The Power of 3-7-11 and the Grand Super Cycle: How We Saw the Bullish Turn in April 2025 Back on April 9, 2025, while World Indices were dropping sharply and global sentiment had turned overwhelmingly bearish, we published an article that challenged the fear-driven narrative. We explained why selling was not the right approach and […]

-

General Electric Co. ($GE) Reacts Higher From The Blue Box Area.

Read MoreHello everyone. In today’s article, we will look at the past performance of the 1 Hour Elliott Wave chart of General Electric Co. ($GE) The rally from 6.23.2023 low unfolded as a 5 wave impulse with an incomplete bullish sequence from 7.19.2023 low. So, we advised members to buy the pullback in 7 swings at […]

-

Southern Copper (SCCO) Favors Upside & Should Remain Supported

Read MoreSouthern Copper Corporation (SCCO) engages in mining, exploration, smelting & refining of Copper & other minerals in Peru, Mexico, Argentina, Ecuador & Chile. The company is based in Phoenix, Arizona, US, comes under Basic Materials Sector & trades as “SCCO” ticker at NYSE. As discussed in previous article, SCCO favors pullback in ((2)), which ended […]

-

Nikkei ( $NKD_F ) Should Find Extreme In Wave 4 Pullback Soon

Read MoreNikkei ($NKD_F) pullback from the peak should find extreme in wave 4 soon. This article and video look at the Elliott Wave path of the index.

-

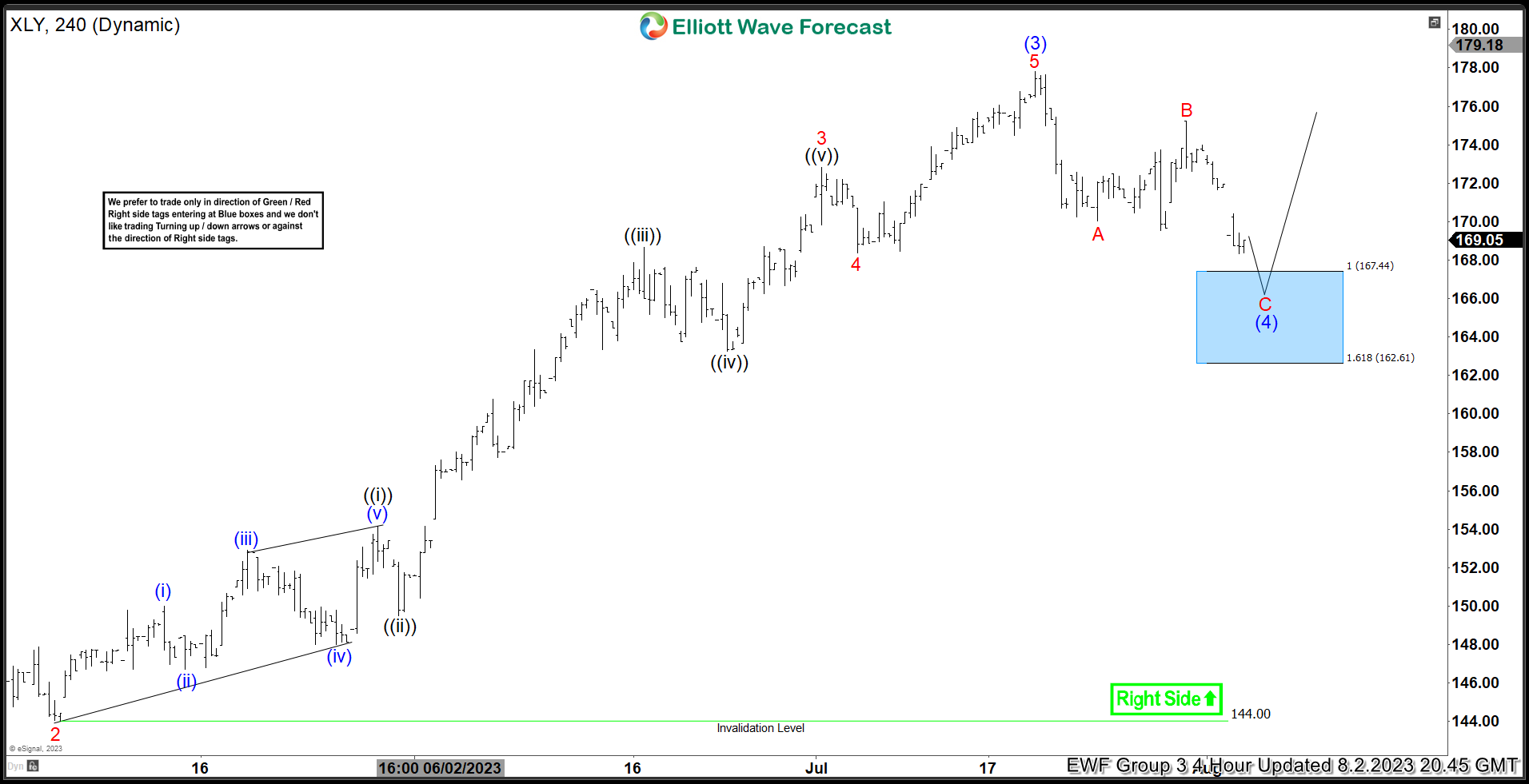

XLY Reacted Strongly From The Extreme Blue Box Area

Read MoreIn this blog, we take a look at the past performance of XLY charts. The ETF provided a buying opportunity in the blue box area.

-

NVDA 3 Wave Pullback Soon Should Find Support

Read MoreNVDA short term pullback from the peak is expected to find support soon. This article and video look at the Elliott Wave path.

-

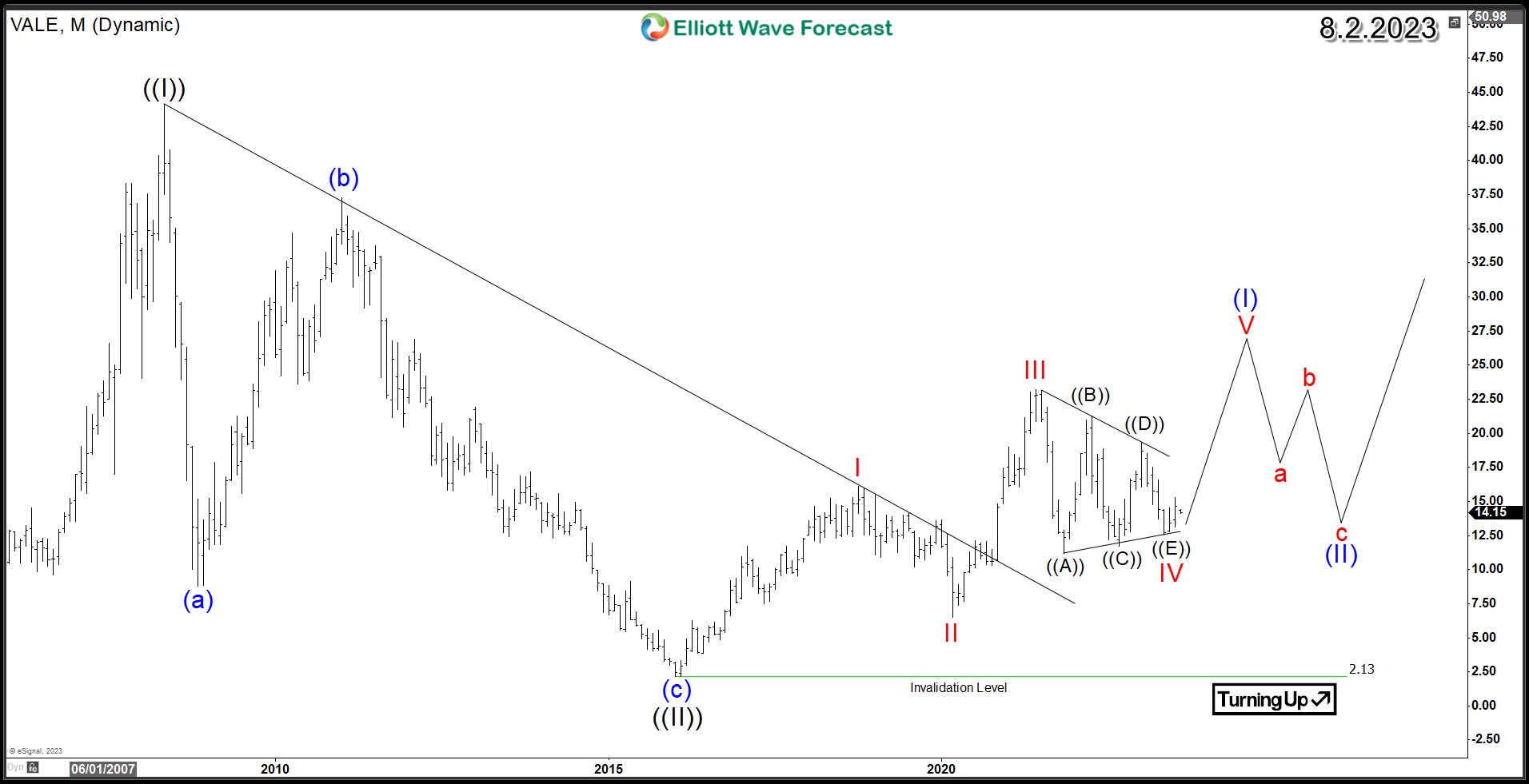

Vale SA (NYSE: VALE) Price Action Signals Further Upside

Read MoreAs a major player in the mining sector, Vale SA (NYSE: VALE) has been making significant strides with its robust performance and strategic position in the industry. This article will delve into Vale’s Monthly chart analysis, focusing on the bullish continuation pattern that has been unfolding. In a prior 2019 article, we examined the prospect […]