The Power of 3-7-11 and the Grand Super Cycle: How We Saw the Bullish Turn in April 2025 Back on April 9, 2025, while World Indices were dropping sharply and global sentiment had turned overwhelmingly bearish, we published an article that challenged the fear-driven narrative. We explained why selling was not the right approach and […]

-

American Express AXP is Heading to a Potential Selling Area

Read MoreAmerican Express Company (Amex), symbol AXP, is an American multinational financial services corporation that specializes in payment cards. Headquartered in New York City, it is one of the most valuable companies in the world and one of the 30 components of the Dow Jones Industrial Average. AXP Weekly Chart August 2023 We believe that the […]

-

SPDR Metals & Mining ETF ($XME) Reacting Higher from Extreme Area.

Read MoreHello everyone. In today’s article, we will look at the past performance of the 4H Hour Elliott Wave chart of SPDR Metals & Mining ETF ($XME). The rally from 10.23.2023 low at $48.01 broke above 09.15 peak creating a bullish sequence. So, we expected the pullback to unfold in 7 swings and find buyers again. […]

-

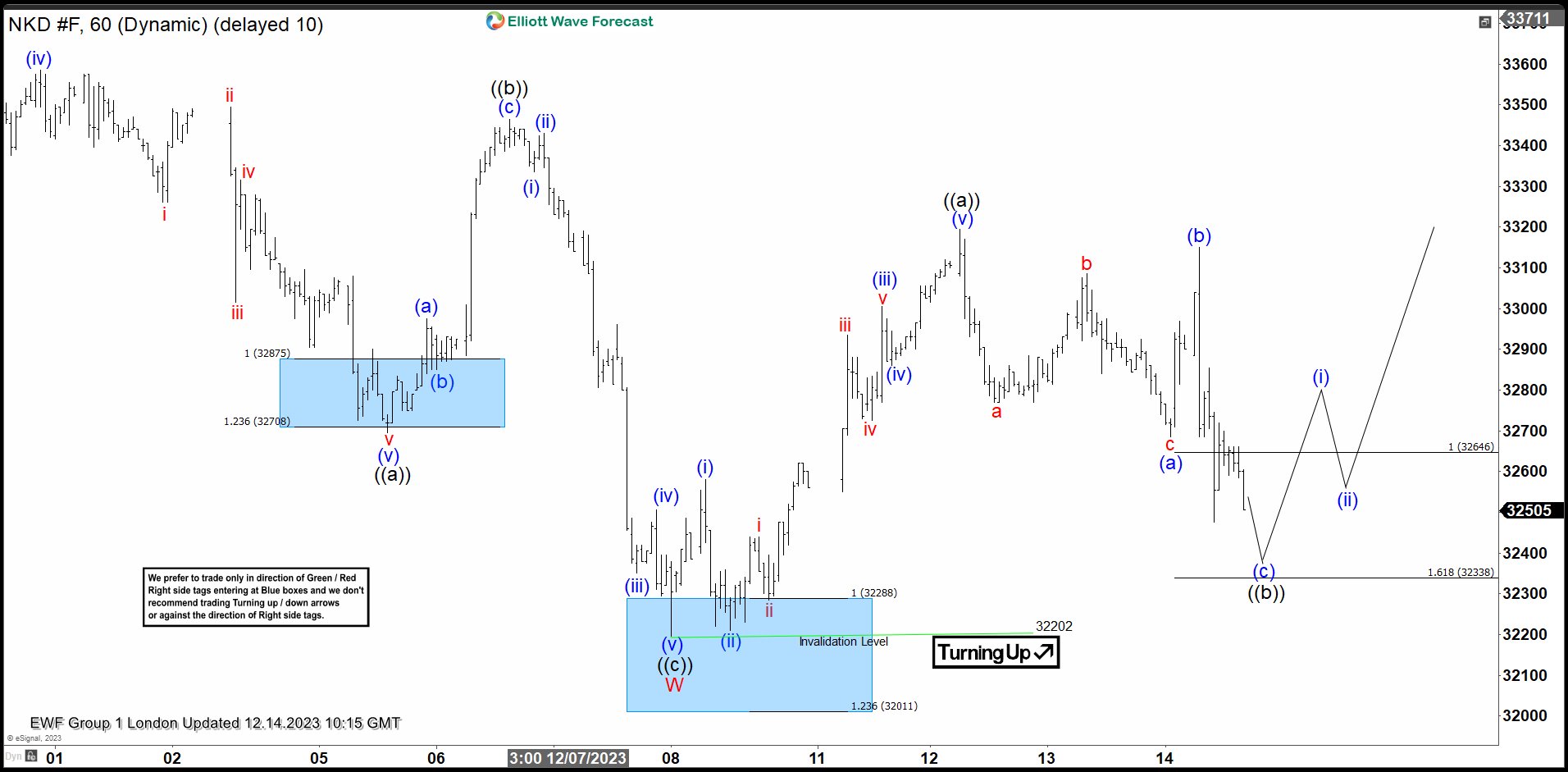

NIKKEI ( NKD_F ) Forecasting The Rally After 3 Waves Pull Back

Read MoreHello fellow traders. In this technical article we’re going to take a look at the Elliott Wave charts charts of NIKKEI Futures published in members area of the website. As our members know NIKKEI Futures has been giving us good trading setups recently. We have been favoring the long side due to impulsive bullish sequences […]

-

S&P 500 (SPX) Impulsive Rally in Progress

Read MoreS&P 500 (SPX) rally from 10.28.2023 low is in progress as an impulse. This article and video look at the Elliott Wave path.

-

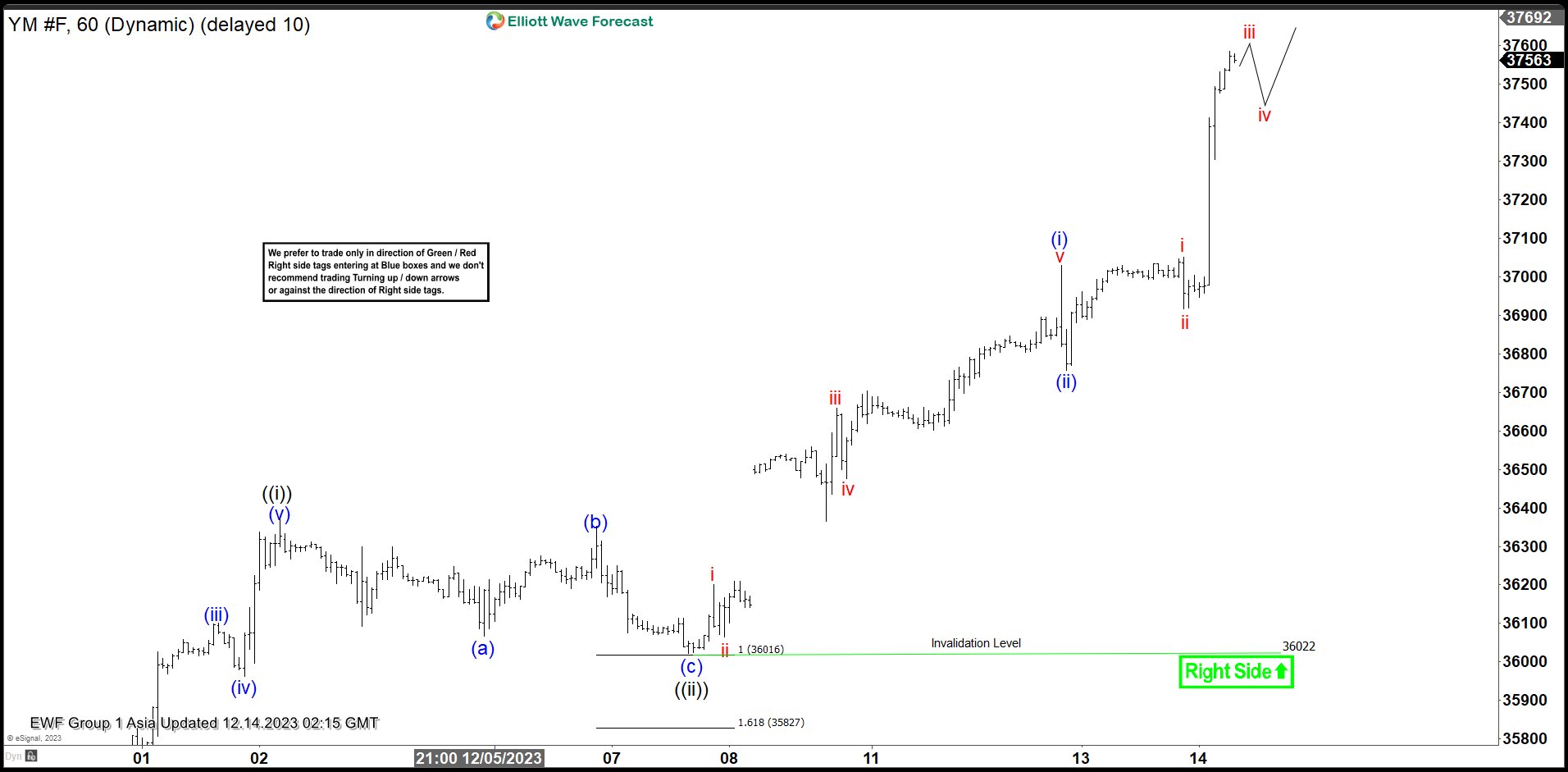

Dow Futures (YM) Breaking to New All-Time High

Read MoreDow Futures (YM) has broken to new all-time high suggesting the next bullish cycle has started. This article and video look at the Elliott Wave path.

-

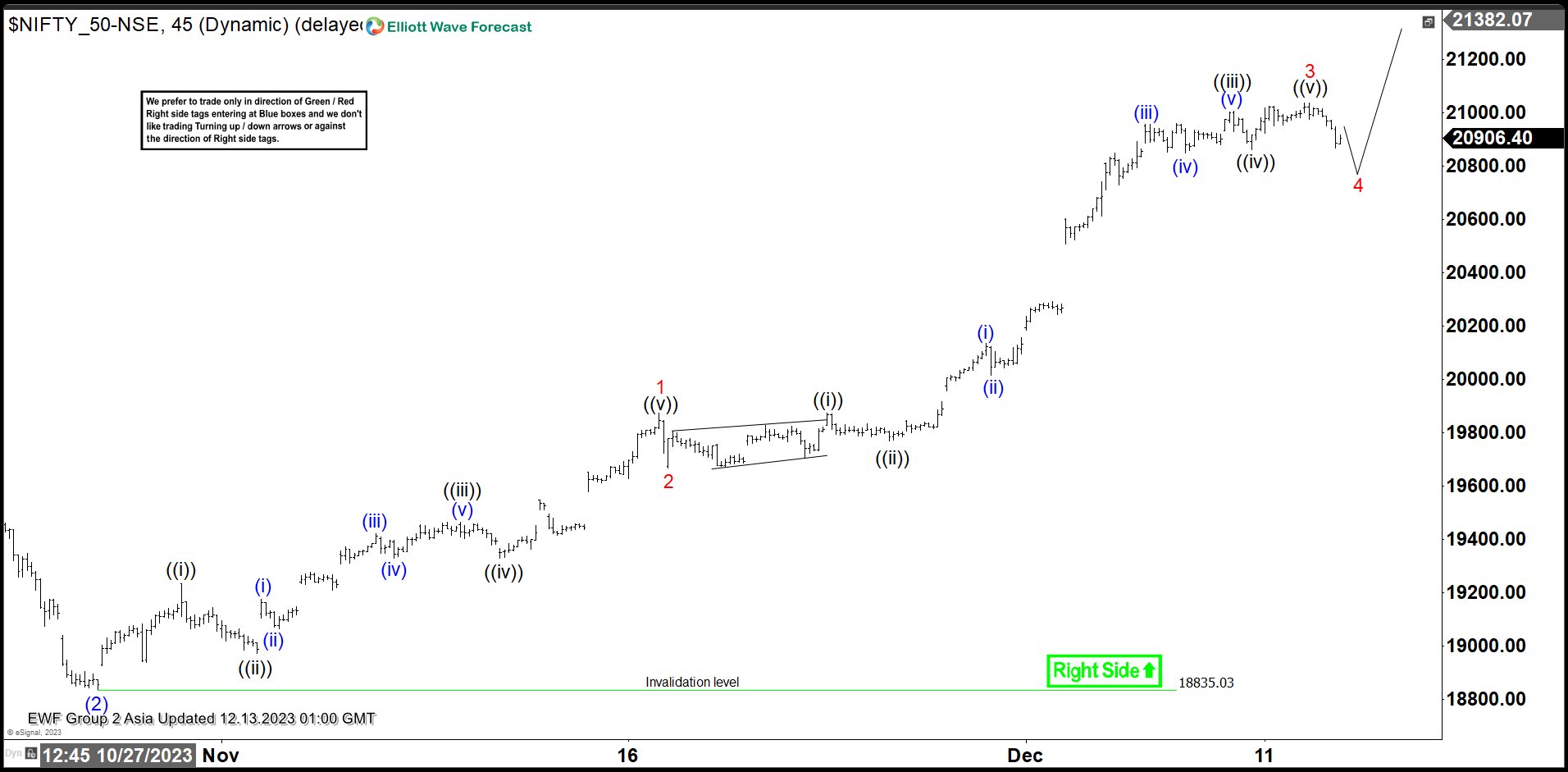

Nifty Short Term Pullback Likely Find Support in 3, 7 or 11 Swing

Read MoreNifty is looking to end impulsive rally and short term dips should find support in 3, 7, 11 swing. This article and video look at the Elliott Wave path.