The Power of 3-7-11 and the Grand Super Cycle: How We Saw the Bullish Turn in April 2025 Back on April 9, 2025, while World Indices were dropping sharply and global sentiment had turned overwhelmingly bearish, we published an article that challenged the fear-driven narrative. We explained why selling was not the right approach and […]

-

Tesla (TSLA) Correction Remains in Progress

Read MoreTesla (TSLA) cycle from July 19, 2023 high remains incomplete and favors more downside. This article and video look at the Elliott Wave path.

-

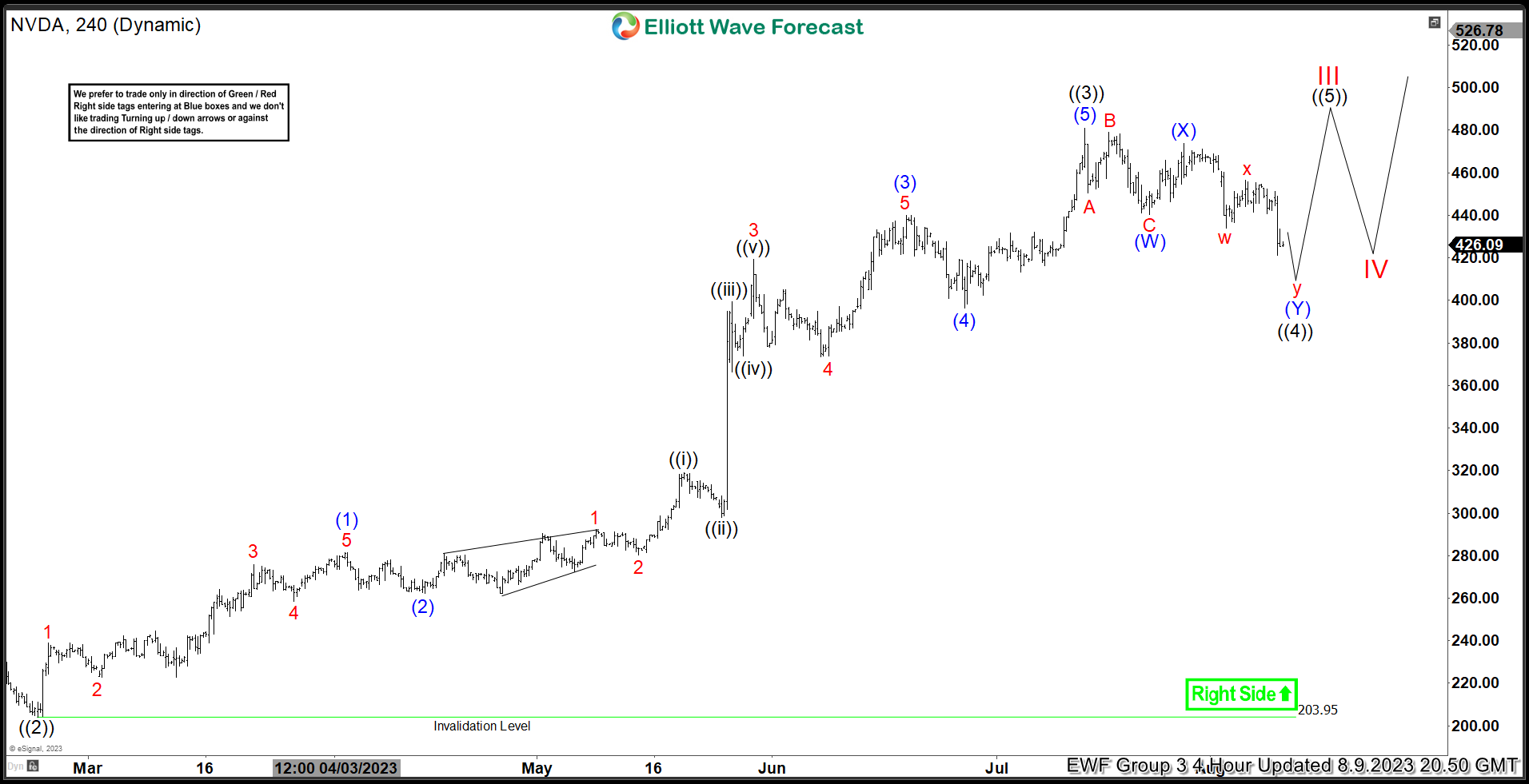

NVIDIA Corp. ($NVDA) Found Buyers After a Corrective Pull Back.

Read MoreHello everyone. In today’s article, we will look at the past performance of the 4 Hour Elliott Wave chart of NVIDIA Corp. ($NVDA) The rally from 10.13.2022 low unfolded as a 5 wave impulse breaking to new all time highs with an incomplete bullish sequence from 2.28.2023 low. So, we expected the pullback to unfold […]

-

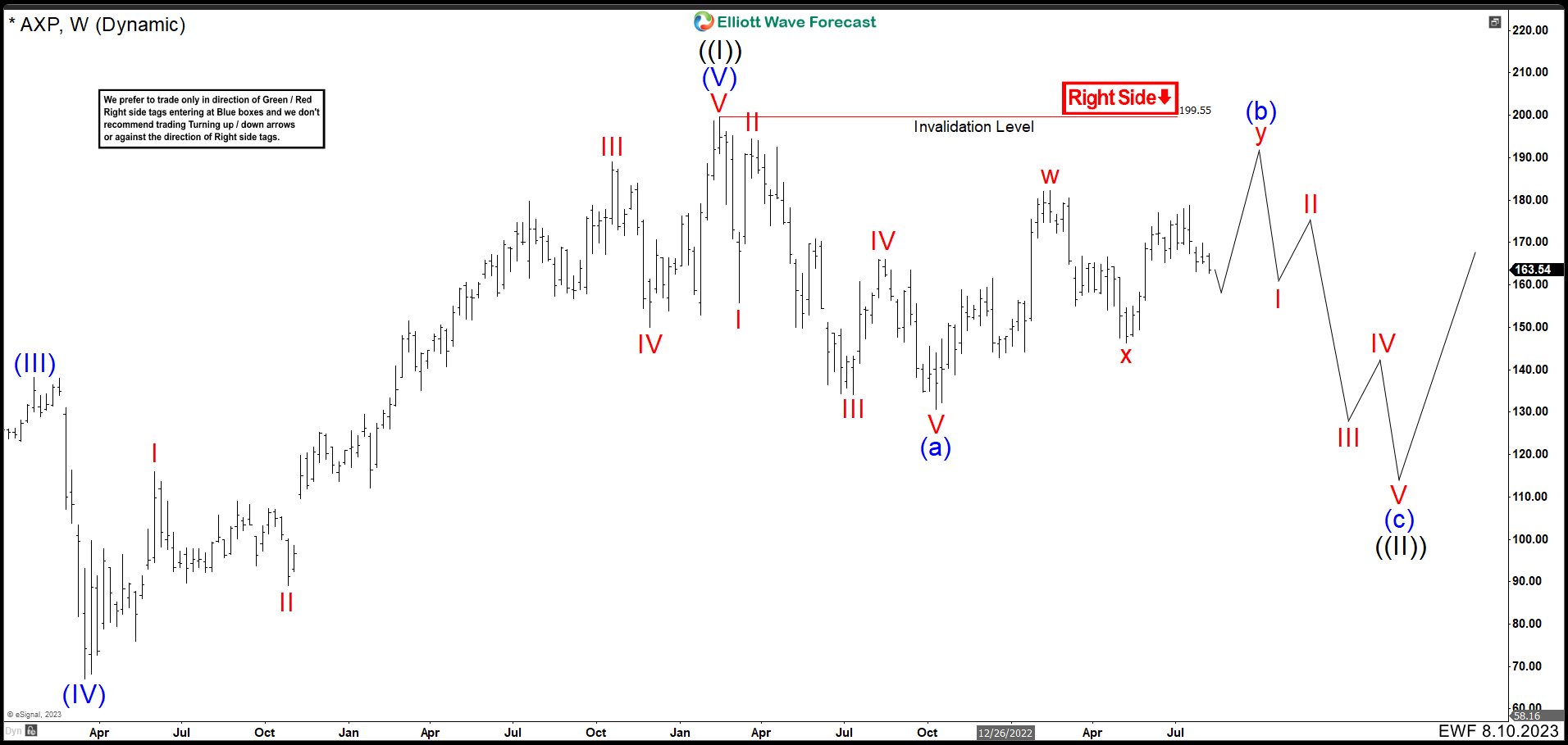

American Express (AXP) Structure Shows Financial Crisis Is Coming

Read MoreAmerican Express Company (Amex), symbol AXP, is an American multinational financial services corporation that specializes in payment cards. Headquartered in New York City, it is one of the most valuable companies in the world and one of the 30 components of the Dow Jones Industrial Average. AXP Weekly Chart August 2023 We believe that the […]

-

GDX Lower Low Sequence Supports More Downside

Read MoreGold Miners ETF (GDX) shows 5 swings lower low sequence from May peak supports more downside. This article and video look at the Elliott Wave path.

-

SPX Pullback In Wave 4 Should Find Support Again

Read MoreS&P 500 (SPX) is doing a pullback in wave 4 against 3.15.2023 low & expected to find support. This article and video look at the Elliott Wave path.

-

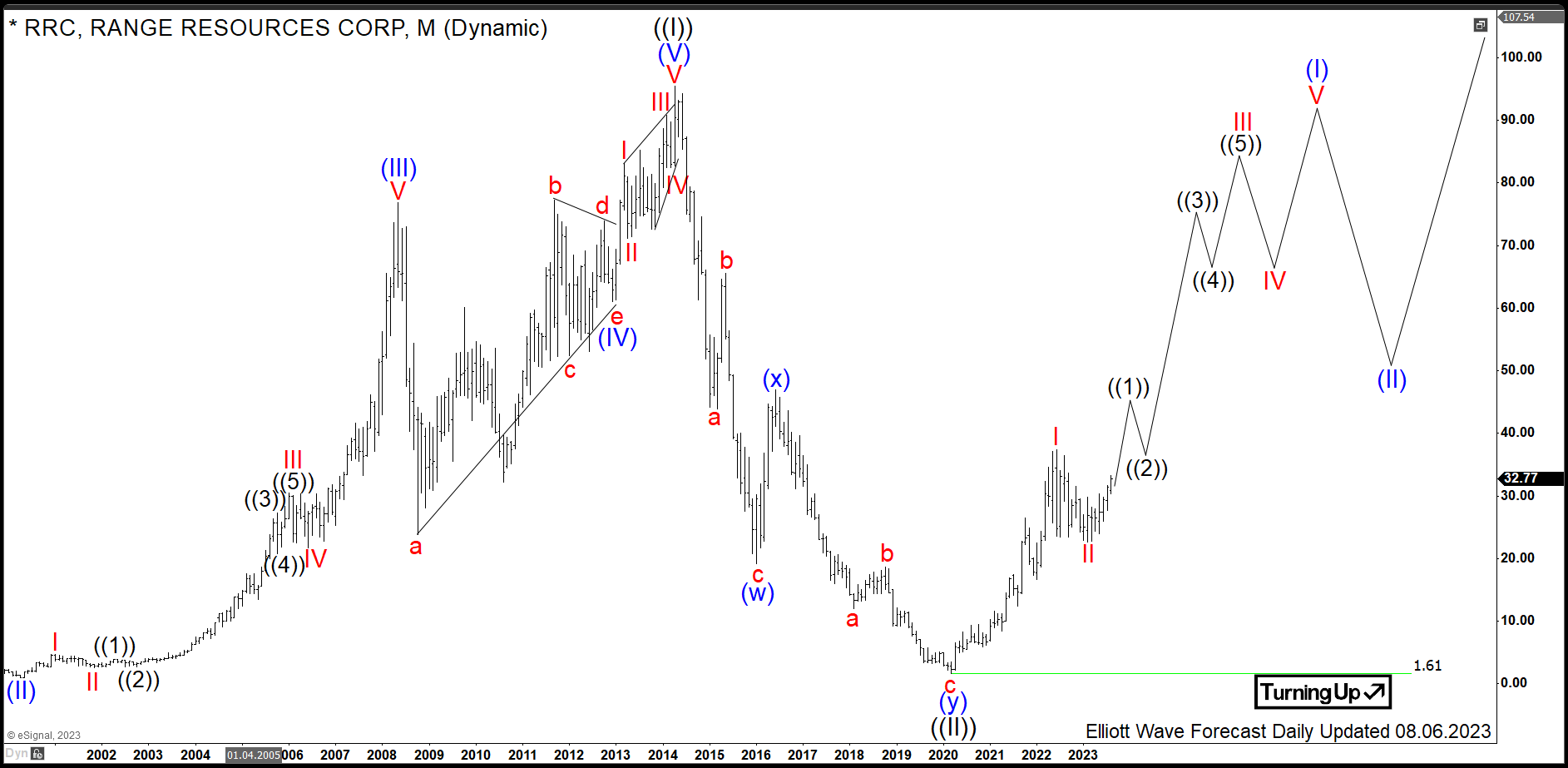

$RRC: Gas Producer Range Resources Starting Next Bullish Cycle

Read MoreRange Resources is an U.S. american corporation which has its headquarters in Fort Worth, Texas, USA. Founded in 1976 and traded under tickers $RRC at NYSE, it is a component of the S&P400 index. Range Resources is the 7th largest U.S. producer of natural gas and possesses the reserves in the Appalachian Basin, the Barnett Shale […]