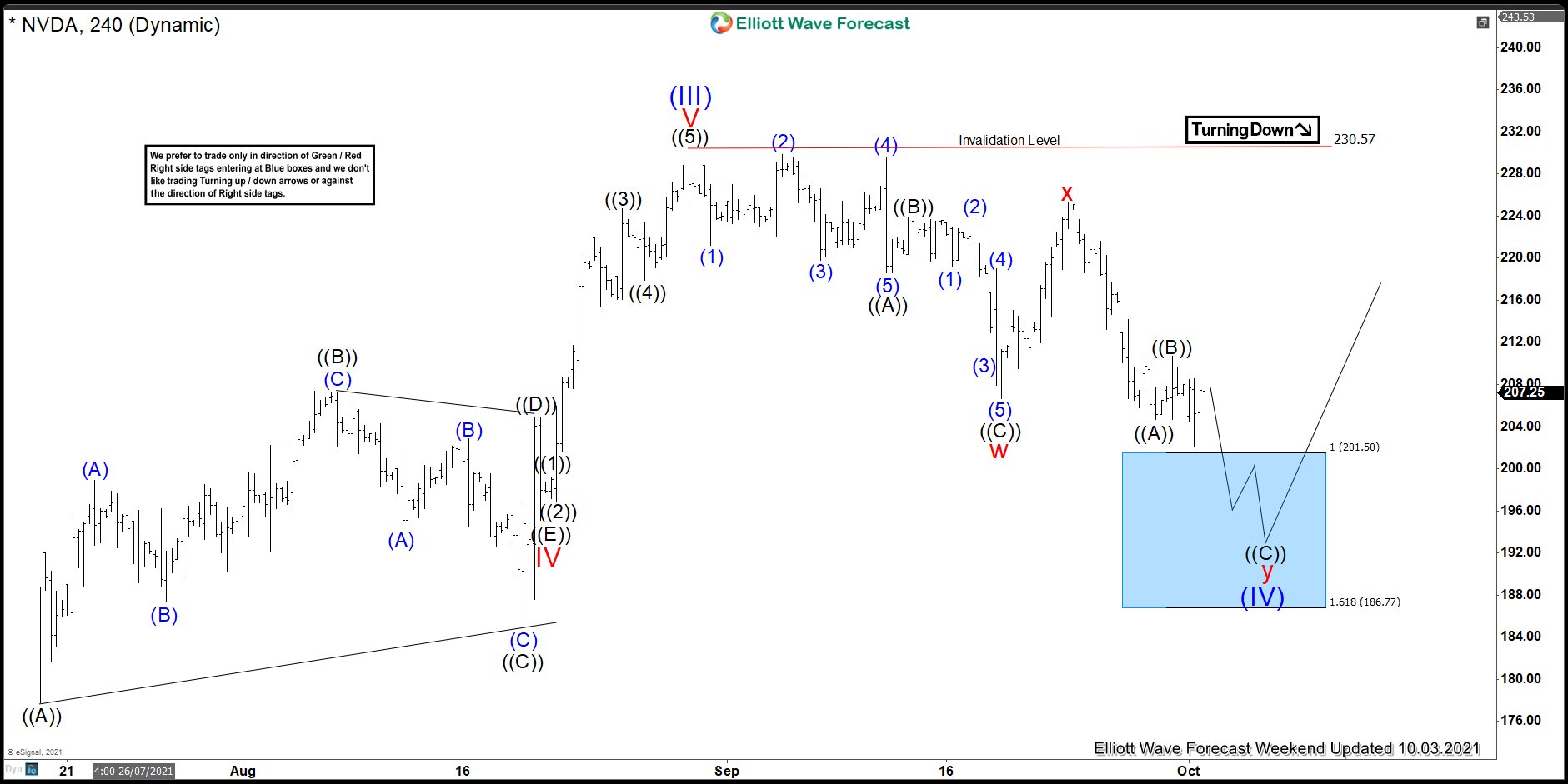

NVDA Made New All-Time Highs From Blue Box Area

Read MoreIn this blog, we take a look at the past performance of NVDA 4hr charts. In which, the stock made new all-time highs from the blue box area.

-

Elliott Wave View: FTSE Extending in Wave 5

Read MoreFTSE rally from September 20 low is in progress as an impulse. This article and video look at the Elliott Wave path of the Index.