The Power of 3-7-11 and the Grand Super Cycle: How We Saw the Bullish Turn in April 2025 Back on April 9, 2025, while World Indices were dropping sharply and global sentiment had turned overwhelmingly bearish, we published an article that challenged the fear-driven narrative. We explained why selling was not the right approach and […]

-

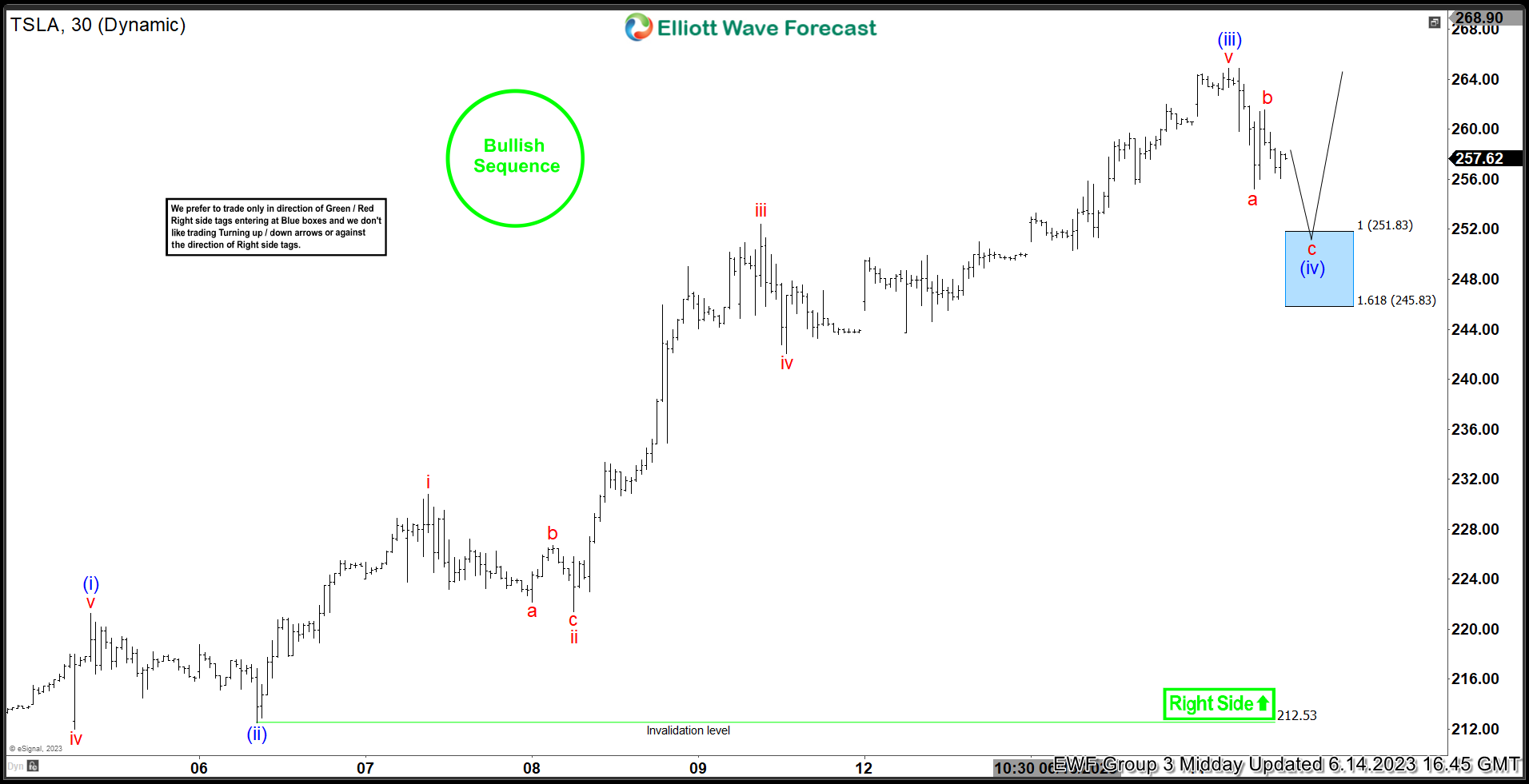

Tesla Inc. ($TSLA) Reacts Higher From The Blue Box Area.

Read MoreHello everyone. In today’s article, we will look at the past performance of the 1 Hour Elliott Wave chart of Tesla Inc. ($TSLA) The rally from 6.06.2023 low unfolded as a 5 wave impulse with an incomplete bullish sequence from 5.31.2023 low. So, we advised members to buy the pullback in 3 swings at the […]

-

Is Costco Wholesale (COST) Ready For The Next Rally?

Read MoreCostco Wholesale Corporation., (COST) engages in the operation of membership warehouse in the United States, Puerto Rico, Canada, United Kingdom, Mexico, Japan, Korea, Australia, Spain, France, Iceland, China & Taiwan together with its subsidiaries. It offers branded & private label products in the range of merchandise categories. It also operates e-commerce websites in the US, […]

-

JPMorgan (JPM) Shares Are Not Ready For A Pullback

Read MoreJPMorgan Chase & Co. (JPM) is an American multinational investment bank and financial services holding company headquartered in New York City and incorporated in Delaware. As of December 31, 2021, JPMorgan Chase is the largest bank in the United States, the world’s largest bank by market capitalization, and the fifth-largest bank in the world in […]

-

DAX Incomplete Elliott Wave Bullish Sequence Favors Higher

Read MoreDAX shows incomplete bullish sequence from 5.31.2023 low favoring more upside. This article and video look at the Elliott Wave path.

-

SPX Favors Rally With Bullish Momentum & Remain Supported

Read MoreShort term, SPX favors upside in wave ((iii)) of 3 started from 4048.28 low of 5.04.2023 and expect to remain supported in pullback. It is nesting as the part of impulse Elliott wave structure and favors further upside. It placed 2 of (3) at 3838.24 low and ((i)) of 3 at 4186.92 high. Within wave […]

-

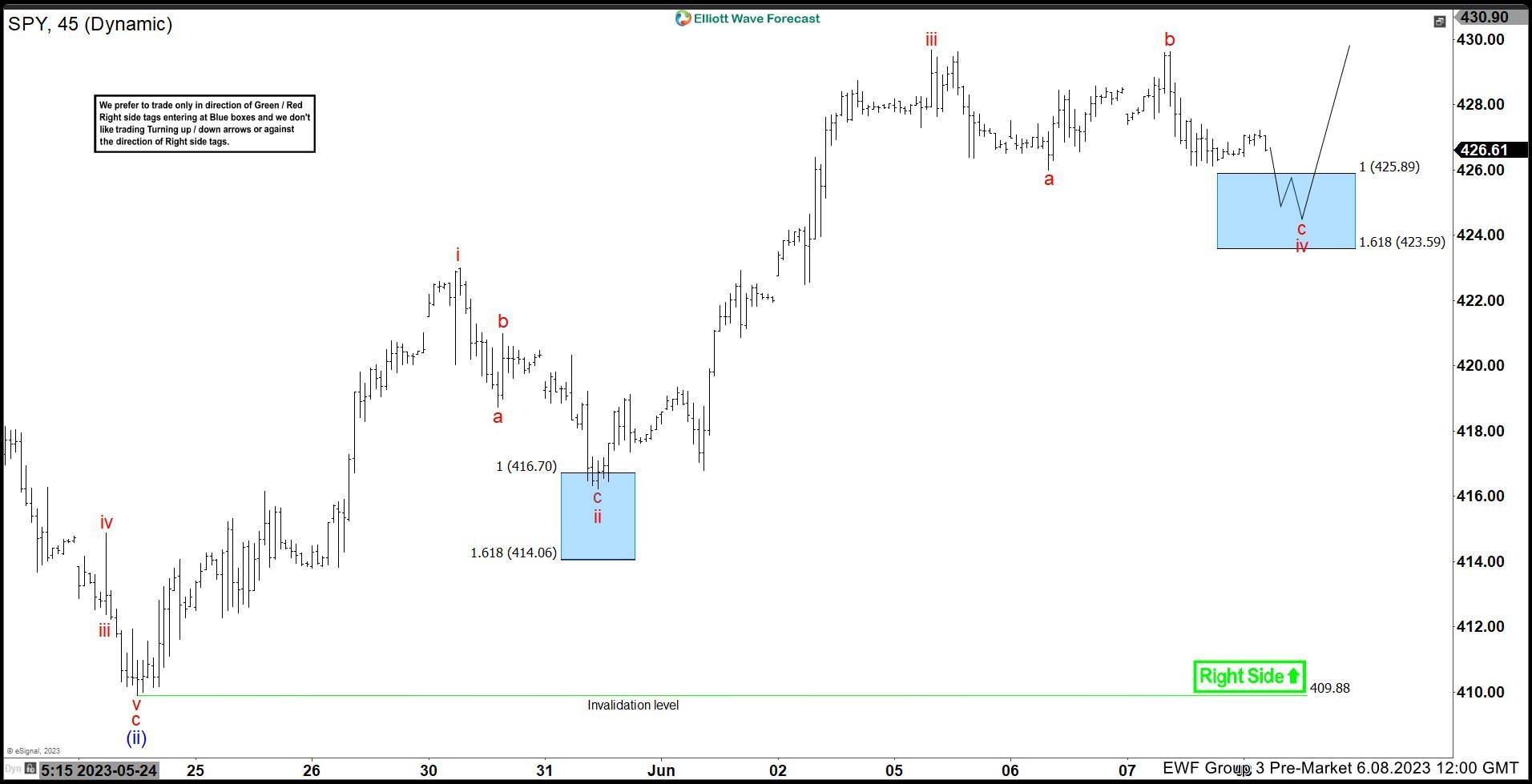

SPY Reacting Higher Perfectly From The Blue Box Area

Read MoreIn this technical blog, we will look at the past performance of the 1-hour Elliott Wave Charts of SPY. We presented to members at the elliottwave-forecast. In which, the rally from 24 May 2023 low unfolded as an impulse structure. And showed a higher high sequence favored more upside extension to take place. Therefore, we advised members not […]