The Power of 3-7-11 and the Grand Super Cycle: How We Saw the Bullish Turn in April 2025 Back on April 9, 2025, while World Indices were dropping sharply and global sentiment had turned overwhelmingly bearish, we published an article that challenged the fear-driven narrative. We explained why selling was not the right approach and […]

-

Starbucks ($SBUX) Ended A Double Correction And It Should Continue Higher

Read MoreStarbucks Corporation (SBUX) is an American multinational chain of coffeehouses and roastery reserves. It is the world’s largest coffeehouse chain. As of November 2021, the company had 33,833 stores in 80 countries, 15,444 of which were located in the United States. Out of Starbucks’ U.S.-based stores, over 8,900 are company-operated, while the remainder are licensed. Starbucks ($SBUX) Elliott Wave Analysis – […]

-

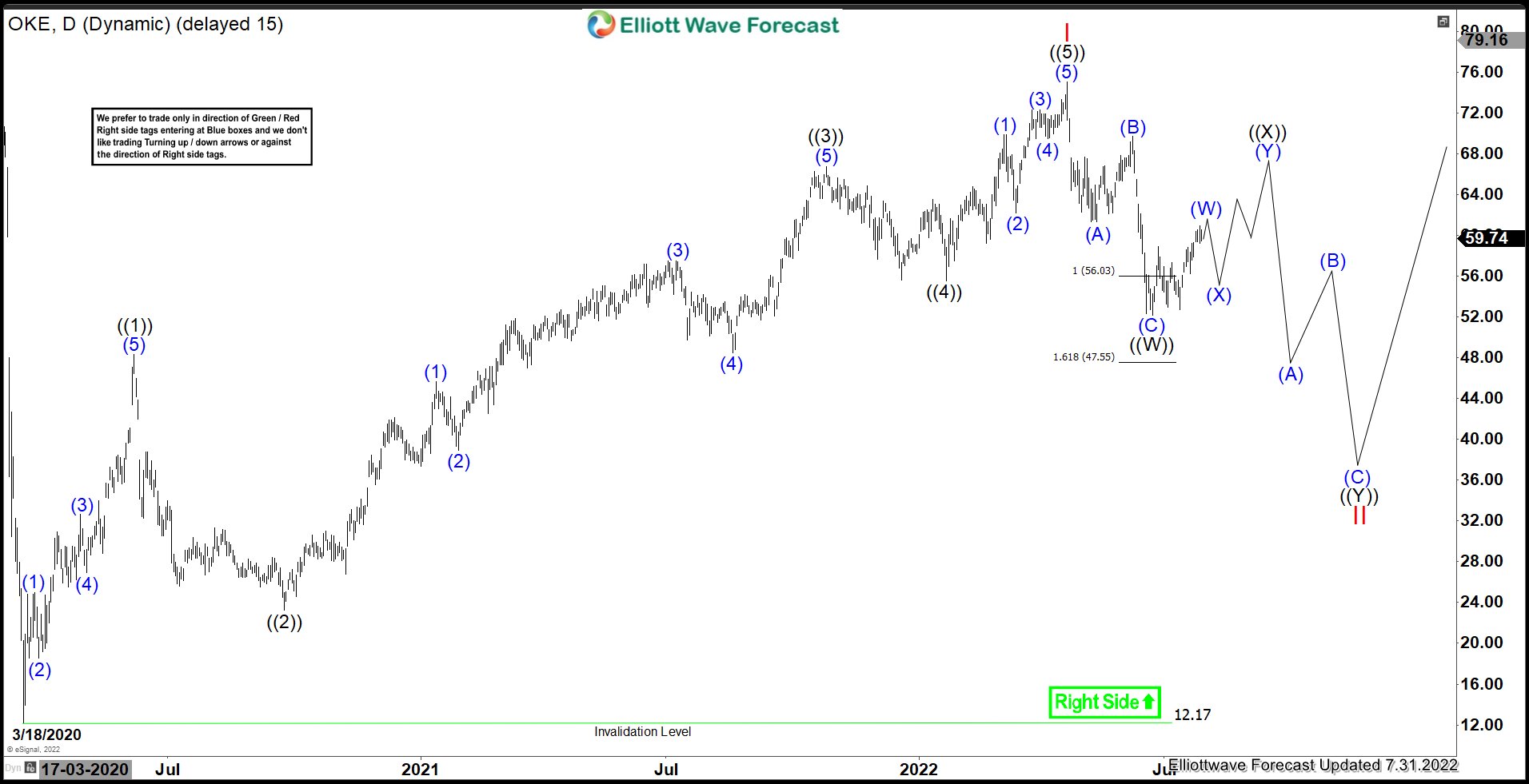

OKE : Should Expect More Weakness After A Corrective Bounce

Read MoreONEOK, Inc., (OKE) together with its subsidiaries, engages in gathering, processing, storage & transportation of natural gas in the United States. It operates through Natural gas gathering & processing, Natural gas liquids & Natural gas pipelines segments. The company has headquartered in Tulsa, Oklahoma, comes under Energy sector and trades as “OKE” ticker at NYSE. […]

-

Elliott Wave View: 5 Waves Rally in SPX Suggests Further Upside

Read MoreSPX shows a 5 waves up from 6.17.2022 low suggesting further upside is expected. This article and video look at the Elliott Wave path.

-

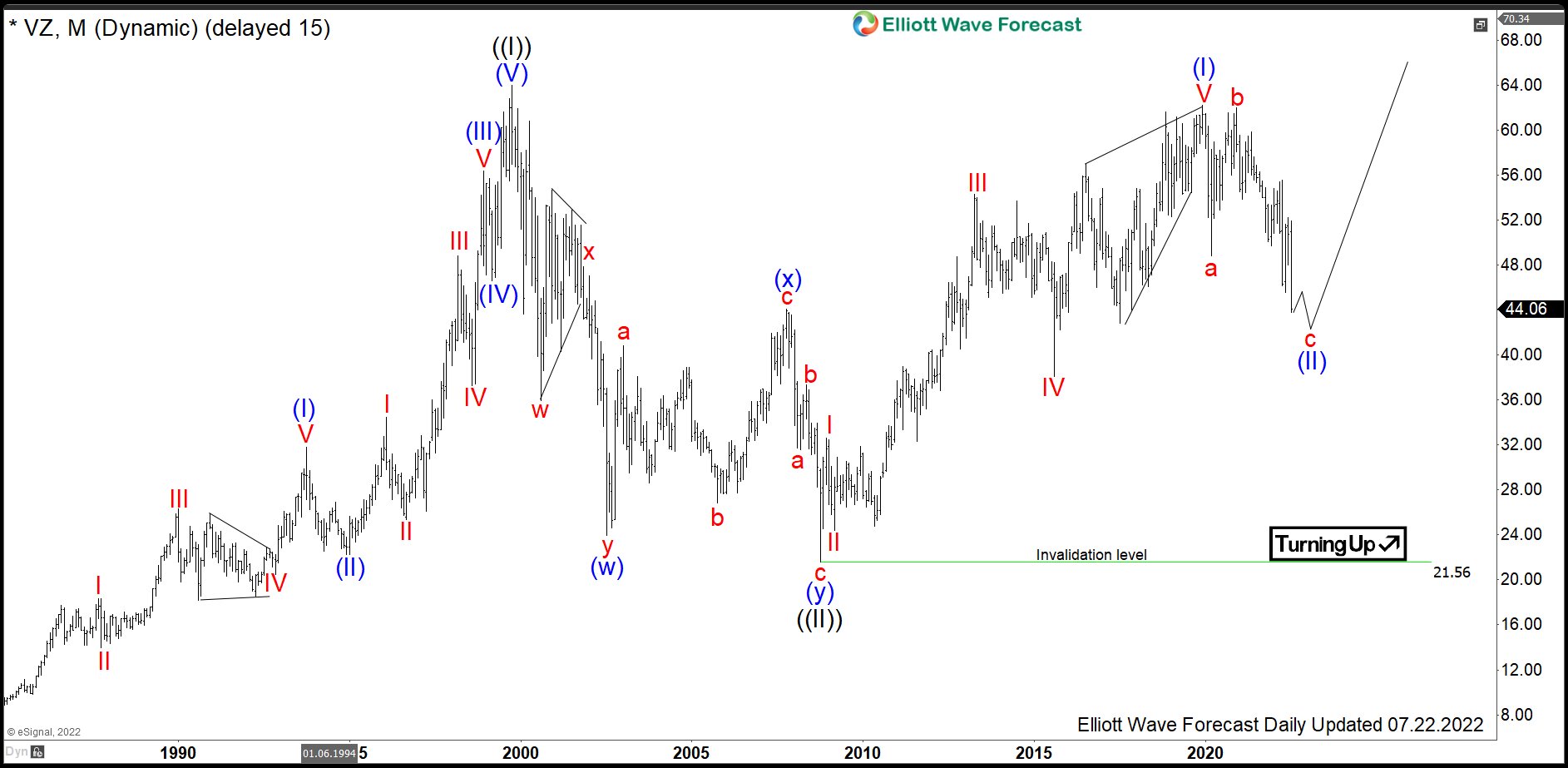

$VZ: Verizon Communications is Trading within Buying Area

Read MoreVerizon Communications Inc., commonly known as Verizon, is an US American telecommunications giant. Founded in 1983 as Bell Atlantic, it is a result of the break up of the Bell System into seven regional Baby Bells. Headquartered in New York, USA, Verizon is a part of DJIA, S&P100 and S&P500 indices. One can trade it […]

-

Updated Canopy Growth Corporation ($CGC) 4H Forecast

Read MoreGood day Traders and Investors. In today’s article, we are going to follow up on Canopy Growth Corporation ($CGC) forecast posted back in April 2022 and take a look at the latest 4H count. You can find the article here: https://elliottwave-forecast.com/stock-market/canopy-growth-corporation-cgc-lucrative-investment/ Company Profile: “Canopy is a global, best-in-class cannabis company and CPG organization with the intention […]

-

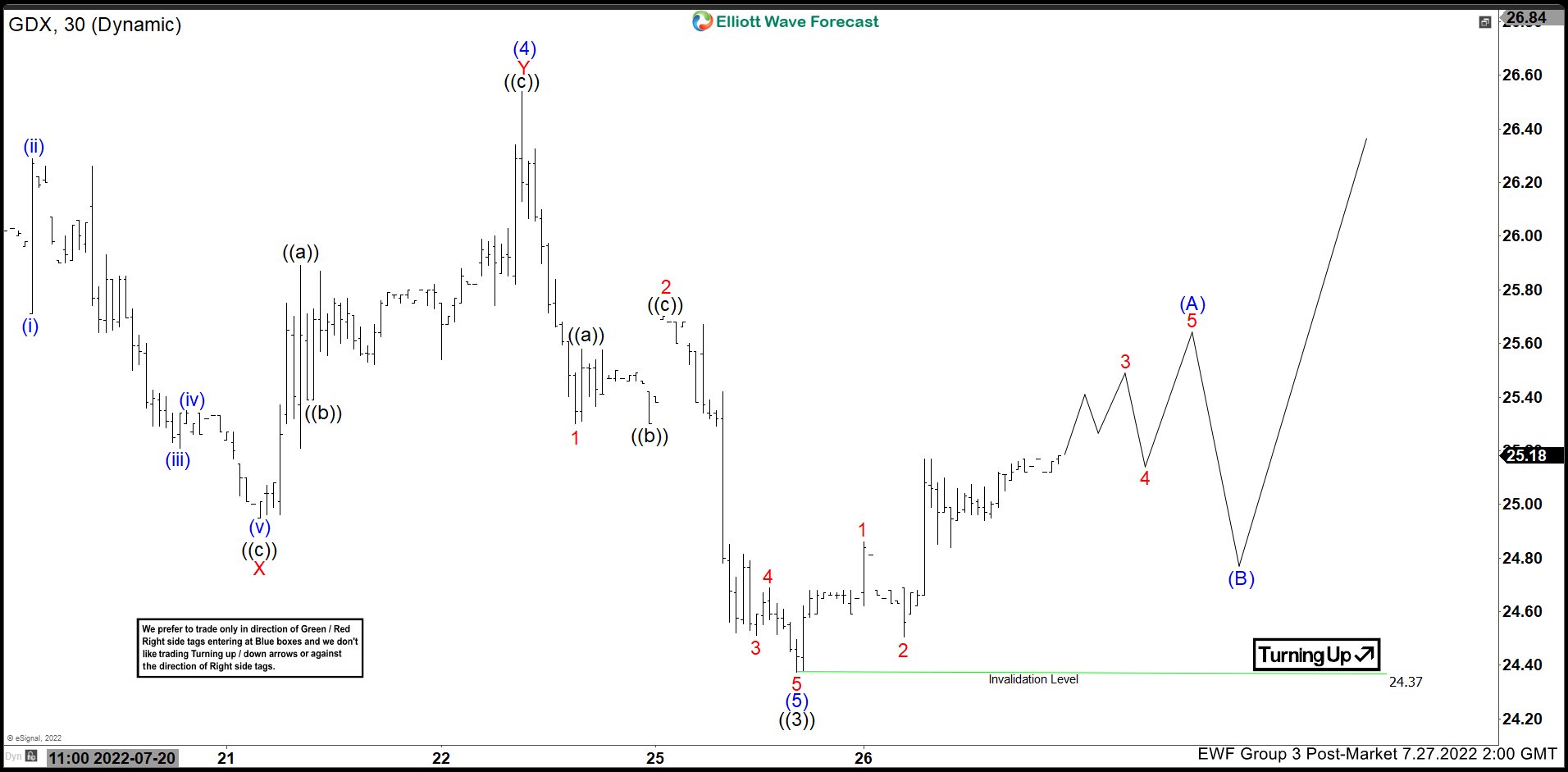

Elliott Wave View: GDX in Support Zone

Read MoreGDX (Gold Miners ETF) cycle from 4/18/2022 high is in progress as an impulse. This article and video look at the Elliott Wave path.