The Power of 3-7-11 and the Grand Super Cycle: How We Saw the Bullish Turn in April 2025 Back on April 9, 2025, while World Indices were dropping sharply and global sentiment had turned overwhelmingly bearish, we published an article that challenged the fear-driven narrative. We explained why selling was not the right approach and […]

-

DAX Doing 3 Wave Corrective Bounce From The Lows

Read MoreDAX index is doing a 3 wave corrective bounce from the lows to correct the decline from 7/31/2023 peak. This article & video look at the Elliott Wave path.

-

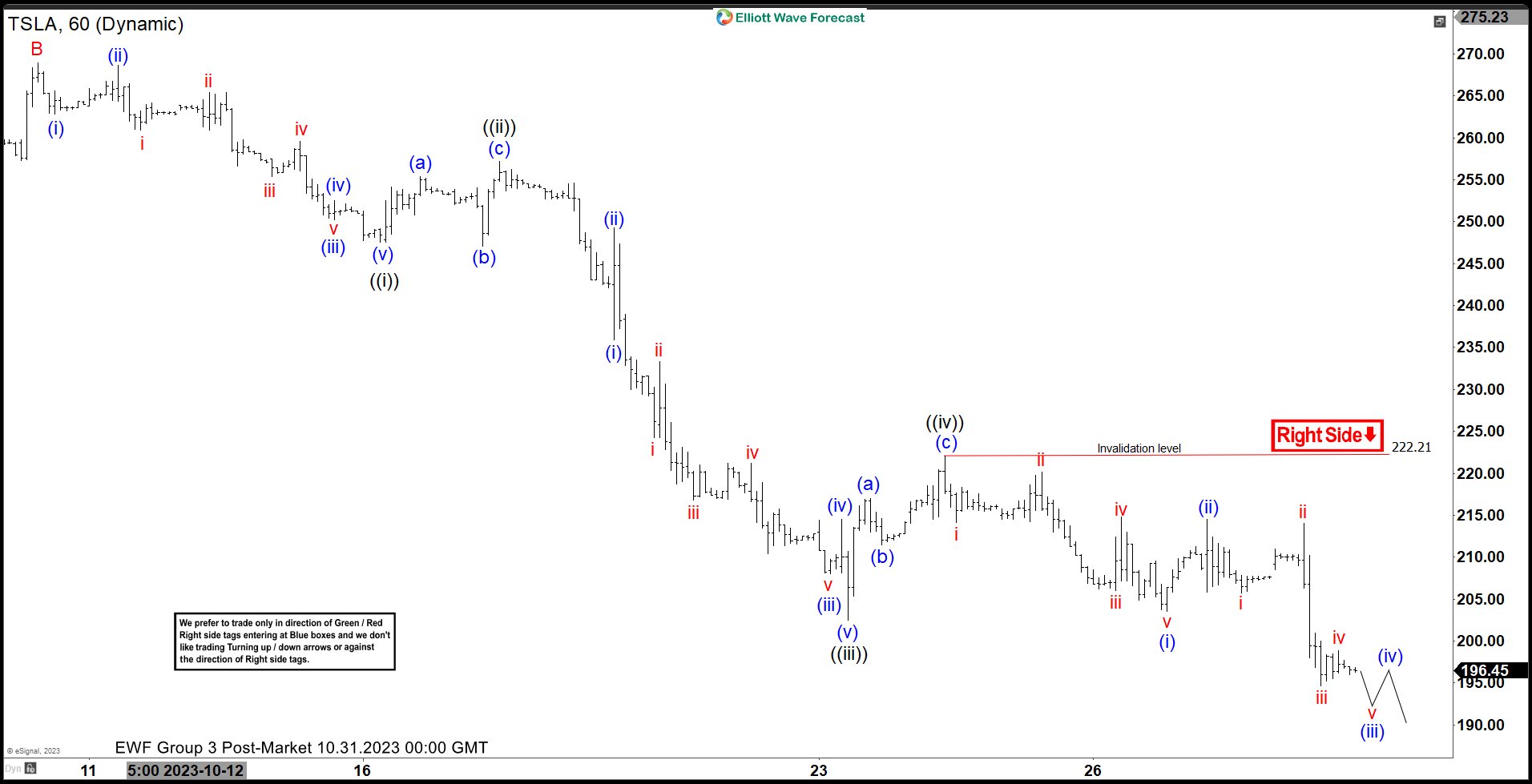

TSLA Minimum 3 Wave Bounce Is Expected To Happen

Read MoreTSLA is close reaching the extreme from 7/19/2023 peak & expected to see a bounce in minimum 3 waves. This article and video look at the Elliott Wave path.

-

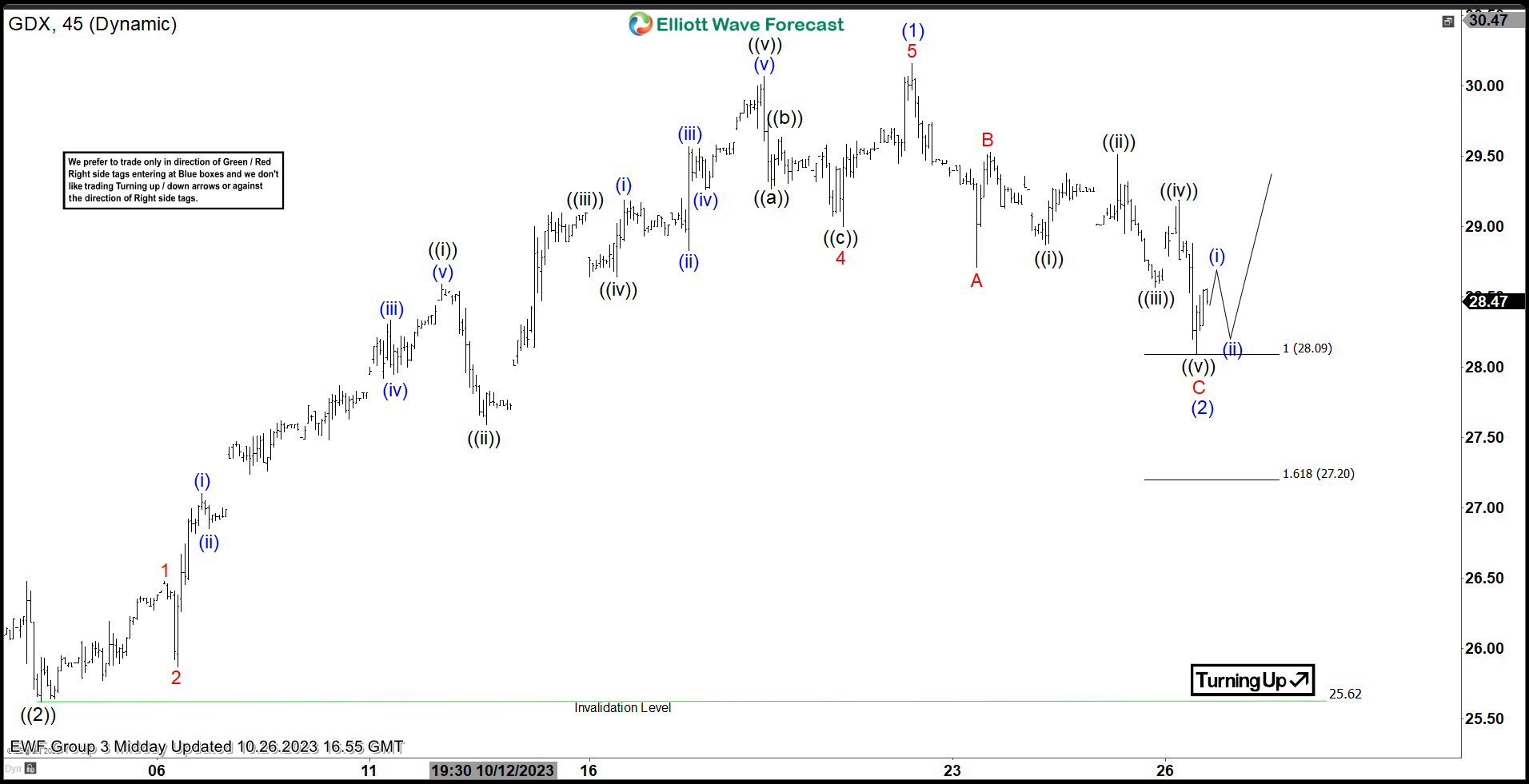

VanEck Gold Miners ETF ($GDX) Reacted Higher After a Corrective Pull Back.

Read MoreHello everyone. In today’s article, we will look at the past performance of the 1H Hour Elliott Wave chart of VanEck Gold Miners ETF ($GDX). The rally from 10.04.2023 low unfolded as a 5 wave impulse. So, we expected the pullback to unfold in 3 swings and find buyers again. We will explain the structure […]

-

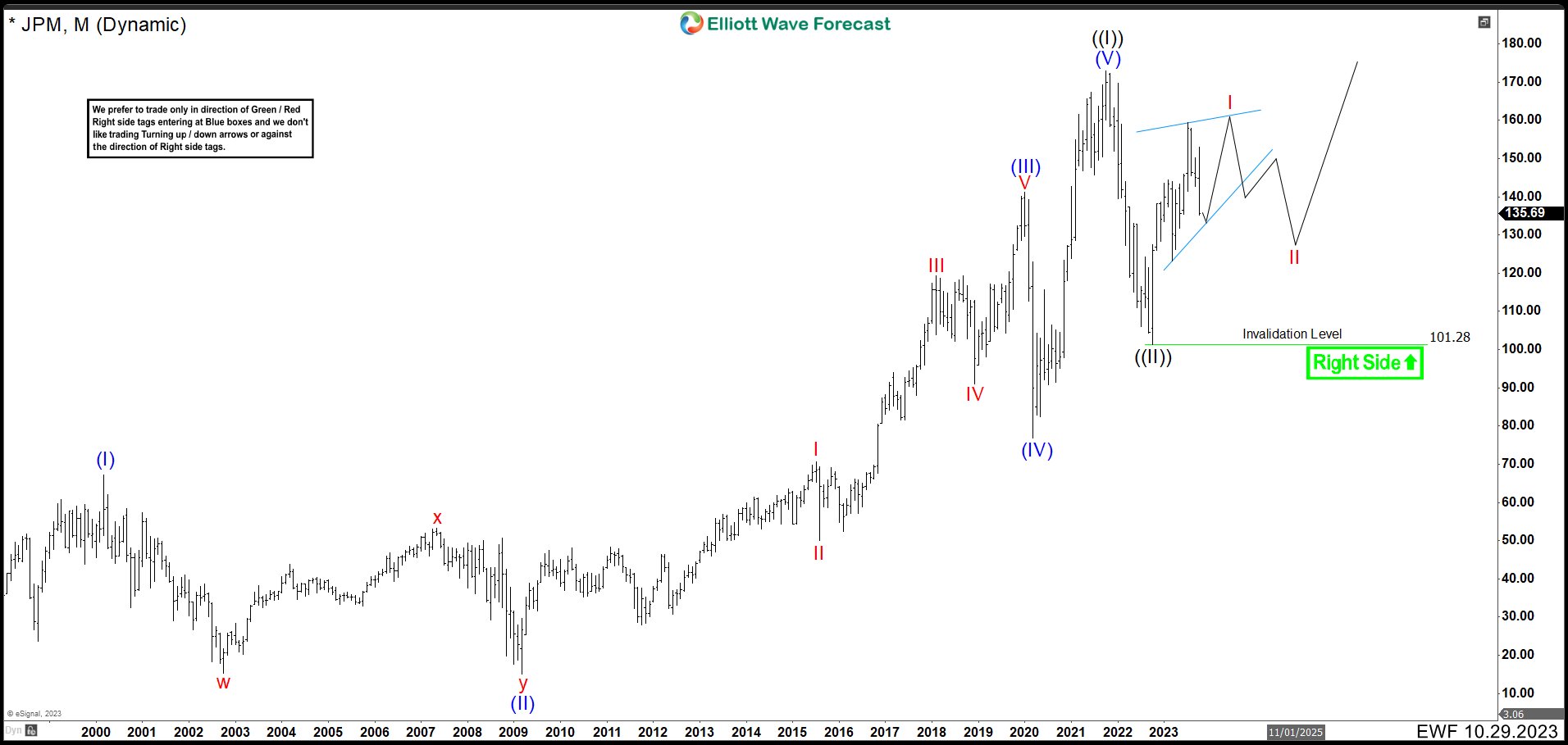

JPMorgan (JPM) Shares Could Have Started A Collapse

Read MoreJPMorgan Chase & Co. (JPM) is an American multinational investment bank and financial services holding company headquartered in New York City and incorporated in Delaware. As of December 31, 2021, JPMorgan Chase is the largest bank in the United States, the world’s largest bank by market capitalization, and the fifth-largest bank in the world in […]

-

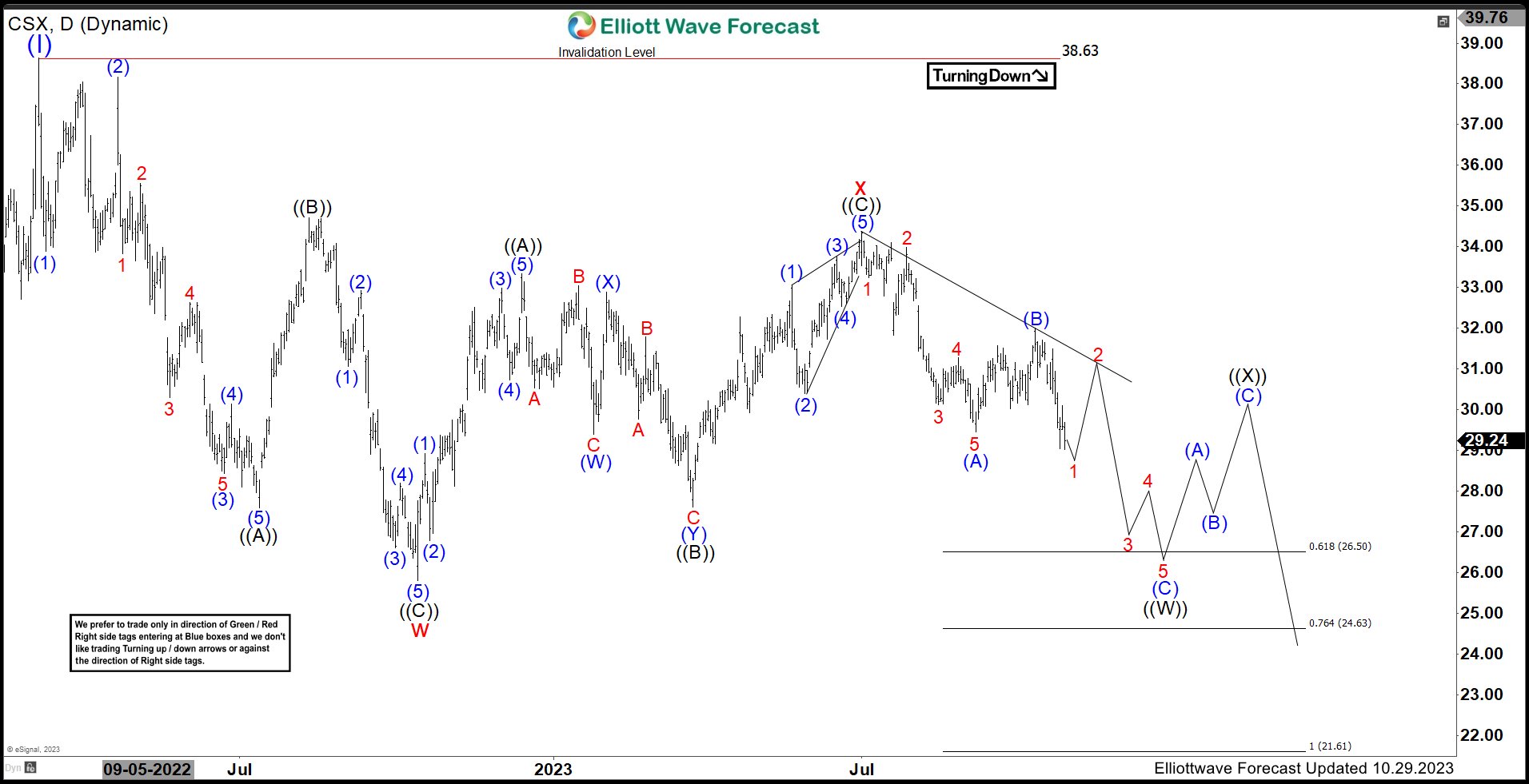

CSX Corporation (CSX) Expects Weakness In Double Correction

Read MoreCSX Corporation (CSX) provides rail-based fright transportation services. The Company offers rail services & transportation of intermodal containers & trailers as well as other services such as rail-to-truck transfers & bulk commodity operations. It transports chemicals, agricultural & food products, minerals, automotive, forest products, fertilizers, metals & equipment & coal, coke, iron ore to electricity-generating […]

-

$CVNA: Car Retailer Carvana Entering Short Term Support Area

Read More$CVNA Carvana Co. is an online used car retailer and is known for its multi-store car vending machines. Today, the company is the fastest growing online used car dealer in the United States. Recently, Carvana gained publicity as it was named to the 2021 Fortune 500 list, in fact, one of the youngest companies to be added to the […]