The Power of 3-7-11 and the Grand Super Cycle: How We Saw the Bullish Turn in April 2025 Back on April 9, 2025, while World Indices were dropping sharply and global sentiment had turned overwhelmingly bearish, we published an article that challenged the fear-driven narrative. We explained why selling was not the right approach and […]

-

SONY Is Near To Give Us New Buying Opportunities

Read MoreSony Group Corporation, commonly known as SONY, is a Japanese multinational conglomerate corporation. As a major technology company, it operates as one of the world’s largest manufacturers of consumer and professional electronic products, the largest video game console company. SONY ended an impulse that began at the end of 2012. The share price reached 133.75 […]

-

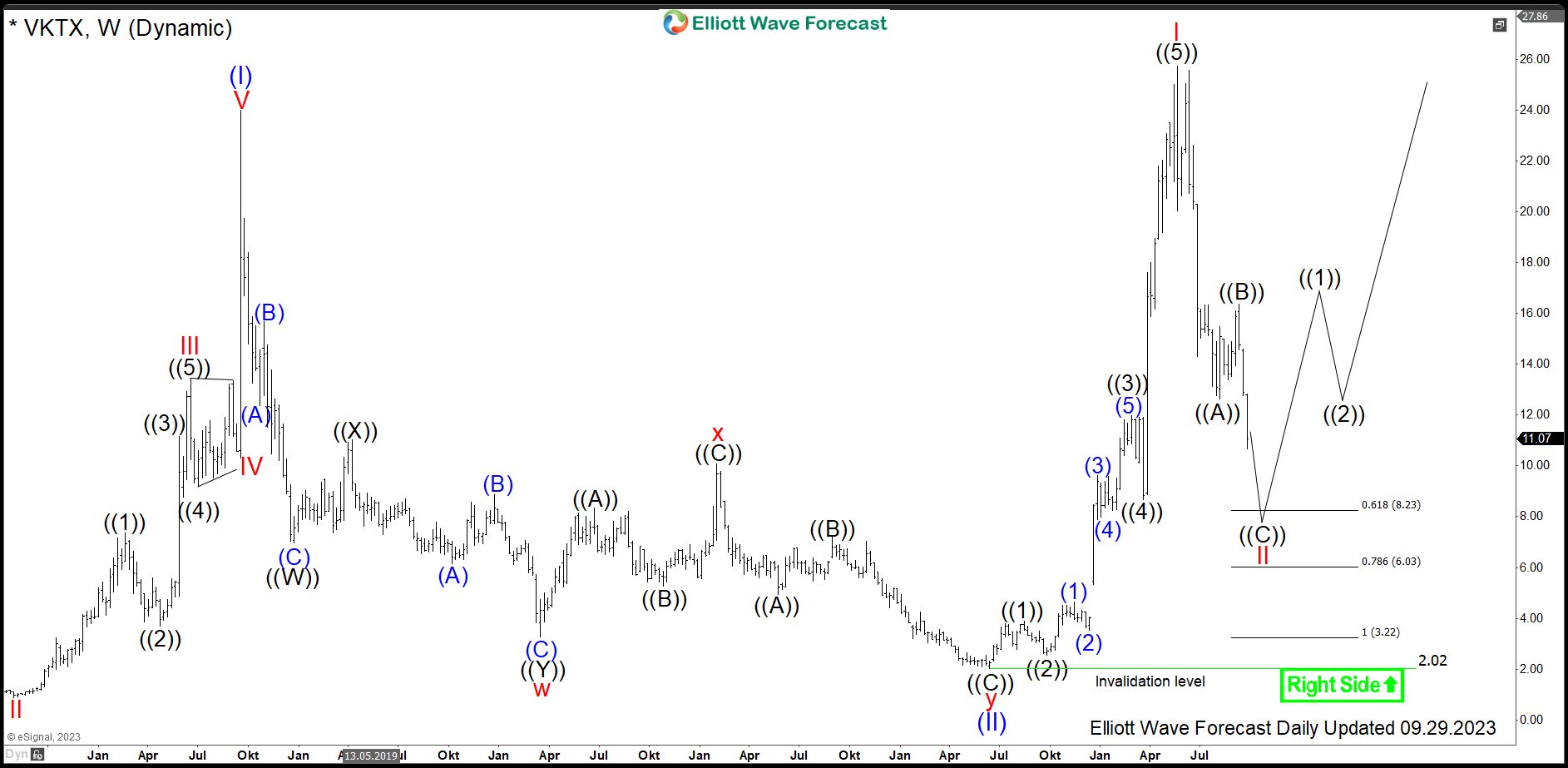

$VKTX: Consolidation in Viking Therapeutics Provides an Opportunity

Read MoreViking Therapeutics Inc. is an innovative biotechnology company developing novel therapeutics for metabolic and endocrine diseases. Metabolic and rare disease programs include novel selective thyroid receptor-β agonist approach. These and other programs are currently within phases 1, 2 and preclinical. Viking Therapeutics saw IPO back in 2015. Since then, investors can trade it under the […]

-

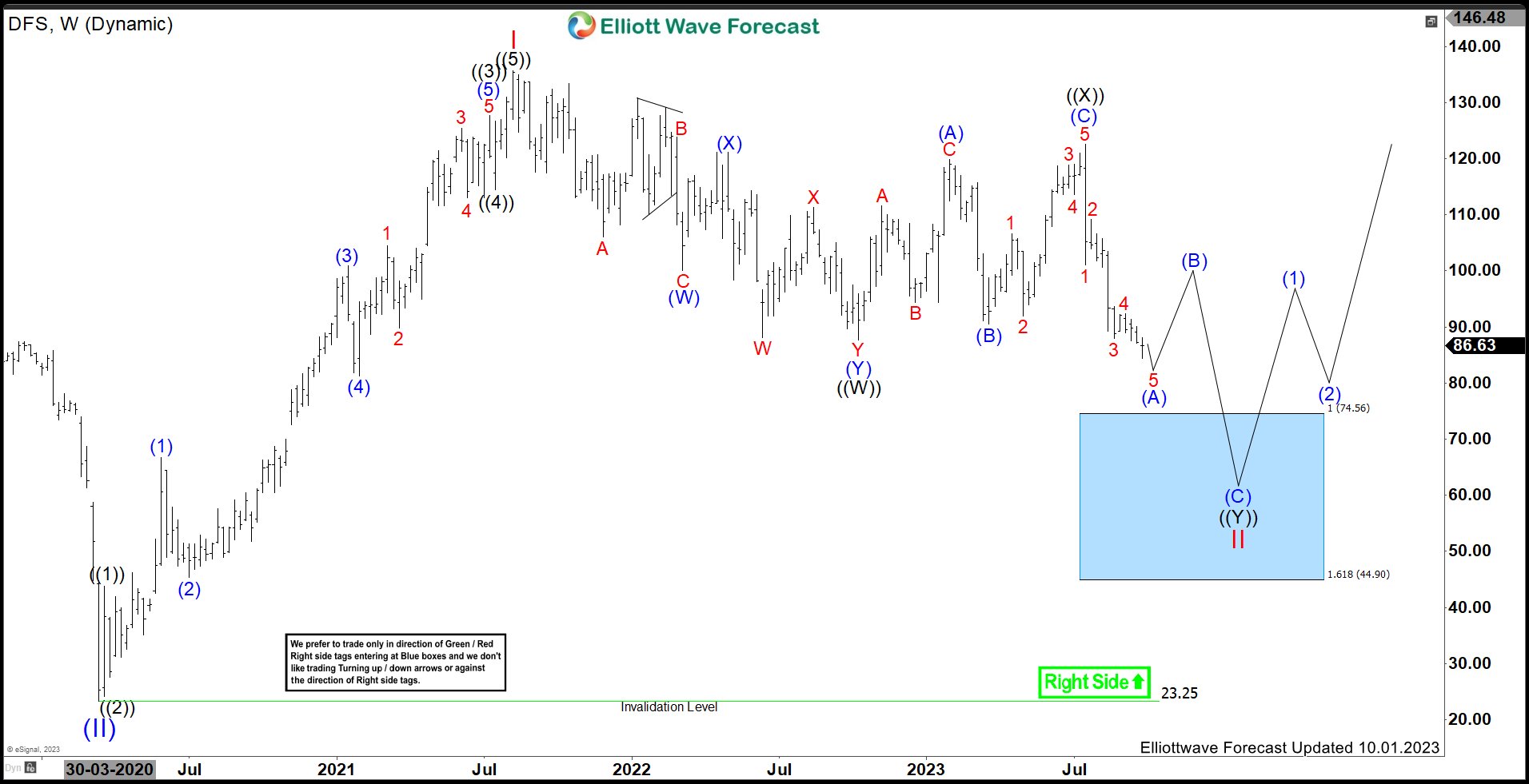

Is Discover Financial Services (DFS) Ready Next Rally?

Read MoreDiscover Financial Services (DFS) provides digital banking products & services, & payment services in United States. It operates through two segments – Digital banking & Payment services. It is based in Riverwoods, Illinois, comes under Financial services sector & trades as “DFS” ticker at NYSE. DFS ended wave I as impulse sequence at $135.69 high […]

-

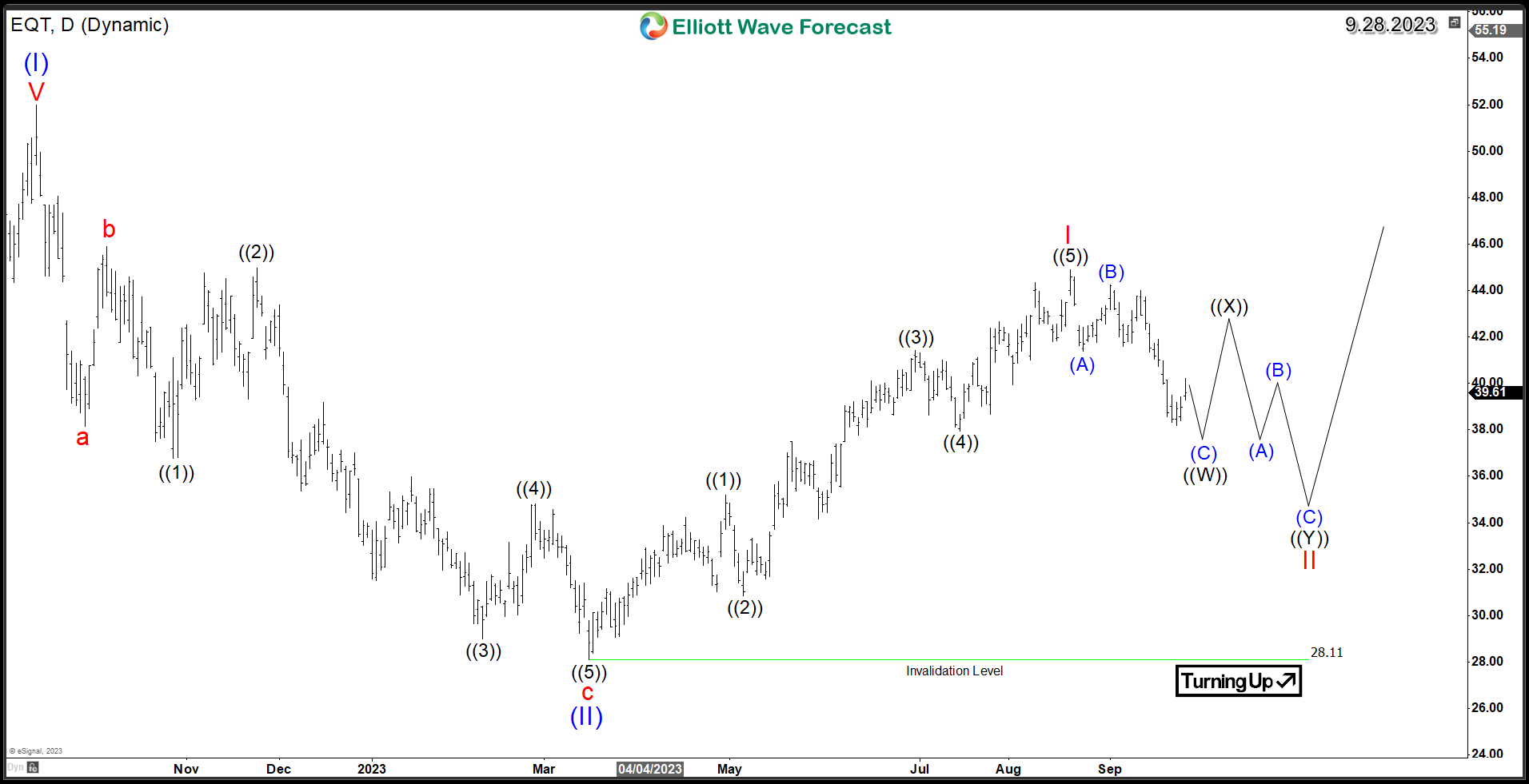

EQT Corporation : A Fresh Look at Energy Investment Opportunities

Read MoreAs the global energy landscape continues to evolve, EQT Corporation (NYSE: EQT) emerges as a key player in the realm of energy exploration and production. In our previous article, we explored the weekly path for the stock as it was presenting an investment opportunity for this year and we explained the potential path based on […]

-

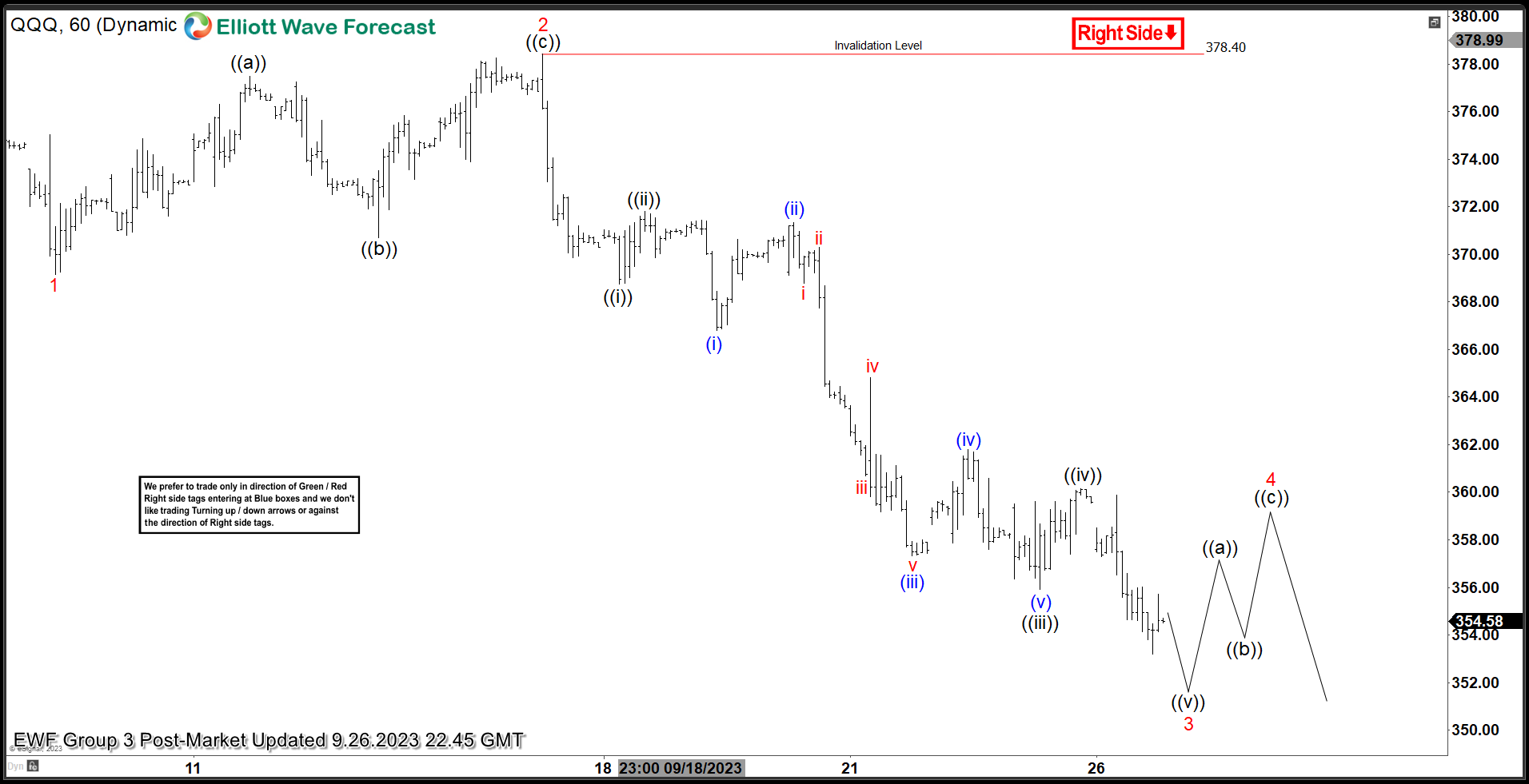

Nasdaq 100 ETF (QQQ) Continues Bearish Move Lower

Read MoreNasdaq 100 ETF (QQQ) shows incomplete bearish sequence and should see further downside. This article looks at the Elliott Wave path of the ETF.

-

$DIS(Walt Disney): The Stock is Trading Within Buying Area

Read MoreDisney has been in a tremendous decline since it peaked at $203.02 back 03.08.2021. The Peak ended a Grand Super Cycle and since then it has corrected in larger pullback. The Elliott Wave Theory provides us with cycle degrees determined by the time each cycle lasts. So the Grand Super Cycle is the highest cycle […]