The Power of 3-7-11 and the Grand Super Cycle: How We Saw the Bullish Turn in April 2025 Back on April 9, 2025, while World Indices were dropping sharply and global sentiment had turned overwhelmingly bearish, we published an article that challenged the fear-driven narrative. We explained why selling was not the right approach and […]

-

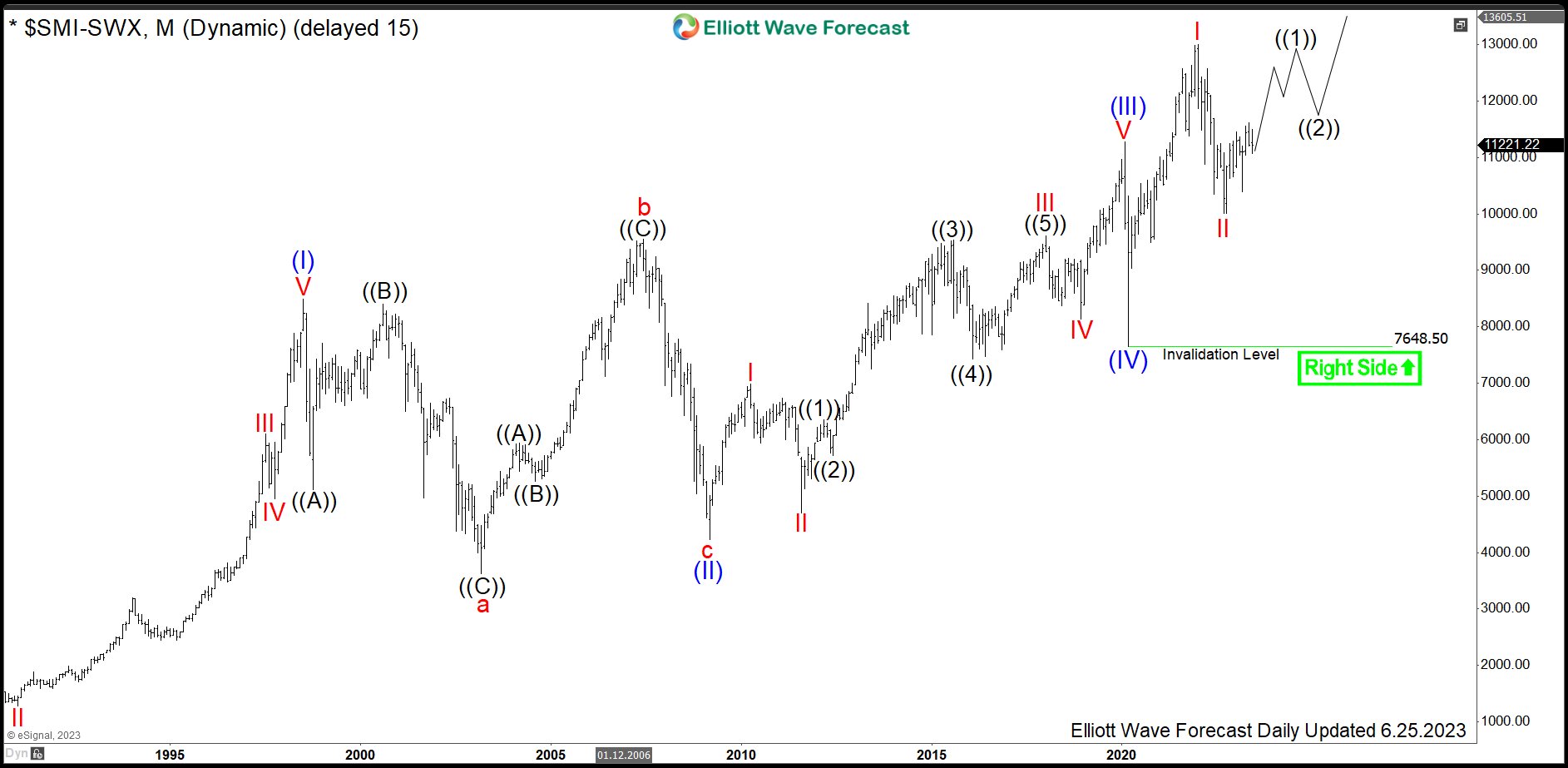

SMI: Swiss Market Index to Accelerate After Double Nest

Read MoreSMI is a Swiss Market Index representing a capitalization-weighted measure of the 20 most significant stocks on the SIX Swiss Exchange in Zurich; the ticker is $SMI. In the initial blog article from November 2020, we were calling the “COVID-19” drop in February-March 2020 to become a significant low in world indices. We were right. Then, in the […]

-

E.L.F Beauty ELF Rides the Strong Wave of Bullish Sentiment

Read MoreIn the dynamic world of beauty and cosmetics, e.l.f. Beauty Inc (NYSE : ELF ) has been making waves with its innovative products and customer-centric approach. The company has been riding a strong wave of bullish sentiment, driven by its ability to capture the hearts of consumers and deliver impressive financial results. In this article, we will […]

-

SPDR Consumer Discretionary ETF ($XLY) Blue Box Area Wins Again.

Read MoreHello everyone. In today’s article, we will look at the past performance of the 1 Hour Elliott Wave chart of SPDR Consumer Discretionary ETF ($XLY). The rally from 5.31.2023 low unfolded as a 5 wave impulse with an incomplete bullish sequence from 5.25.2023 low. So, we advised members to buy the pullback in 3 swings […]

-

Pan American Silver (PAAS) Correcting in a Flat Structure

Read MorePan American Silver (PAAS) continues to extend lower and it looks like the stock is correcting in a flat structure as the second daily chart below shows. The stock is a good representation for the silver mining sector. Although it has been pretty tough lately for mining sector generally (both gold and silver miners), a […]

-

Is Albemarle Corporation (ALB) Providing Another Investment Opportunity ?

Read MoreAlbemarle Corporation (ALB) develops, manufactures & markets engineered specialty chemicals worldwide. It operates through three segments, Lithium, Bromine & Catalysts. It also serves energy storage, petroleum refining, consumer electronics, construction, automotive, lubricants, pharmaceuticals & crop protection markets. It is headquartered in Charlotte, NC, comes under Basic Materials sector & trades under “ALB” ticker at NYSE. […]

-

Nio Inc. (NIO) Hit The Blue Box And Rally As Expected

Read MoreNio Inc. (NIO) is a Chinese multinational automobile manufacturer headquartered in Shanghai, specializing in designing and developing electric vehicles. The company develops battery-swapping stations for its vehicles, as an alternative to conventional charging stations. The company has raised over $5 billions from investors. In 2021, it plans to expand to 25 different countries and regions by 2025. NIO Daily […]