The Power of 3-7-11 and the Grand Super Cycle: How We Saw the Bullish Turn in April 2025 Back on April 9, 2025, while World Indices were dropping sharply and global sentiment had turned overwhelmingly bearish, we published an article that challenged the fear-driven narrative. We explained why selling was not the right approach and […]

-

Common Mistakes to Avoid in Investing in Stocks

Read MoreDifferent Types of Stocks Common Stock Investing in stocks usually refers to investment in common stocks. These are the basic stocks that are publicly traded on the stock market. When you own common stock, it gives you the right to vote on board members and other corporate issues at a company’s annual meeting. Some common […]

-

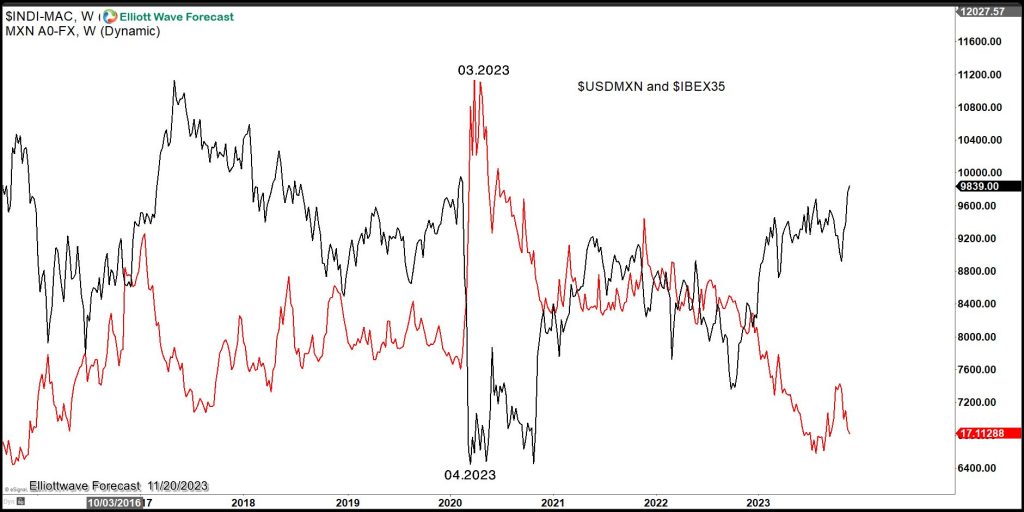

$USDMXN: How the Path of the Pair Correlates with World Indices

Read More$USDMXN has been trading lower since the peak at 04.2020. We have been waiting for the area between $15.98-$12.14 to be reached. The pair is important because of the correlation with the $USDX and the implication across the Market. Here is the Weekly chart for the pair and the $USDX showing the correction and the […]

-

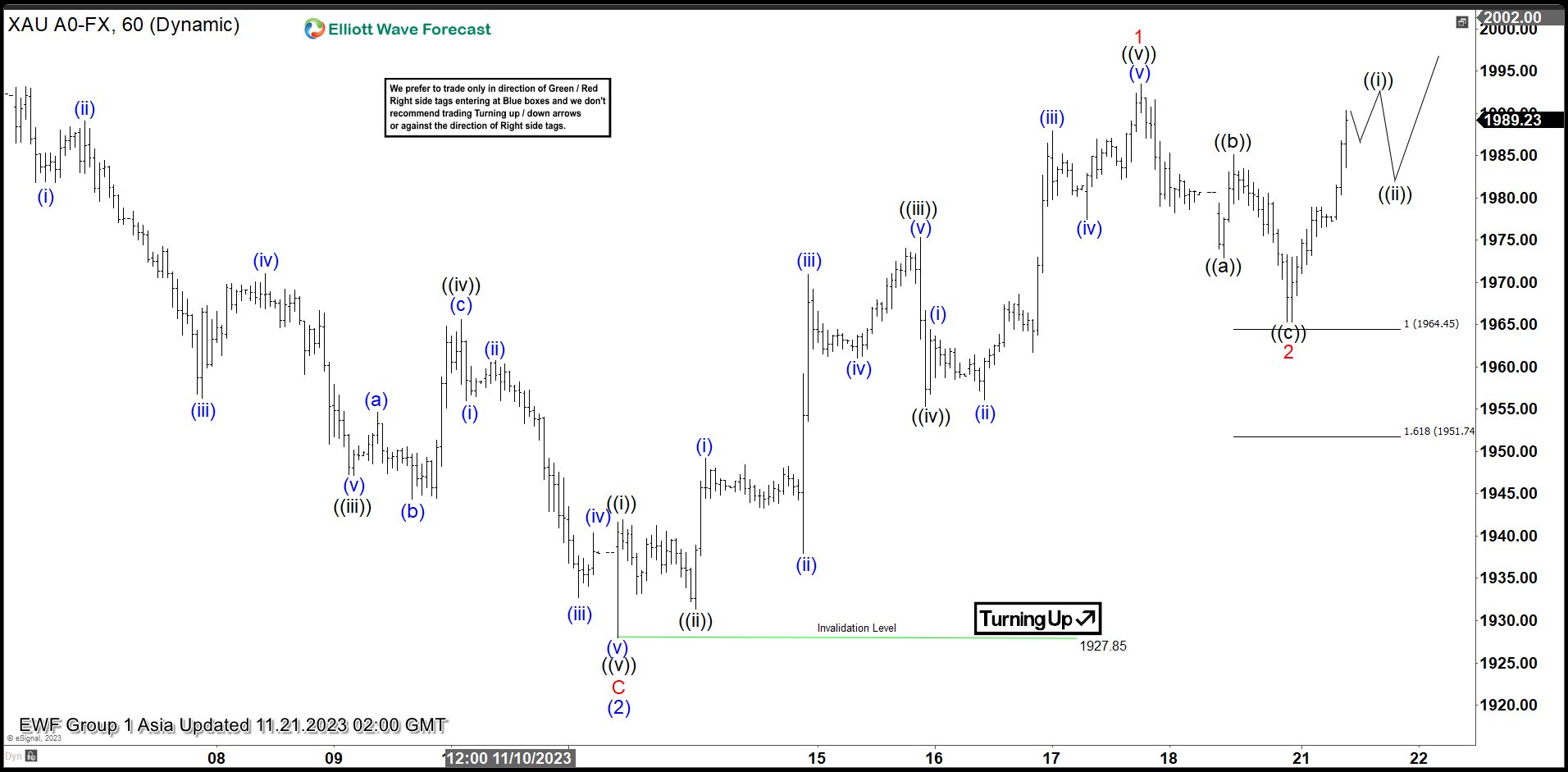

Gold (XAUUSD) Elliott Wave Impulse Breakout In Progress

Read MoreGold (XAUUSD) rally from 9.28.2022 low as an impulse and should see further upside. This article and video look at the Elliott Wave path.

-

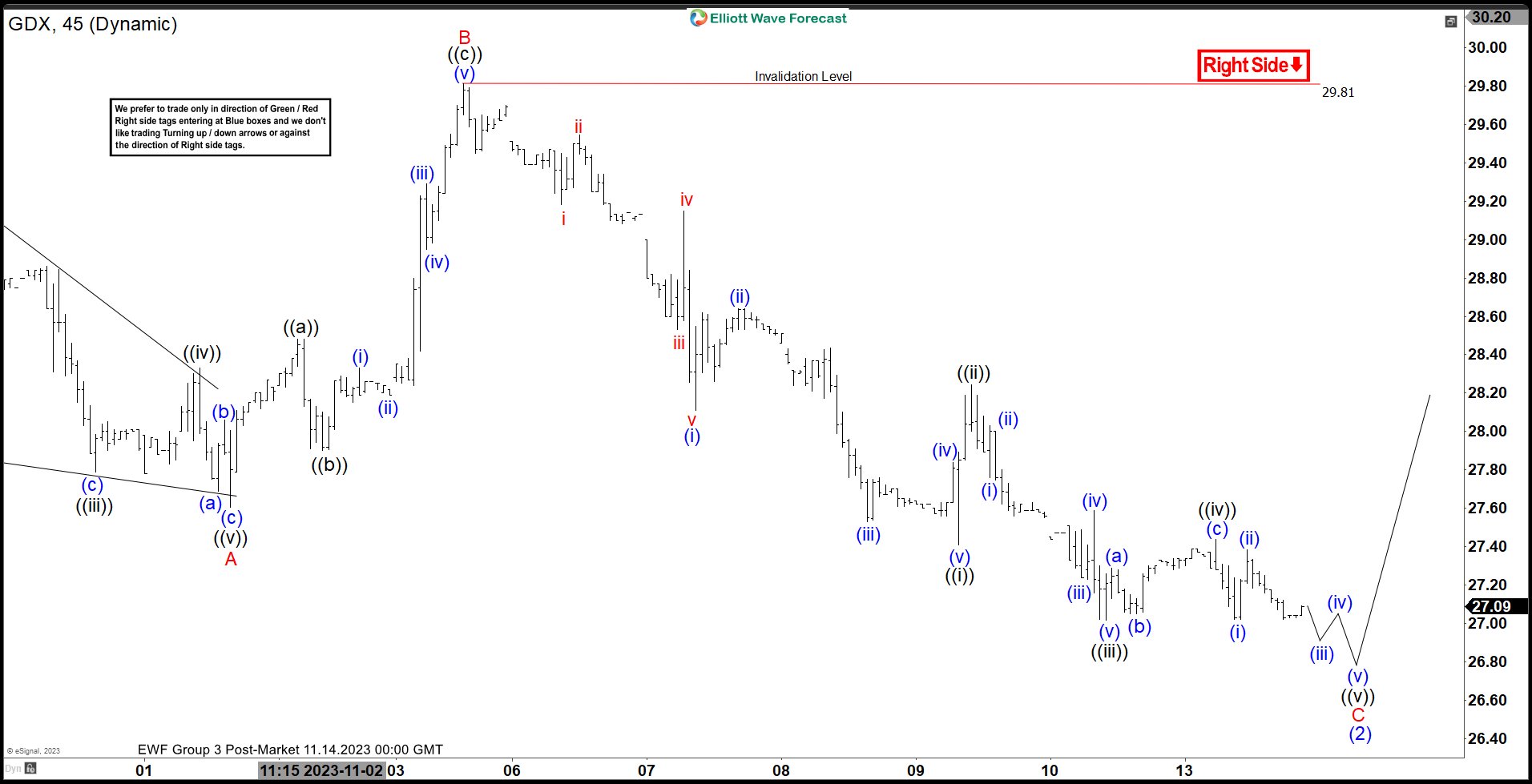

VanEck Gold Miners ETF ($GDX) Keeps Finding Buyers at Extreme Areas.

Read MoreHello everyone. In today’s article, we will look at the past performance of the 1H Hour Elliott Wave chart of VanEck Gold Miners ETF ($GDX). The rally from 10.04.2023 low unfolded as a 5 wave impulse. So, we expected the pullback to unfold in 3 swings and find buyers again. We will explain the structure […]

-

Travelers (TRV) Looks Like Will Make A Double Correction Lower

Read MoreThe Travelers Companies, Inc., TRV, is an American insurance company. It is the second-largest writer of U.S. commercial property casualty insurance, and the sixth-largest writer of U.S. personal insurance through independent agents. Weekly TRV Chart July 2023 TRV ended a great super cycle in the year of 2019 reaching a peak at $154.86 which we call […]

-

Influence of Global Events on the Stock Market

Read MoreIt’s no secret that international markets can be volatile, with everything from simple demand to political unrest holding the potential to affect how well any one stock or commodity is performing. While most prices tend to be affected by a number of different factors, global events have the potential to affect not just one market, […]