The Power of 3-7-11 and the Grand Super Cycle: How We Saw the Bullish Turn in April 2025 Back on April 9, 2025, while World Indices were dropping sharply and global sentiment had turned overwhelmingly bearish, we published an article that challenged the fear-driven narrative. We explained why selling was not the right approach and […]

-

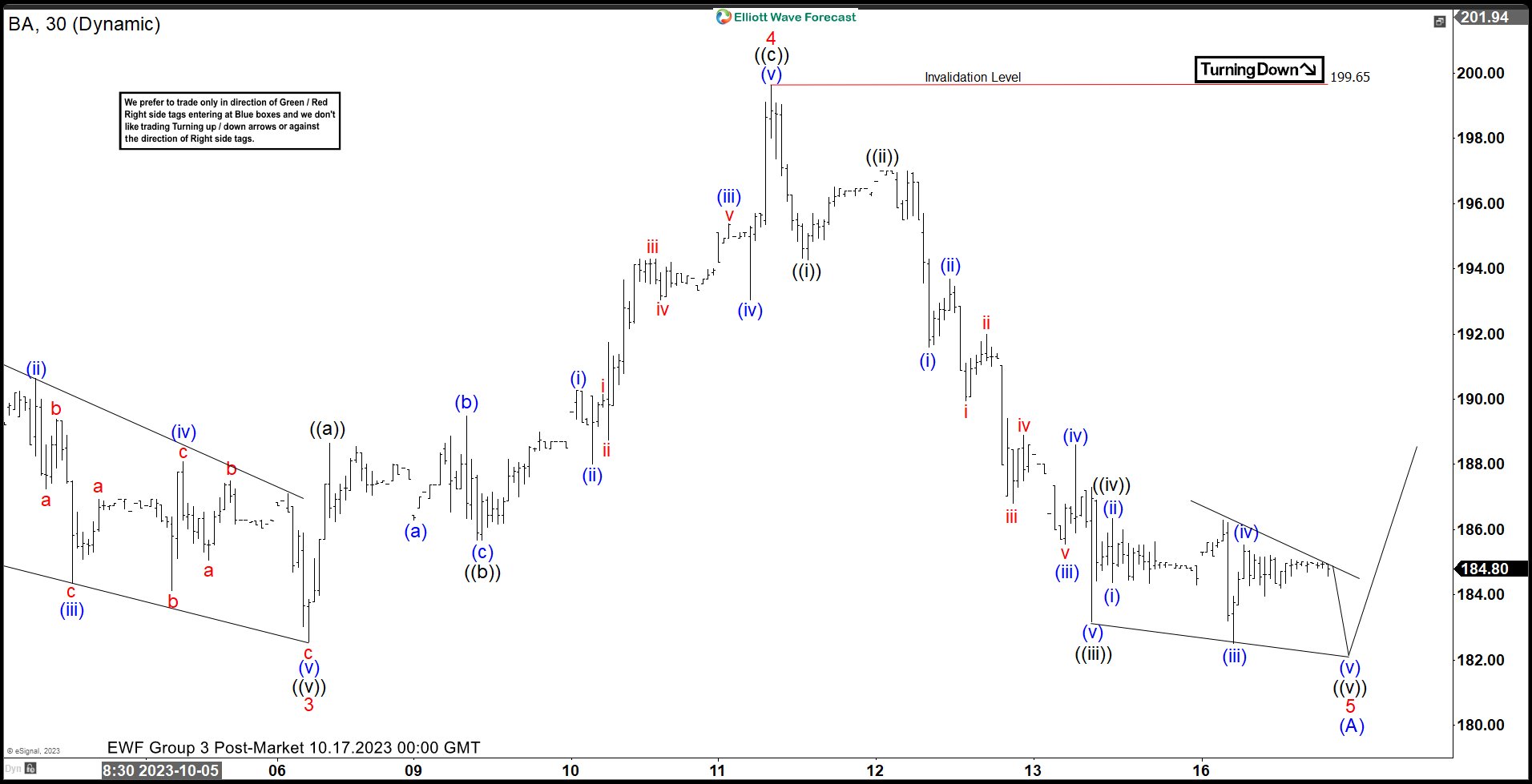

Boeing (BA) Looking to End Impulsive Decline Soon

Read MoreBoeing (BA) is ending cycle from 8.1.2023 high as impulse & should soon rally to correct the cycle. This article & video look at the Elliott Wave path.

-

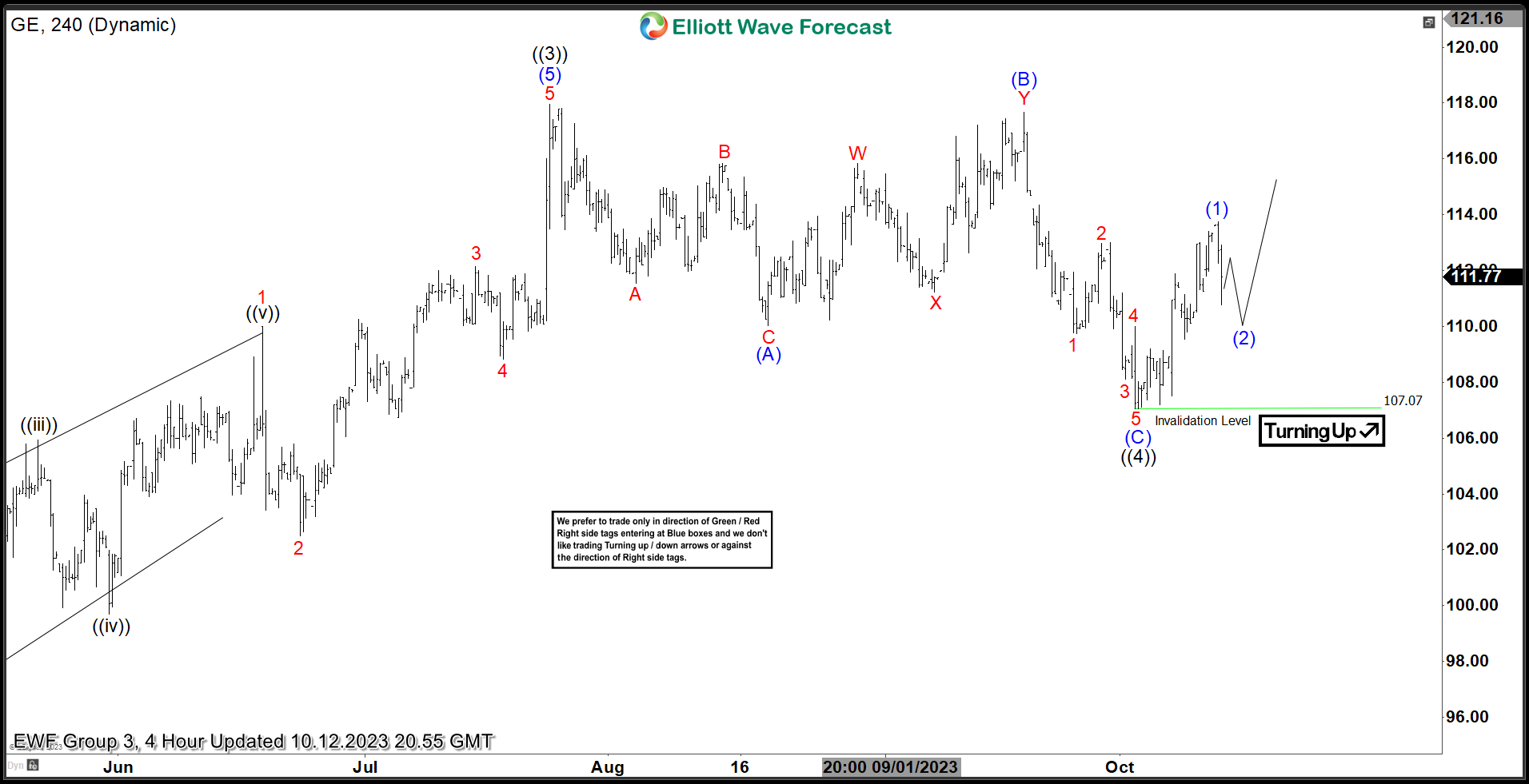

General Electric Co. ($GE) Reacted Higher After a Corrective Pull Back.

Read MoreHello everyone. In today’s article, we will look at the past performance of the 8 Hour Elliott Wave chart of General Electric Co. ($GE). The rally from 12.16.2022 low unfolded as a 5 wave impulse. So, we expected the pullback to unfold in 7 swings and find buyers again. We will explain the structure & […]

-

Johnson & Johnson (JNJ) Resumed the Bearish Cycle

Read MoreJohnson & Johnson (JNJ) is an American multinational corporation founded in 1886 that develops medical devices, pharmaceuticals, and consumer packaged goods. Its common stock is a component of the Dow Jones Industrial Average, and the company is ranked No. 36 on the 2021 Fortune 500 list of the largest United States corporations by total revenue. […]

-

Bank of Montreal (BMO) Continues Weakness In Correction

Read MoreBank of Montreal (BMO) provides diversified financial services primarily in North America. The company’s personal banking products & services include checking & savings accounts, credit cards, mortgages, financial & investment advice services & commercial banking products & services. It is based in Montreal, Canada, comes under Financial services sector & trades as “BMO” at NYSE. […]

-

Silver (XAGUSD) Pullback May See Buyers and Resume Higher

Read MoreSilver (XAGUSD) is correcting impulsive rally from 10.3.2023 low before it resumes higher. This article and video look at the Elliott Wave path.

-

S&P 500 Futures (ES) Impulsive Rally Favors the Bullish Side

Read MoreS&P 500 Futures (ES) shows 5 waves impulse from 10.4.2023 low favoring the upside. This article and video look at the Elliott Wave path.