The Power of 3-7-11 and the Grand Super Cycle: How We Saw the Bullish Turn in April 2025 Back on April 9, 2025, while World Indices were dropping sharply and global sentiment had turned overwhelmingly bearish, we published an article that challenged the fear-driven narrative. We explained why selling was not the right approach and […]

-

AMX : Should Expect Short Term Pullback

Read MoreAmerica Movil, S.A.B. de C.V. (AMX) provides telecommunication services in Latin America & internationally. The company offers wireless & fixed voice services, including local, domestic & international long distance services & network interconnection services along with data services. It is based in Mexico, comes under Communication services sector and trades as “AMX” ticket at NYSE. […]

-

Top 10 Shipping Stocks in 2024

Read MoreThe shipping sector had to face many challenges over the past few years which led to skyrocketing prices, and a three-fold increase in transit times. As a result, 93% of importers and exporters reported supply-chain difficulties. Over 80% of world trade volume is in seaborne. Due to supply and demand factors, world trade was initially […]

-

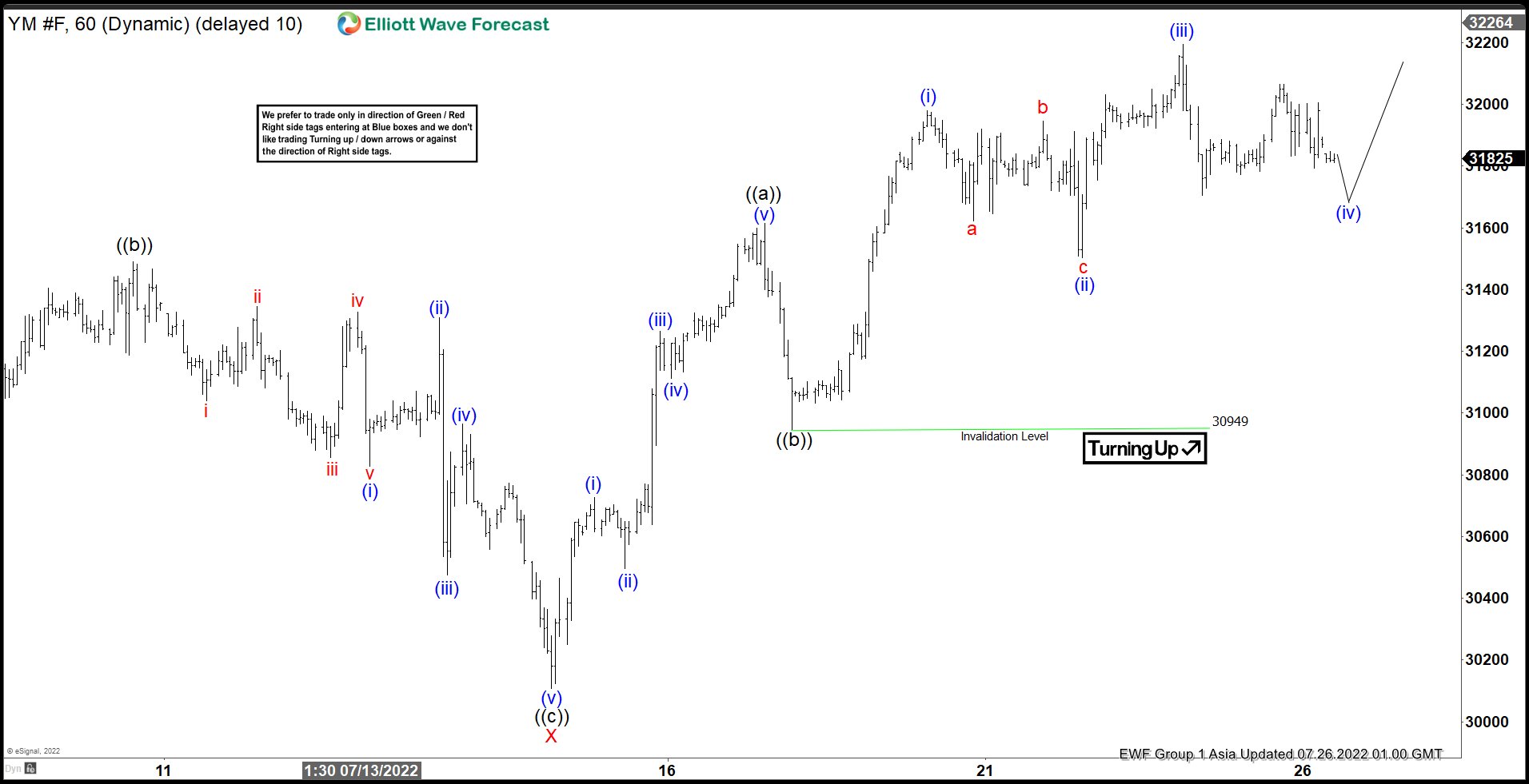

Elliott Wave View: Dow Futures (YM) May Pullback Soon

Read MoreDow Futures (YM) cycle from 6.17.2022 low is in progress as a double three and soon can see resistance. This article & video look at the Elliott Wave path.

-

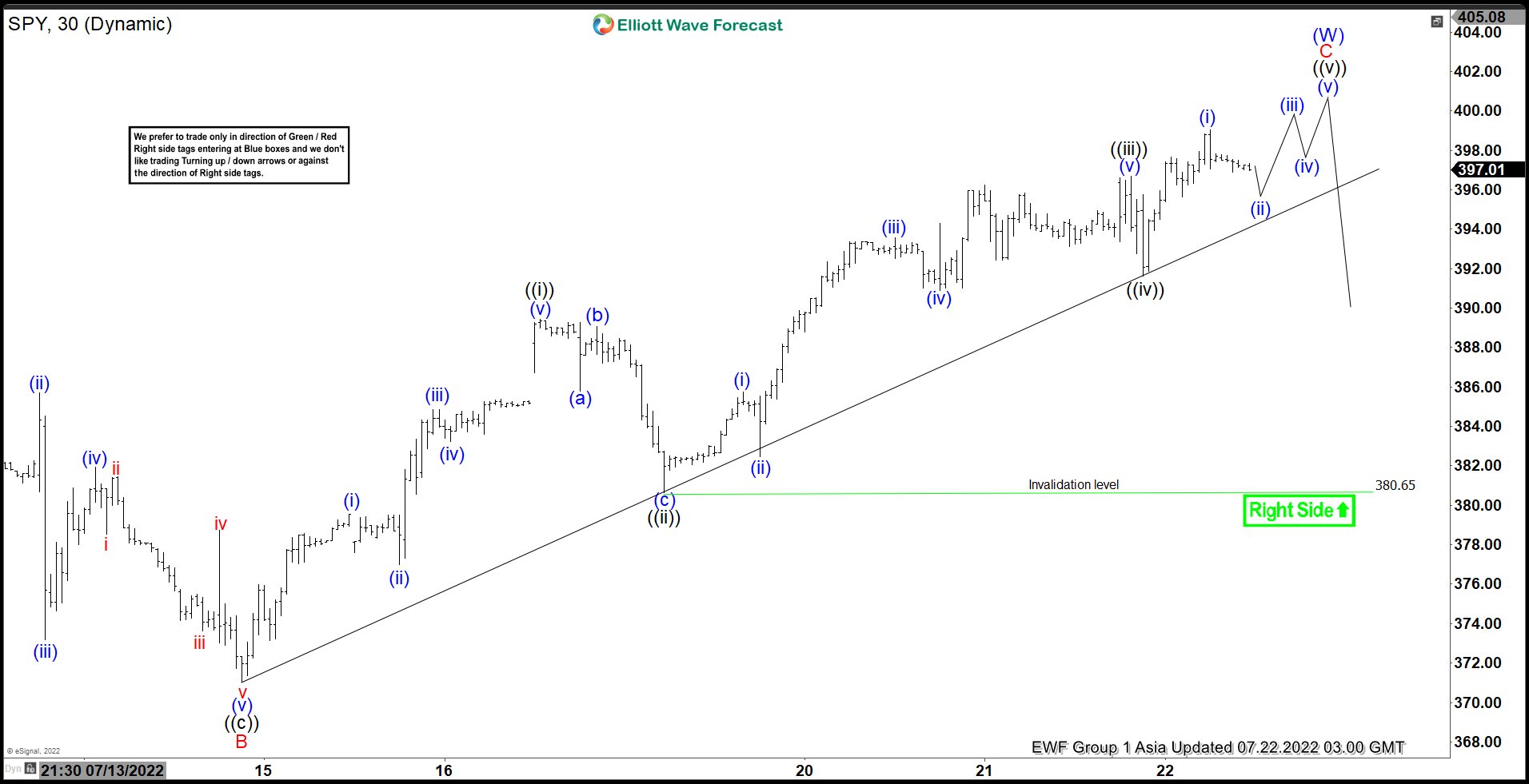

Elliott Wave View: SPY Could See A Pullback Soon

Read MoreSPY can see further upside before ending cycle from 6/17/2022 low. This article and video look at the Elliott Wave path for the ETF.

-

Has ARK Invest ($ARKK) Bottomed or More Downside?

Read MoreSummary of the Fund: ARK Invest (ARKK) is an actively managed Exchange Traded Fund (ETF). It seeks long-term growth of capital by investing in domestic and foreign equity securities of companies that are relevant to the Fund’s investment theme of disruptive innovation. ARK defines ‘‘disruptive innovation’’ as the introduction of a technologically enabled new product […]

-

Elliott Wave View: DAX Rally is Corrective

Read MoreDAX ended cycle from 3/29/2022 peak & looking to correct that cycle in 7 swing before it resumes lower. This article & video look at the Elliott Wave path.