The Power of 3-7-11 and the Grand Super Cycle: How We Saw the Bullish Turn in April 2025 Back on April 9, 2025, while World Indices were dropping sharply and global sentiment had turned overwhelmingly bearish, we published an article that challenged the fear-driven narrative. We explained why selling was not the right approach and […]

-

Best Growth Stocks Right Now in 2024

Read MoreWhat are Growth Stocks? Growth stocks are stocks that offer a substantially higher growth rate as opposed to the mean growth rate prevailing in the market. Growth stock grows at a faster rate than the average stock in the market and consequently, generates earnings more rapidly. Characteristics of a Growth Stock High growth rate Growth […]

-

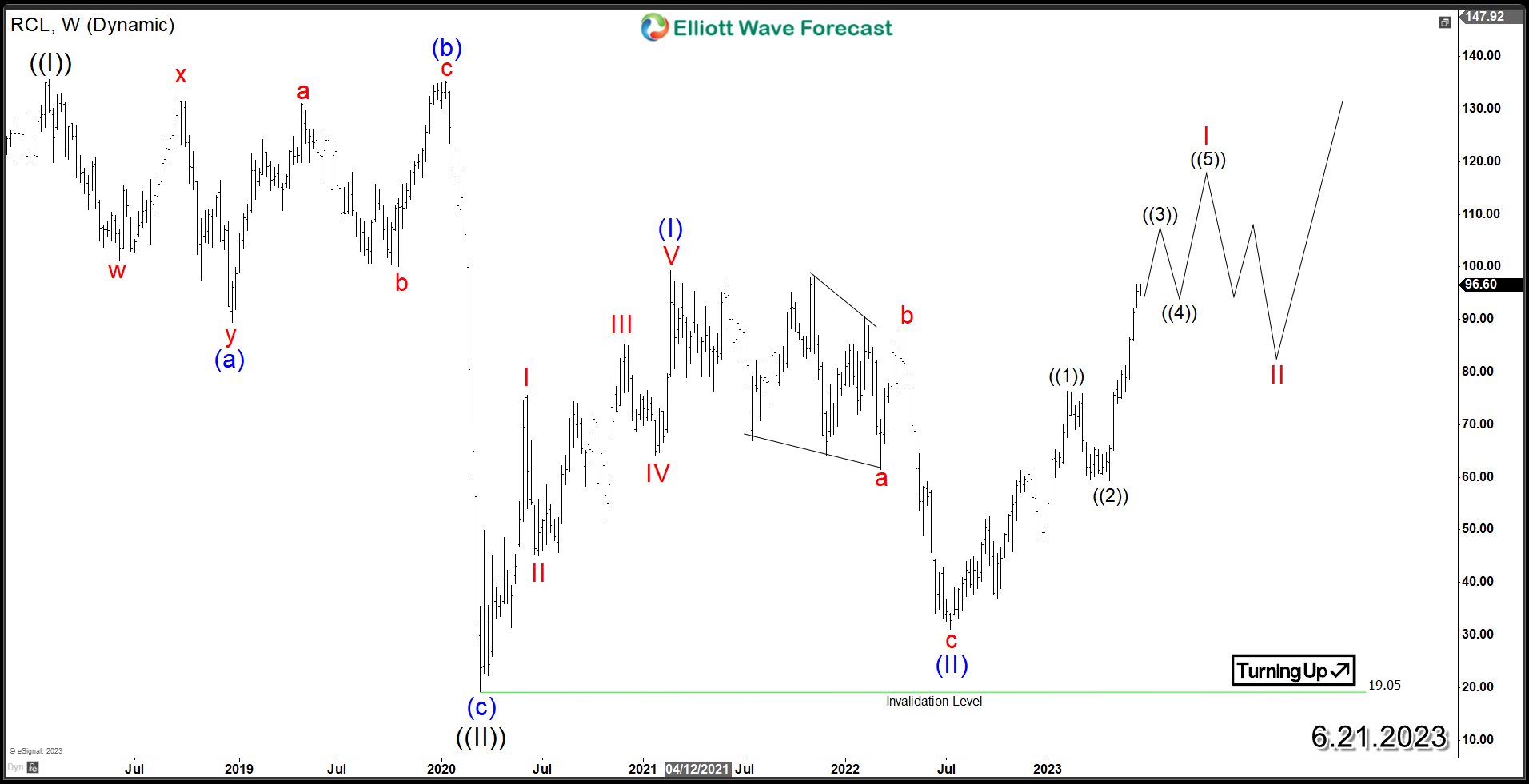

Royal Caribbean Cruises (NYSE: RCL) Sets Sail For Profitable Growth

Read MoreRoyal Caribbean Cruises Ltd (NYSE: RCL), a leading player in the global cruise industry, has weathered the challenges of the past year and is now poised for continued growth and success. As the world emerges from the pandemic and travel restrictions gradually ease, Royal Caribbean Cruises is well-positioned to capitalize on the pent-up demand for […]

-

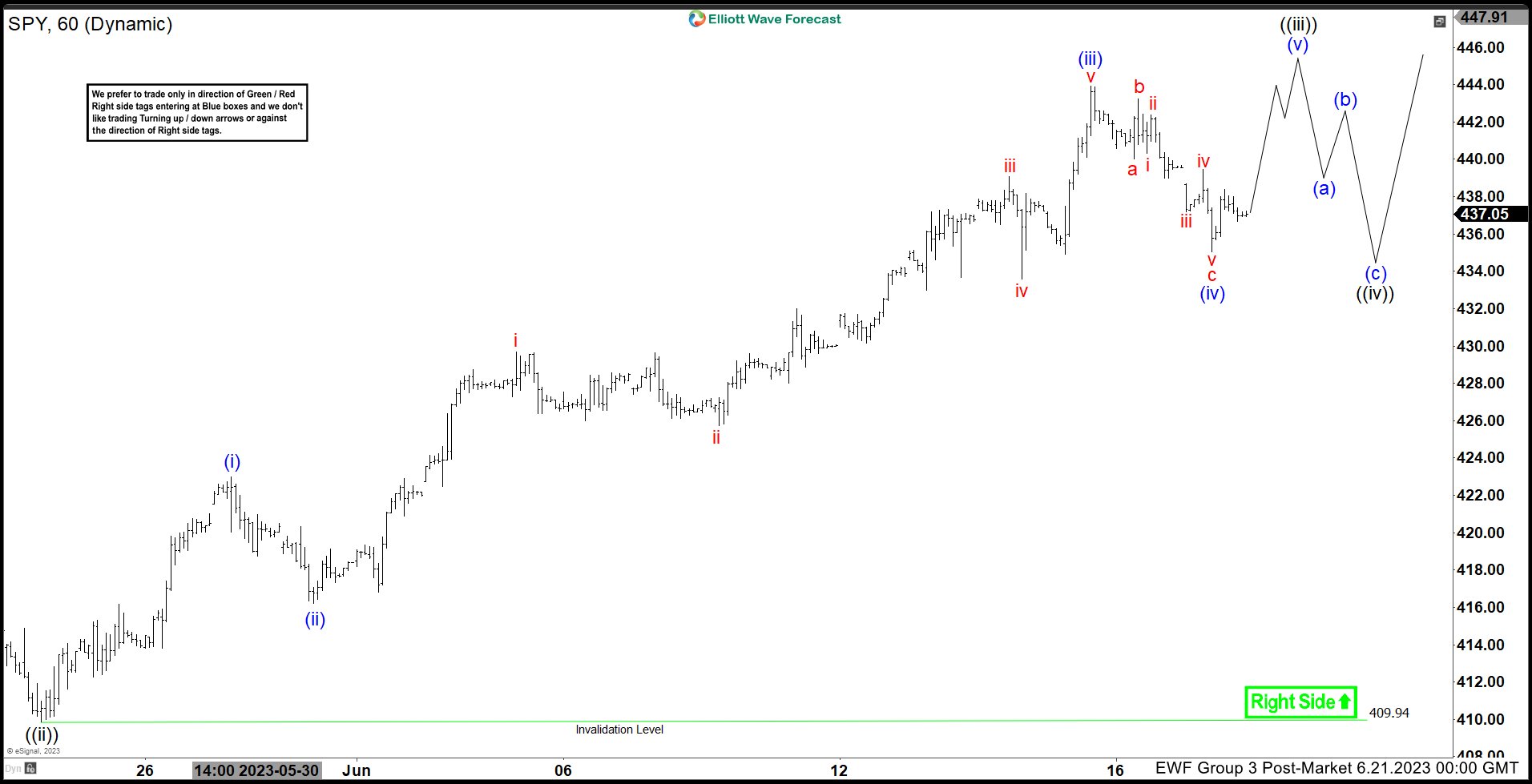

S&P 500 ETF (SPY) Elliott Wave Sequence Remains Bullish

Read MoreShort term, SPY favors higher in impulse Elliott wave sequence started from 5.04.2023 low and expect further strength to continue in wave 3. SPY finished wave 1 at 417.62 high started from 3.13.2023 low. It placed ((i)) at 402.49 high and ((ii)) at 389.33 low as 0.618 Fibonacci retracement. It finished ((iii)) of 1 at […]

-

World Indices: Can History repeat itself

Read MoreWorld Indices Overview The World Indices rally since the low at 10.2022. Many are already trading into new highs above the 2022 peak. The idea can be seen as bullish, and our expected wave III of (3) might have started. As it is known across the trading world, we at EWF are very bullish on […]

-

QQQ Correcting in Wave 4 and Should Find Buyers

Read MoreNasdaq 100 ETF (QQQ) rallying as an impulse and now pulling back in wave 4. Buyers should appear in 3, 7, or 11 swing for more upside.

-

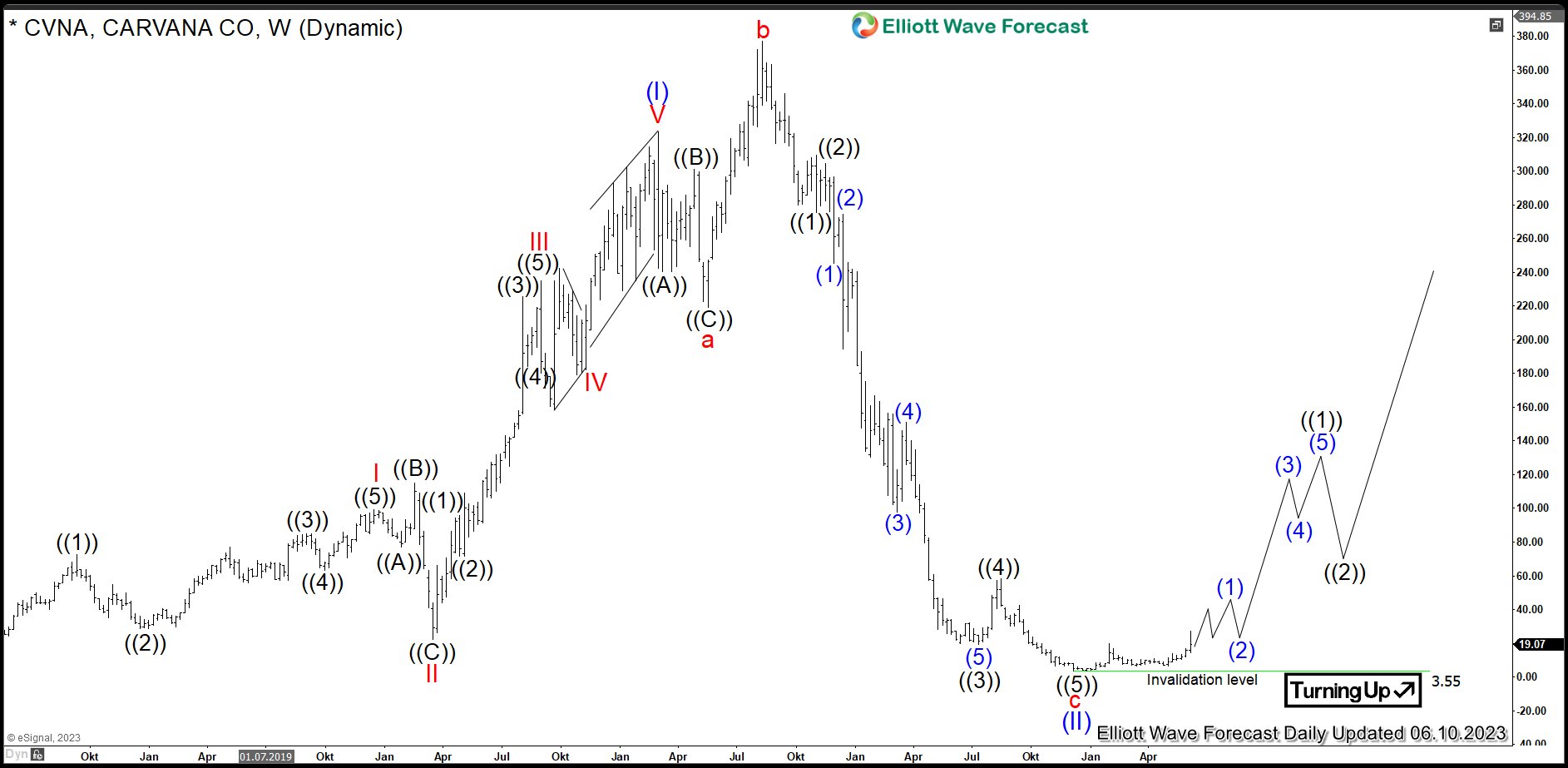

$CVNA: Car Retailer Carvana Entered Next Bullish Cycle

Read MoreCarvana Co. is an online used car retailer and is known for its multi-store car vending machines. Today, the company is the fastest growing online used car dealer in the United States. Recently, Carvana gained publicity as it was named to the 2021 Fortune 500 list, in fact, one of the youngest companies to be added to the list. […]