The Power of 3-7-11 and the Grand Super Cycle: How We Saw the Bullish Turn in April 2025 Back on April 9, 2025, while World Indices were dropping sharply and global sentiment had turned overwhelmingly bearish, we published an article that challenged the fear-driven narrative. We explained why selling was not the right approach and […]

-

Has Chewy Inc. ($CHWY) Bottomed and Ready to Rally?

Read MoreGood day Traders and Investors. In today’s article, we are going to take a look at the Elliott Wave path in Chewy Inc. ($CHWY) Chewy, Inc. founded in 2010, is an American online retailer of pet food and treats, pet supplies and pet medications, and other pet-health products, as well as pet services. It offers approximately 100,000 products from 3,000 […]

-

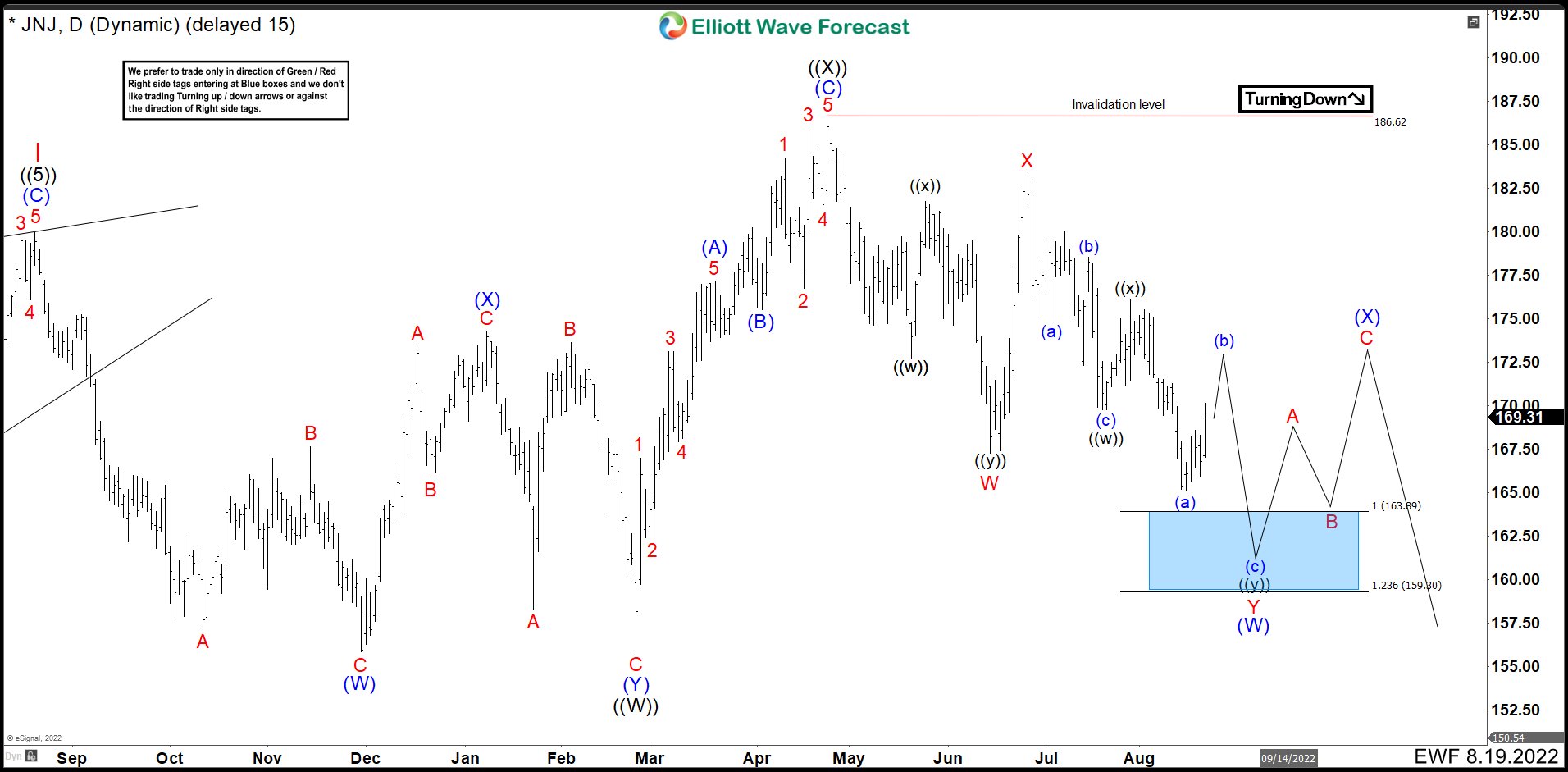

Johnson & Johnson (JNJ) Should Continue Choppiness Before More Downside

Read MoreJohnson & Johnson (JNJ) is an American multinational corporation founded in 1886 that develops medical devices, pharmaceuticals, and consumer packaged goods. Its common stock is a component of the Dow Jones Industrial Average, and the company is ranked No. 36 on the 2021 Fortune 500 list of the largest United States corporations by total revenue. […]

-

Best Cyclical Stocks to Buy in 2024

Read MoreWhat are Cyclical Stocks? The term cyclical describes things that aren’t behaving in a stable and regular pattern but occur in irregular intervals. It is a cycle is where the same events happen repeatedly in the same order. Cyclical stocks are securities that are heavily affected by economic cycles. These stocks go up and down […]

-

10 Best Green Energy Stocks to Buy in 2024

Read MoreWhat Is Green Energy? Green energy is energy generated from natural resources. The major sources of green energy are sunlight, wind, and water amongst others. The reason green energy is becoming increasingly popular is that they don’t harm the environment by emitting greenhouse gases into the atmosphere. The major forms of green energy are: Solar […]

-

SUN : Should Bounce Before Continue Correcting Lower

Read MoreSunoco LP (SUN) together with its subsidiaries, distributes & retails motor fuels in the US. It operates in two segments, Fuel distribution & Marketing & all other. The company is based in Dallas, TX, comes under Energy Sector & trades as “SUN” ticker at NYSE. SUN made an all time low at $10.46 in early […]

-

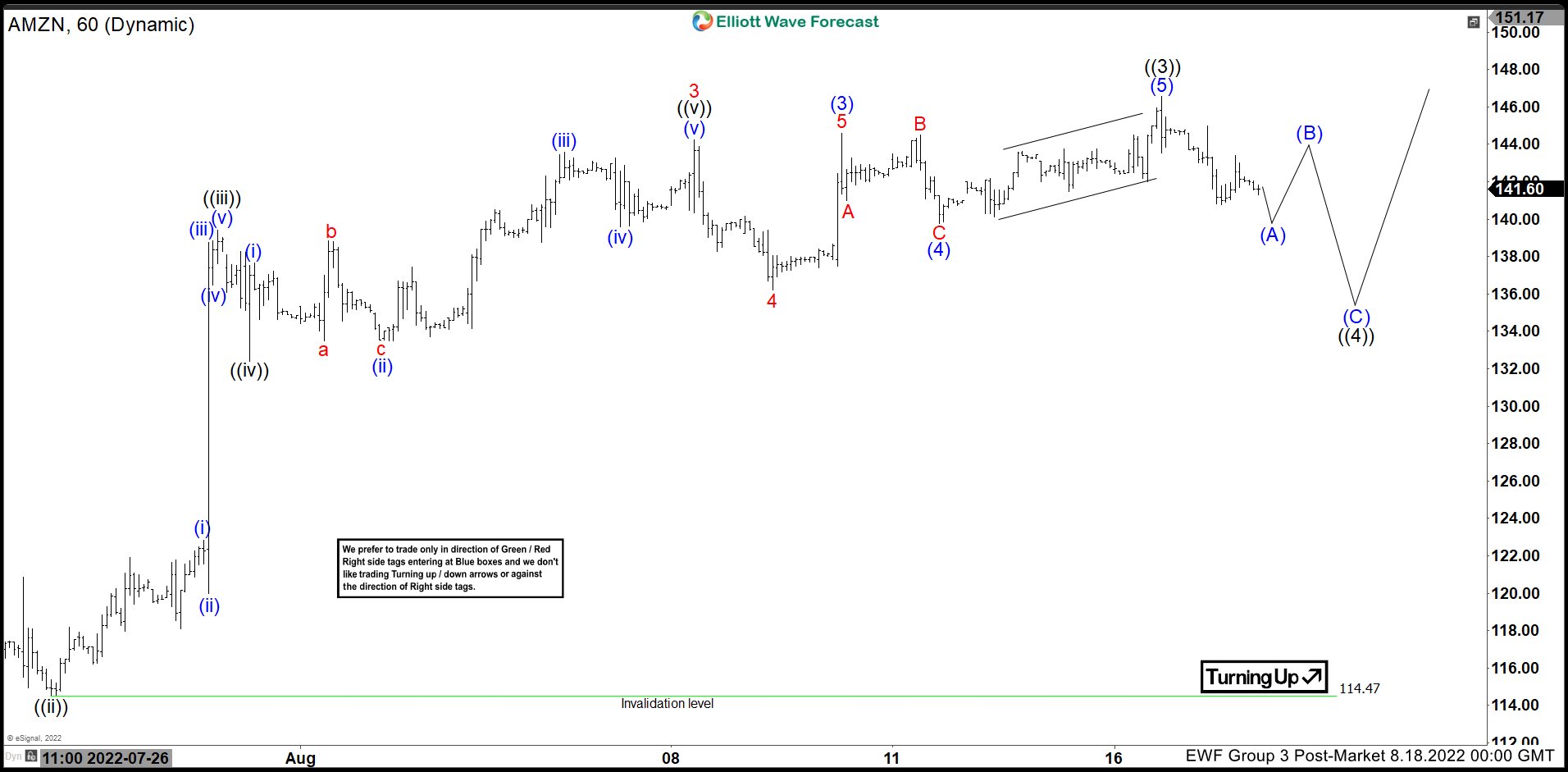

Elliott Wave View: Amazon (AMZN) in Wave 4 Pullback

Read MoreAmazon (AMZN) rally from 5.24.2022 low is in a 5 waves impulse and should see further upside. This article and video look at the Elliott Wave path.