The Power of 3-7-11 and the Grand Super Cycle: How We Saw the Bullish Turn in April 2025 Back on April 9, 2025, while World Indices were dropping sharply and global sentiment had turned overwhelmingly bearish, we published an article that challenged the fear-driven narrative. We explained why selling was not the right approach and […]

-

TXN Elliott Wave Analysis Update: Calling Resurgence From Pullback

Read MoreAfter it completed a 5-wave resurgence from the April 2025 blue box, TXN is about to correct this bullish cycle to a zone where it could attract fresh bids it would need to launch a new bullish cycle. Texas Instruments (TXN) is a global semiconductor company known for designing and manufacturing analog and embedded processing chips. […]

-

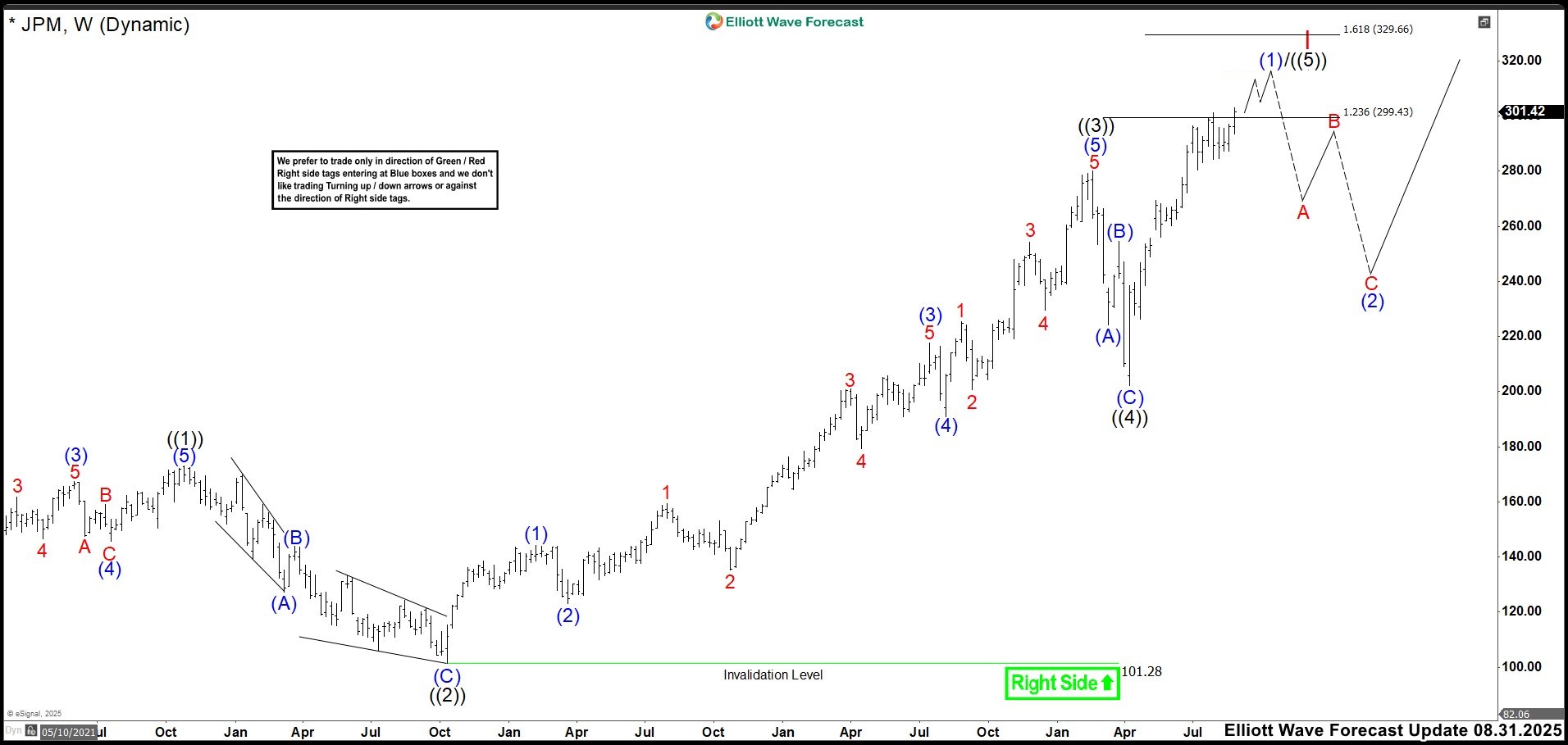

Cycle Maturity in JPM: Bulls Fatigued, Bears Warming Up

Read MoreJPMorgan Chase (JPM) trades at $301.42, testing a breakout zone near its 52-week high. This level signals strong bullish momentum. The stock remains above its 50-day and 200-day moving averages by 3.39% and 15.00%, respectively. Investors continue to show confidence in JPM’s earnings and strategic direction. Despite macro uncertainty and policy shifts, the bank maintains […]

-

PAAS Elliott Wave Forecast: Riding Higher in Wave III

Read MorePan American Silver Corp. (PAAS) is a leading precious metals mining company headquartered in Vancouver, Canada. The compnay specializes in the exploration, development, and production of silver and gold. Operating primarily in the Americas, the company owns and manages a portfolio of high-quality mines in countries such as Mexico, Peru, Bolivia, and Argentina. Below we […]

-

Elliott Wave Outlook: Nvidia (NVDA) Targets 189+ in Wave 5 Completion

Read MoreNvidia (NVDA) has resumed higher in wave 5. This article and setup looks at the Elliott Wave path of the stock and potential target.

-

Apple Inc. $AAPL Blue Box Area Offers A Buying Opportunity

Read MoreHello everyone! In today’s article, we’ll examine the recent performance of Apple Inc. ($AAPL) through the lens of Elliott Wave Theory. We’ll review how the rally from the August 01, 2025 low unfolded as a 5-wave impulse followed by a 3-swing correction (ABC) and discuss our forecast for the next move. Let’s dive into the structure and expectations for this stock. […]

-

Dollar Index (DXY) Elliott Wave Outlook: Bearish Impulse Aims for 97.3

Read MoreDollar Index (DXY) shows a short term bearish sequence from August 1 favoring downside. This article and video look at the Elliott Wave path.