The Power of 3-7-11 and the Grand Super Cycle: How We Saw the Bullish Turn in April 2025 Back on April 9, 2025, while World Indices were dropping sharply and global sentiment had turned overwhelmingly bearish, we published an article that challenged the fear-driven narrative. We explained why selling was not the right approach and […]

-

10 Best Defensive Stocks to Invest in 2025

Read MoreA defensive stock is a stock that demonstrates relatively stable performance regardless of the current state of the economy. Defensive stocks are also called non-cyclical stocks, as they are less prone to the economic cycle of expansions and recessions. Defensive stocks will come with a steady dividend payment and a more constant share price. Defensive […]

-

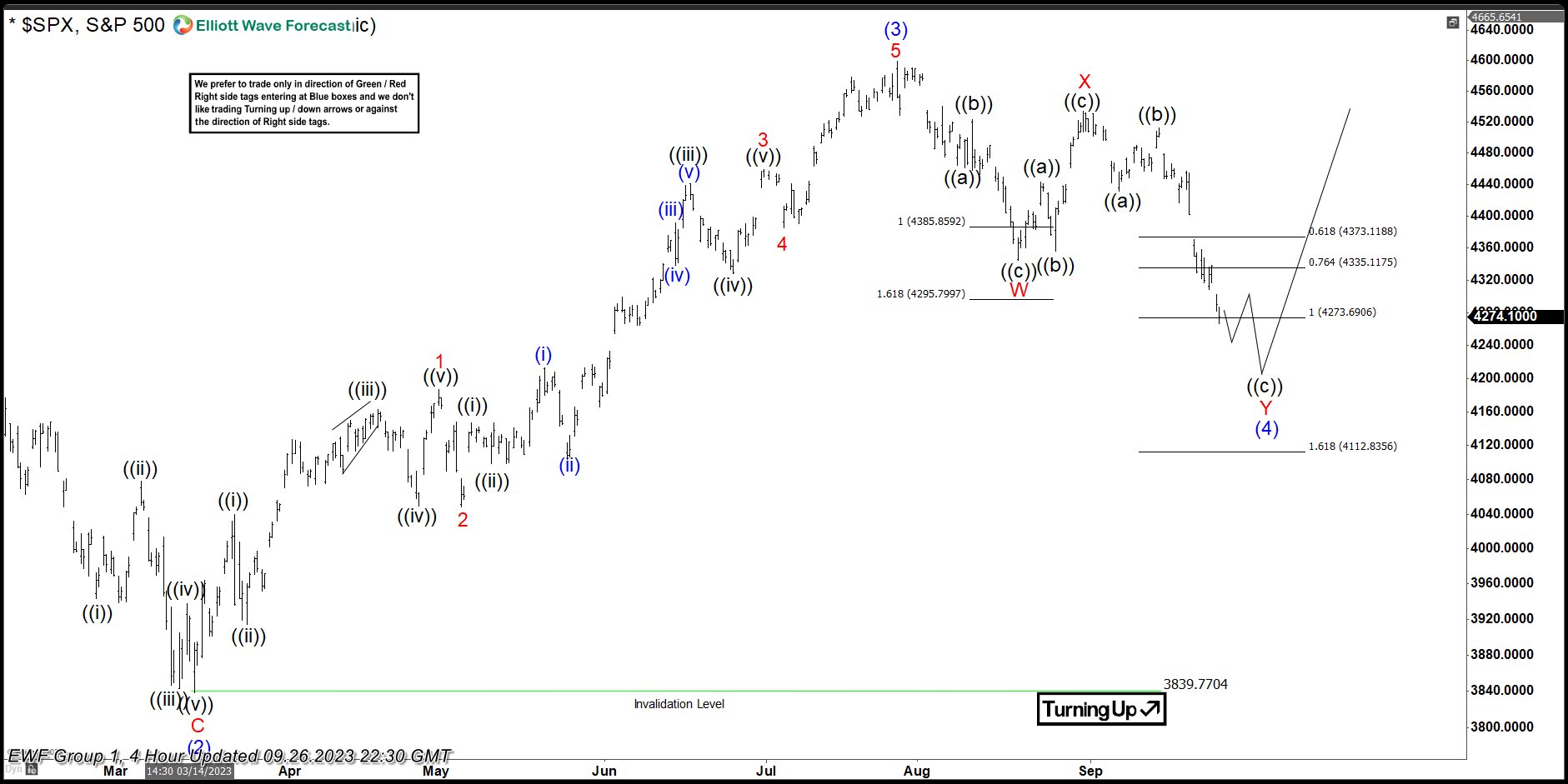

S&P500 (SPX) Found Buyers At The Equal Legs Area

Read MoreHello fellow traders. In this technical article we’re going to take a quick look at the Elliott Wave charts of SPX published in membership area of the website. As our members know, S&P500 is trading within the cycle from the October’s 3492.7 low, which is unfolding as 5 waves structure. Recently we got 3 waves […]

-

Tesla (TSLA) 5 Swing Sequence Favors Upside

Read MoreTesla (TSLA) shows a 5 swing sequence from 9.28.2023 low favoring the upside. This article and video look at the Elliott Wave path.

-

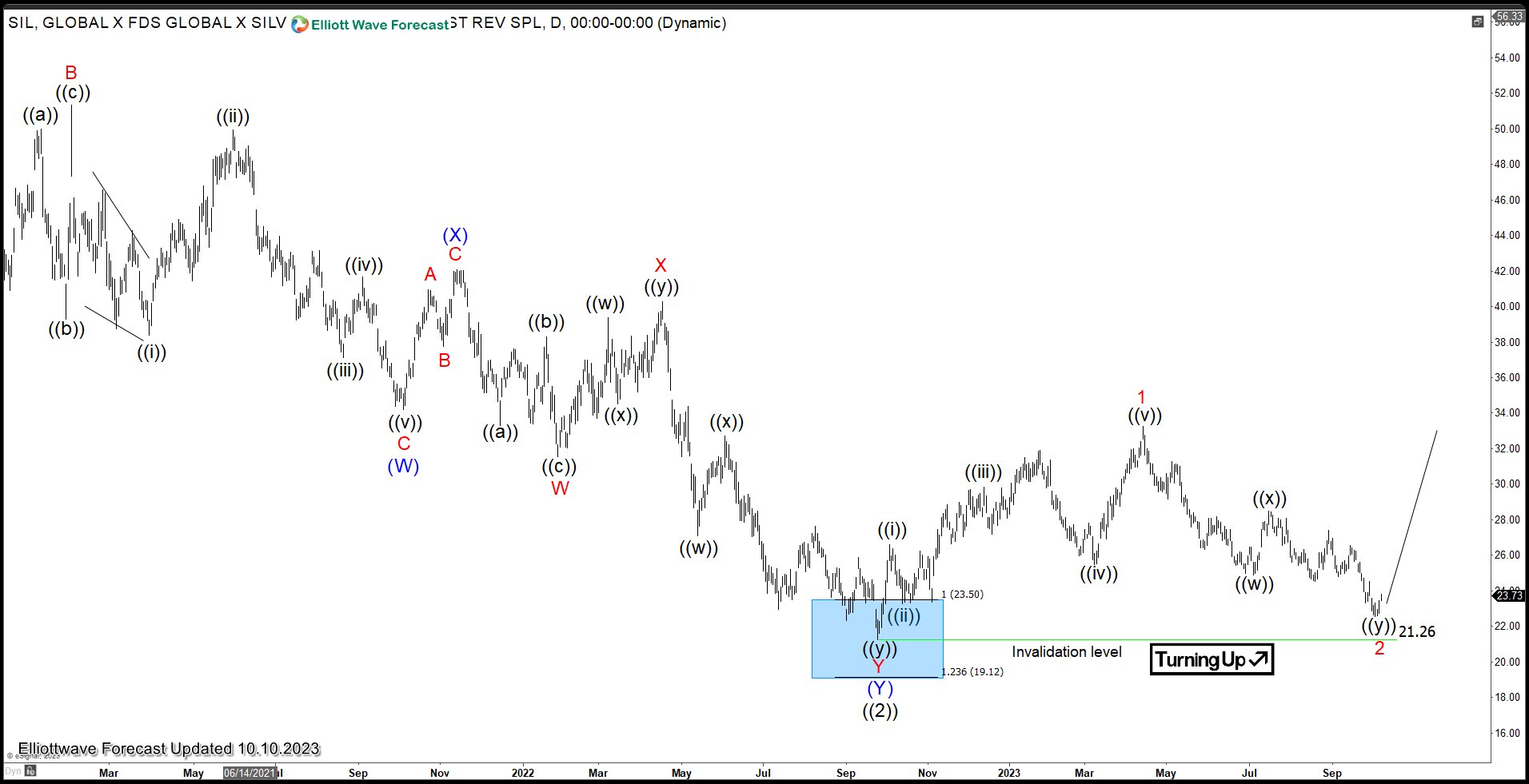

Silver Miners ETF (SIL) May Have Started to Turn Higher

Read MoreSilver Miners ETF (SIL) has ended the correction to the cycle from March 2020 low on Sept 26, 2022 low at 21.26. It is retesting the low on Sept 26, 202. As far as it stays above there, the ETF can start turning higher. We will take a look at the Elliott Wave view of […]

-

Will Costco Wholesale (COST) Continue to See Further Strength?

Read MoreCostco Wholesale Corporation., (COST) engages in the operation of membership warehouse in the United States, Puerto Rico, Canada, United Kingdom, Mexico, Japan, Korea, Australia, Spain, France, Iceland, China & Taiwan together with its subsidiaries. It offers branded & private label products in the range of merchandise categories. It also operates e-commerce websites in the US, […]

-

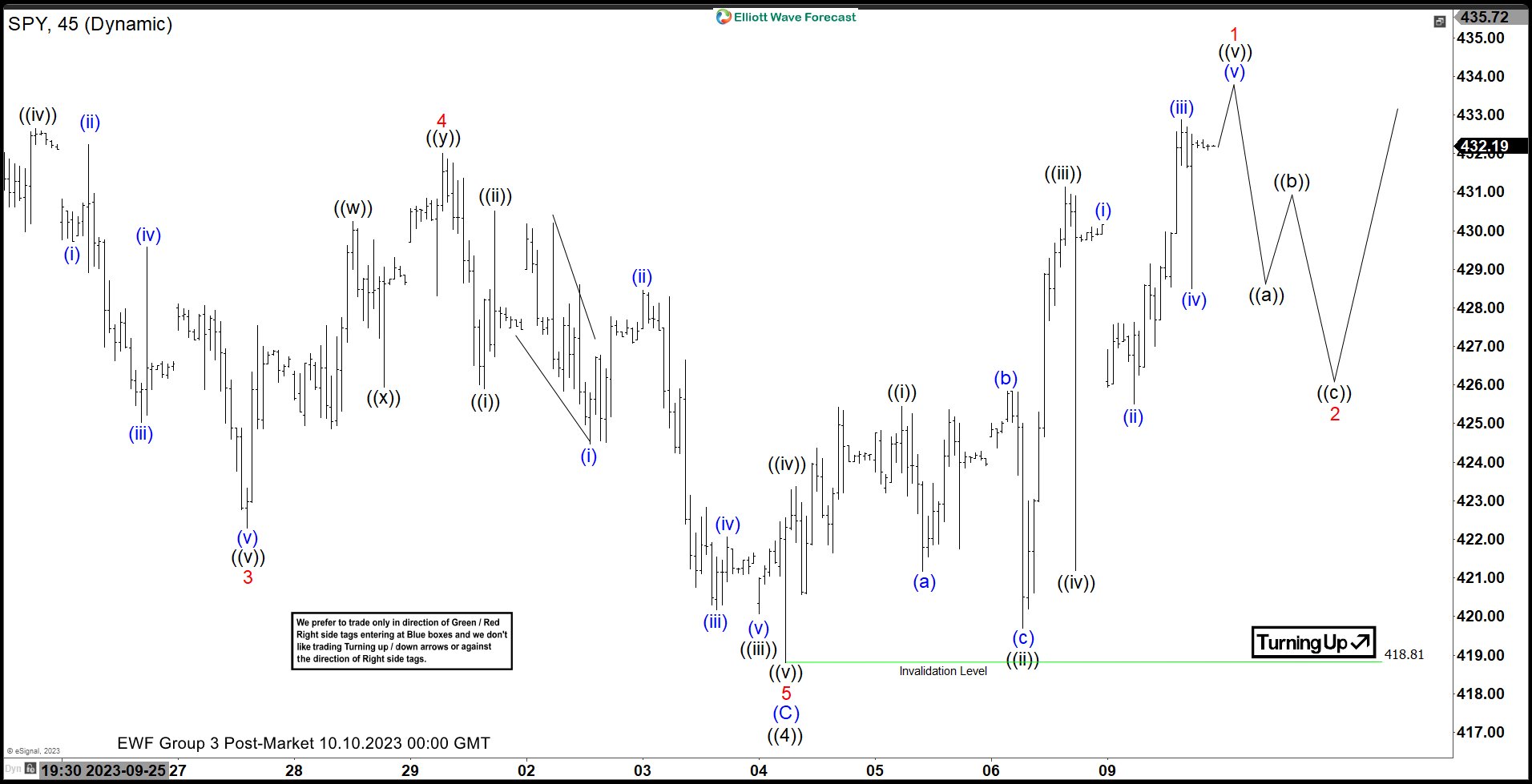

S&P 500 ETF (SPY) Has Ended Correction and Turned Higher

Read MoreS&P 500 ETF (SPY) ended cycle from 7.27.2023 high and turned higher. This article and video look at the Elliott Wave path for the ETF.