The Power of 3-7-11 and the Grand Super Cycle: How We Saw the Bullish Turn in April 2025 Back on April 9, 2025, while World Indices were dropping sharply and global sentiment had turned overwhelmingly bearish, we published an article that challenged the fear-driven narrative. We explained why selling was not the right approach and […]

-

SPDR S&P Bank ETF (KBE) Bouncing from Daily Blue Box Area

Read MoreSPDR S&P Bank ETF (KBE) is a widely-tracked exchange-traded fund that provides exposure to the banking sector within the S&P 500 index. As an essential component of the financial markets, KBE offers investors an opportunity to participate in the performance of leading banks and financial institutions. This article will explore the current outlook for KBE, based […]

-

Freeport-McMoRan (FCX) Should Remain Sideways To Higher

Read MoreFreeport-McMoRan Inc., (FCX) engages in the mining of minerals in North America, South America & Indonesia. It primarily explores for Copper, Gold, Molybdenum, Silver & other metals, as well as Oil & gas. It is based in Phoenix, Arizona, US, comes under Basic Materials sector & trades as “FCX” ticker at NYSE. FCX finished corrective […]

-

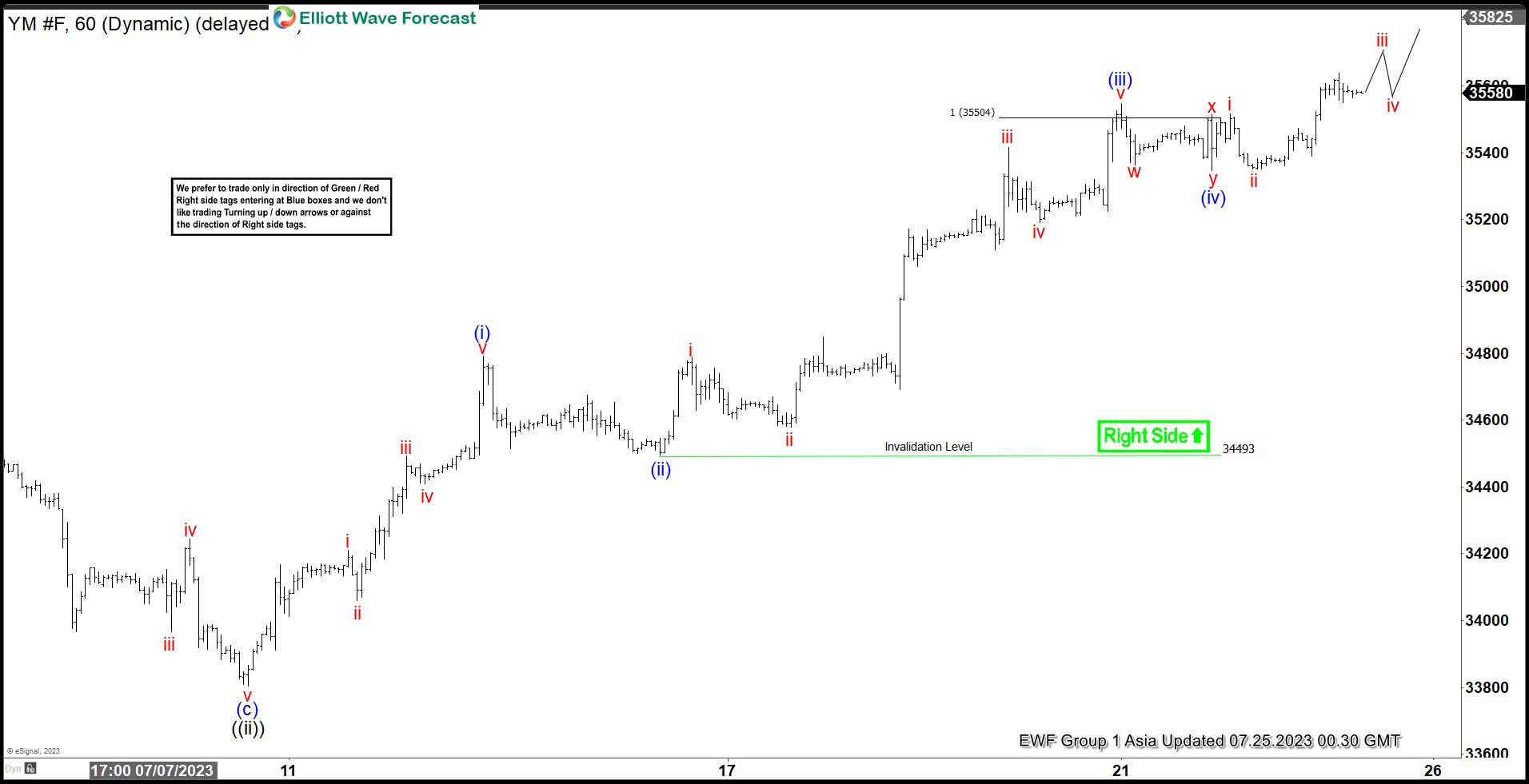

Dow Futures (YM) Ending Short Term Impulse Soon

Read MoreDow Futures (YM) is about to end cycle from 7.10.2023 low as 5 waves impulse and see pullback. This article and video look at the Elliott Wave path.

-

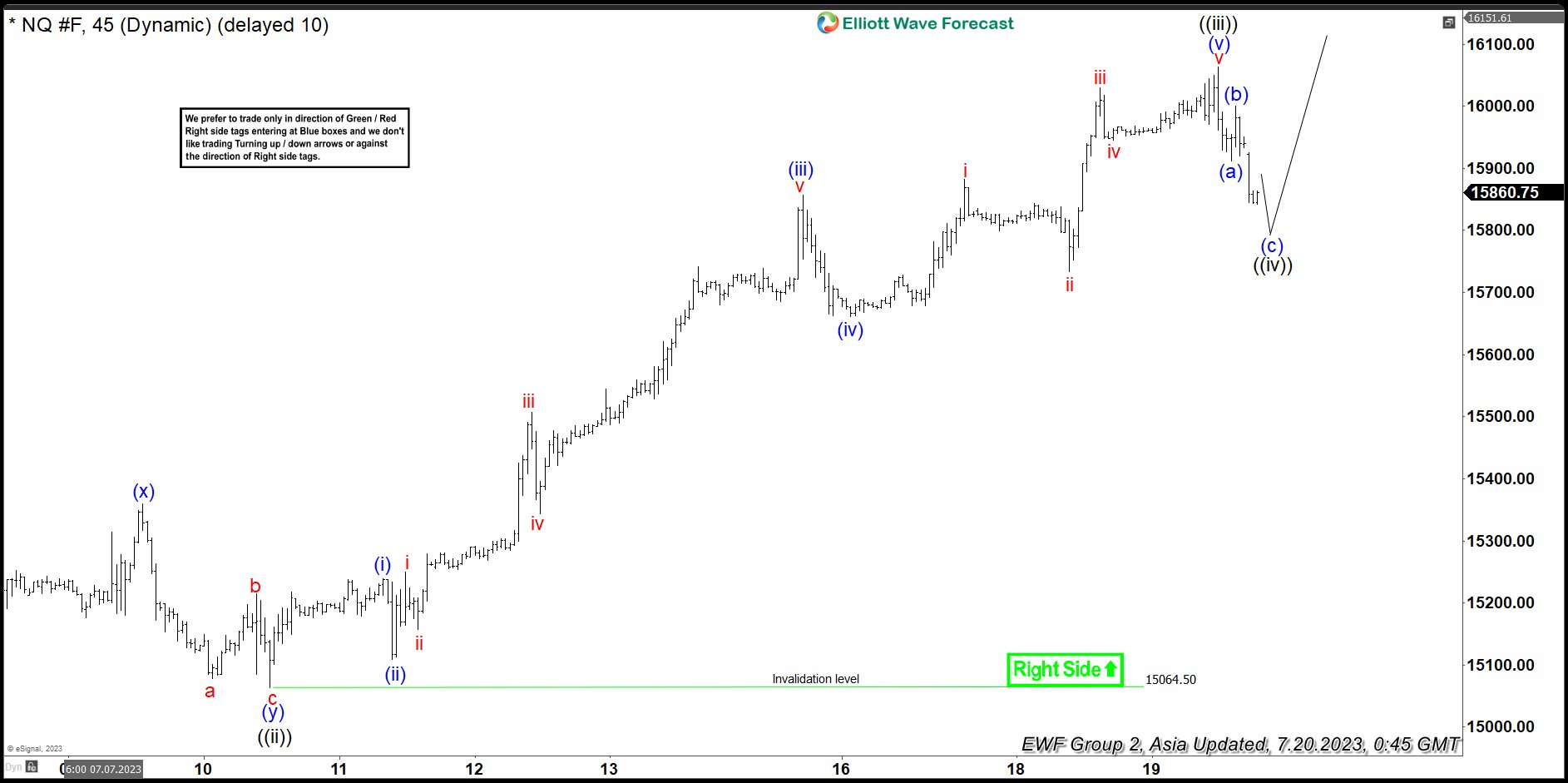

Nasdaq (NQ) Pullback Should Continue to Find Support

Read MoreNasdaq (NQ) Shows an Impulsive Rally and Pullback should find support in 3, 7, 11 swing. This article and video look at the Elliott Wave path.

-

Gold Miners ETF (GDX) Bullish View Showing Impulsive Rally

Read MoreGold Miners ETF (GDX) shows 5 waves impulsive rally from 6.29.2023 low favoring further upside. This article and video look at the Elliott Wave path.

-

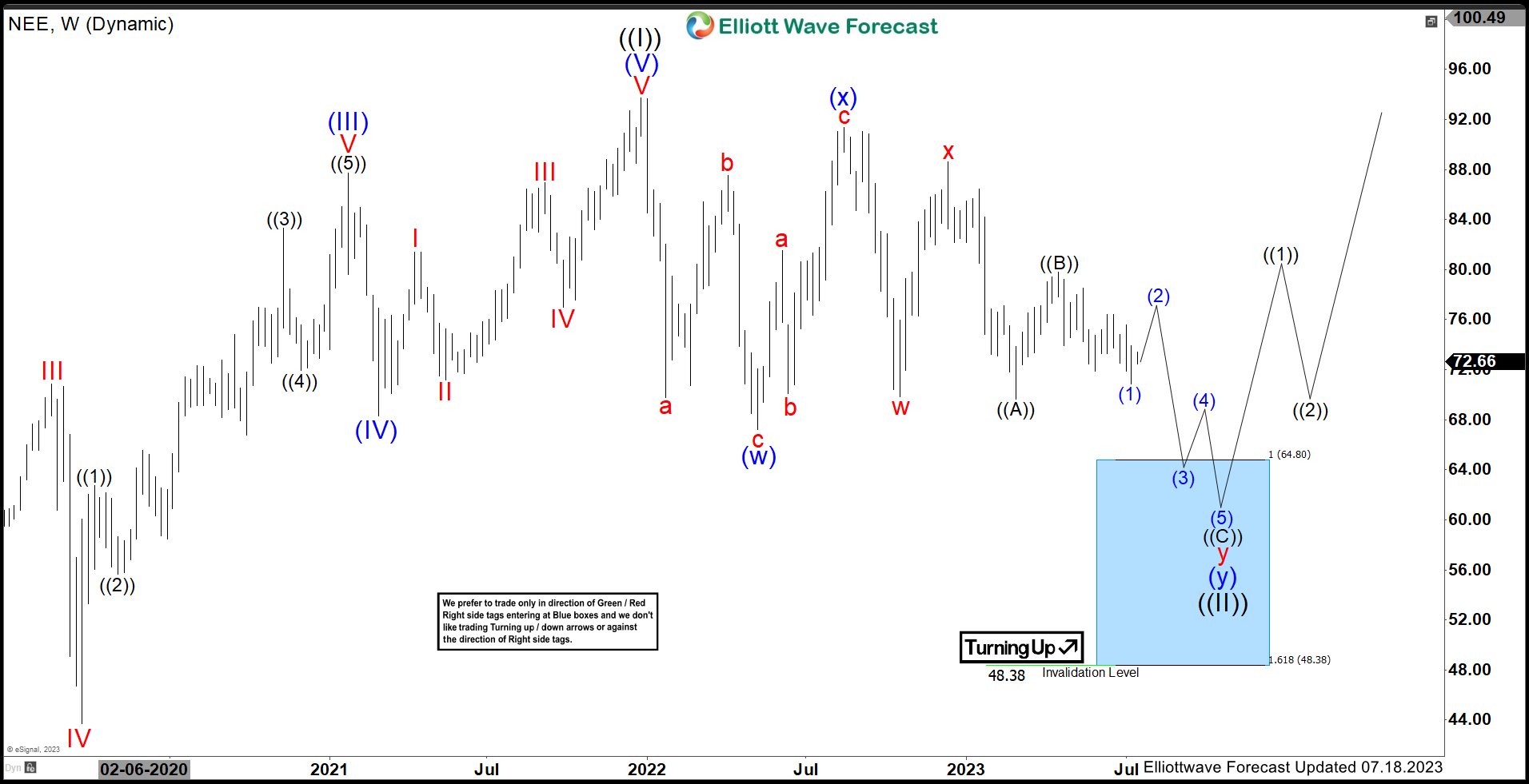

NextEra Energy (NEE) Favors Sideways Lower Before Rally Resumes

Read MoreNextEra Energy Inc (NEE) generates, transmits, distributes & sells electric power to retail & wholesale customers in North America. The company generates electricity through wind, solar, coal, nuclear & natural gas. It is based in Juno Beach, Florida, comes under Utility sector & trades as “NEE” ticker at NYSE. NEE made an all time high […]