The Power of 3-7-11 and the Grand Super Cycle: How We Saw the Bullish Turn in April 2025 Back on April 9, 2025, while World Indices were dropping sharply and global sentiment had turned overwhelmingly bearish, we published an article that challenged the fear-driven narrative. We explained why selling was not the right approach and […]

-

DAX Higher High Sequence Supports More Upside

Read MoreDAX short term cycle from 7.7.2023 low is showing a higher high sequence supports more upside. This article and video look at the Elliott Wave path.

-

Crocs Inc (CROX) Favors Corrective Pullback Before Rally Resumes

Read MoreCrocs Inc., (CROX) designs, manufactures, markets & distributes casual lifestyle footwear & accessories for men, women & children worldwide. The company sells its products in approximately 85 countries through wholesalers, retail stores, e-commerce sites & third-party marketplaces. It is based in Colorado, US, comes under Consumer Cyclical sector & trades as “CROX” ticker at Nasdaq. […]

-

$CVS: CVS Health Corporation Trading within Bullish Triangle

Read MoreCVS Health Corporation is an US American healthcare company. Founded in 1963 and headquartered in Woonsocket, Rhode Island, USA, it is a part of S&P100 and S&P500 indices. Investors can trade it under the ticker $CVS at New York Stock Exchange. CVS Health owns CVS Pharmacy, a retail pharmacy chain; CVS Caremark, a pharmacy benefits manager; and Aetna, a health insurance […]

-

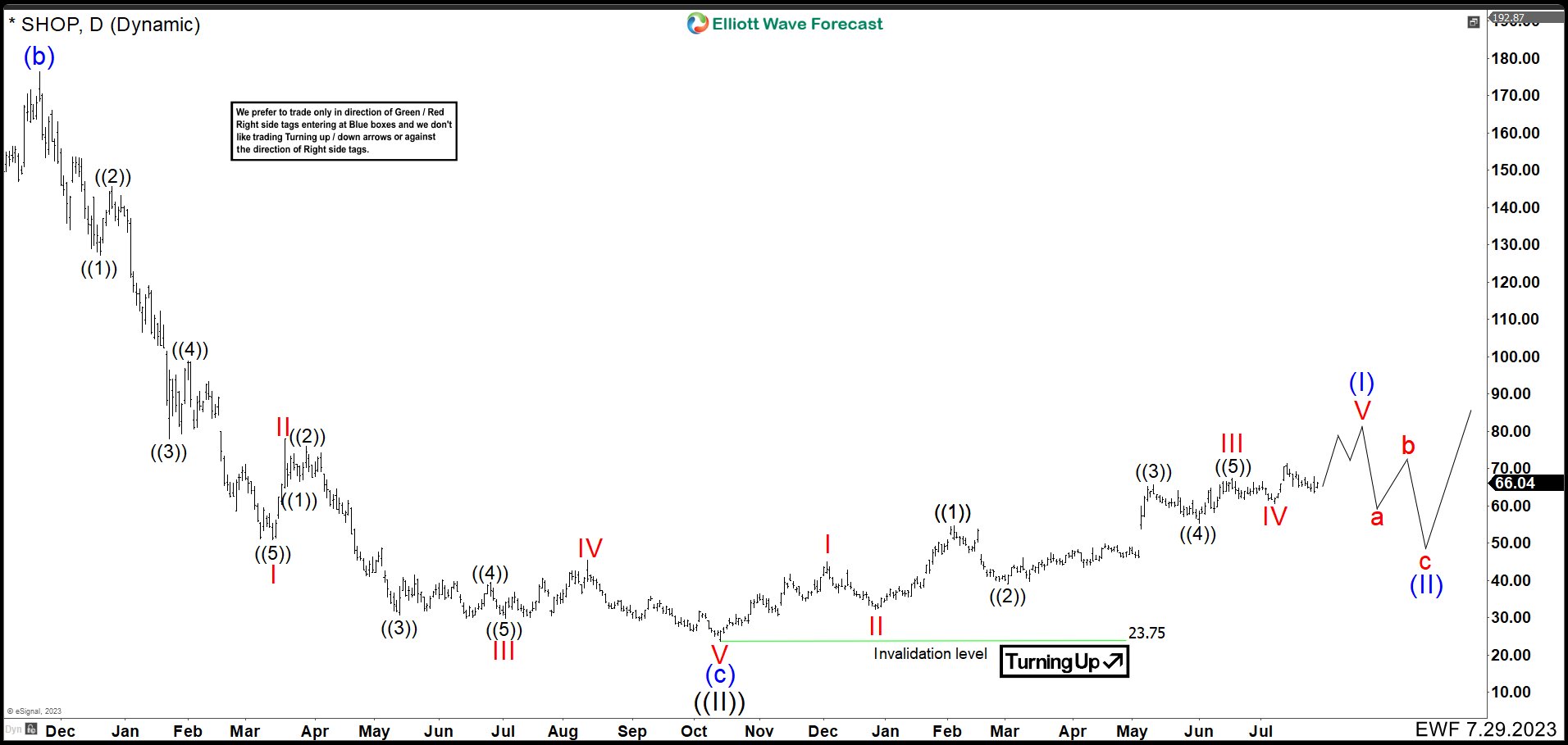

Shopify (SHOP) Is Extending An Impulse From October 2022 low

Read MoreShopify Inc. is a Canadian multinational e-commerce company headquartered in Ottawa, Ontario. Shopify (SHOP) is the name of its proprietary e-commerce platform for online stores and retail point-of-sale systems. The Shopify platform offers online retailers a suite of services including payments, marketing, shipping and customer engagement tools. SHOP Daily Chart February 2023 Shopify ended a Grand Supercycle in July 2021 and we labeled it as wave ((I)). Since […]

-

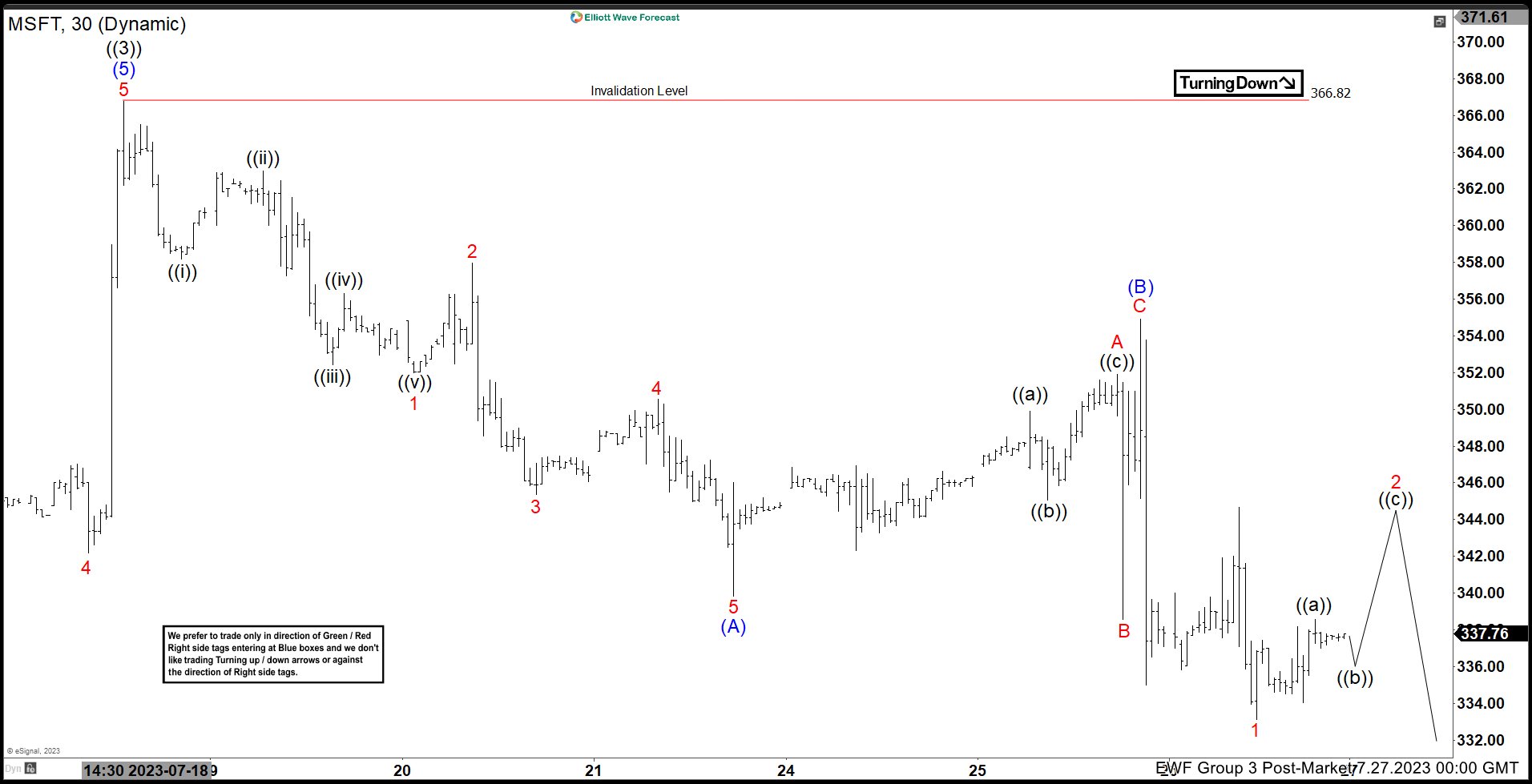

Microsoft (MSFT) Looking for Zigzag Pullback

Read MoreMicrosoft (MSFT) is correcting in wave ((4)) as a zigzag before it resumes higher. This article and video look at the Elliott Wave path.

-

Travelers (TRV) Is Correcting The Cycle From March 2020 Low.

Read MoreThe Travelers Companies, Inc., TRV, is an American insurance company. It is the second-largest writer of U.S. commercial property casualty insurance, and the sixth-largest writer of U.S. personal insurance through independent agents. Weekly TRV Chart July 2023 TRV ended a great super cycle in the year of 2019 reaching a peak at $154.86 which we call […]